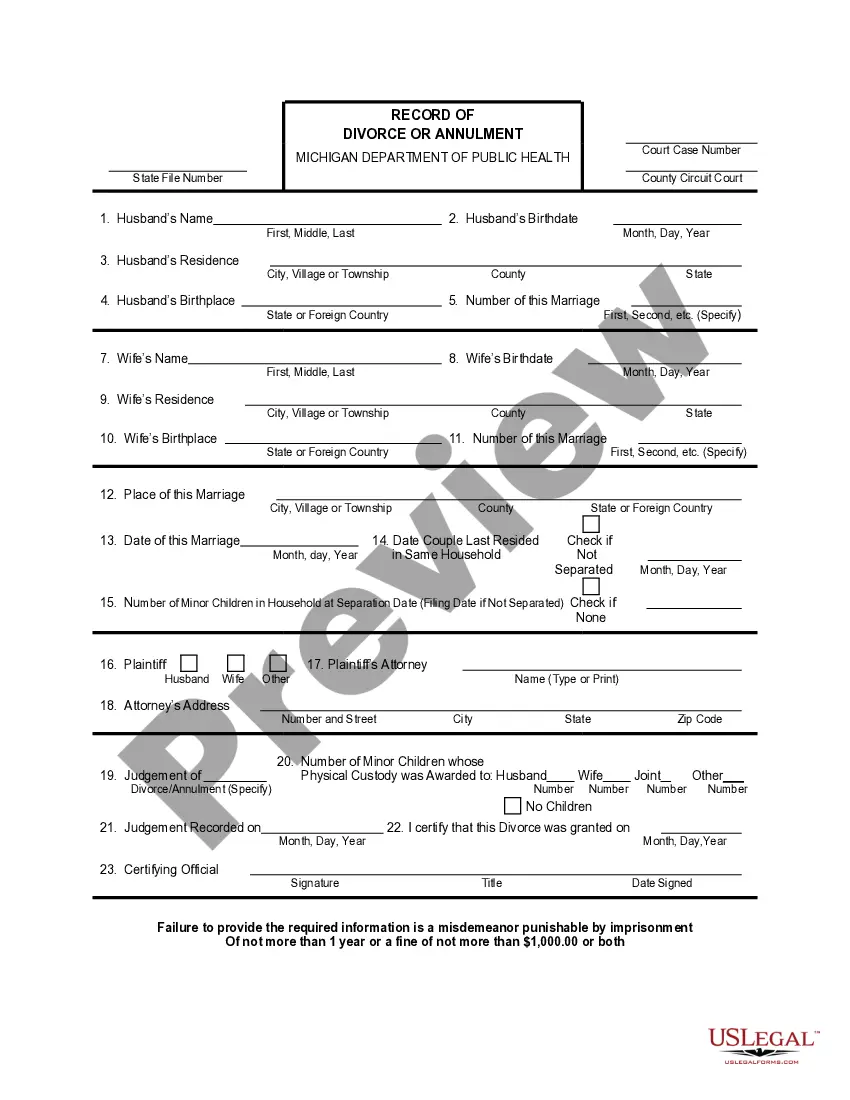

Record Of Divorce Or Annulment Michigan Without Marriage

Description

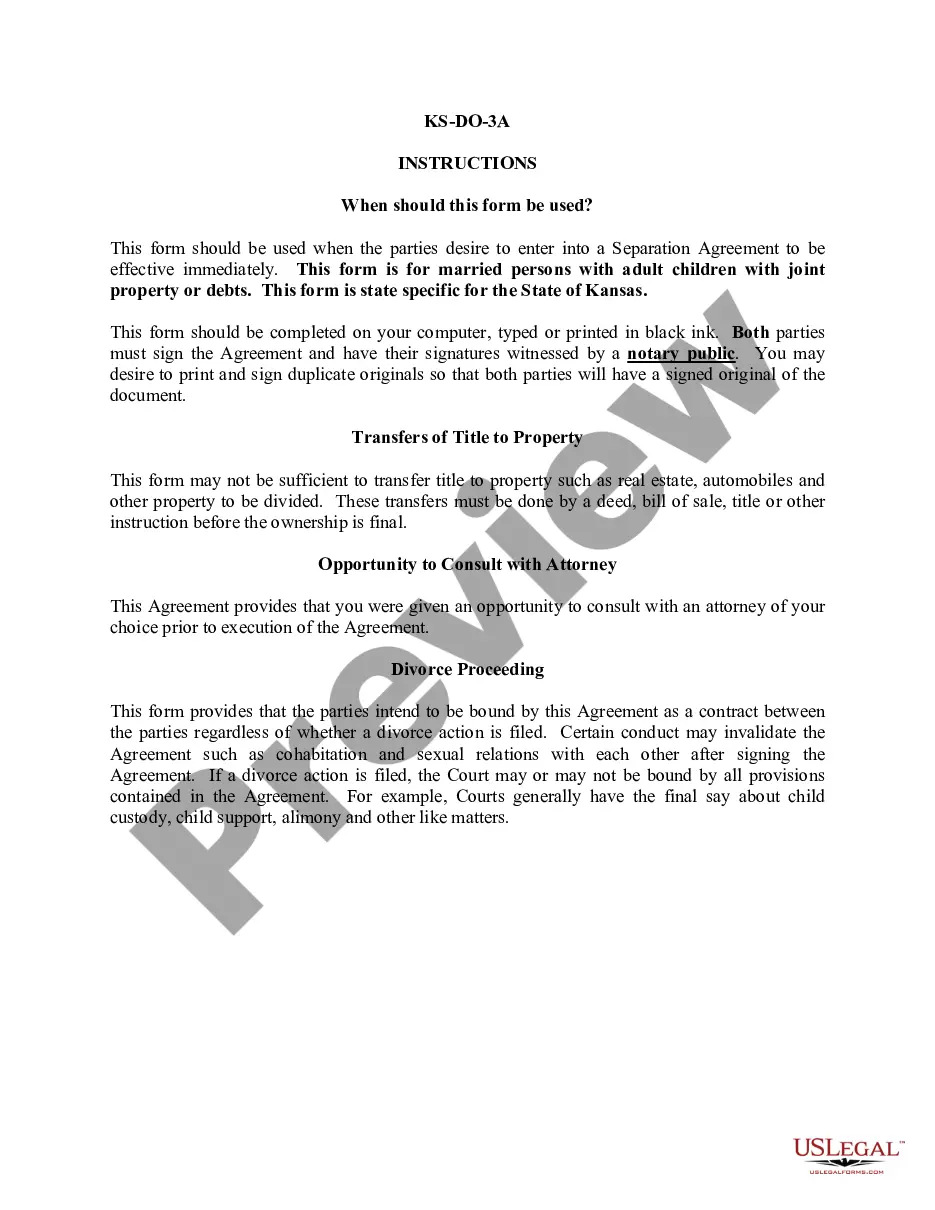

How to fill out Michigan Record Of Divorce Or Annulment?

The Document Of Divorce Or Annulment Michigan Without Marriage you see on this page is a reusable legal template crafted by expert attorneys in accordance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal professionals with over 85,000 validated, state-specific documents for various business and personal situations. It’s the fastest, simplest, and most reliable way to obtain the forms you require, as the service ensures bank-level data protection and anti-malware safeguards.

Register with US Legal Forms to have validated legal templates for all of life’s situations at your fingertips.

- Search for the paper you require and examine it.

- Browse the example you looked for and preview it or check the form description to verify it meets your requirements. If it doesn’t, use the search function to find the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Choose the payment plan that works for you and set up an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

- Pick the format you desire for your Document Of Divorce Or Annulment Michigan Without Marriage (PDF, Word, RTF) and save the file on your device.

- Complete and endorse the documents.

- Print the template to finish it by hand. Alternatively, use an online versatile PDF editor to quickly and accurately fill out and sign your form with a valid signature.

- Re-download your forms when needed.

- Re-use the same document whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

A certified copy of your Certificate of Organization or Articles of Incorporation can be ordered by fax, mail, email, in person, or online, but we recommend online. Online processing costs $12 plus $. 30 cents per page and is immediate.

To start a corporation in Utah, you must file Articles of Incorporation with the Division of Corporations & Commercial Code. You can file the document online, by mail or in person. The Articles of Incorporation cost $54 to file. Once filed with the state, this document formally creates your Utah corporation.

In Utah, you pay a $54 LLC filing fee and file the LLC Certificate of Organization with the Division of Corporations. And a business license is a document, which gives a person, or a company, the right to transact business.

Setting Up Your LLC in Utah: Submitting Paperwork The filing fee for both in-state and out-of-state entities forming LLCs is $70.

Register Your Company There is a $22 fee to complete the form, which can be done as a paper application or via the online portal. It costs $54 to file articles of organization and articles of incorporation and $70 for the other forms.

Utah: Comprehensive LLC Laws. Corporations or individuals can form an LLC easily and without much paperwork. Additionally, the state doesn't impose any personal income tax on businesses. That makes Utah a great option for businesses looking to avoid taxes and maximize profits in their first year of operations.

To form your LLC or corporation, you will need to file your documents with the Utah Division of Corporations and Commercial Code.

The State of Utah provides on their Division of Corporations and Commercial Code site a sample form that you can use to submit the Articles of Organization when filing your LLC.