Michigan Lady Bird Sample Withholding

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

Acquiring legal document samples that adhere to national and local regulations is crucial, and the web provides numerous choices to select from.

However, what’s the benefit of spending time searching for the correct Michigan Lady Bird Sample Withholding template online if the US Legal Forms digital library already consolidates such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by attorneys for any business and life situation. They are easy to navigate with all documents categorized by state and intended use.

Search for an alternative sample using the search feature at the top of the page if necessary. Click Buy Now once you’ve located the appropriate form and choose a subscription plan. Create an account or Log In and process a payment via PayPal or a credit card. Select the format for your Michigan Lady Bird Sample Withholding and download it. All templates available through US Legal Forms are reusable. To re-download and fill out previously purchased forms, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal paperwork service!

- Our experts stay updated with legislative changes, ensuring your paperwork remains current and compliant when obtaining a Michigan Lady Bird Sample Withholding from our site.

- Acquiring a Michigan Lady Bird Sample Withholding is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- If you are unfamiliar with our website, follow the steps outlined below.

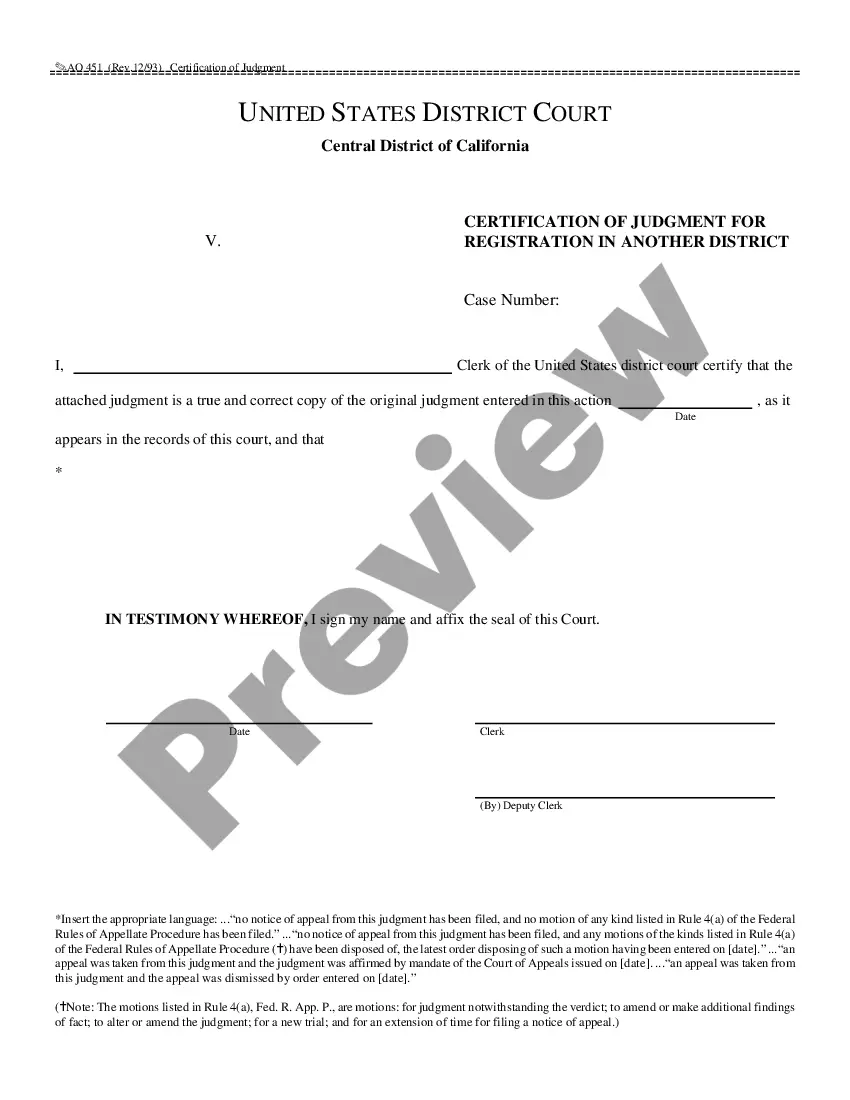

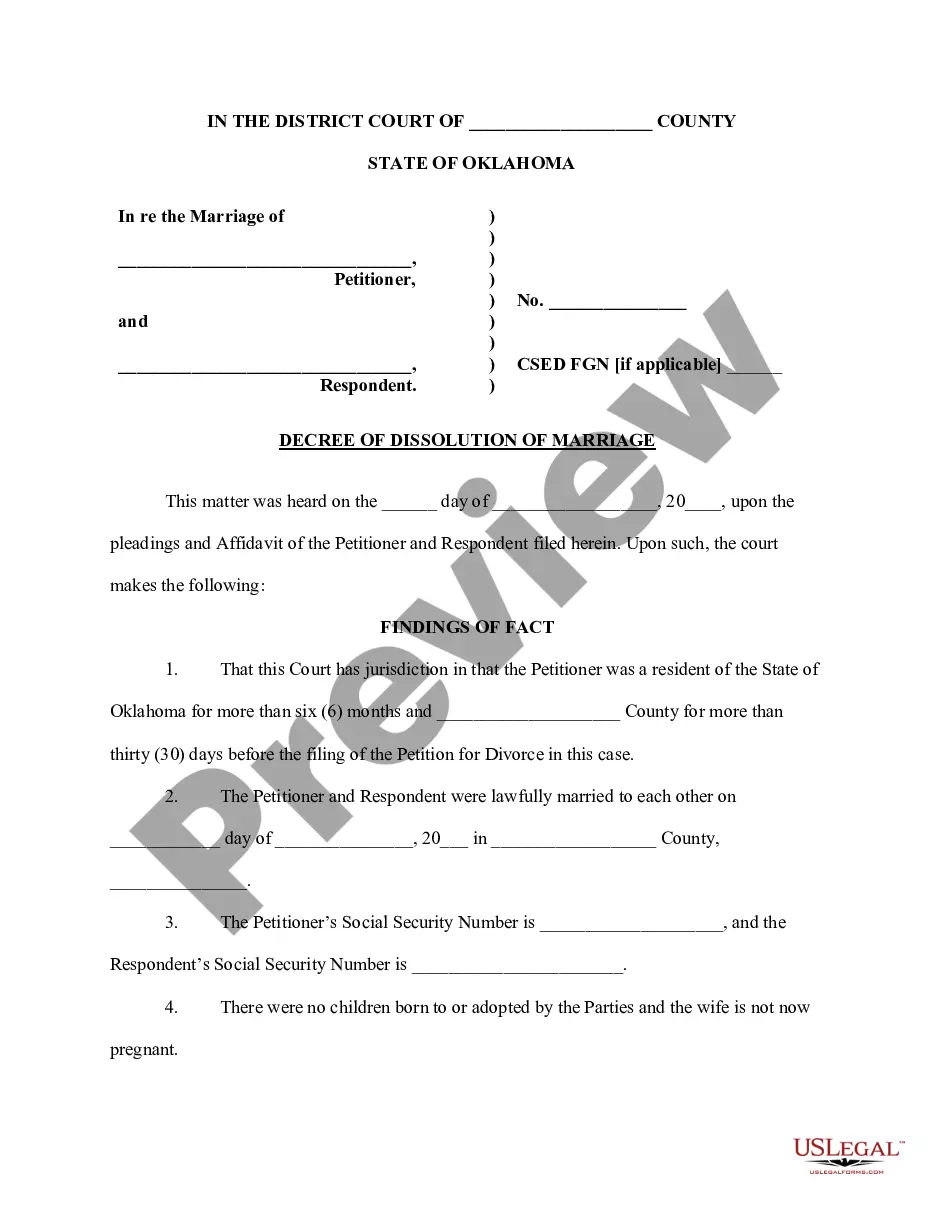

- Review the template using the Preview option or through the text description to confirm it fulfills your requirements.

Form popularity

FAQ

Filling out a Michigan quit claim deed requires you to gather the essential details about the property and the individuals involved. Start by entering the names of the grantor and grantee clearly, followed by a precise legal description of the property. After completing the form, ensure you sign it in front of a notary. For a streamlined process, consider accessing the US Legal Forms platform, which provides easy-to-follow templates for Michigan quit claim deeds and can enhance your understanding of the Michigan lady bird sample withholding.

Yes, you can write your own lady bird deed in Michigan, but it is essential to follow the legal guidelines to ensure its validity. You should include all necessary information such as the names of the parties involved and the property description. However, to avoid mistakes and ensure compliance with Michigan laws, you might find it helpful to utilize a Michigan lady bird sample withholding template available on the US Legal Forms platform.

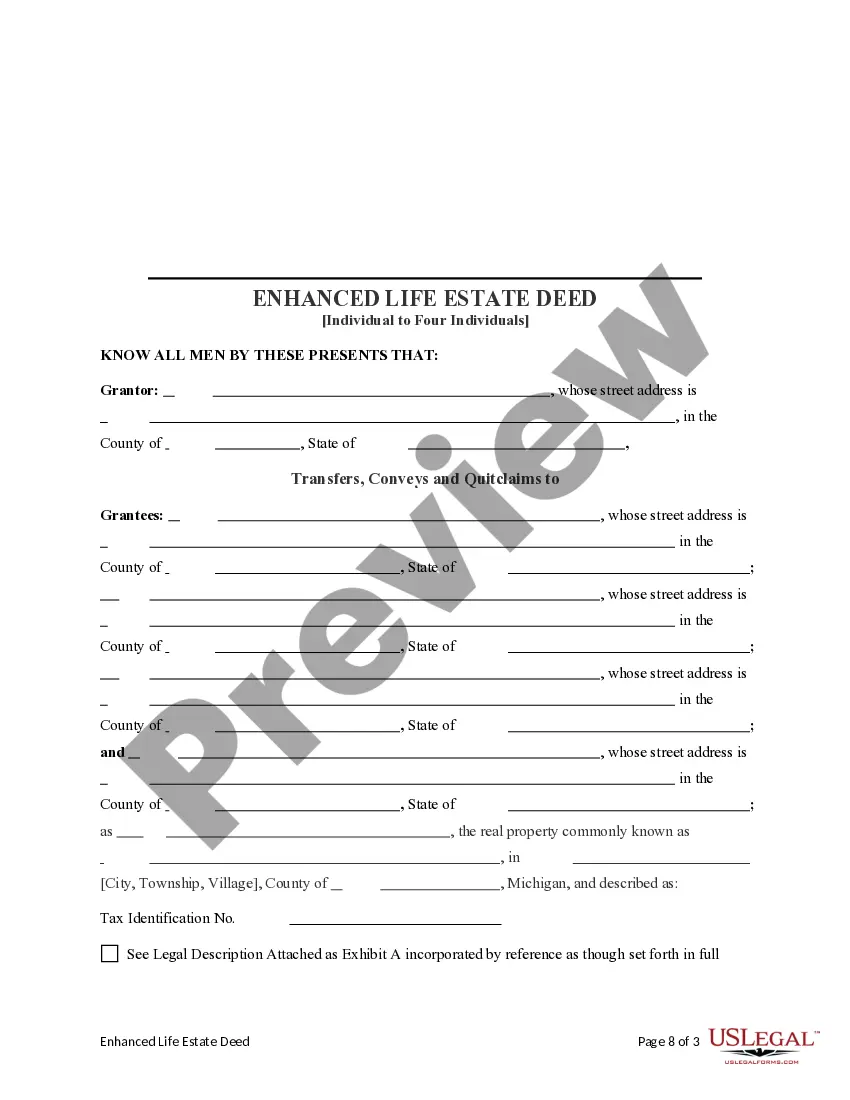

To fill out a lady bird deed in Michigan, start by obtaining a sample form that adheres to state requirements. You will need to provide the names of the grantor and grantee, along with a legal description of the property. Ensure you include the special powers granted to the grantee, allowing them to retain ownership and control during their lifetime. If you need guidance, consider using the resources available on the US Legal Forms platform for a Michigan lady bird sample withholding.

To obtain a ladybird deed in Michigan, you will need to complete a specific form that designates your property transfer upon your passing. First, you can find a Michigan lady bird sample withholding form online, ensuring it meets your local requirements. After filling out the form, sign it in front of a notary public and then file it with your local county register of deeds. If you prefer a simplified process, consider using the services of USLegalForms, which offers tailored templates to help you create a ladybird deed efficiently.

Yes, you can file a lady bird deed yourself in Michigan. However, it is essential to understand the legal requirements and ensure that the document is filled out accurately. If you feel uncertain about the process, seeking assistance from a knowledgeable platform like USLegalForms can provide you with the necessary tools and resources to file correctly. Utilizing a Michigan lady bird sample withholding can also simplify your experience.

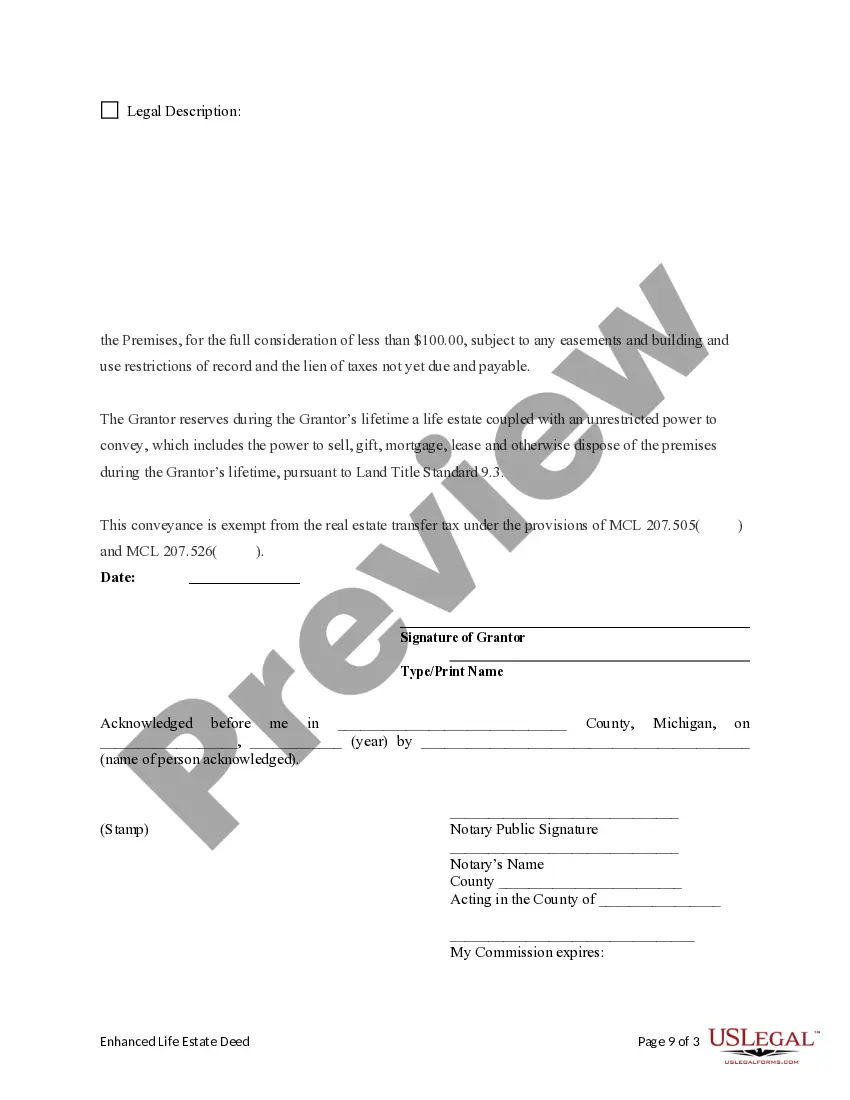

To file a lady bird deed in Michigan, you first need to create the deed document, ensuring it includes the necessary details like the property description and the names of the grantor and grantee. After drafting the document, you must sign it in front of a notary public. Then, you will need to record the deed with the county register of deeds where the property is located. Using a Michigan lady bird sample withholding can guide you in preparing the deed correctly.

Under Michigan law, a ladybird deed transfers ownership of real property at death and avoids probate court too. One of the most time-consuming probate process issues deals with houses, land, and other forms of property. Using the lady bird deed will help you avoid that.

The cost for a Lady Bird deed in Michigan can vary, generally less than $500. Keep in mind, this document takes additional attorney time when drafting the document, as the individual circumstance(s) and the appropriateness of the deed should be evaluated by an Estate Planning attorney.

The Ladybird deed should be recorded at the Register of Deeds office in the county in which the property is located. The Ladybird deed only becomes active once the grantor(s) passes away and his/her death certificate is recorded with the register of deeds.

In Michigan, a Lady Bird Deed (also known as a Ladybird Deed or Enhanced Life Estate Deed) is a type of Quitclaim Deed that allows you, the creator, to transfer your property upon your death to a named beneficiary without having to go through the expensive and time consuming Probate process.