Lien Release Letter For Car For Ford

Description

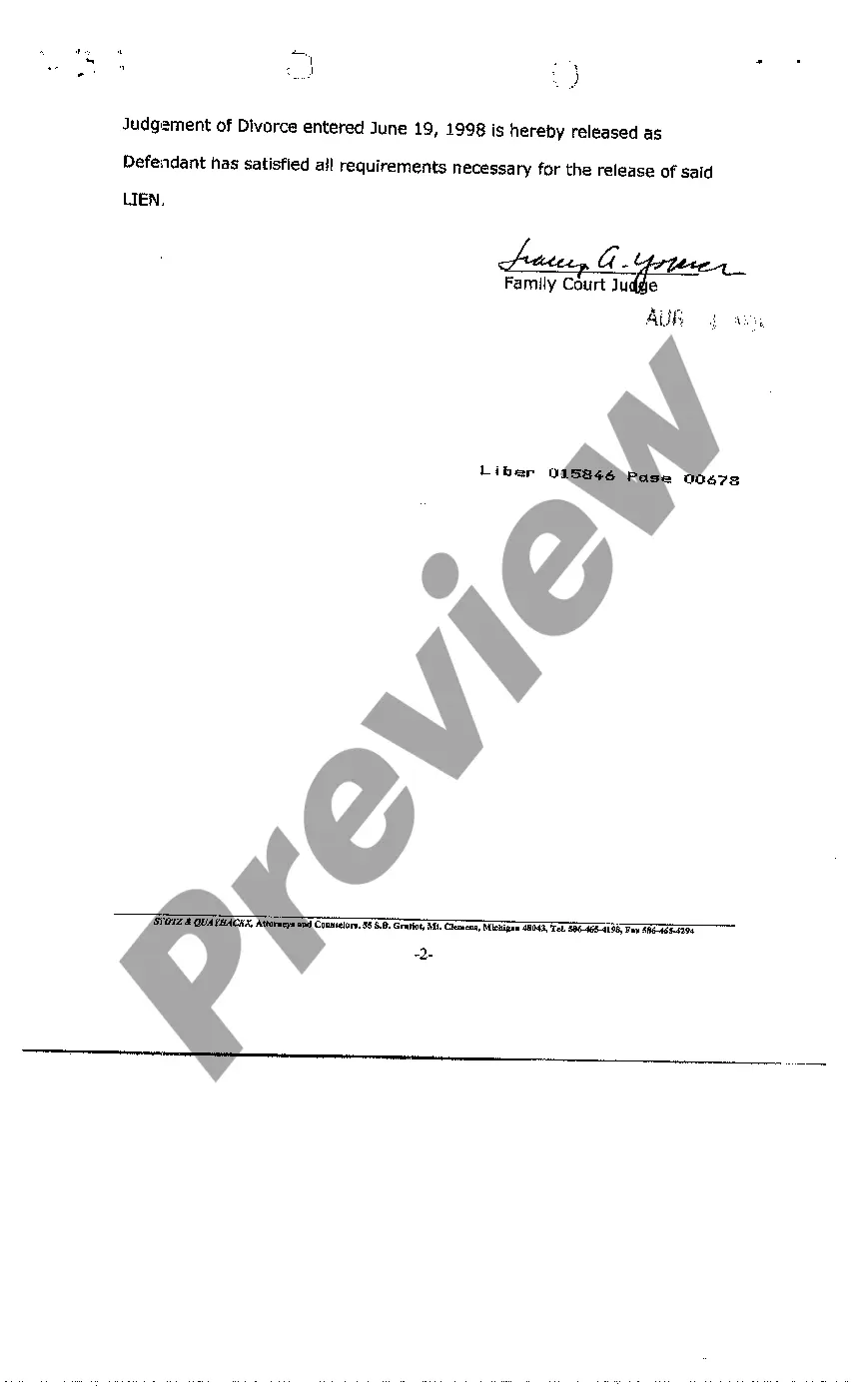

How to fill out Michigan Order For Release Of Lien?

Whether for commercial reasons or personal affairs, everyone must handle legal matters at some point in their life.

Filling out legal forms requires meticulous care, starting from selecting the correct template sample.

Complete the registration form for your account. Select your payment method: you can use a credit card or PayPal account. Choose the preferred file format and download the Lien Release Document For Car For Ford. After downloading, you can fill out the form using editing software or print and complete it manually. With an extensive US Legal Forms catalog available, you won't have to waste time searching for the correct template online. Utilize the library’s easy navigation to find the appropriate template for any situation.

- For instance, if you choose an incorrect version of a Lien Release Document For Car For Ford, it will be rejected upon submission.

- Thus, it's crucial to have a dependable source of legal paperwork such as US Legal Forms.

- If you wish to acquire a Lien Release Document For Car For Ford template, follow these straightforward steps.

- Retrieve the template you require using the search bar or catalog navigation.

- Examine the form’s details to confirm it aligns with your circumstances, state, and area.

- Click on the form’s preview to review it.

- If it is the incorrect document, return to the search feature to locate the Lien Release Document For Car For Ford template you need.

- Obtain the template if it fulfills your requirements.

- If you possess a US Legal Forms account, click Log in to access previously stored documents in My documents.

- If you don't have an account yet, you can download the form by clicking Buy now.

- Choose the suitable pricing plan.

Form popularity

FAQ

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

To receive a bigger refund, adjust line 4(c) on Form W-4, called "Extra withholding," to increase the federal tax withholding for each paycheck you receive. Tax withholding calculators help you get a big picture view of your refund situation by asking detailed questions.

Most of the new laws benefit employees in New Jersey, including modest minimum wage increases across all industries and enhancements to compensation and protections for employees facing mass layoffs. As of January 1, the statewide minimum wage for most employees is $14.13 per hour, up from $13 in 2022.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

How to Fill Out an IRS W-4 Form | 2023 | Money Instructor - YouTube YouTube Start of suggested clip End of suggested clip Form there are several sections to the form. So we'll break down each one individually. Here we willMoreForm there are several sections to the form. So we'll break down each one individually. Here we will look at a sample form for John who has a pretty basic form Section 1 personal information.

New Jersey New Hire Paperwork IRS Form W-4 (for federal tax reporting) Form NJ-W4 (tax withholding certificate of the employee) Notice of employee rights (under New Jersey laws) Notice of COBRA rights. Notes of paid sick leave rights.