Michigan Bird Deed With Mortgage Owed

Description

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Four Individuals?

Utilizing legal templates that adhere to federal and local regulations is essential, and the internet provides numerous choices to select from.

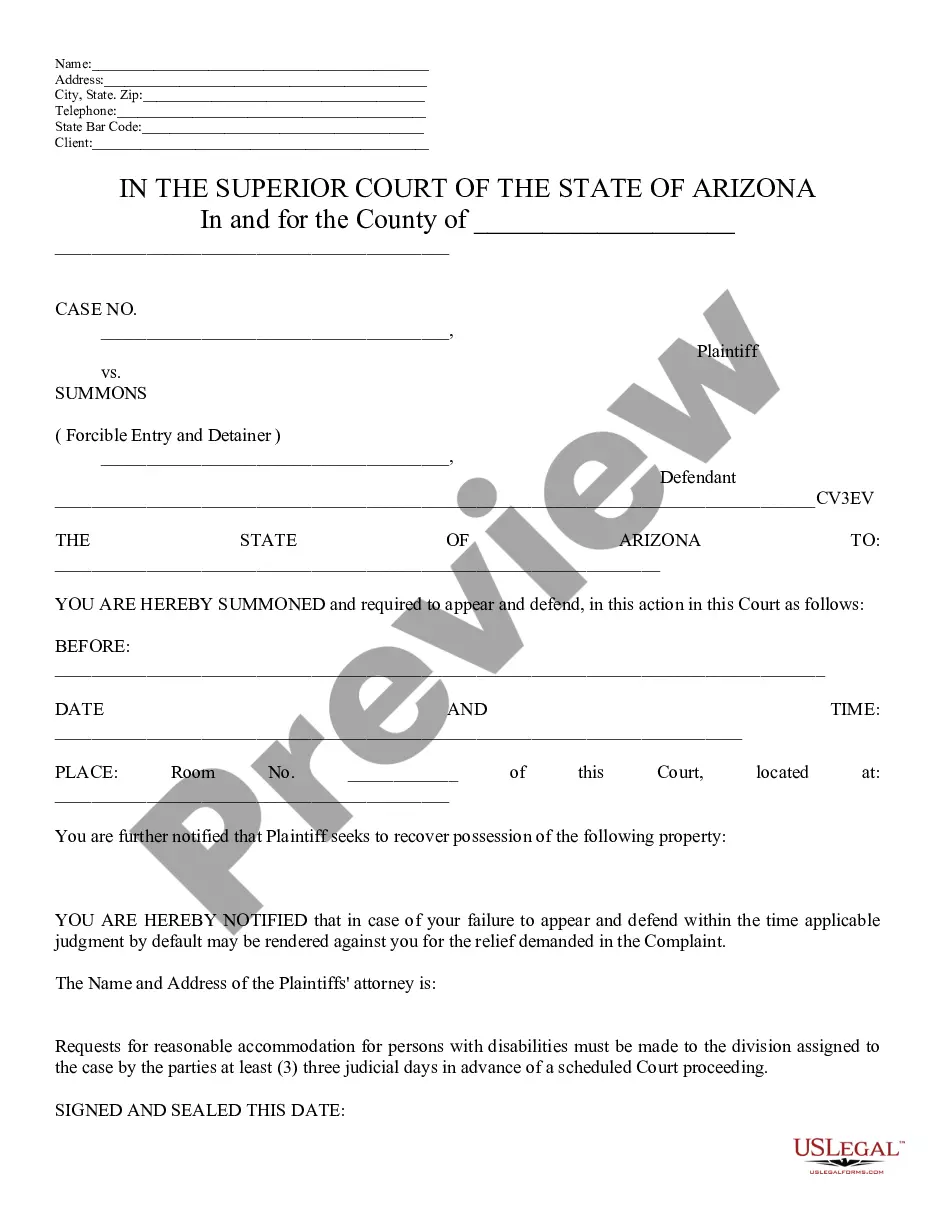

However, what is the benefit of spending time searching for the appropriate Michigan Bird Deed With Mortgage Owed example online when the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates created by attorneys for various professional and personal situations.

Review the template using the Preview feature or the text description to confirm it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legal changes, so you can always be confident that your form is current and compliant when obtaining a Michigan Bird Deed With Mortgage Owed from our platform.

- Acquiring a Michigan Bird Deed With Mortgage Owed is simple and rapid for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in your preferred format.

- If you are new to our website, follow the steps below.

Form popularity

FAQ

In Michigan, the common method of securing loans is through a mortgage rather than a deed of trust. A Michigan bird deed with mortgage owed can provide you with a clear transfer of property while retaining certain rights. If you want to understand how these two documents interact, checking them out through US Legal Forms can provide you with the necessary resources to navigate your options effectively.

To fill out a Michigan bird deed with mortgage owed, you must first obtain the correct form. Begin by providing the names of the property owners and the beneficiaries. Clearly outline the property description and any mortgage obligations attached to the property. After completing the form, make sure to sign it in the presence of a notary and file it with the county where the property is located.

The primary difference lies in the rights granted to the grantee. A quitclaim deed transfers any interest the grantor has without warranties, often resulting in potential risks. In contrast, a Lady Bird deed not only transfers ownership but also retains the right to control the property during the grantor's lifetime, which is especially important when considering a Michigan bird deed with mortgage owed. Understanding these distinctions can guide your decision on which type of deed serves your needs.

While it is possible to create a Lady Bird deed independently, consulting a lawyer is highly advisable. A legal professional can help ensure that your deed complies with Michigan laws and accurately reflects your intentions, especially if it involves a Michigan bird deed with mortgage owed. Engaging a lawyer can save you time and prevent potential legal issues down the line.

In many cases, a Lady Bird deed can be a beneficial estate planning tool in Michigan. It helps avoid probate and can provide protection against creditors, which is particularly valuable if you have a Michigan bird deed with mortgage owed. However, it is vital to assess your financial situation and goals to determine if this option aligns with your needs.

While the Lady Bird deed offers several benefits, there are some drawbacks to consider. For instance, it may affect Medicaid eligibility due to asset transfer rules. Additionally, a Michigan bird deed with mortgage owed does not eliminate the need for managing existing mortgages, and heirs might face challenges if there are outstanding debts. It is essential to weigh these factors carefully before proceeding.

A Michigan bird deed with mortgage owed can offer some level of protection from creditors. This type of deed allows property owners to retain control over their property while designating a beneficiary. However, it does not completely shield the property from creditor claims, especially if there are existing debts. Understanding how a ladybird deed works is essential, and platforms like uslegalforms can help you navigate these complexities effectively.

One notable downside of the ladybird deed is that it does not shield property from all financial issues. If you encounter significant debt or if creditors seek to claim the asset, the property could still be at risk. Moreover, if the beneficiaries decide to sell the property before the original owner's death, this can lead to family disagreements. It is vital to consider these aspects when using a Michigan bird deed with mortgage owed.

While a ladybird deed offers many benefits, it also comes with some disadvantages. For instance, it may affect your eligibility for certain types of assistance, and the property is still subject to creditors' claims during your lifetime. Additionally, changes in circumstances, such as divorce or family disputes, can complicate matters. Understanding the potential downsides is essential, particularly when dealing with a Michigan bird deed with mortgage owed.

A ladybird deed can work effectively alongside an existing mortgage, allowing homeowners to retain control while ensuring a smooth transfer upon death. The property remains under your control even if there's a mortgage owed, and you remain responsible for payments. It's important to inform your lender about the deed to avoid potential issues. A carefully crafted Michigan bird deed with mortgage owed can be an advantageous estate planning tool.