Power Attorney Poa Form For Individuals

Description

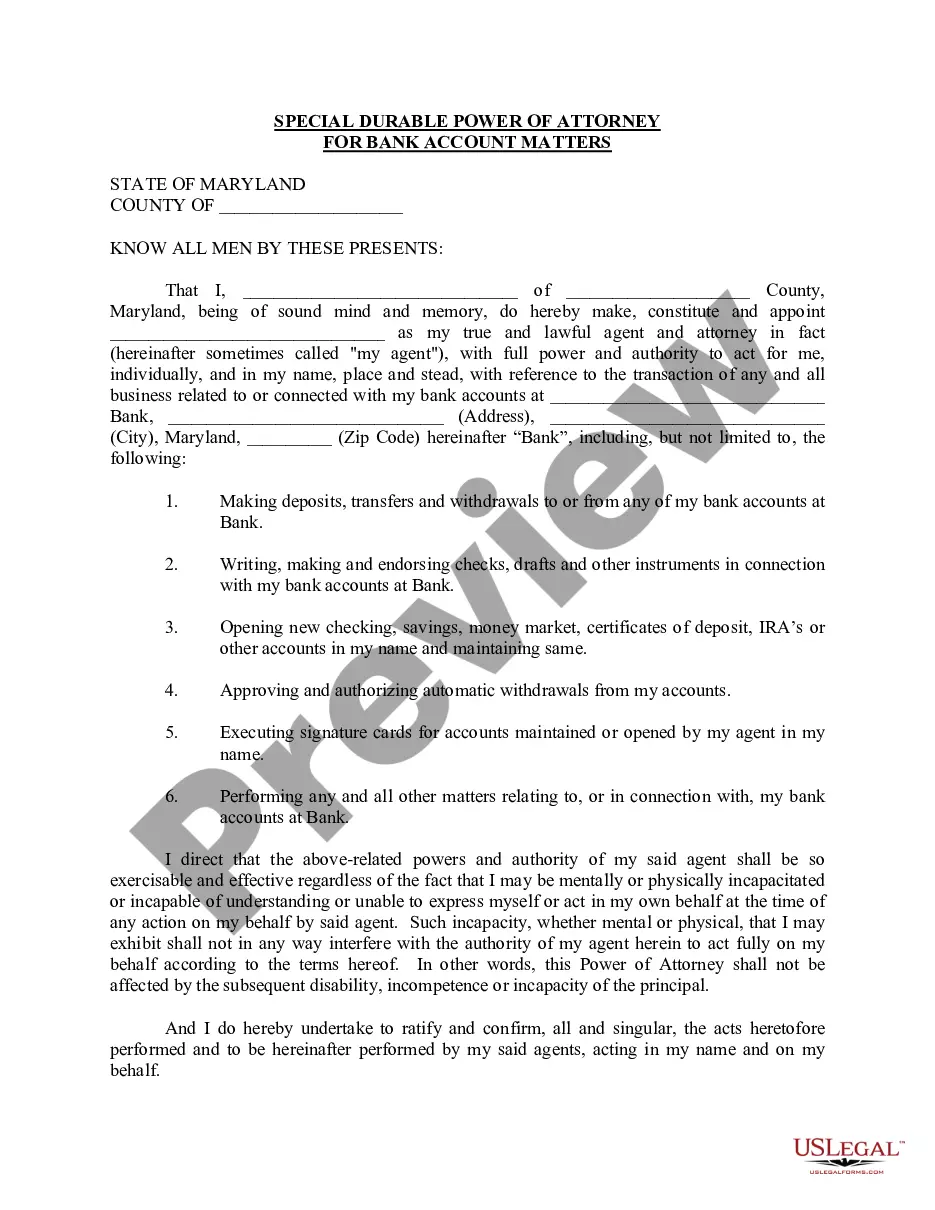

How to fill out Maryland Special Durable Power Of Attorney For Bank Account Matters?

- Log into your account on US Legal Forms if you're an existing user. Ensure your subscription is active before moving forward.

- For new users, start by checking the preview modes and descriptions of available POA forms to find one that suits your needs and aligns with your local jurisdiction.

- If necessary, utilize the search feature to locate additional templates that may fit your requirements.

- Once you’ve selected the right form, click on the 'Buy Now' button and choose an appropriate subscription plan.

- Complete your purchase by entering your payment information, whether via credit card or PayPal.

- After your transaction, download the POA form to your device. You can access it anytime from the 'My Forms' section of your profile.

In conclusion, US Legal Forms provides a robust collection of legal documents, including Power attorney poa forms for individuals. Their platform ensures that you have access to the necessary resources and support to create precise legal documents.

Get started today and simplify your legal document needs with US Legal Forms!

Form popularity

FAQ

To submit Form 2848 to the IRS, complete the document carefully, ensuring all required information regarding your representative is correct. You can mail the completed form to the designated IRS address or, if applicable, submit it online through the IRS e-services. Proper submission of the Form 2848 is essential for your representative to represent you effectively in tax matters, aligning with the intention behind your power attorney poa form for individuals.

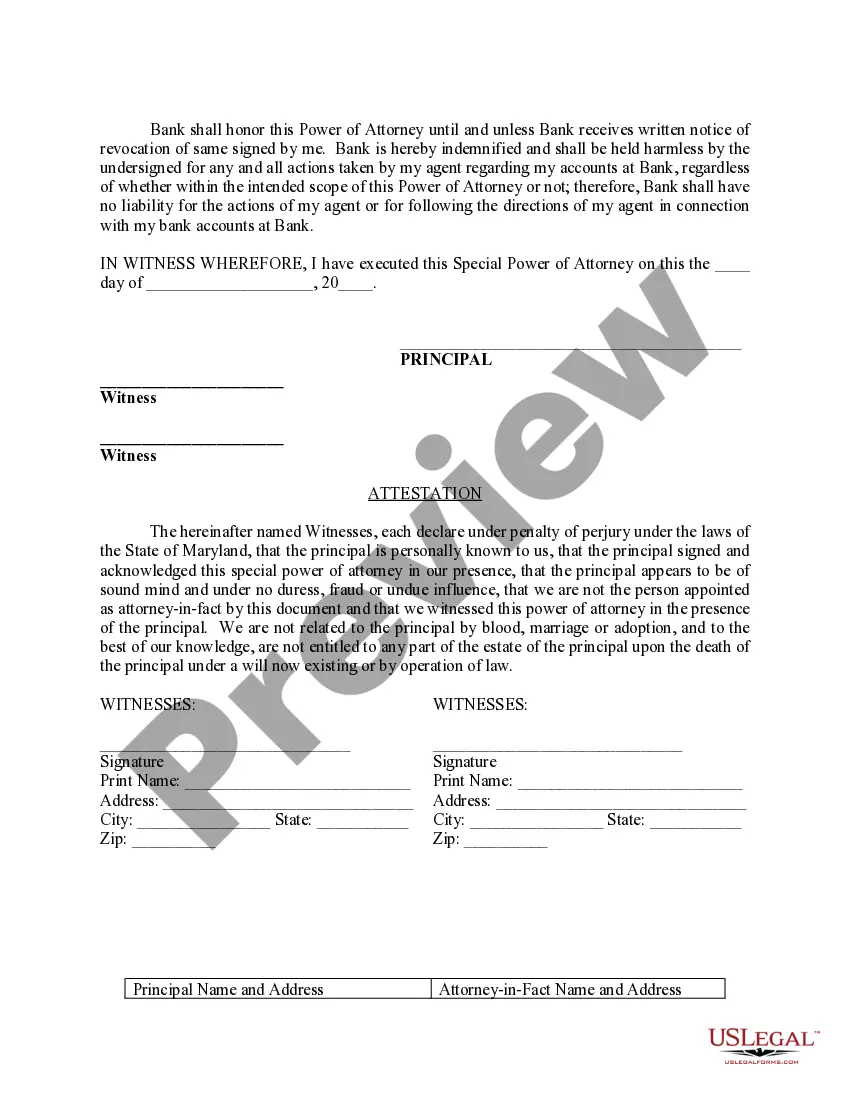

When signing as power of attorney using the power attorney poa form for individuals, you would sign your name followed by the phrase 'as attorney-in-fact for Your Full Name.' For instance, if your name is John Doe, you would sign it as: 'Jane Smith, as attorney-in-fact for John Doe.' This clearly indicates that you are acting on behalf of another person, which is crucial for legal recognition.

Form 56, used to notify the IRS of the creation or termination of a power of attorney poa form for individuals, should be filed at the address provided in the form's instructions. Typically, you will send it to the address corresponding to the IRS office that manages your tax records. Ensuring proper filing helps keep your records updated and allows your designated agent access to necessary information.

To submit your power of attorney poa form for individuals to the IRS, it is advisable to send it via mail or through e-file if supported. Ensure that all accompanying documents, such as Form 2848 or Form 56, are properly filled out and included. This practice helps in establishing clear communication between you and the IRS, allowing your appointed representative to act on your behalf efficiently.

Filling out power of attorney paperwork can be straightforward with the right approach. Begin by carefully reading each section of the power attorney poa form for individuals to understand what information is needed. Complete the form accurately, and be sure to specify any limitations or particular responsibilities you want your agent to have, ensuring that all parties involved are fully informed.

To fill out a power of attorney poa form for individuals, start by gathering essential information about yourself and the person you are designating as your agent. Ensure you include their name, address, and any relevant powers you wish to grant them. Next, follow the specific guidelines laid out in the form to ensure legal compliance, and finally, sign the document in the presence of a notary or witnesses as required by your state.

The three basic types of powers of attorney include general, durable, and medical. A general power of attorney grants broad authority to the agent, while a durable power of attorney remains effective even if the principal becomes incapacitated. A medical power of attorney specifically allows the agent to make healthcare decisions. Understanding these types can help you choose the right power attorney poa form for individuals.

Form 2848 and form 8821 serve different purposes in power of attorney contexts. Form 2848, also known as the Power of Attorney and Declaration of Representative, allows you to authorize someone to represent you before the IRS. In contrast, form 8821 is an Information Return that grants access to your tax information without representation authority. Depending on your needs, you should choose the appropriate form.

In New Jersey, a power attorney poa form for individuals does not need to be recorded with the county clerk to be effective. However, if the document grants the agent authority to handle real estate transactions, it must be recorded to be valid. Keeping a copy of the document in a secure place is recommended while providing copies to relevant parties.

The best way to set up a power attorney poa form for individuals involves consulting an attorney to ensure that the document meets your specific needs. However, you can also use trusted online platforms like US Legal Forms to customize and generate your power of attorney. It's essential to clearly define the powers you wish to grant and choose a reliable agent to represent your interests.