This is one of the official Workers' Compensation forms for the state of Maine.

Maine Workers Comp Settlement Without Surgery

Description

How to fill out Maine Lump Sum Settlement For Workers' Compensation?

Finding a reliable source for accessing the most up-to-date and pertinent legal templates is a significant part of managing bureaucracy.

Identifying the correct legal documents requires precision and meticulousness, which is why it's crucial to obtain samples of Maine Workers Comp Settlement Without Surgery solely from credible sources, like US Legal Forms. An incorrect template will squander your time and delay your situation. With US Legal Forms, you have minimal concerns.

Eliminate the complications associated with your legal paperwork. Explore the extensive US Legal Forms catalog where you can discover legal templates, assess their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Access the form’s details to determine if it meets your state's and area's requirements.

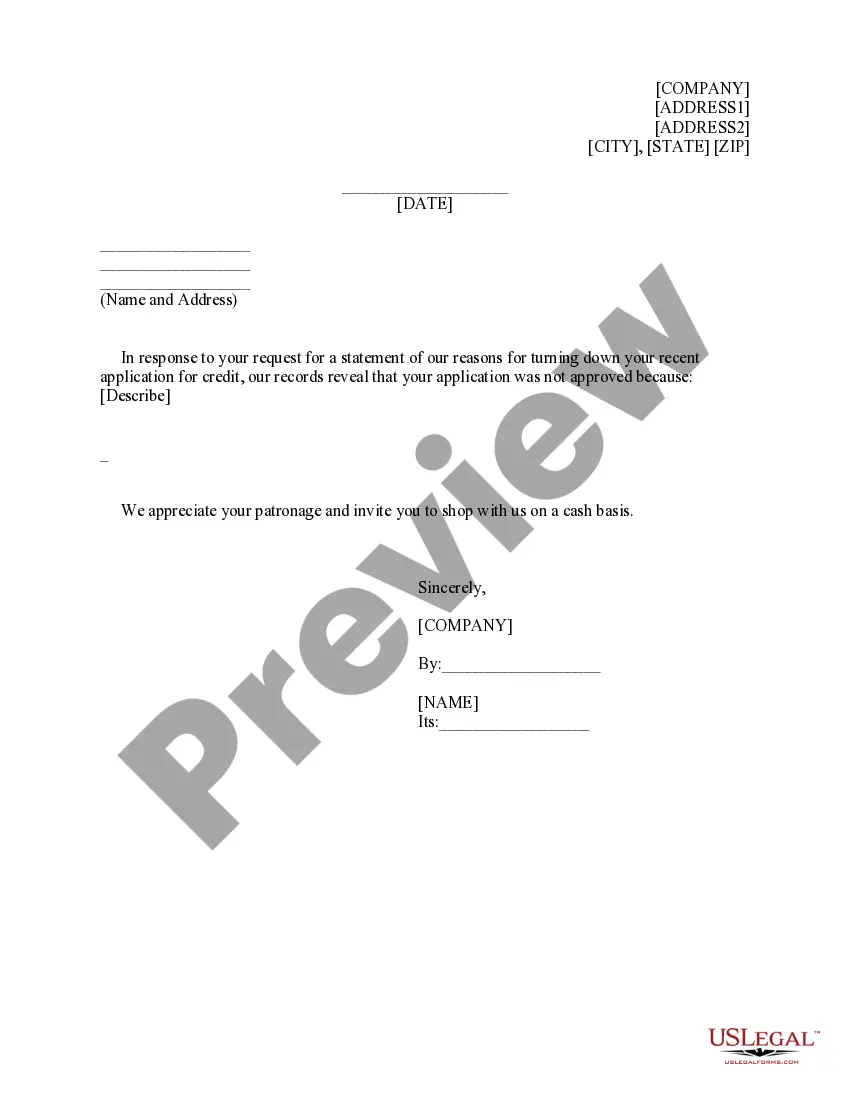

- Preview the form, if available, to confirm it is the template you need.

- Return to the search to find the suitable document if the Maine Workers Comp Settlement Without Surgery does not fulfill your criteria.

- If you are confident about the form’s relevance, download it.

- As an authorized customer, click Log in to verify and access your selected forms in My documents.

- If you haven't created a profile yet, click Buy now to acquire the template.

- Choose the pricing plan that suits your requirements.

- Proceed to the registration to complete your purchase.

- Conclude your transaction by selecting a payment option (credit card or PayPal).

- Select the document format for downloading Maine Workers Comp Settlement Without Surgery.

- After obtaining the form on your device, you may edit it using the editor or print it for manual completion.

Form popularity

FAQ

Your employer will pay you 2/3 of your average weekly wage. This is called your compensation rate. There is a limit on how much you can receive, and the limit is different for different dates of injury.

Do you have to pay taxes on your workers' compensation payments? The answer is no. Whether you received wage loss benefits on a weekly basis or a lump sum settlement, workers' compensation is not taxable. IRS Publication 907 reads as follows: ?The following payments are not taxable ?

The maximum compensation rate for injuries on or after January 1, 2020 is 125% of the State Average Weekly Wage. Update for 2022: the state average weekly wage (SAWW) to $1,036.13. Provides that the maximum for injuries occurring July 1, 2022, through June 30, 2023, is $1295.16. States that the multiplier is 1.05298.

Regardless of your date of injury, if your incapacity is total, you may receive benefits for as long as you are unable to work.

Typically, if your new job pays you less than you were making prior to your injury, you can still receive payment for the difference in wages. You can also continue to receive medical benefits for all healthcare costs related to your injury. If you're disabled, you can still receive disability benefits.