Printable Lady Bird Deed Form Michigan With Name

Description

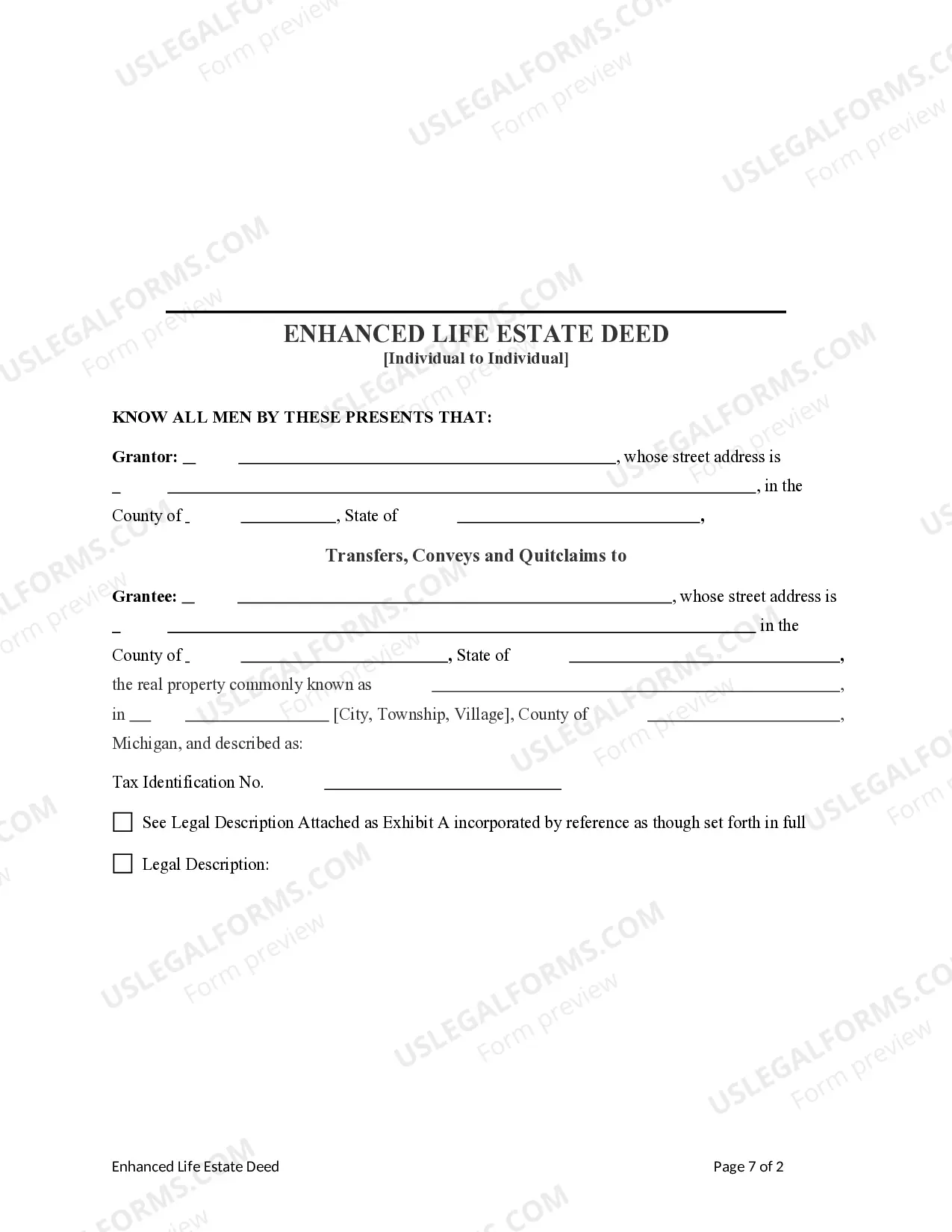

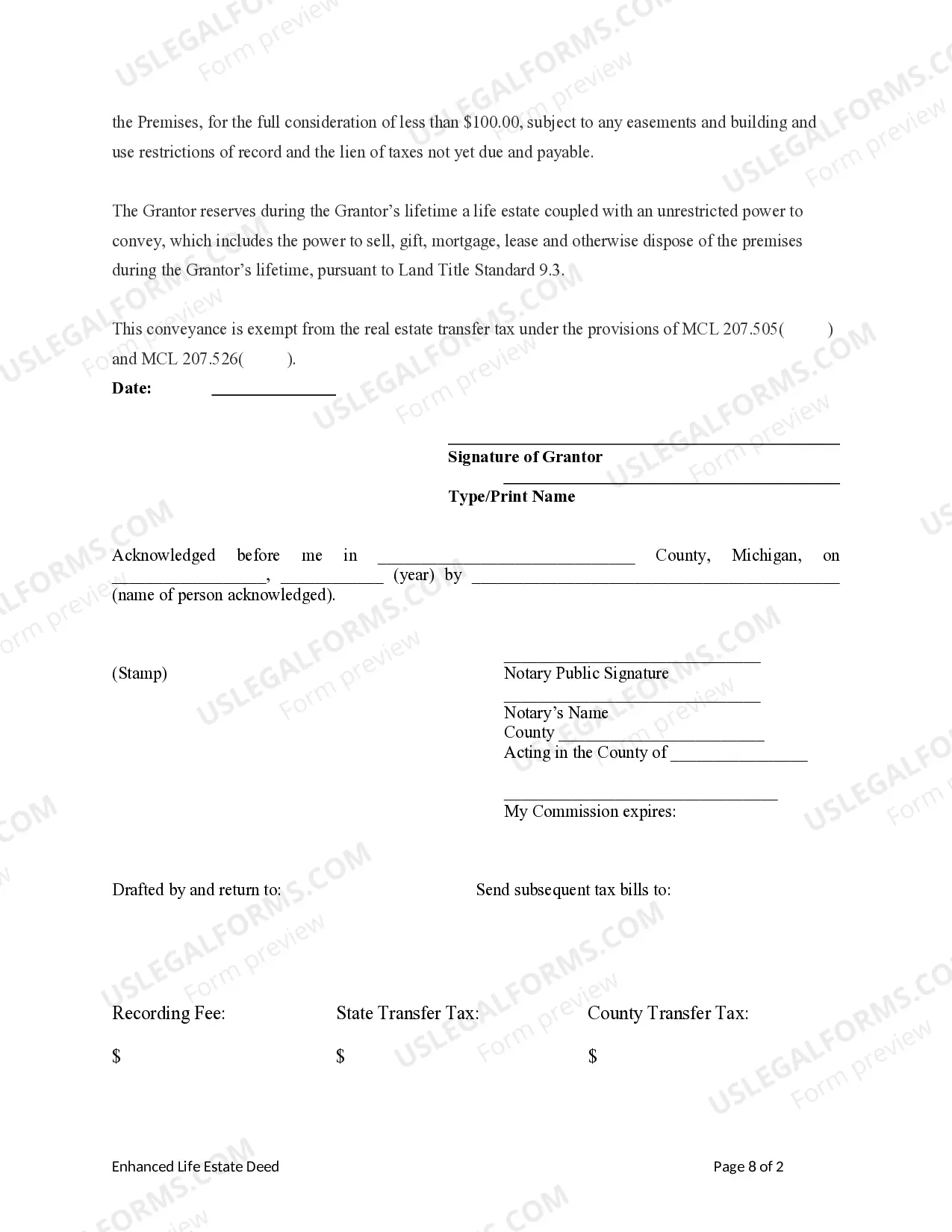

How to fill out Michigan Enhanced Life Estate Or Lady Bird Deed - Individual To Individual?

Creating legal documents from the beginning can frequently be intimidating.

Certain situations may require extensive research and considerable financial investment.

If you’re seeking a more straightforward and economical method of preparing the Printable Lady Bird Deed Form Michigan With Name or any other forms without unnecessary complications, US Legal Forms is consistently available to assist you.

Our online repository of over 85,000 current legal documents covers nearly every aspect of your financial, legal, and personal affairs. With mere clicks, you can swiftly obtain state- and county-compliant forms meticulously assembled for you by our legal experts.

Examine if the selected form complies with the regulations and laws of your state and county. Choose the most appropriate subscription plan to acquire the Printable Lady Bird Deed Form Michigan With Name. Download the form, then complete it, sign it, and print it. US Legal Forms has an impeccable reputation and more than 25 years of experience. Join us today and make form completion easy and efficient!

- Utilize our service whenever you need a trustworthy and dependable platform through which you can easily find and download the Printable Lady Bird Deed Form Michigan With Name.

- If you’re familiar with our site and have already established an account, just Log In to your account, select the template, and download it right away or re-download it anytime from the My documents section.

- Not registered yet? No worries. It requires minimal time to sign up and browse the catalog.

- However, before directly jumping to download the Printable Lady Bird Deed Form Michigan With Name, consider these suggestions.

- Review the form preview and descriptions to ensure you have located the document you need.

Form popularity

FAQ

No, a quitclaim deed is not the same as a ladybird deed in Michigan. While both transfer property rights, a quitclaim deed lacks provisions for avoiding probate. A ladybird deed provides more substantial benefits by allowing you to maintain control of the property until your passing. You can easily access the Printable lady bird deed form Michigan with name to explore this option.

A living trust can help you manage and pass on a variety of assets. However, there are a few asset types that generally shouldn't go in a living trust, including retirement accounts, health savings accounts, life insurance policies, UTMA or UGMA accounts and vehicles.

A Wyoming trust typically costs anywhere between $600 and $2,950. At Snug, any member can create a Power of Attorney and Health Care Directive for free. A Will costs $195 and a Trust costs $500. For many families, this is a great option to get you fully covered and save some money while doing it.

The two basic types of trusts are a revocable trust, also known as a revocable living trust or simply a living trust, and an irrevocable trust. The owner of a revocable trust may change its terms at any time.

Limitations: Requires adherence to trust document's instructions on asset assignments. Joint assets, including certain IRAs and retirement plans, cannot be placed into a one-person trust. No complete tax avoidance: Total avoidance of taxes is rarely possible with living trusts, though there may be ways to reduce them.

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.

The Disadvantage of a Revocable Living Trust Expansive: Creating a revocable living trust can be more expensive than a simple will due to legal fees and document preparation. Complexity: Managing a trust requires ongoing paperwork and record-keeping, which can be burdensome and time-consuming.

To create your living trust in Wyoming, prepare a written trust document and then sign it in front of a notary. For the trust to be effective, you must next transfer ownership of assets into it. A living trust may be a good solution for your estate plan. Weigh its benefits and limitations when making a decision.

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the terms can be changed at any time. An irrevocable trust describes a trust that cannot be modified after it is created without the beneficiaries' consent.