Certificate Of Trust Michigan Form For Llc

Description

How to fill out Michigan Certificate Of Trust?

Getting a go-to place to take the most recent and appropriate legal samples is half the struggle of handling bureaucracy. Finding the right legal documents demands precision and attention to detail, which explains why it is vital to take samples of Certificate Of Trust Michigan Form For Llc only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the information concerning the document’s use and relevance for the circumstances and in your state or county.

Take the listed steps to complete your Certificate Of Trust Michigan Form For Llc:

- Make use of the library navigation or search field to find your sample.

- Open the form’s information to check if it suits the requirements of your state and county.

- Open the form preview, if available, to ensure the form is the one you are interested in.

- Go back to the search and look for the correct document if the Certificate Of Trust Michigan Form For Llc does not fit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are an authorized user, click Log in to authenticate and gain access to your picked templates in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Pick the pricing plan that fits your needs.

- Proceed to the registration to finalize your purchase.

- Finalize your purchase by choosing a transaction method (bank card or PayPal).

- Pick the document format for downloading Certificate Of Trust Michigan Form For Llc.

- When you have the form on your gadget, you can modify it with the editor or print it and finish it manually.

Eliminate the inconvenience that accompanies your legal paperwork. Explore the extensive US Legal Forms catalog to find legal samples, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

If you have a trust in Michigan, state law provides that you can register the trust. Registering a Michigan trust is not required (except for certain charitable trusts, as discussed below). Even for non-charitable trusts, there are good reasons that a trust should be registered.

How to Create a Living Trust in Michigan Decide what type of trust you want. ... Next you'll need to take stock of your property. ... Pick a trustee. ... Create the trust document. ... Sign the trust document in front of a notary public. Fund the trust by placing property into it.

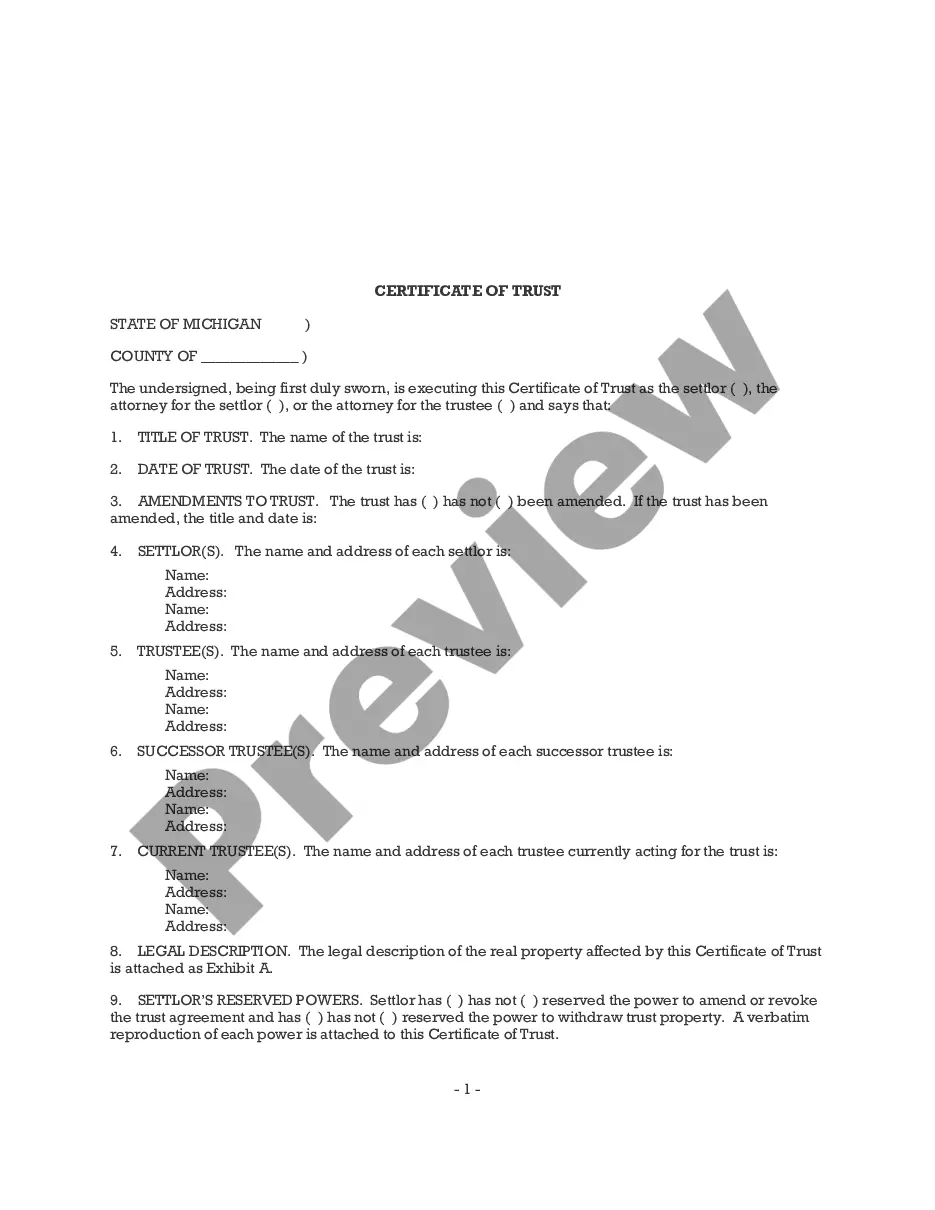

Pursuant to the current law, a certificate of trust must include: The name of the trust, the date of the trust, and the date of each operative trust instrument. The name and address of each current trustee. The powers of the trustee relating to the purposes for which the certificate of trust is offered.

(2) A certificate of trust may be signed or otherwise authenticated by the settlor, any trustee, or an attorney for the settlor or trustee. The certificate must be in the form of an affidavit.

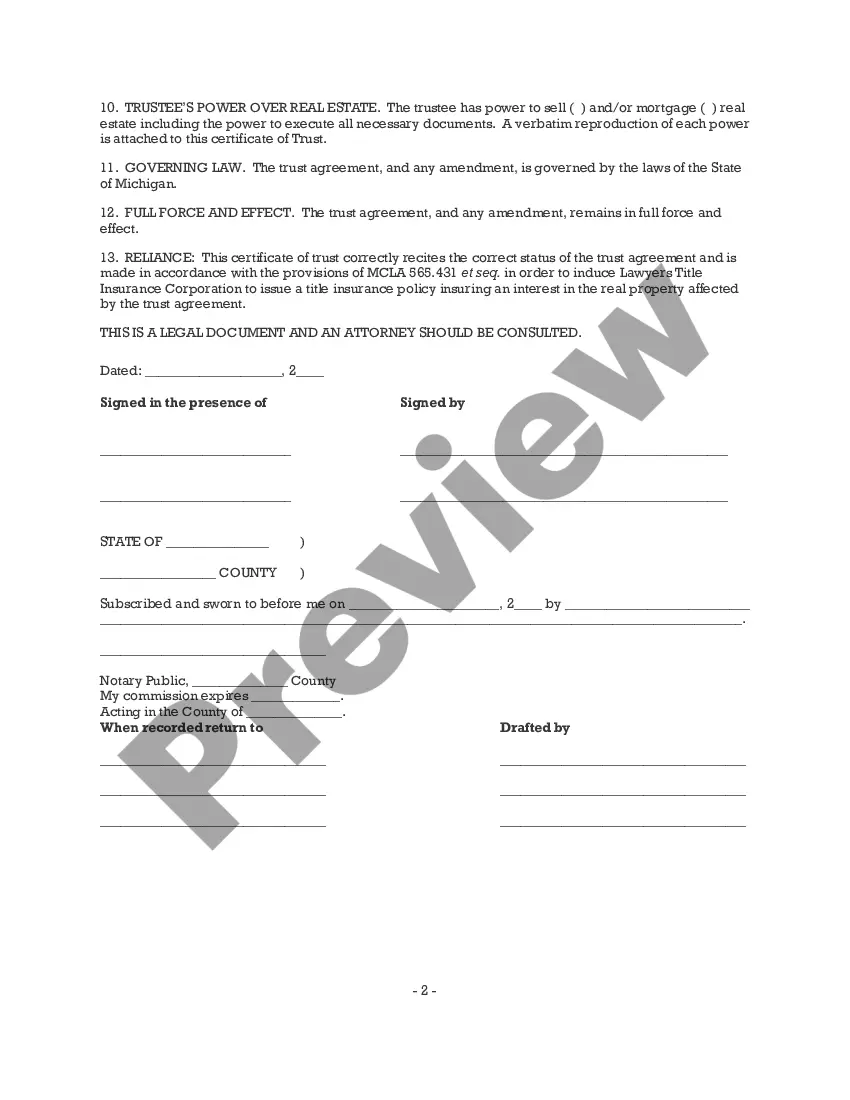

A Certificate of Trust may need to be recorded in the county that any real property is in. That said, if there's no real property owned by the Trust, there may not be any need to record it.