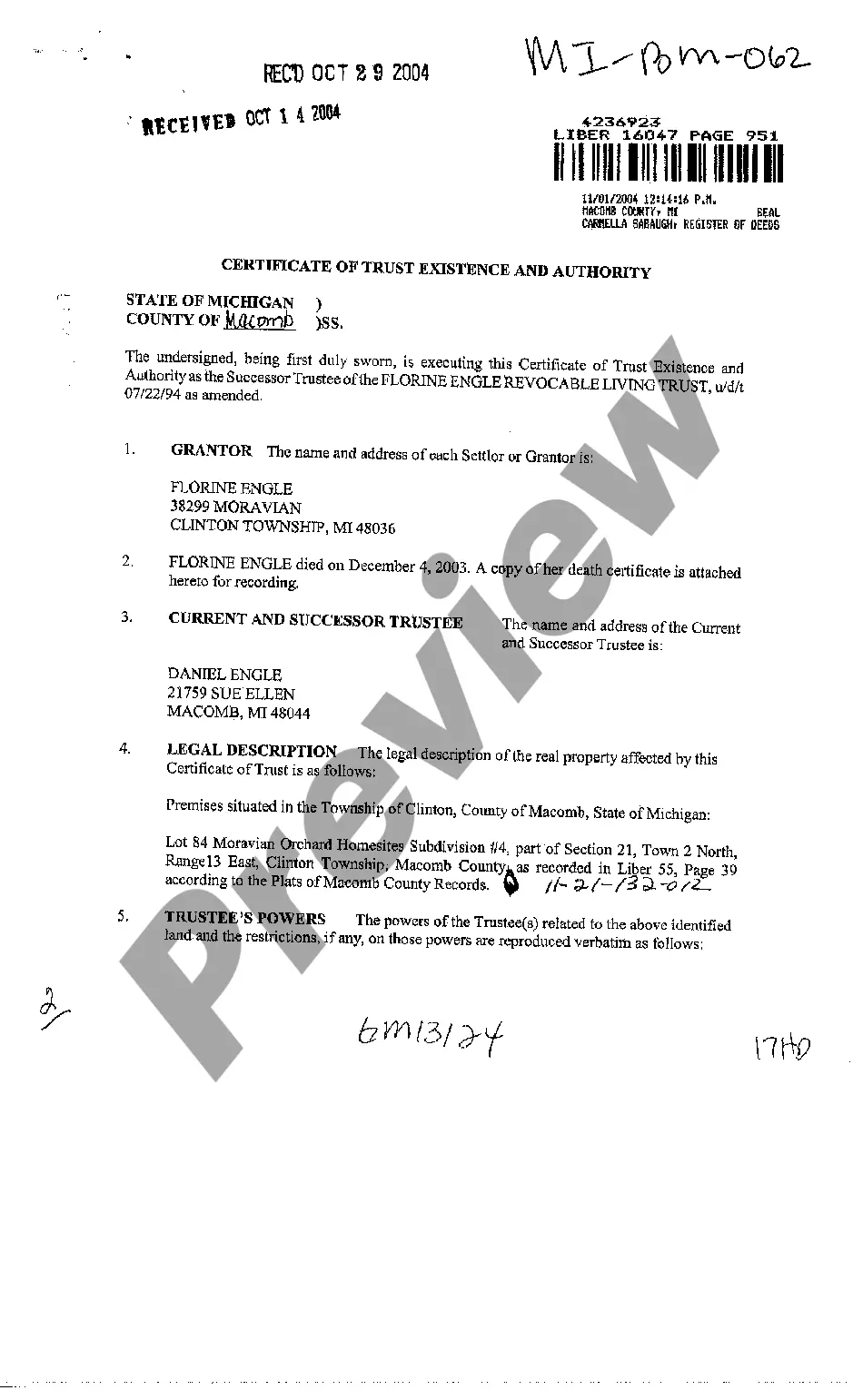

Certificate Of Trust Existence And Authority Form Michigan

Description

How to fill out Michigan Certificate Of Trust Existence And Authority?

Creating legal documents from the ground up can sometimes be intimidating.

Certain situations may require extensive research and substantial financial investment.

If you seek an easier and more budget-friendly method for preparing the Certificate Of Trust Existence And Authority Form Michigan or other documents without unnecessary complications, US Legal Forms is always available to assist.

Our online library of over 85,000 up-to-date legal forms encompasses nearly every facet of your financial, legal, and personal matters.

But before proceeding to download the Certificate Of Trust Existence And Authority Form Michigan, keep in mind these suggestions: Check the form preview and descriptions to verify you have located the document you need. Ensure the template you select meets the standards of your state and county. Choose the appropriate subscription option to acquire the Certificate Of Trust Existence And Authority Form Michigan. Download the file, then complete, certify, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us now and make document execution a straightforward and efficient process!

- With just a few clicks, you can immediately obtain state- and county-compliant templates meticulously crafted by our legal experts.

- Utilize our website whenever you require trustworthy and dependable services to easily find and download the Certificate Of Trust Existence And Authority Form Michigan.

- If you are a returning user who has established an account with us previously, simply Log In to your account, locate the form and download it or re-download it anytime in the My documents section.

- Not signed up yet? No worries. It requires minimal time to register and explore the collection.

Form popularity

FAQ

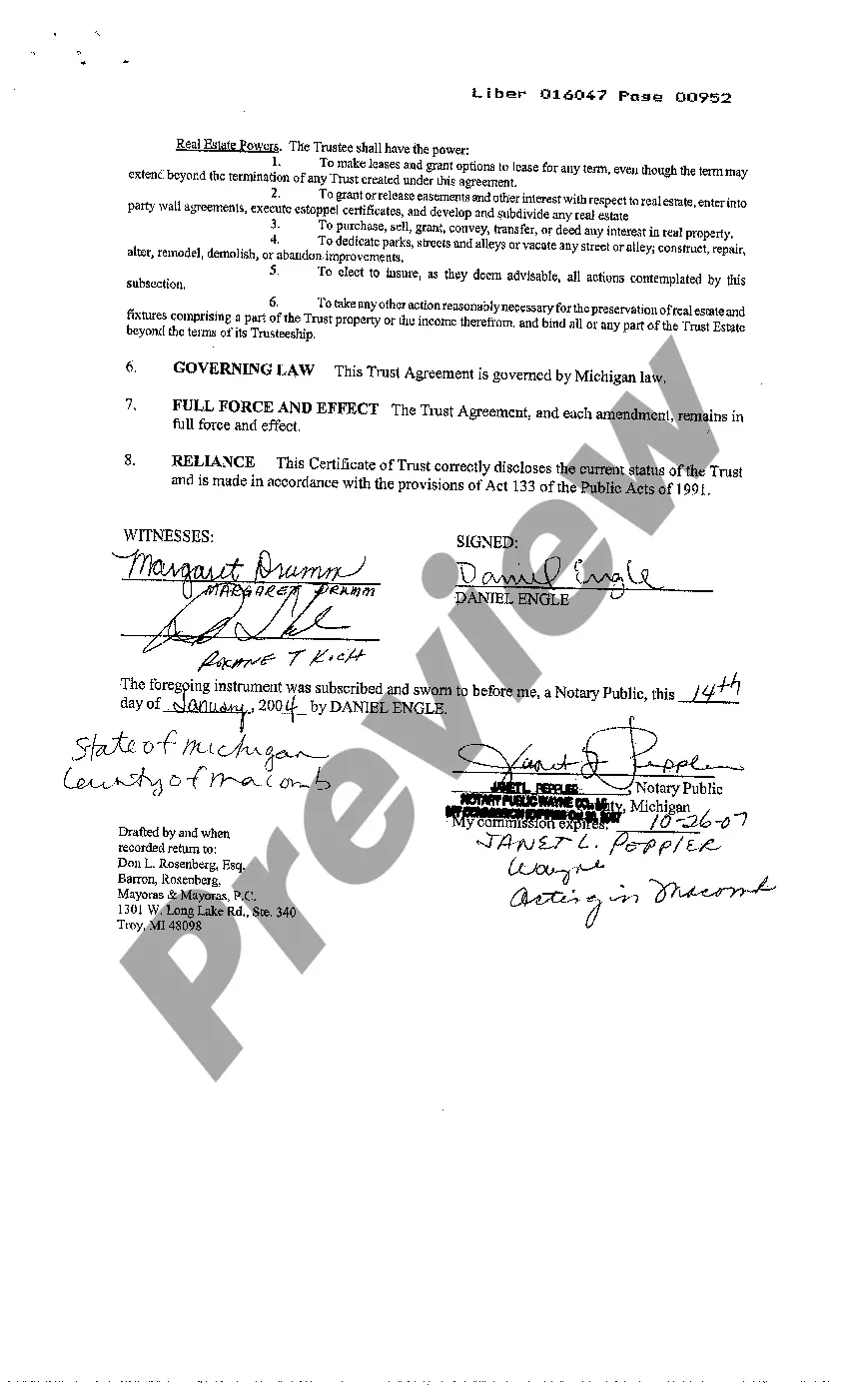

(2) A certificate of trust may be signed or otherwise authenticated by the settlor, any trustee, or an attorney for the settlor or trustee. The certificate must be in the form of an affidavit.

To create a living trust in Michigan, you prepare the trust document and then sign it in the presence of a notary.

Grounds for Contesting a Michigan Will or Trust The Will or Trust wasn't signed as required by state law. In Michigan, the testator must sign, and two witnesses must also sign, each having witnessed the testator's signature.

Pursuant to the current law, a certificate of trust must include: The name of the trust, the date of the trust, and the date of each operative trust instrument. The name and address of each current trustee. The powers of the trustee relating to the purposes for which the certificate of trust is offered.

A Certificate of Trust may need to be recorded in the county that any real property is in. That said, if there's no real property owned by the Trust, there may not be any need to record it.