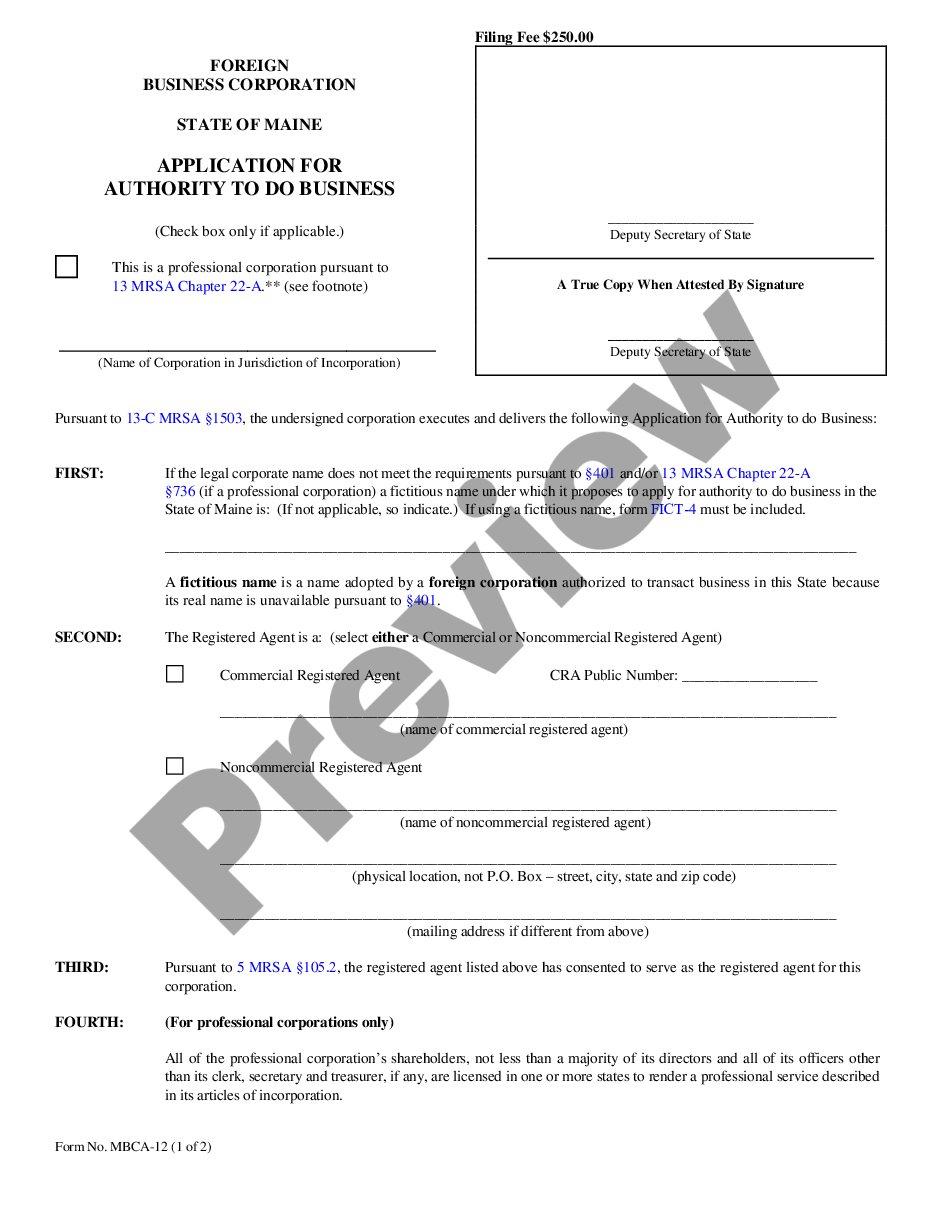

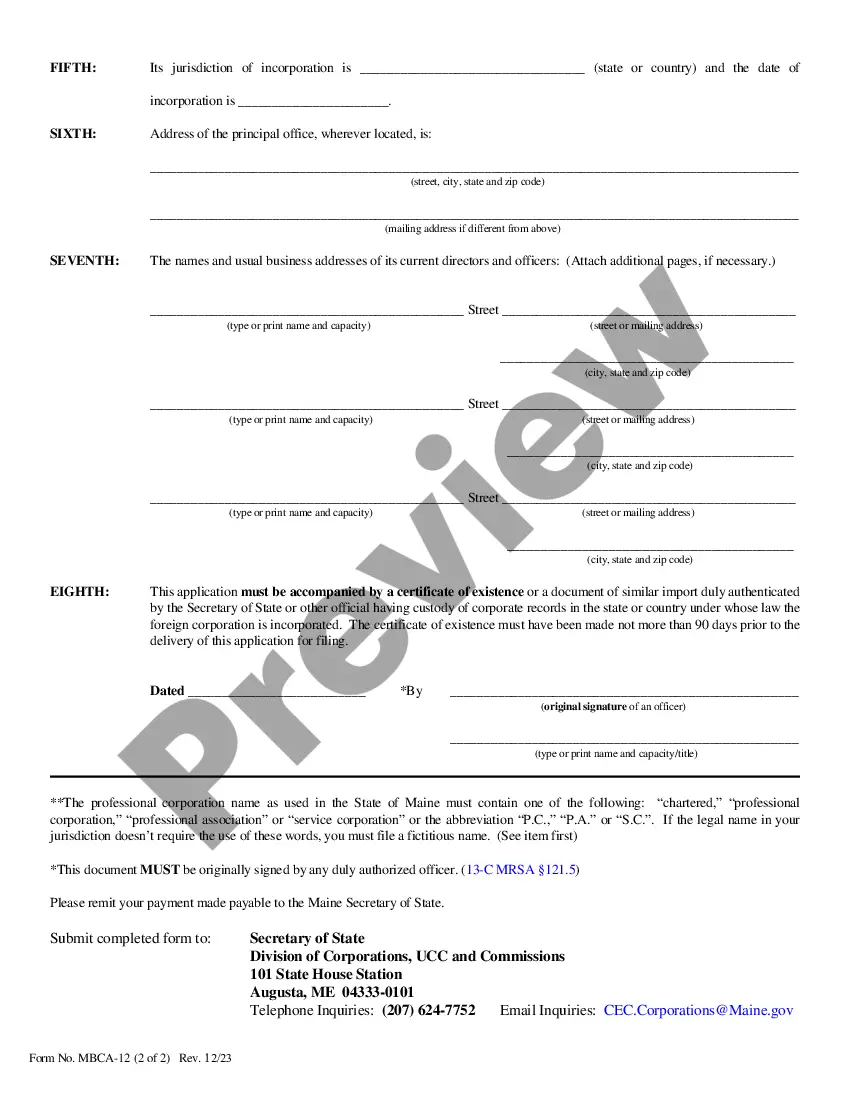

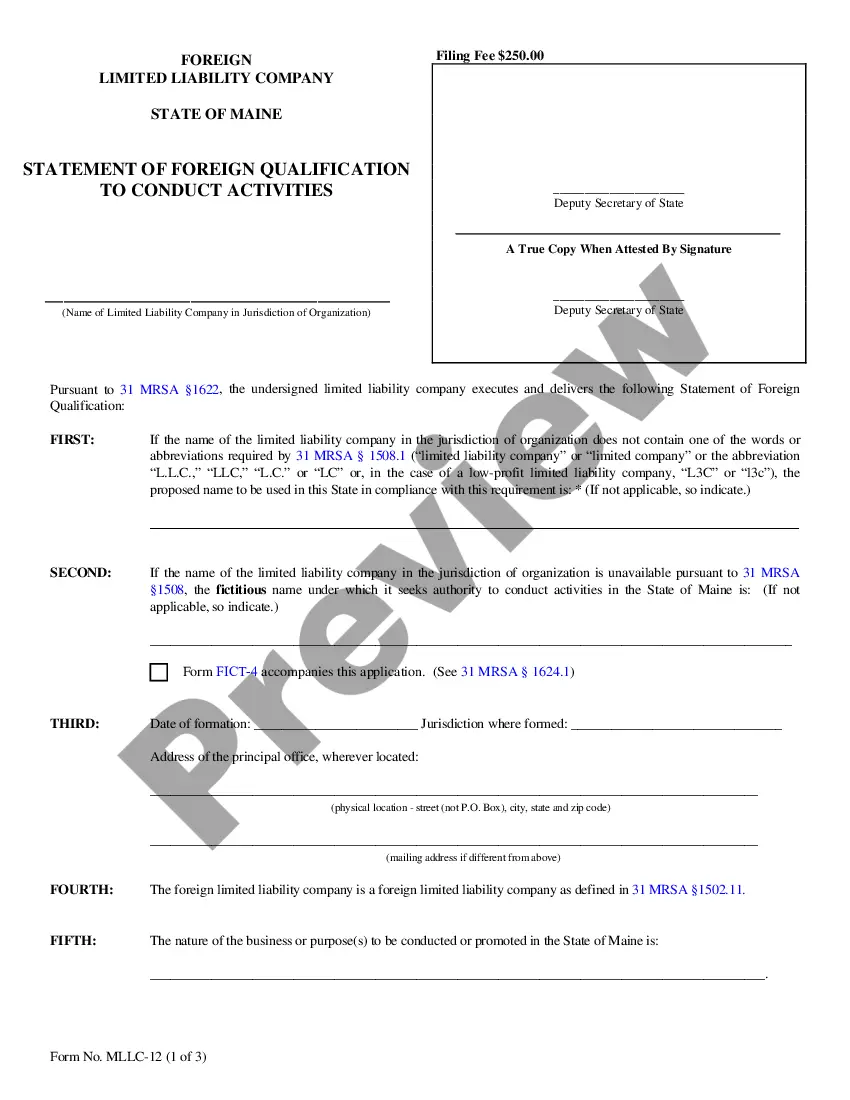

Maine Registration of Foreign Corporation

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maine Registration Of Foreign Corporation?

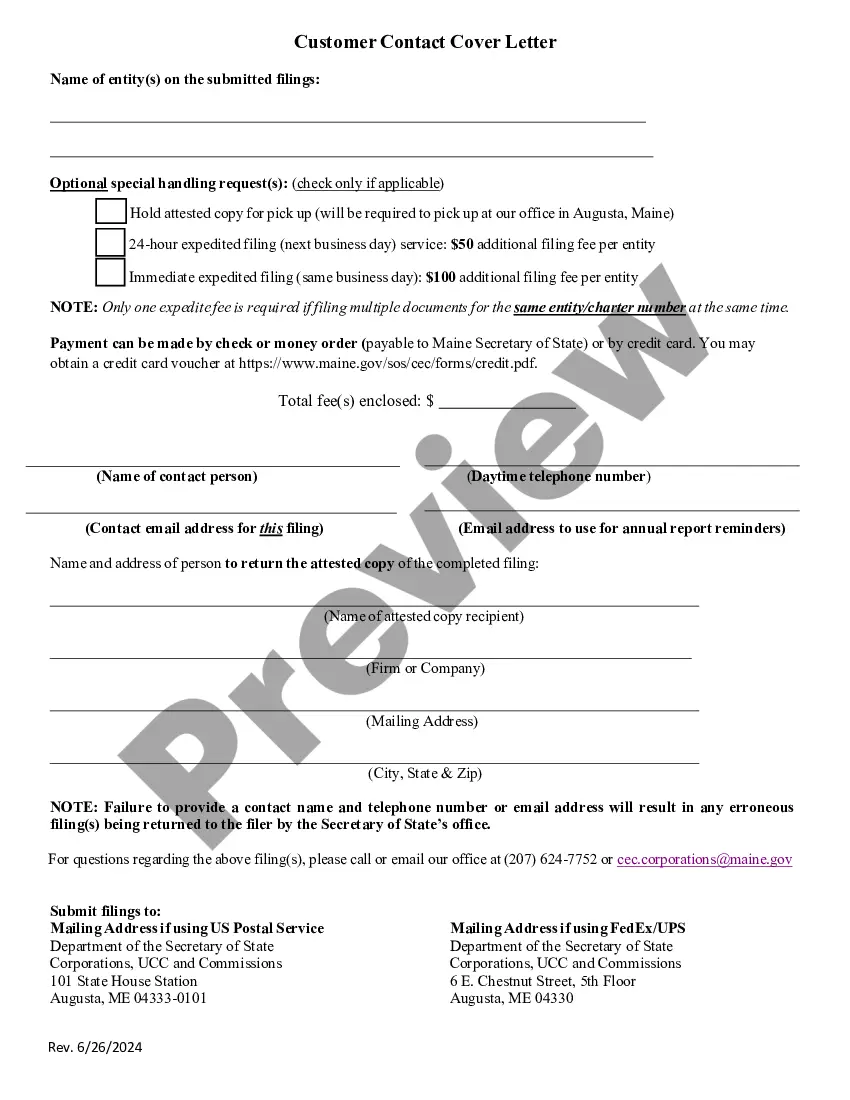

Greetings to the most extensive collection of legal documentation, US Legal Forms. Here you can obtain any template such as Maine Registration of Foreign Corporation documents and retrieve them (as many as you require). Prepare formal papers in just a few hours, instead of days or weeks, without incurring significant costs with a legal expert. Acquire the state-specific template in a couple of clicks and feel assured with the understanding that it was created by our skilled legal experts.

If you’re already a registered user, simply Log In to your profile and click Download next to the Maine Registration of Foreign Corporation you require. Since US Legal Forms is online, you’ll always have access to your downloaded forms, no matter what device you are using. Find them in the My documents section.

If you haven't created an account yet, what are you waiting for? Follow our instructions below to begin: If this is a state-specific document, verify its legitimacy in your state. Review the description (if available) to determine if it’s the correct template. Explore additional content with the Preview feature. If the document fulfills all your criteria, click Buy Now. To create an account, select a pricing option. Use a credit card or PayPal for registration. Download the file in your desired format (Word or PDF). Print the document and fill it in with your/your business’s details. Once you’ve completed the Maine Registration of Foreign Corporation, present it to your legal expert for confirmation. It’s an additional step but a crucial one for ensuring you’re completely protected. Enroll in US Legal Forms now and access thousands of reusable templates.

When you’ve completed the Maine Registration of Foreign Corporation, give it to your legal professional for verification. It’s an extra step but a necessary one for making certain you’re fully covered. Sign up for US Legal Forms now and get a large number of reusable samples.

- If this is a state-specific document, check its validity in your state.

- Look at the description (if available) to learn if it’s the correct example.

- See much more content with the Preview function.

- If the document matches all your needs, click Buy Now.

- To make an account, pick a pricing plan.

- Use a credit card or PayPal account to register.

- Download the file in the format you want (Word or PDF).

- Print out the document and fill it with your/your business’s info.

Form popularity

FAQ

Yes, you can create a company in the USA even if you are not a resident. Many non-residents choose to establish businesses in the US, taking advantage of its favorable business climate. For those seeking the Maine Registration of Foreign Corporation, it's crucial to follow the necessary legal steps to ensure compliance and facilitate smooth operations.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

This term is commonly used by all states to identify entities formed outside of their state. A foreign entity can obtain authority to transact business in, for example, Colorado by filing a Statement of Foreign Entity Authority with the Colorado Secretary of State.

How is a corporation formed? When individuals decide that they wish to form a corporation, they must file articles of incorporation with the Office of the Secretary of State. The articles of incorporation establish the individuals' intent to form the corporation and indicate who is forming the corporation.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

Choose a corporate structure. Incorporating means starting a corporation. Check Name Availability. Appoint a Registered Agent. File Maine Articles of Incorporation. Establish Bylaws & Corporate Records. Appoint Initial Directors. Hold Organizational Meeting. Issue Stock Certificates.

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines. The process of setting up a company in a foreign state is called foreign qualification.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.