Limited Lliability

Description

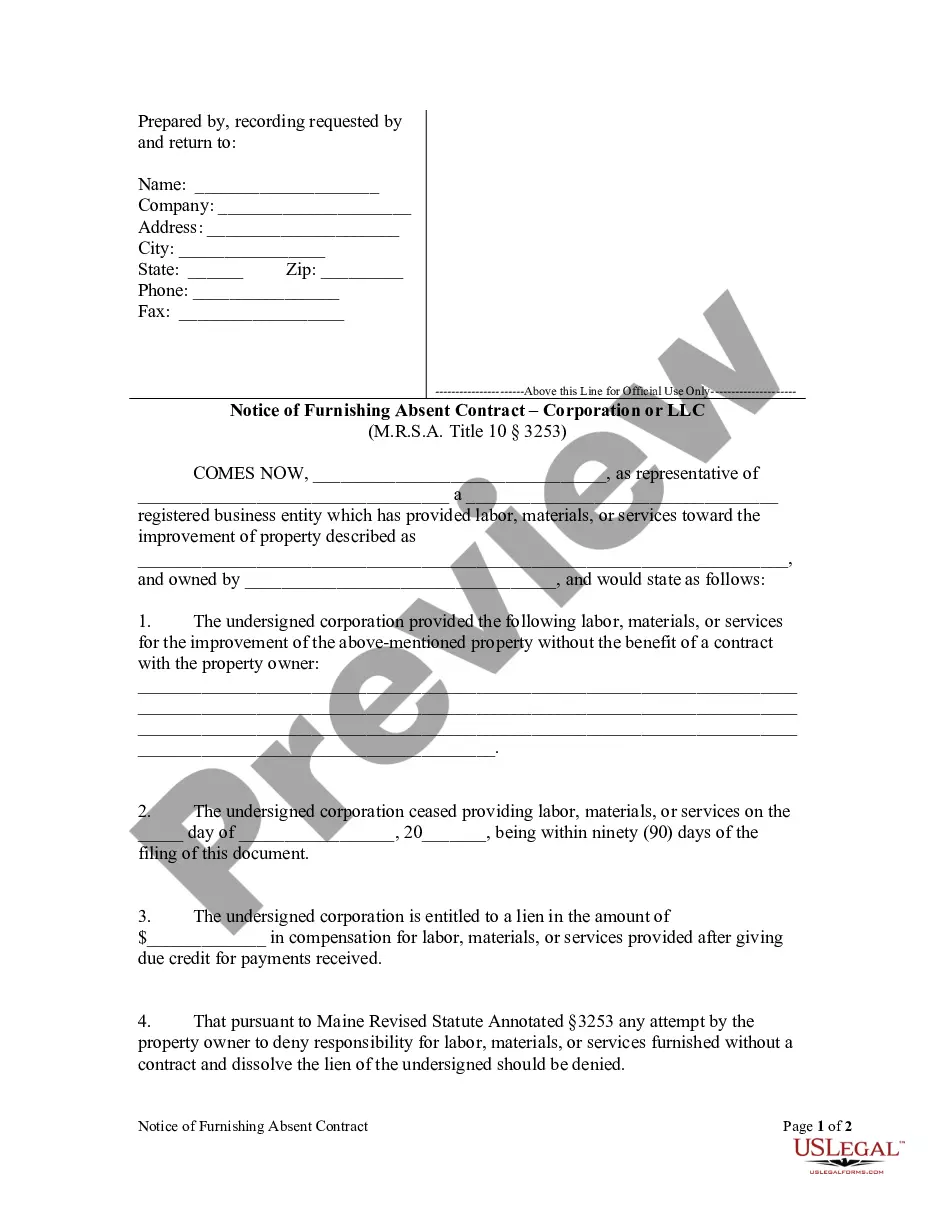

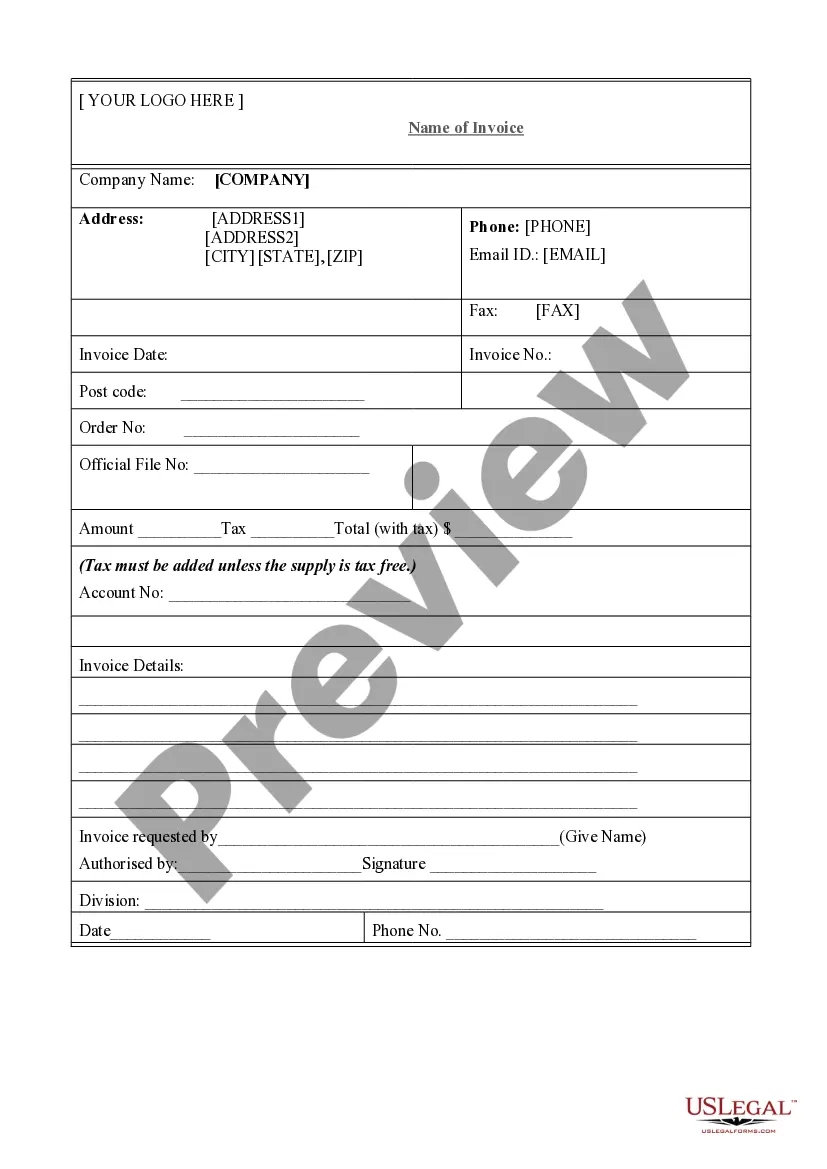

How to fill out Maine Notice Of Furnishing Absent Contract - Corporation Or LLC?

- If you're a returning user, log in to your account and locate your desired form template. Click on the Download button to save it on your device. Confirm that your subscription is current; if not, renew it based on your payment plan.

- For first-time users, start by checking the preview and description of the form. Ensure it aligns with your specific needs and local jurisdiction requirements.

- If the form doesn’t meet your criteria, utilize the Search tab to find alternatives. Select a suitable template before proceeding.

- Once you've identified the right form, click the Buy Now button and choose your preferred subscription plan. You'll need to create an account for access to the entire library.

- Complete your purchase by entering your credit card information or opting for PayPal.

- After your payment, download the required document to your device. To revisit it later, you can access it via the My Forms section of your profile.

US Legal Forms ensures that users have access to more forms than their competitors at a comparable cost, with a library boasting over 85,000 customizable legal forms.

Don't miss out on the opportunity to secure your business's future. Start your journey with US Legal Forms today and ensure your limited liability needs are addressed efficiently!

Form popularity

FAQ

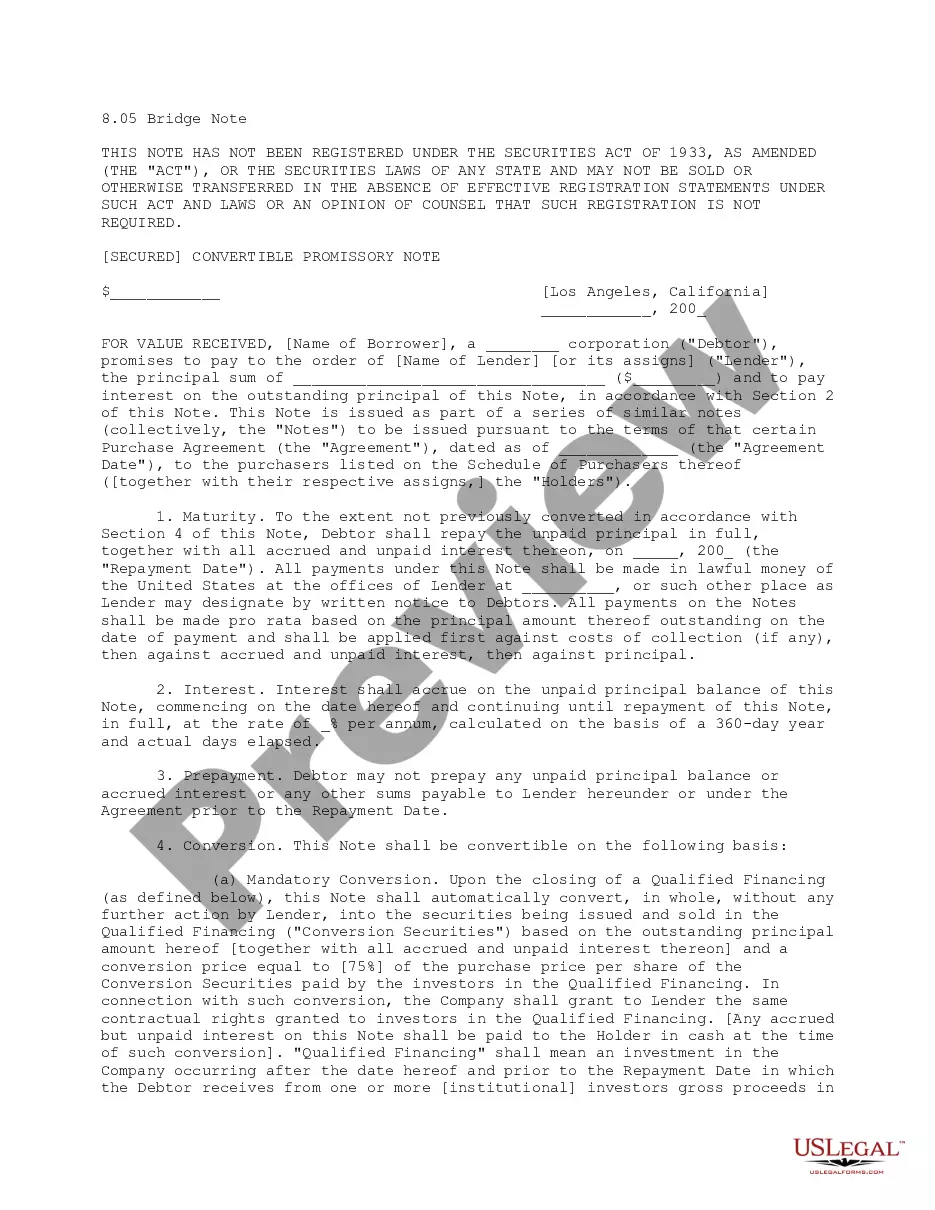

Filling out an LLC involves completing the necessary formation documents, usually called Articles of Organization. Ensure you include vital information such as the LLC name, address, and member details. You can streamline this process by using platforms like uslegalforms, which guide you through the steps to ensure compliance.

To write a limited liability company, you need to create Articles of Organization and file them with your state's secretary of state. This document outlines basic details such as your LLC's name, registered agent, and address. By completing this process, you establish your business formally and enjoy limited liability protection.

A single owner LLC typically files taxes using Schedule C, which becomes part of the owner's personal tax return. This method simplifies the process while retaining the limited liability benefits. It's crucial to accurately report income and expenses, ensuring your LLC remains compliant with tax laws.

Yes, you can file your LLC separately from your personal taxes. This separation allows your business to maintain its own limited liability status while benefiting from options like pass-through taxation. Properly filing your LLC ensures that you protect your personal assets and comply with tax regulations.

A common example of limited liability is when a business owner creates an LLC. This structure protects the owner's personal assets from being used to satisfy business debts. For instance, if your LLC incurs significant liabilities, creditors cannot pursue your home or personal savings, demonstrating the key advantage of limited liability.

If you don't file taxes for your LLC, you may face penalties and interest on unpaid taxes. Additionally, your limited liability status could be jeopardized, potentially leading to personal liability for business debts. It's important to understand that filing taxes is essential for maintaining your LLC and its limited liability protections.

The primary risk associated with an LLC involves the potential loss of limited liability protection. For instance, if you engage in fraudulent behavior or co-mingle business and personal funds, courts may disregard the LLC's protection. Additionally, failure to comply with state regulations can lead to personal liability for debts. Understanding these risks is crucial to ensure you maintain the benefits of a limited liability structure.

LLCs are typically not bad for taxes, but they can lead to certain complexities. If your LLC is taxed as a corporation, you may face double taxation on profits. However, if you opt for pass-through taxation, profits and losses can be reported on your personal tax return. Understanding these options is vital to maximize the advantages of limited liability.

Determining whether an LLC is worth it depends on your business goals. An LLC provides limited liability, protecting your personal assets from business debts. Moreover, it can enhance credibility with clients and suppliers. If these benefits align with your objectives, an LLC may indeed be a valuable choice.

While an LLC offers limited liability protection, it does come with some disadvantages. One major concern is the potential for complexity in compliance and regulations. Additionally, running an LLC often entails higher formation fees and ongoing costs, which can vary by state. It's essential to weigh these factors against the benefits of limited liability.