Notice Pay Rent With Credit Card No Fee

Description

How to fill out Michigan 7 Day Notice To Pay Rent Or Lease Terminates?

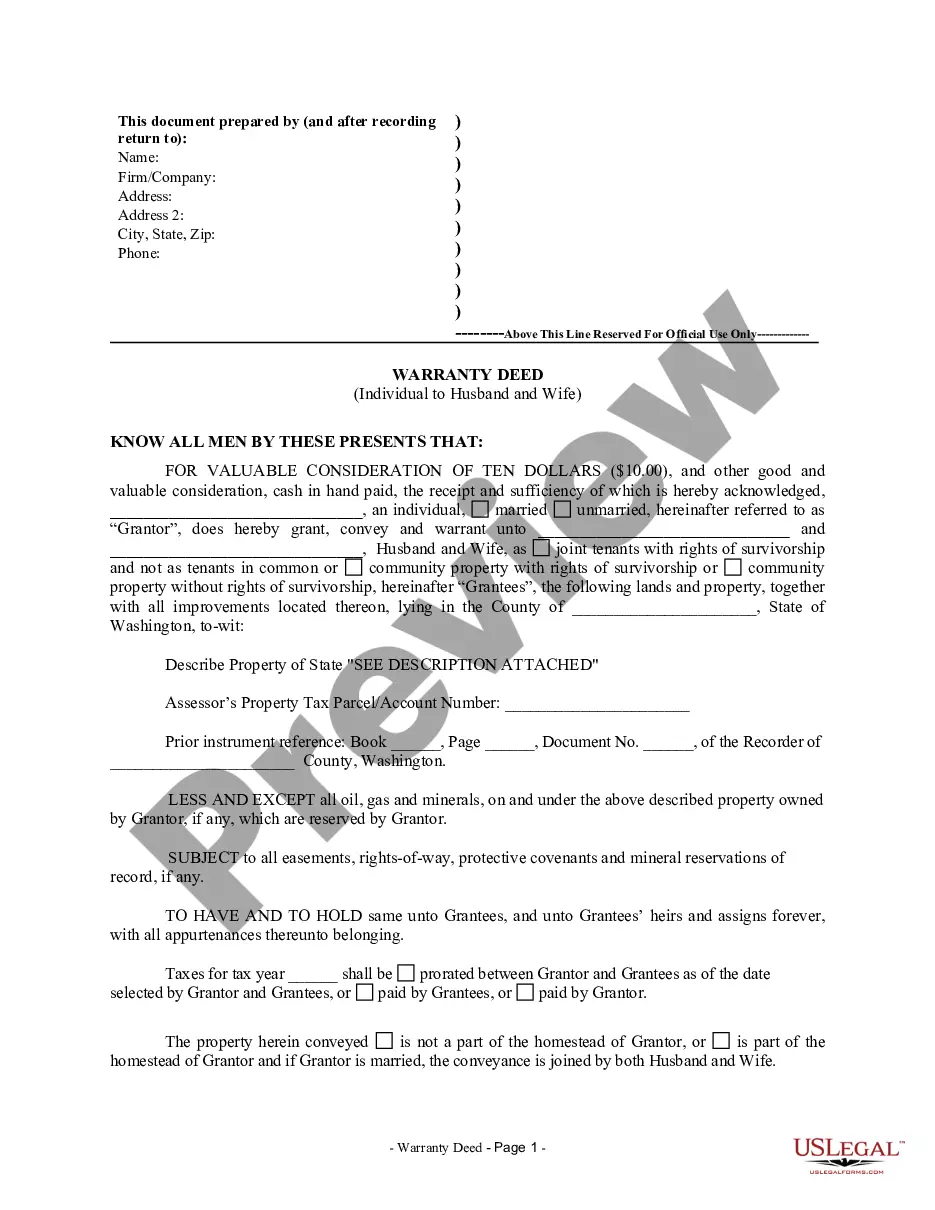

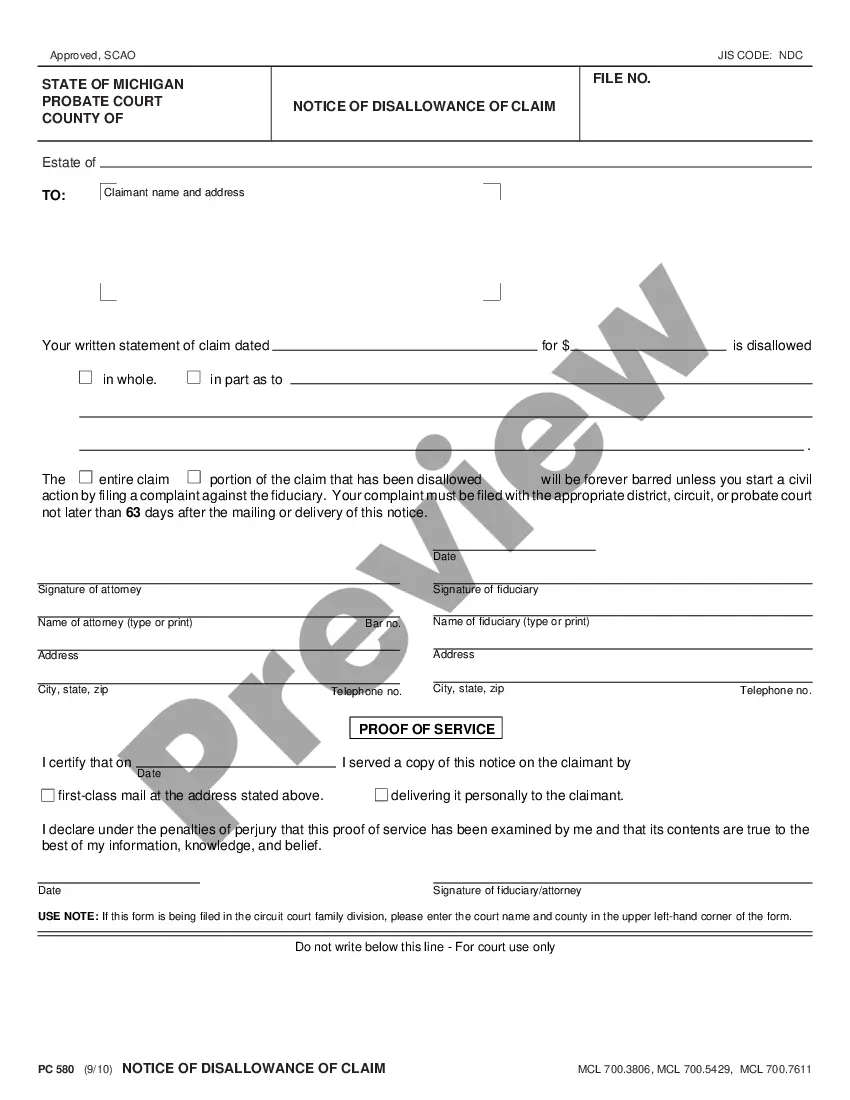

Using legal templates that meet the federal and state laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Notice Pay Rent With Credit Card No Fee sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and personal case. They are easy to browse with all documents collected by state and purpose of use. Our experts stay up with legislative changes, so you can always be sure your form is up to date and compliant when acquiring a Notice Pay Rent With Credit Card No Fee from our website.

Getting a Notice Pay Rent With Credit Card No Fee is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template utilizing the Preview option or through the text outline to make certain it meets your needs.

- Look for a different sample utilizing the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Choose the right format for your Notice Pay Rent With Credit Card No Fee and download it.

All documents you find through US Legal Forms are multi-usable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

CardMaven Issuerrent payment Chargesmilestone ?CitibankNo ChargesYesHDFC BankNo charges for 1st transaction in a month, 1%+GST from 2nd transactionYesHSBC1%+GSTYesICICI Bank1%+GSTYes11 more rows

One of the biggest disadvantages of paying rent through a credit card is the high fees. Many platforms charge a convenience fee for facilitating rent payment through credit card, which can range from 2-3% of the rent amount.

You can make sure your on-time rent payments are being reported to credit bureaus through rent reporting services. There are two ways that your rent can be reported through a rent reporting service: your property manager can report payments for you, or you can report payments yourself.

By federal law, lenders cannot extend credit to someone without first determining that the applicant has the ability to make payments, which is why credit card applications ask for things like your income, employment information, and what you pay in mortgage or rent.

Some rent payment services tout the opportunity to earn incentives for paying rent with rewards credit cards, but the cost of the processing fee can eliminate any reward earnings. If you have a rent payment of $1,000 and you're paying a 2.99% processing fee, that's an additional $29.90 every month.