Covenant For Deed

Description

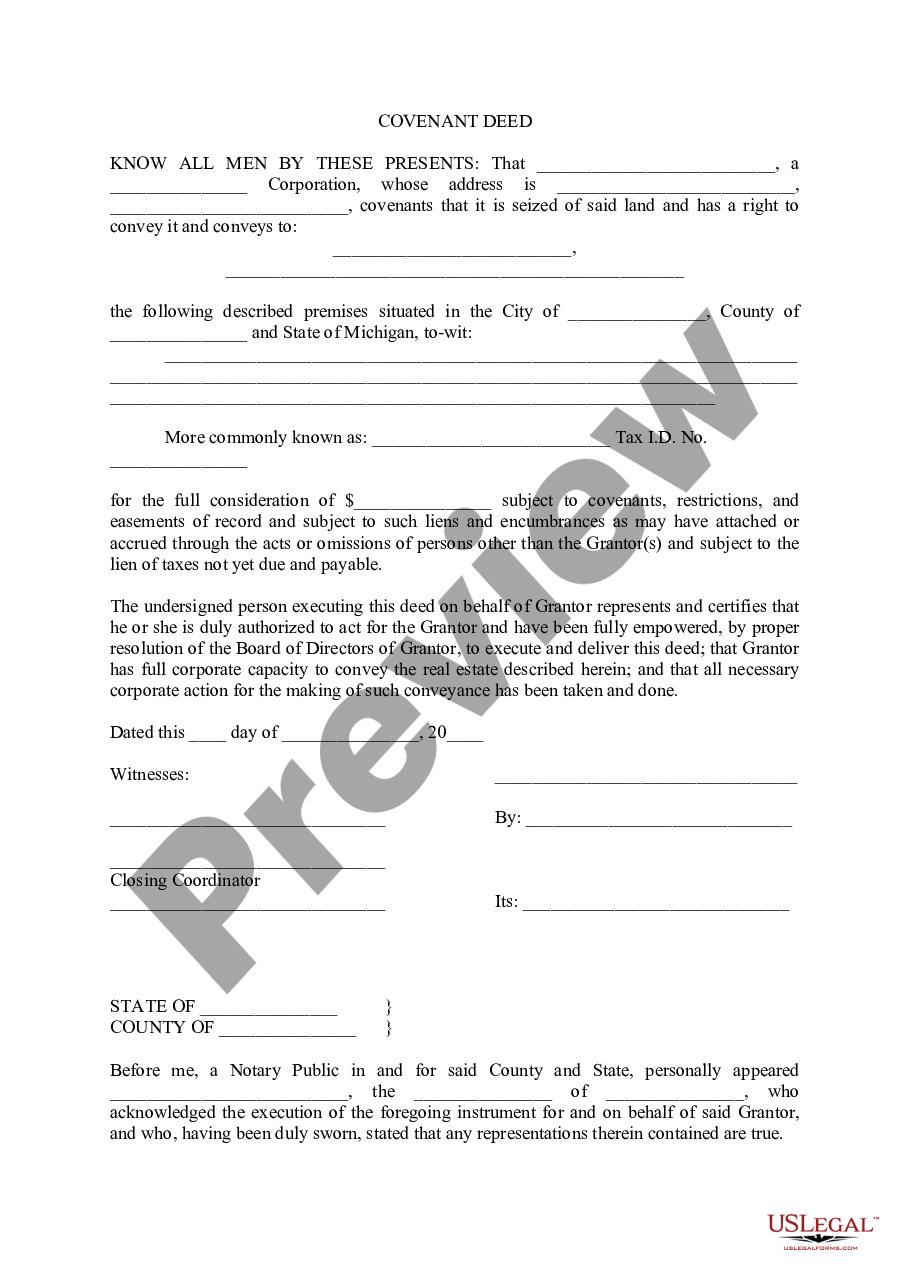

How to fill out Michigan Covenant Deed?

It’s clear that you can’t instantly become a legal expert, nor can you quickly learn how to draft a Covenant For Deed without a specialized skill set.

Assembling legal documents is a lengthy process that demands specific training and expertise. So why not entrust the creation of the Covenant For Deed to the experts.

With US Legal Forms, one of the most extensive libraries of legal templates, you can obtain anything from court filings to templates for internal corporate correspondence.

If you need a different form, start your search again.

Register for a free account and choose a subscription plan to purchase the template. Click Buy now. Once the transaction is completed, you can obtain the Covenant For Deed, complete it, print it, and send or mail it to the appropriate individuals or organizations. You can re-access your documents from the My documents tab at any time. If you’re an existing customer, you can simply Log In and locate and download the template from the same tab. Regardless of the purpose of your forms—whether financial and legal, or personal—our website has you covered. Try US Legal Forms now!

- We understand the significance of compliance and adherence to federal and state laws and regulations.

- That’s why, on our platform, all templates are location-specific and up to date.

- Here’s how to get started with our website and acquire the form you need in just minutes.

- Find the form you require using the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if the Covenant For Deed is what you’re looking for.

Form popularity

FAQ

A deed of covenant can be prepared by individuals involved in the agreement, or more commonly, by a legal professional. Hiring a solicitor or using a reliable platform like USLegalForms can help ensure that the document is prepared correctly and includes all necessary terms. This preparation is vital for creating a binding covenant for deed.

To complete a deed of covenant, you will need to fill out the required information in the document, sign it in front of witnesses, and ensure all parties receive copies. It is crucial to follow local regulations regarding the execution of such documents. Using a service like USLegalForms can guide you through the completion process, ensuring that your covenant for deed is properly executed.

A deed of covenant can be drawn up by the parties involved, but it is often advisable to have a legal professional handle the drafting. This ensures that all necessary legal language is included, and the document adheres to local laws. Platforms like USLegalForms offer templates and resources to assist you in creating a covenant for deed, making the process more accessible.

Typically, the parties in a deed of covenant include the grantor, who creates the covenant, and the grantee, who benefits from it. These parties may also include future property owners if the covenant is designed to run with the land. Understanding the roles of each party is crucial when establishing a covenant for deed.

While it is not strictly necessary to hire a solicitor for a deed of covenant, doing so can provide valuable legal insight and ensure that the document is legally binding. A solicitor can help draft the agreement, making sure it meets all legal requirements and adequately protects your interests. For those less familiar with legal documents, seeking professional assistance is often a wise choice.

To create a deed of covenant, start by drafting the document clearly outlining the obligations and rights of each party involved. You will need to include details about the property and the specific covenants being established. Utilizing a platform like USLegalForms can help streamline this process by providing templates and guidance tailored for a covenant for deed.

In general, covenants on land are enforced by the parties involved in the covenant agreement, often the property owners or their successors. Local government or homeowners' associations may also play a role in enforcing these agreements. It is essential to understand that a covenant for deed typically includes specific enforcement mechanisms detailed in the agreement.

An example of a covenant for deed might involve a homeowner agreeing to maintain their property in a specific condition or to refrain from certain activities that could affect neighboring properties. This type of covenant ensures that all parties understand their responsibilities and helps preserve property values. For further clarity and legally sound examples, consider exploring the resources available on US Legal Forms.

To draft a covenant for deed, you should start by clearly defining the terms and conditions of the agreement. Include details such as the parties involved, the property description, and any specific obligations or restrictions. It's important to ensure that the language is clear and legally binding. Utilizing a reliable platform like US Legal Forms can simplify this process by providing templates and guidance tailored to your needs.

Covenants in a deed refer to legally binding promises tied to property ownership. They dictate how a property can be used, maintained, or altered, ensuring compliance with community standards. Understanding these covenants is essential when entering into a covenant for deed, as they can impact your rights and responsibilities. If you need assistance with drafting or interpreting these agreements, platforms like US Legal Forms provide valuable resources.