Promissory Note Template Michigan With Notary

Description

How to fill out Michigan Promissory Note - Horse Equine Forms?

Bureaucracy demands exactness and correctness.

If you do not engage in completing paperwork such as the Promissory Note Template Michigan With Notary on a regular basis, it could lead to potential confusions.

Selecting the appropriate sample from the beginning will guarantee that your document submission proceeds smoothly and avert any issues of needing to resubmit a document or replicating the same task from the beginning.

Review the descriptions of the forms and retain those you need at any time. If you are not a registered user, finding the required sample will take a few extra steps: Locate the template using the search bar. Confirm the Promissory Note Template Michigan With Notary you have discovered is relevant to your state or county. Access the preview or review the description that includes the details on how to use the sample. If the result meets your criteria, click the Buy Now button. Choose the correct option from the suggested pricing plans. Sign in to your account or create a new one. Finalize the purchase using a credit card or PayPal payment method. Download the form in your preferred format. Acquiring the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate the bureaucratic challenges and simplify your document handling.

- You can consistently find the suitable sample for your paperwork in US Legal Forms.

- US Legal Forms is the largest online repository of forms that provides over 85 thousand samples across various topics.

- You can acquire the latest and most applicable version of the Promissory Note Template Michigan With Notary simply by searching it on the site.

- Find, store, and save templates in your profile or consult the description to confirm that you possess the correct one.

- With an account on US Legal Forms, you can gather, store in one place, and navigate through the templates you have saved to access them with just a few clicks.

- When on the website, click the Log In button to authenticate.

- Then, move to the My documents page, where the history of your forms is maintained.

Form popularity

FAQ

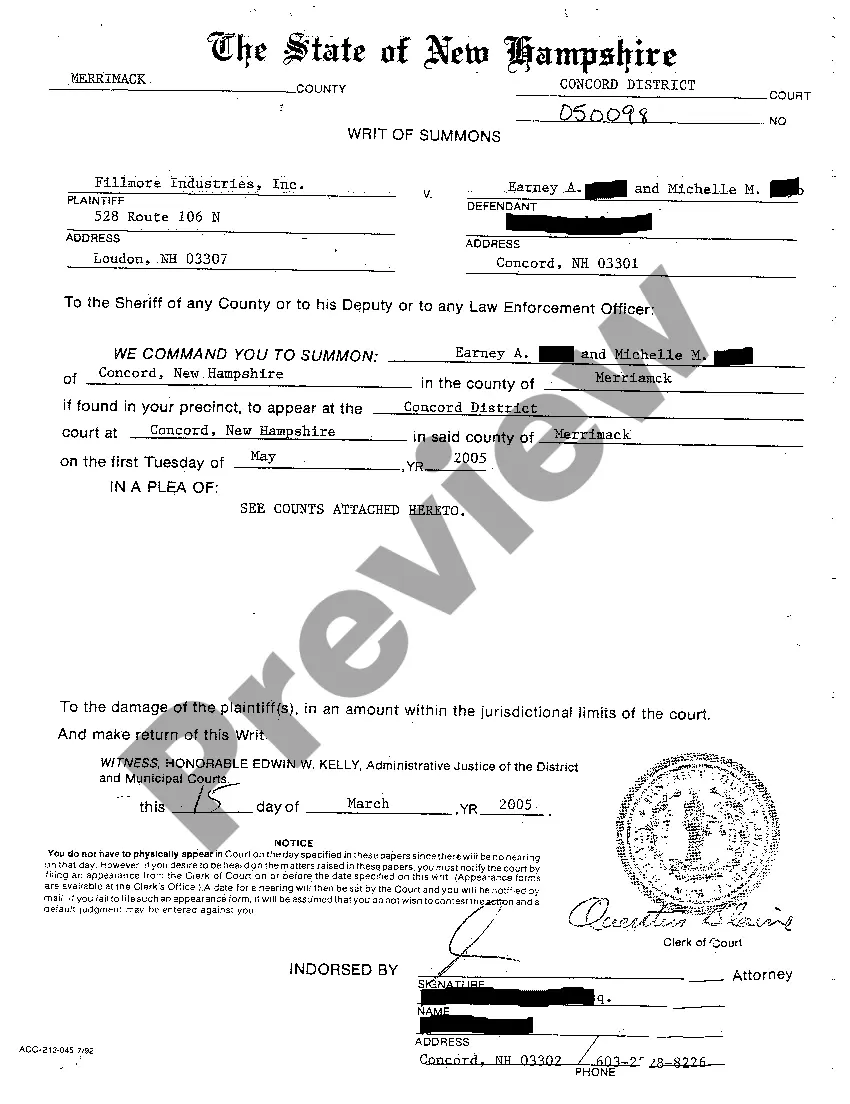

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."

There is no legal requirement for most promissory notes to be witnessed or notarized in Michigan (a promissory note for a home loan, however, may need to be notarized). Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

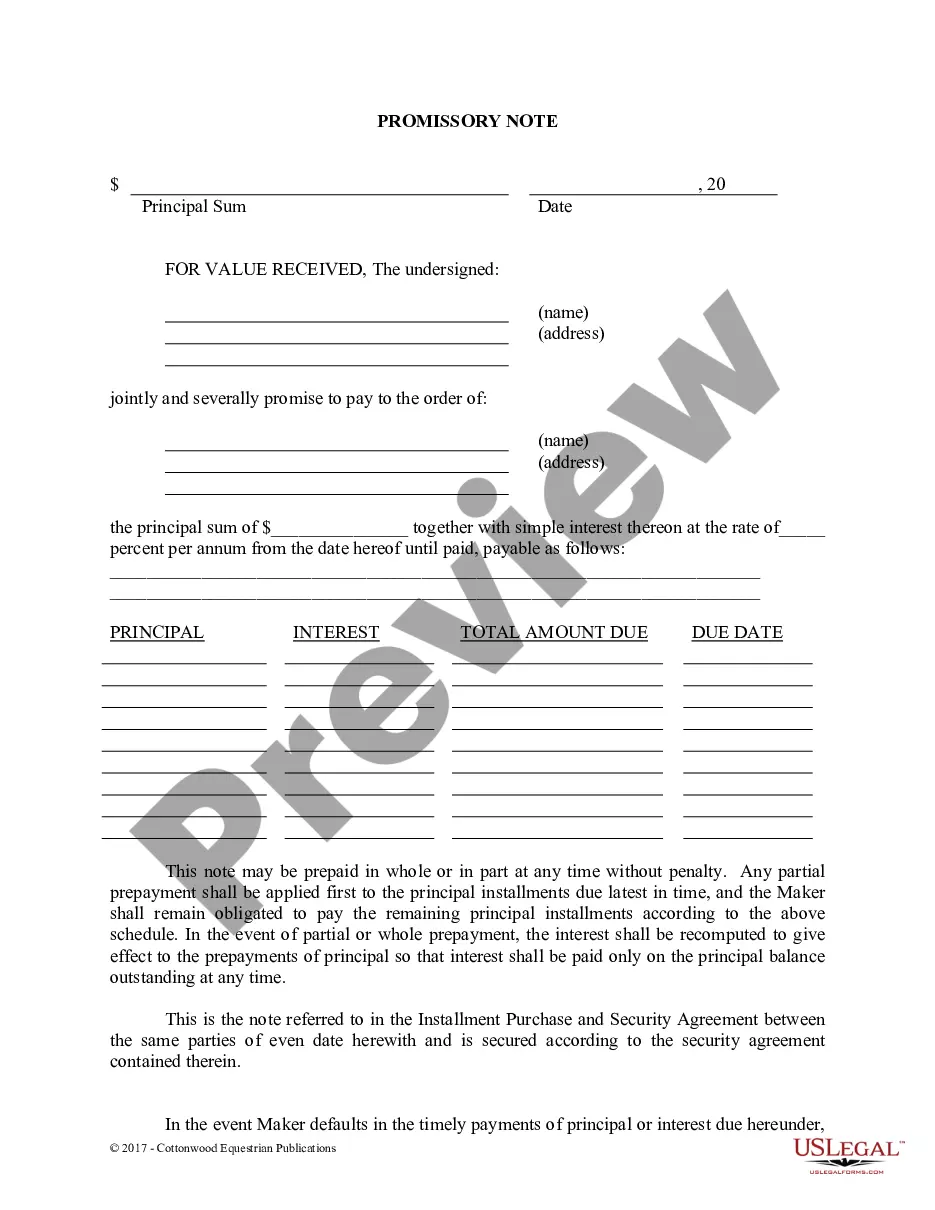

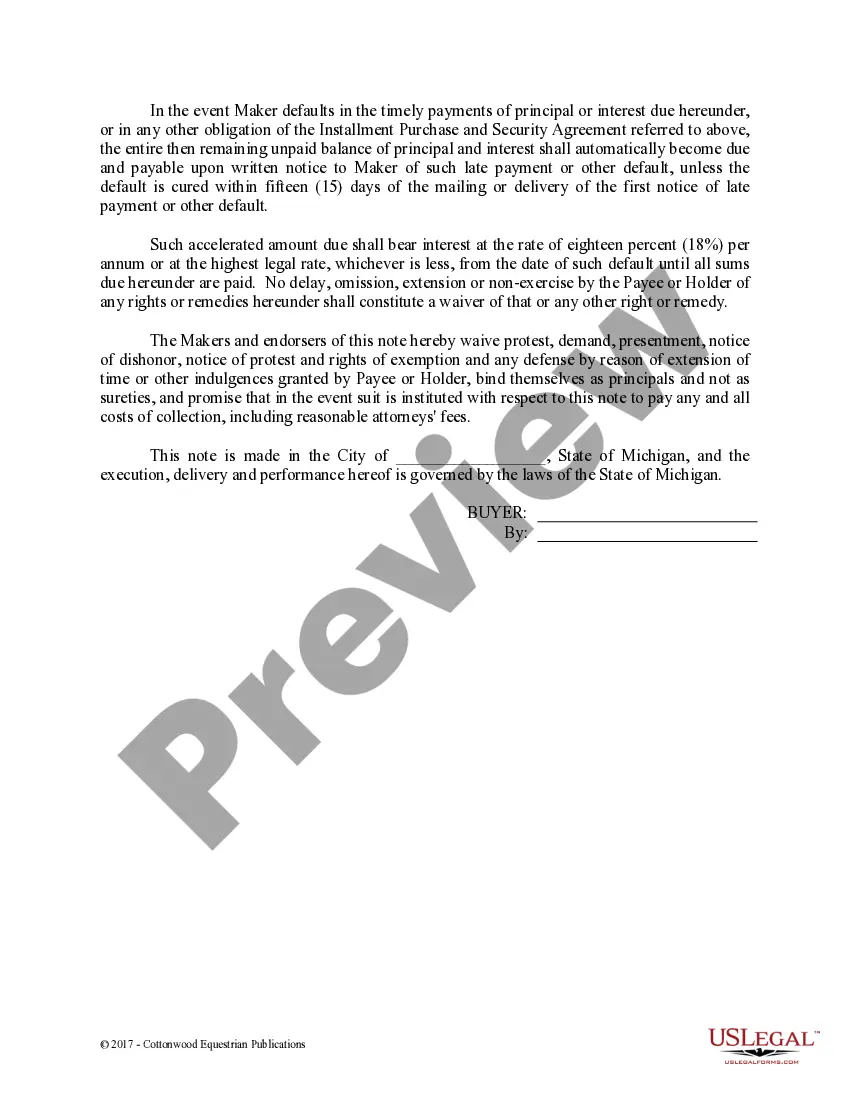

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

In any event, a promissory note does not have to be notarized to be binding. The private respondents have admitted signing the two notes and they have not succeeded in proving that they did so "under duress, fear and undue influence."