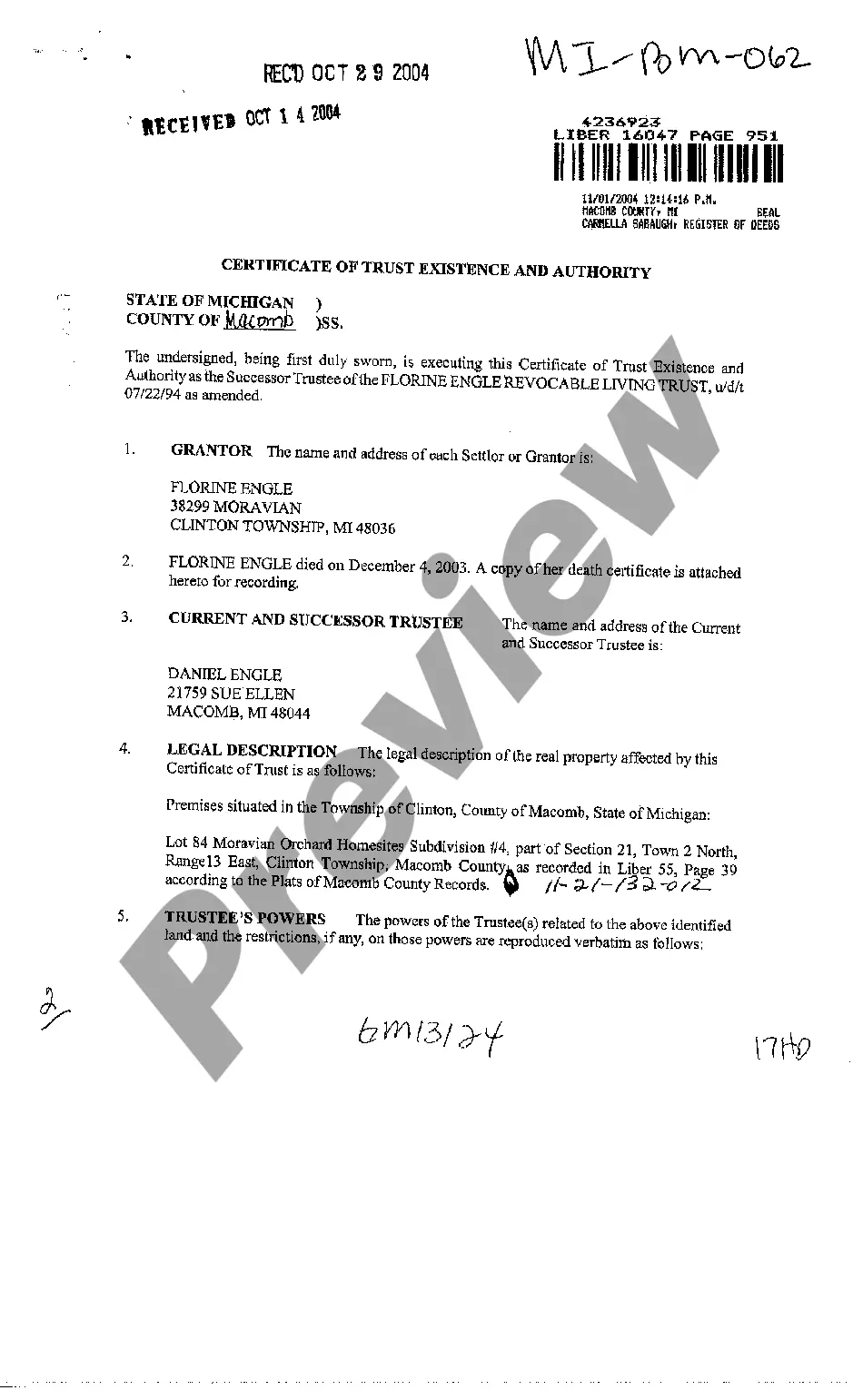

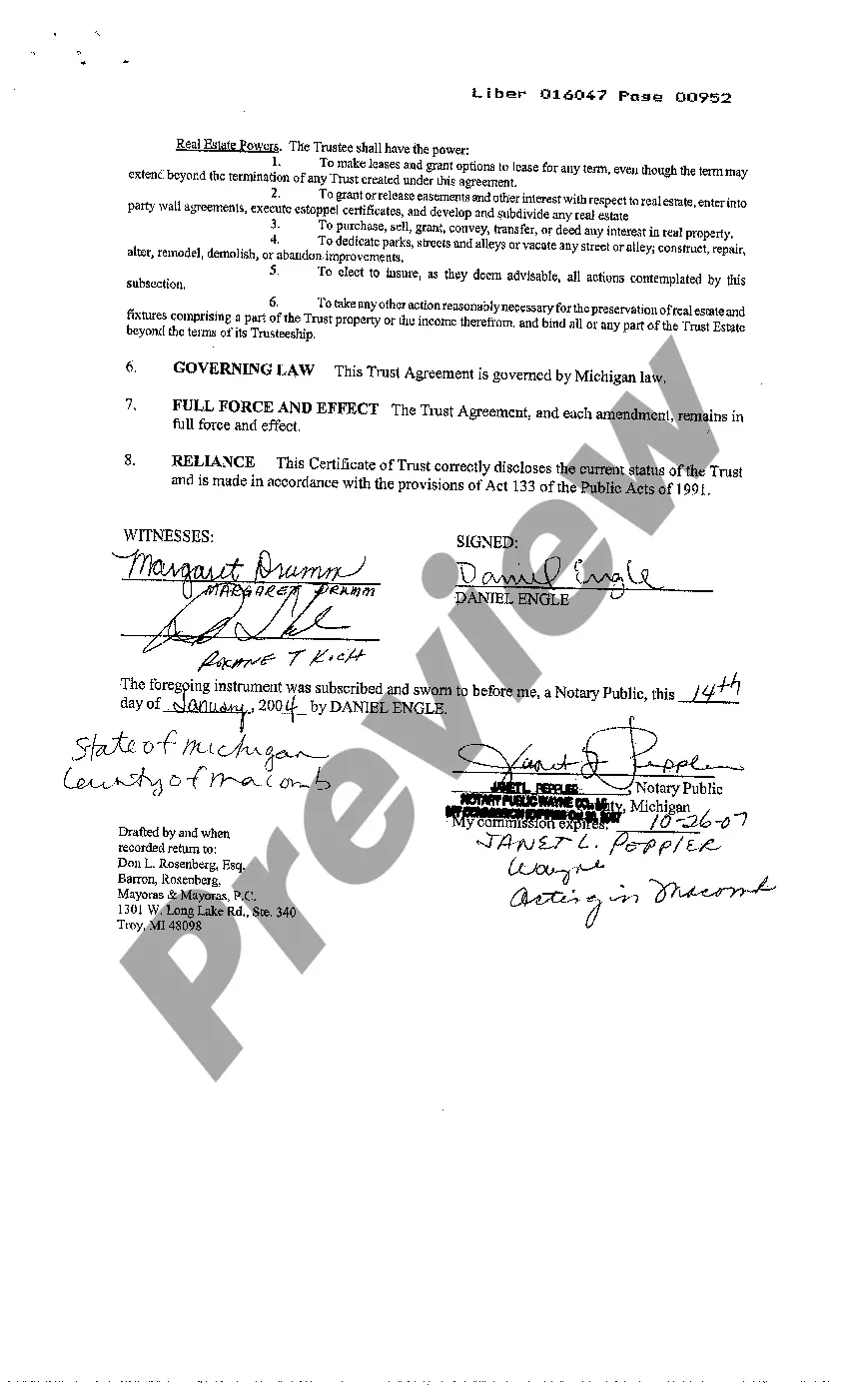

Certificate Of Trust Existence And Authority Michigan Withholding Tax

Description

How to fill out Michigan Certificate Of Trust Existence And Authority?

The Certificate Of Trust Existence And Authority Michigan Withholding Tax presented on this page is a reusable official template crafted by experienced attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, corporations, and legal professionals with more than 85,000 authenticated, state-specific documents for every business and personal situation. It is the quickest, easiest, and most trustworthy means of acquiring the documents you require, as the service assures bank-level data encryption and anti-malware safeguards.

Subscribe to US Legal Forms to gain access to verified legal templates for every aspect of life at your convenience.

- Search for the document you desire and review it.

- Examine the file you searched for and preview it or check the form description to confirm it meets your needs. If it does not, use the search function to find the correct document. Click Buy Now once you have found the template you require.

- Register and Log In.

- Select the pricing plan that fits you and create an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and review your subscription to proceed.

- Obtain the fillable template.

- Choose the format you wish for your Certificate Of Trust Existence And Authority Michigan Withholding Tax (PDF, Word, RTF) and download the sample onto your device.

- Fill out and sign the documents.

- Print the template to fill it out manually. Alternatively, utilize an online versatile PDF editor to efficiently and accurately complete and sign your document with a legally-binding electronic signature.

- Download your documents again.

- Reuse the same document whenever necessary. Access the My documents section in your profile to redownload any previously saved documents.

Form popularity

FAQ

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Every employer must obtain a Withholding Exemption Certificate (Form MI-W4) from each employee. The federal W-4 cannot be used in place of the MI-W4. The exemption amount is $4,750 per year times the number of personal and dependency exemptions allowed under Part 1 of the Michigan Income Tax Act.

You can claim exemption from withholding only if both the following situations apply: For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability. For the current year, you expect a refund of all federal income tax withheld because you expect to have no liability.

The CIT replaces the Michigan Business Tax; however, MBT taxpayers who have received or been assigned certain certificated credits may elect to continue to file under the MBT rather than the new CIT in order to claim such credits. Filing Requirements 2. Who must file CIT quarterly estimates?