Maine Foreign Llc Withdrawal

Description

Form popularity

FAQ

To dissolve a foreign LLC, you first need to file a certificate of cancellation with the state where it was originally registered. Additionally, ensure you have resolved any outstanding obligations and notify the relevant authorities in the states where you operate. If you are focused on the Maine foreign LLC withdrawal, be aware of the specific requirements in Maine for a smooth process.

Foreign LLCs in the US are typically subject to federal and state taxation based on their income. States may have different tax rates and obligations, depending on where your business operates. It's advisable to consult with a tax professional to understand your tax liabilities, especially as you consider a Maine foreign LLC withdrawal.

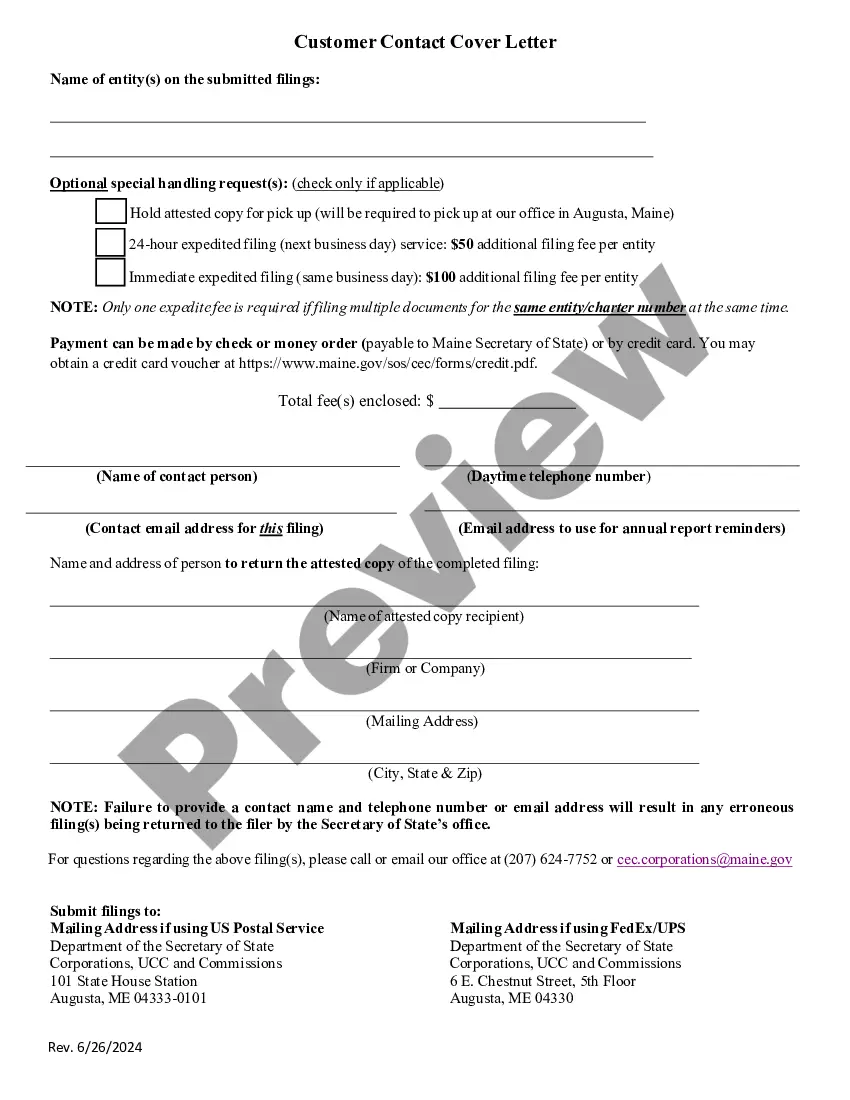

A foreign LLC refers to a business entity formed in one state but conducting operations in another. For example, if your LLC is established in New York and you wish to operate in Maine, you need to file as a foreign LLC in Maine. This process ensures legal compliance during the Maine foreign LLC withdrawal if you ever choose to dissolve your operations there.

Dissolving a Wisconsin LLC involves filing a dissolution form with the Wisconsin Department of Financial Institutions. Be sure to claim any outstanding debts and inform stakeholders before completing the submission. If you're transitioning to a Maine foreign LLC withdrawal, familiarizing yourself with both states’ regulations is vital.

Choosing the best state to register a foreign LLC depends on your business needs and goals. Many entrepreneurs prefer Delaware for its business-friendly laws and ease of formation. However, if you are considering a Maine foreign LLC withdrawal, you'll want to understand both states' requirements to make an informed decision.

To dissolve an LLC in the USA, you typically start by obtaining a consensus among the members to proceed with the dissolution. Next, you should file the necessary documents with your state’s Secretary of State office. Additionally, settling any outstanding debts and notifying creditors is crucial before you complete the Maine foreign LLC withdrawal process.

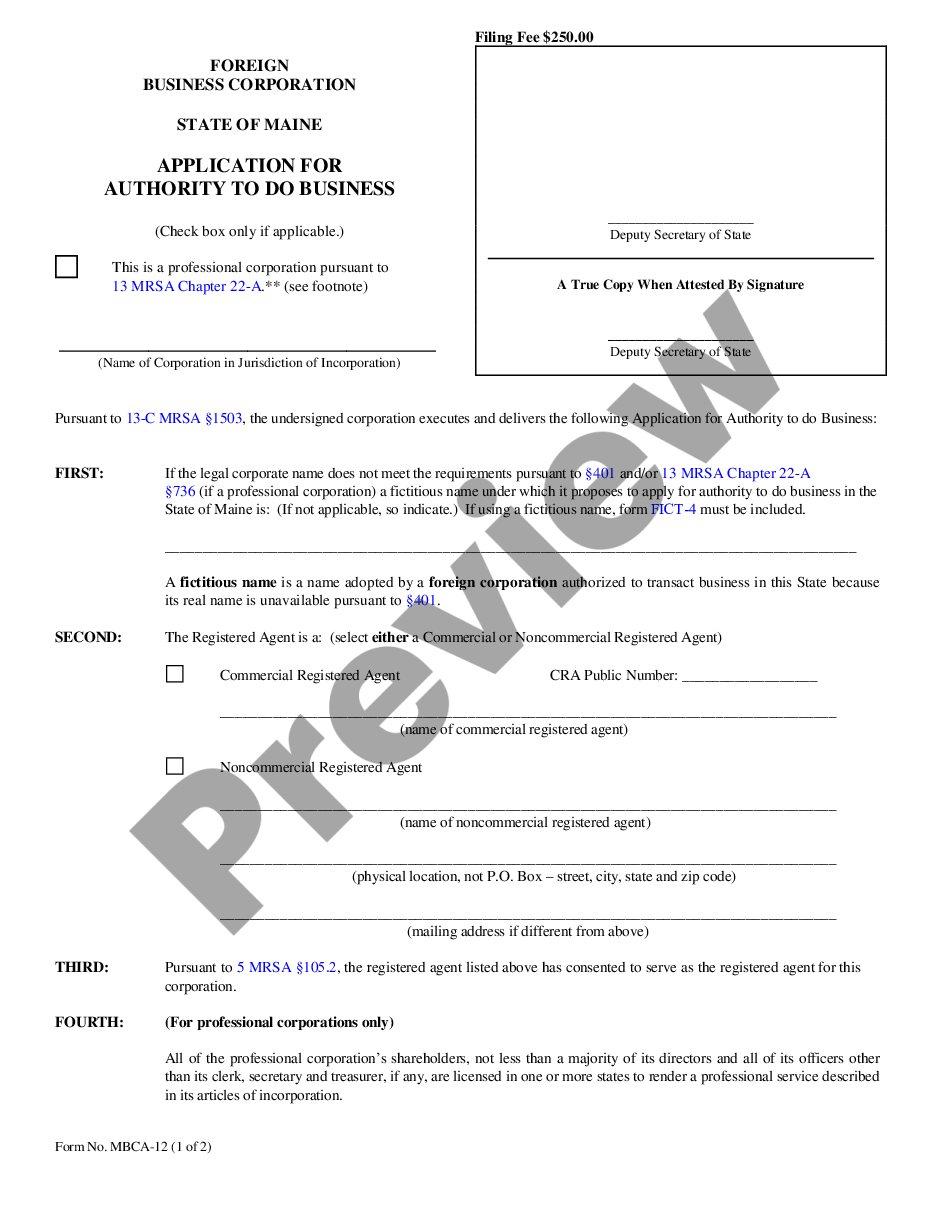

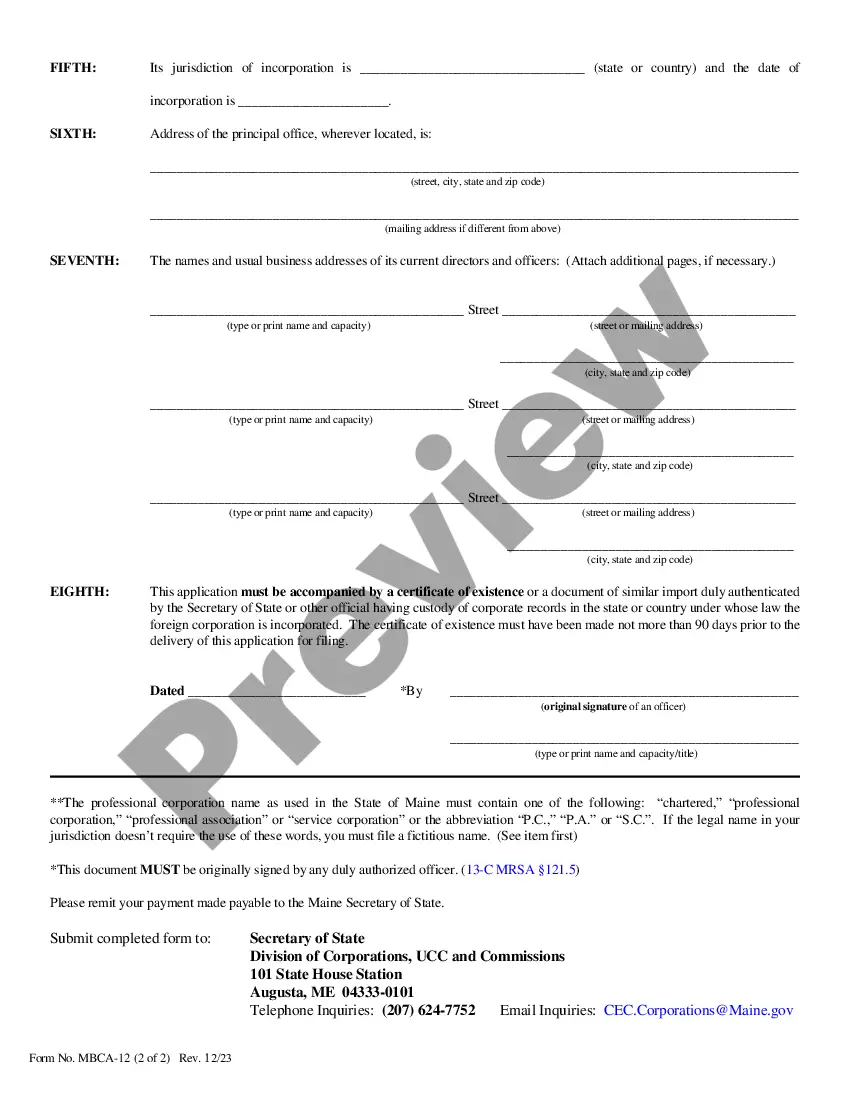

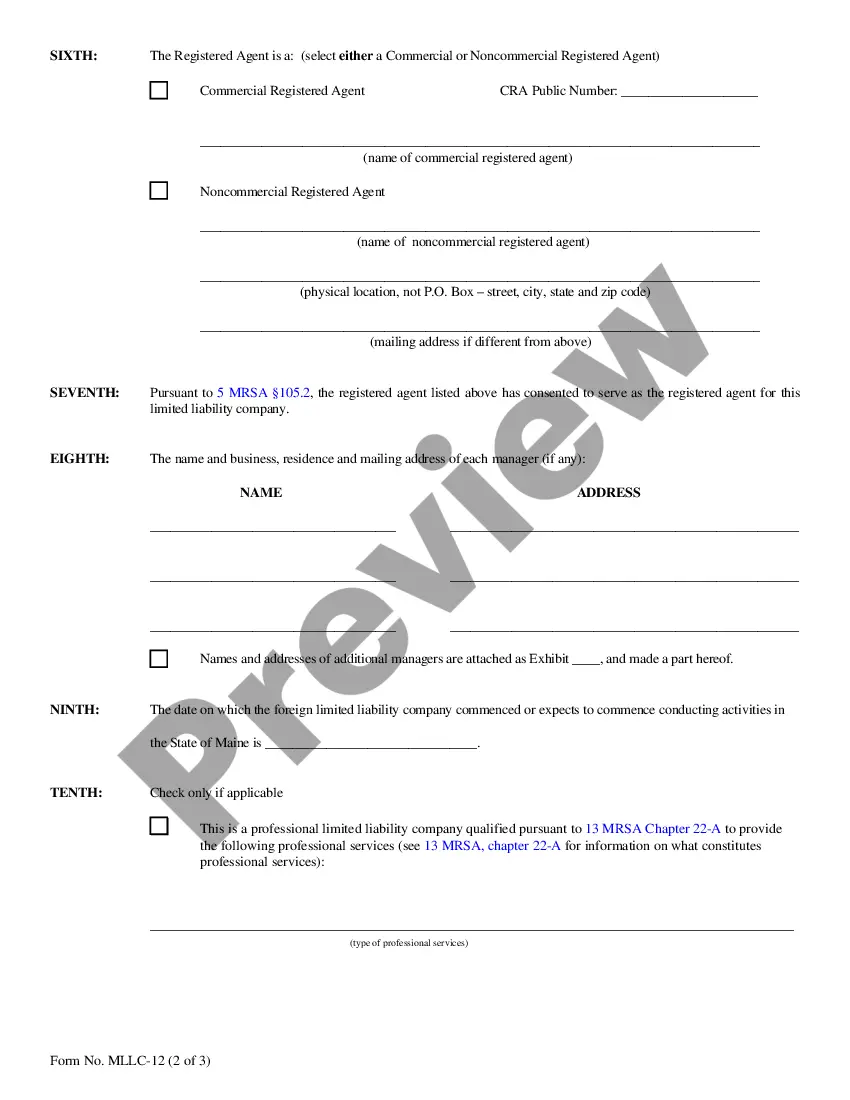

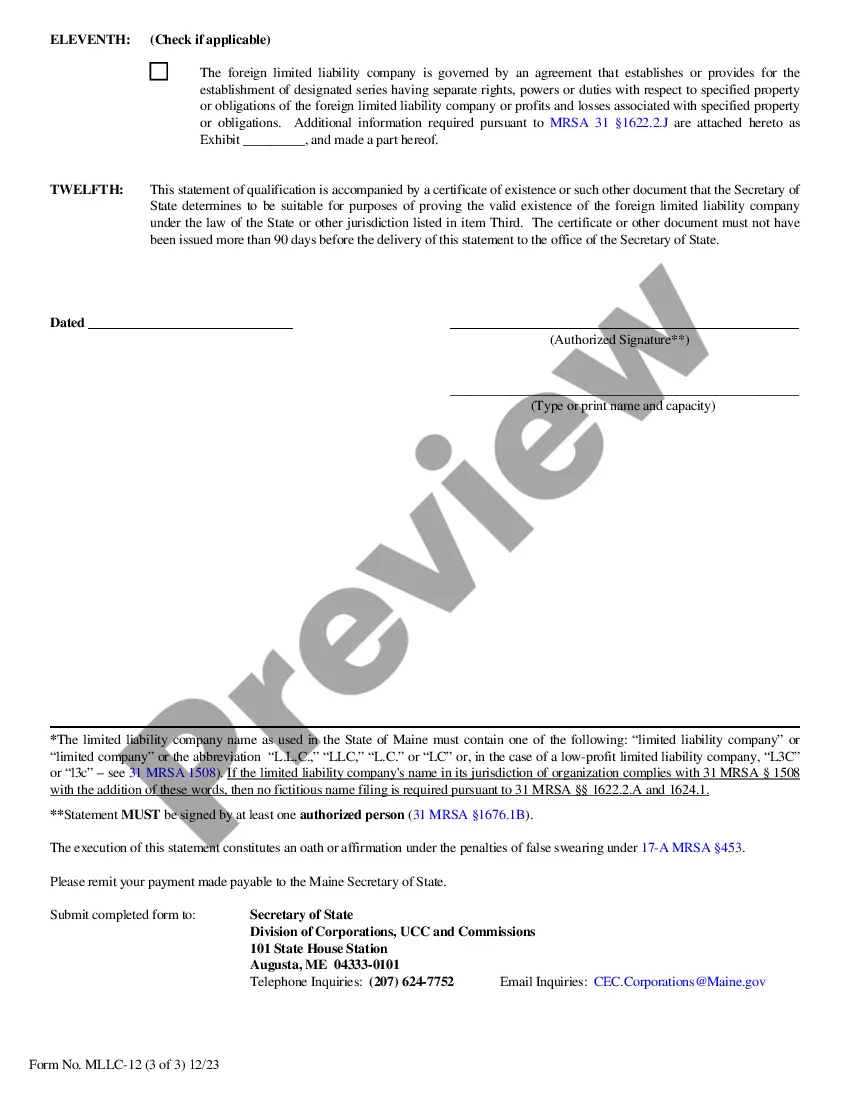

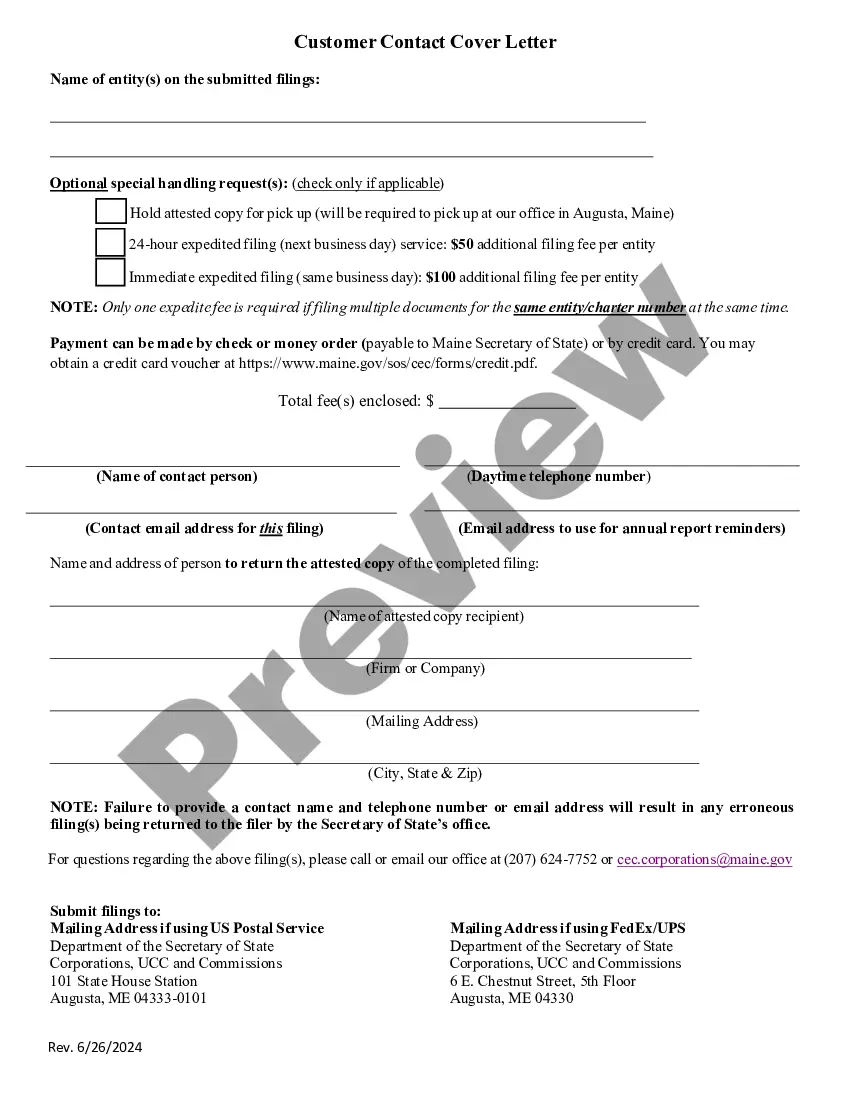

Registering an out-of-state business in Maine requires you to apply for a Certificate of Authority to conduct business. This application can be completed online or by submitting a paper form to the Secretary of State. When considering Maine foreign LLC withdrawal, make sure to comply with all registration requirements to avoid complications in future dissolutions. Using platforms like US Legal Forms can facilitate this registration process.

To file an annual report for your LLC in Maine, you need to submit the report online or by mail to the Secretary of State's office. This report ensures that your LLC remains in good standing and helps maintain your business profile. While focusing on your business operations, don’t forget the significance of Maine foreign LLC withdrawal if you plan to dissolve your LLC in the future. Staying compliant with annual reports is essential for smooth operations.

Starting an LLC in Maine does not require a lawyer, but consulting one can simplify the process. While you can fill out the necessary forms and file them yourself, legal guidance ensures compliance with all local laws. Utilizing resources like US Legal Forms can further streamline your setup. If you later wish to manage your Maine foreign LLC withdrawal, knowing the legal landscape can be beneficial.

To officially close an LLC, you should file the Certificate of Dissolution with the Maine Secretary of State. Completing this form signifies the end of your LLC’s legal existence. By following this filing process, you are effectively managing your Maine foreign LLC withdrawal. It’s important to keep records of the closure for future reference, especially for any tax implications.