Promissory Note Template Michigan With Compound Interest

Description

How to fill out Michigan Promissory Note - Horse Equine Forms?

There’s no longer a requirement to devote time searching for legal documents to adhere to your local state regulations. US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our platform offers over 85k templates for any business and personal legal matters gathered by state and purpose of use. All forms are properly drafted and confirmed for validity, so you can be confident in acquiring an up-to-date Promissory Note Template Michigan With Compound Interest.

If you are acquainted with our service and already possess an account, you must ensure your subscription is active before obtaining any templates. Log In to your account, select the document, and click Download. You can also revisit all acquired documentation whenever necessary by accessing the My documents tab in your profile.

Print your form to fill it out manually or upload the sample if you prefer to use an online editor. Completing official documents under federal and state laws is quick and straightforward with our library. Try US Legal Forms now to keep your documentation organized!

- If you’ve never utilized our service before, the procedure will require a few additional steps to finish.

- Here’s how new users can find the Promissory Note Template Michigan With Compound Interest in our library.

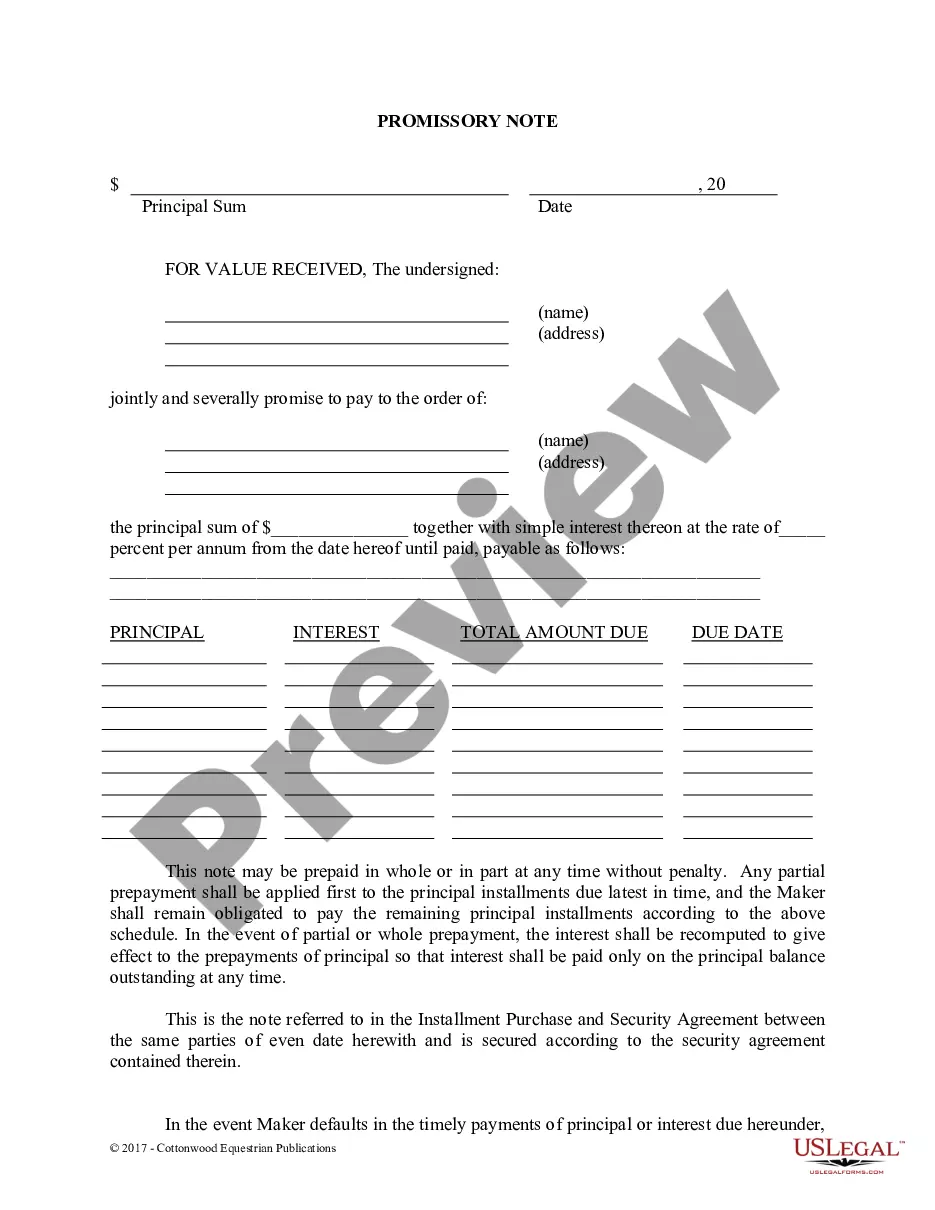

- Examine the page content thoroughly to ensure it holds the sample you need.

- To do so, make use of the form description and preview options if available.

- Use the Search field above to find another sample if the previous one didn't meet your needs.

- Click Buy Now next to the template title once you discover the correct one.

- Select the most suitable pricing plan and create an account or Log In.

- Complete payment for your subscription using a credit card or via PayPal to proceed.

- Select the file format for your Promissory Note Template Michigan With Compound Interest and download it to your device.

Form popularity

FAQ

1. INTEREST. Interest shall accrue on the unpaid principal balance of the Promissory Note at the applicable federal rate in effect on , 199 , which was percent ( %) per annum, compounded semiannually.

A promissory note must specify the percentage interest charged on the loan. All loans should carry some interest, even if it is between family members.

How to Write a Promissory NoteDate.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Calculating Compound Interest Compound interest uses a more complicated formula: You must add 1 to the interest rate (for example, a 5 percent interest rate would mean 1 + 0.05 = 1.05) and then raise the total to the power of whatever the number of periods is for repayment.

Find the principal amount of the loan as stated in the promissory note. Use a free online amortization calculator to calculate the amount of monthly interest. Divide the monthly interest amount by the principal loan amount to get the monthly interest rate.