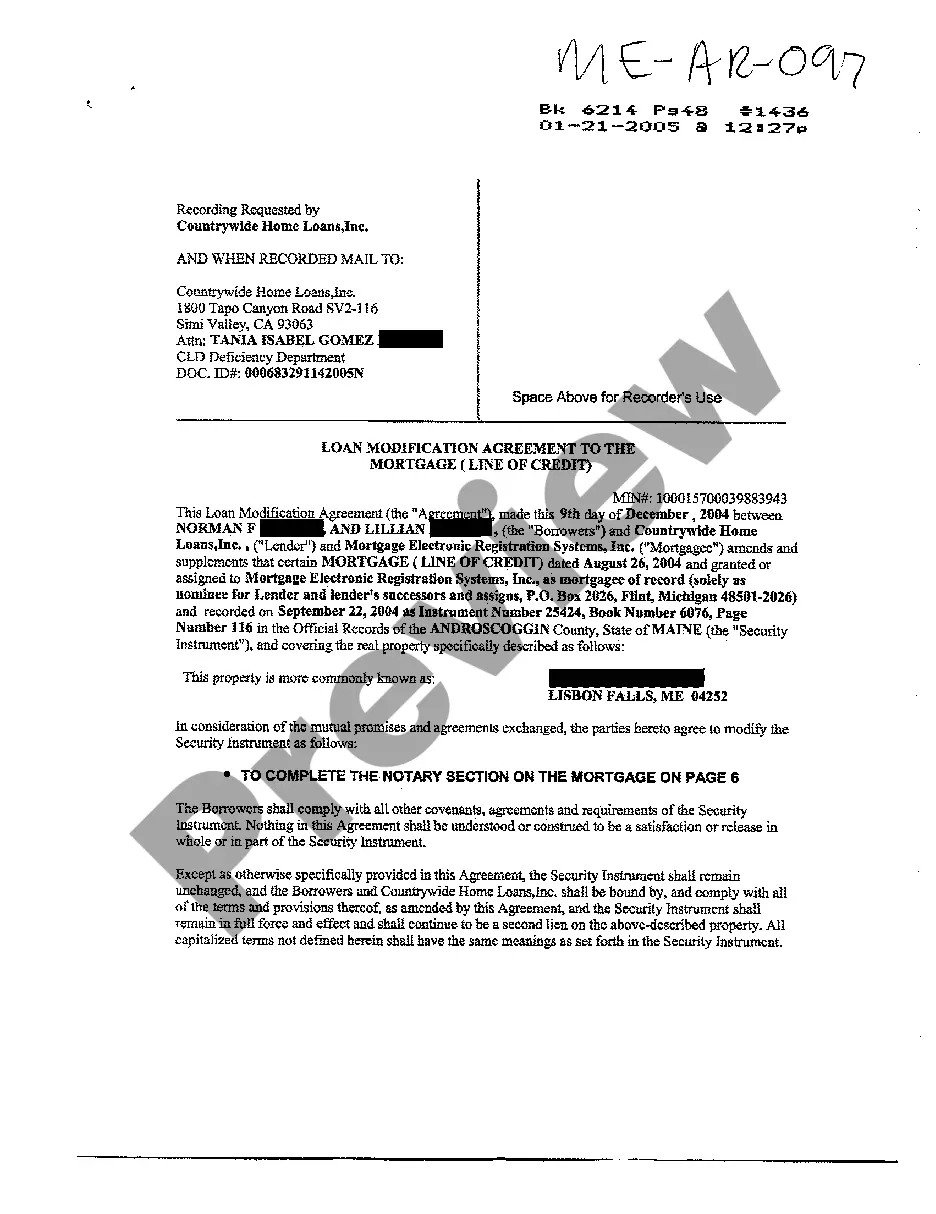

Mortgage Modification Agreement Maine Form

Description

How to fill out Maine Loan Modification Agreement To The Mortgage?

There’s no further justification to squander time looking for legal documents to adhere to your local state rules.

US Legal Forms has compiled all of them in one location and streamlined their accessibility.

Our platform provides over 85k templates for any business and personal legal situations categorized by state and area of application.

Completing legal paperwork under federal and state regulations is swift and straightforward with our platform. Experience US Legal Forms now to maintain your documentation systematically!

- All forms are expertly drafted and verified for authenticity, allowing you to be confident in obtaining a current Mortgage Modification Agreement Maine Form.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documentation whenever necessary by opening the My documents tab in your profile.

- If you’ve never used our service before, the process will involve a few additional steps to finalize.

- Here’s how new users can find the Mortgage Modification Agreement Maine Form in our repository.

- Examine the page content closely to confirm it contains the sample you need.

- To accomplish this, use the form description and preview options if available.

Form popularity

FAQ

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

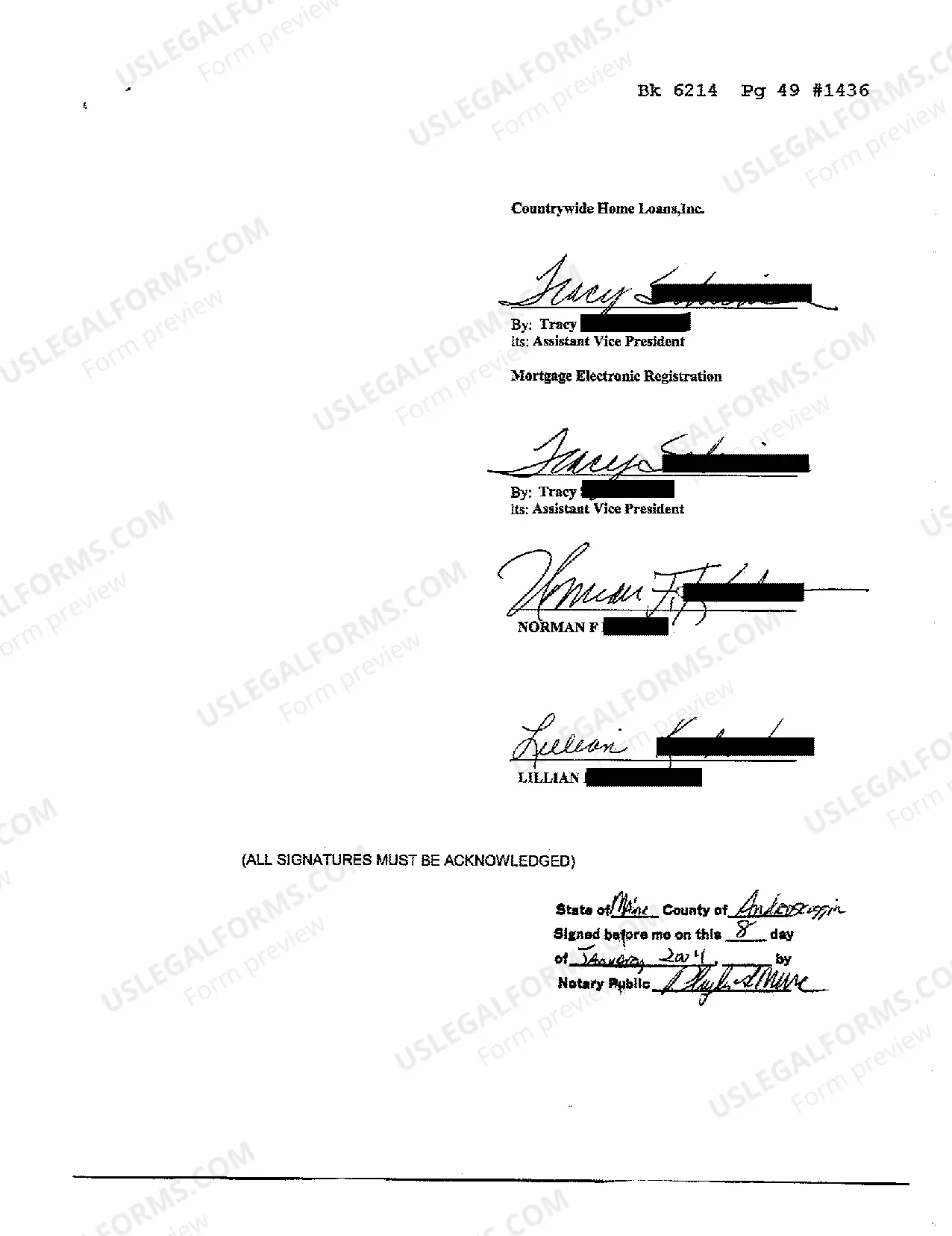

When you've successfully completed your trial modification payments, your mortgage loan servicer will send you a loan modification agreement. That agreement needs to be signed by you, stamped and signed by a notary, and sent back to your servicer.

The loan modification process can be complicated and difficult. Most homeowners are denied a few times before they are finally approved. Often, the denials are legitimate--because the process is confusing, many homeowners don't do it correctly.

Fannie Mae will execute the mortgage loan modification agreement and return it to the servicer, regardless of whether the executed mortgage loan modification agreement needs to be recorded. Note: If the mortgage loan modification agreement needs to be recorded, the servicer must submit it for recordation.

Contact your servicerContact your lender or servicer and ask for a loan modification. If you're denied, you have 14 days after the denial date to ask for a review of your application, but only if you applied for the modification at least three months before the foreclosure sale of your home.