Firpta For Disregarded Entity

Description

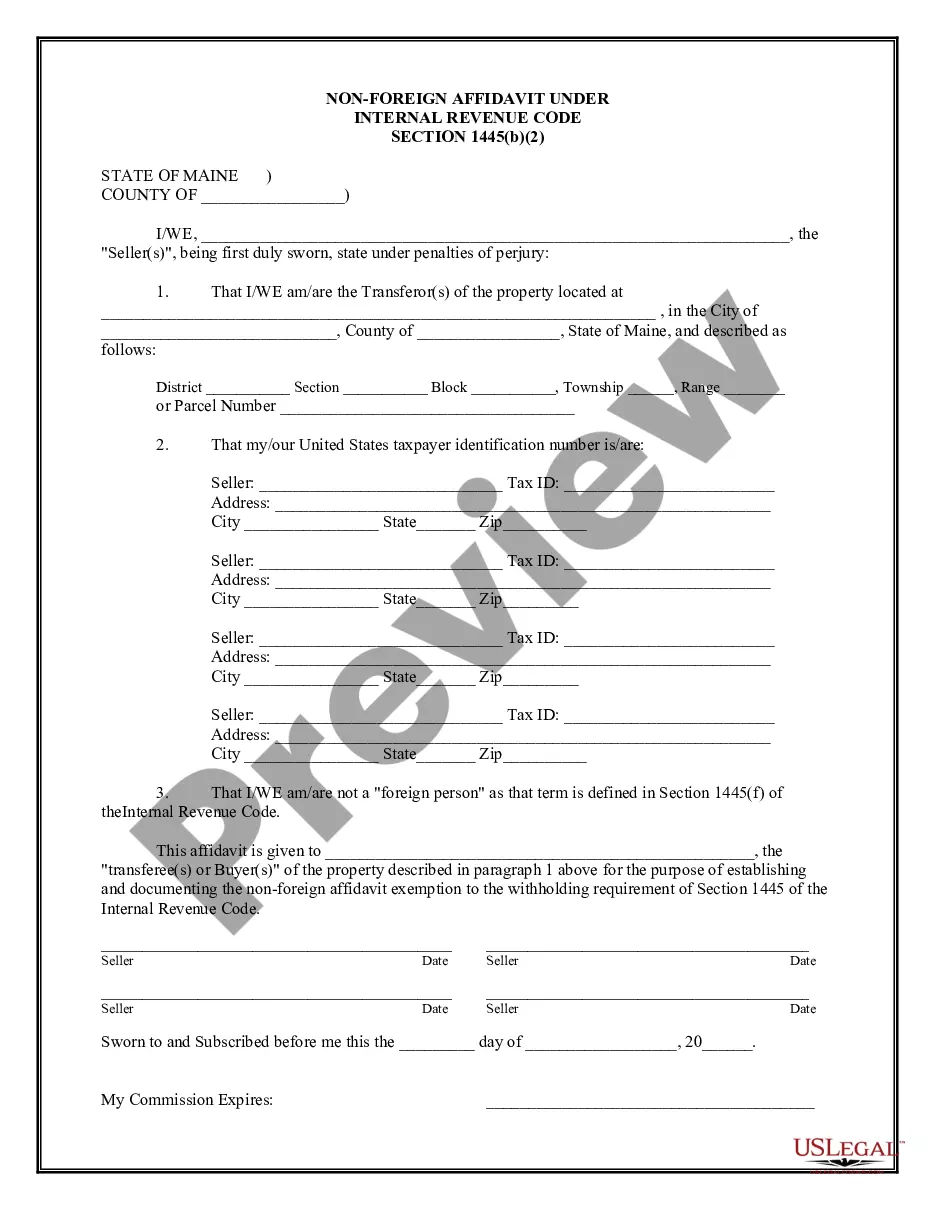

How to fill out Maine Non-Foreign Affidavit Under IRC 1445?

Finding a reliable source to acquire the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires accuracy and careful observation, which is why it is essential to obtain samples of Firpta For Disregarded Entity exclusively from trustworthy sources, such as US Legal Forms.

Eliminate the hassle associated with your legal documentation. Explore the vast collection of US Legal Forms, where you can locate legal templates, assess their suitability for your situation, and download them instantly.

- Utilize the catalog navigation or search feature to locate your template.

- Access the form’s details to ensure it meets the regulations of your state and county.

- Preview the form, if available, to confirm it is the template you need.

- Return to the search to find the appropriate template if the Firpta For Disregarded Entity does not fulfill your needs.

- When you are confident about the form’s suitability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that aligns with your preferences.

- Continue to the registration to finalize your purchase.

- Complete your transaction by selecting a payment option (credit card or PayPal).

- Select the file format for downloading Firpta For Disregarded Entity.

- Once you have the form saved on your device, you can edit it using the editor or print it and complete it manually.

Form popularity

FAQ

A FIRPTA statement is an essential document that conveys the tax status of the seller in a real estate transaction. It confirms whether the seller is a foreign person or entity and outlines any required withholding taxes. Understanding this document is crucial for those dealing with FIRPTA for disregarded entities, as it outlines their tax responsibilities clearly.

You can avoid FIRPTA withholding by qualifying for an exemption or by obtaining a withholding certificate from the IRS. Common exceptions apply to certain sales priced under $300,000 or when the buyer plans to use the property as their primary residence. If you represent a disregarded entity, it is advisable to consult with tax advisors to explore available options that minimize or eliminate FIRPTA liabilities.

To obtain a FIRPTA withholding certificate, you must submit IRS Form 8288-B to the Internal Revenue Service alongside supporting documentation. This form requests a reduction or exemption from withholding, which can be especially useful for disregarded entities. Engaging with tax professionals or platforms like uslegalforms can streamline this process and ensure compliance.

The FIRPTA affidavit is generally prepared by the seller of the property or their legal representative. It is important for sellers to ensure that the affidavit accurately reflects their status under FIRPTA. If you are dealing with a disregarded entity, it is essential to work with professionals who can help draft the necessary affidavit to clarify tax implications.

A FIRPTA statement typically includes details about the seller, the property in question, and the amount of gain realized from the sale. It confirms the status of the seller as either a foreign person or entity and outlines their tax obligations. For a disregarded entity, this statement is crucial as it clarifies tax responsibilities for gains realized from U.S. real property.

Getting around FIRPTA typically involves understanding the legal options available to you. You may consider exemptions, or structuring the deal in a way that minimizes tax liability. It's essential to consult with professionals who can provide tailored advice. Resources like US Legal Forms can offer valuable insights on FIRPTA for disregarded entities, helping you find the best path forward.

Addressing FIRPTA can be challenging, but there are ways to navigate the rules. One option is to explore exemptions that may apply to your situation, such as the seller providing a U.S. tax identification number. Another approach involves structuring the transaction creatively, such as using partnerships. For effective strategies, consider consulting platforms like US Legal Forms for guidance on FIRPTA for disregarded entities.

To obtain a FIRPTA exemption, you must meet specific criteria outlined by the IRS. Common exemptions include sales where the property value is below a certain threshold or when the seller is a U.S. citizen. You will need to provide the necessary documentation to support your claim. Utilizing resources like US Legal Forms can simplify the process of obtaining a FIRPTA exemption for disregarded entity transactions.

A foreign disregarded entity is a business entity created outside the U.S. that has a single owner and is not taxed separately by the IRS. If this entity invests in U.S. real property, it may have FIRPTA obligations when it sells. These rules can introduce complexities, especially regarding tax obligations in both jurisdictions. Accessing resources, like those provided by UsLegalForms, can clarify FIRPTA for disregarded entity implications and help in managing your compliance.

A disregarded entity typically refers to a business entity that the IRS does not consider separate from its owner. This often includes single-member LLCs and sole proprietorships. Such entities do not incur separate federal income tax liabilities, simplifying tax filing processes. However, understanding how FIRPTA for disregarded entity statuses applies is crucial for those involved in real estate transactions.