Limited Power Attorney With A Will

Description

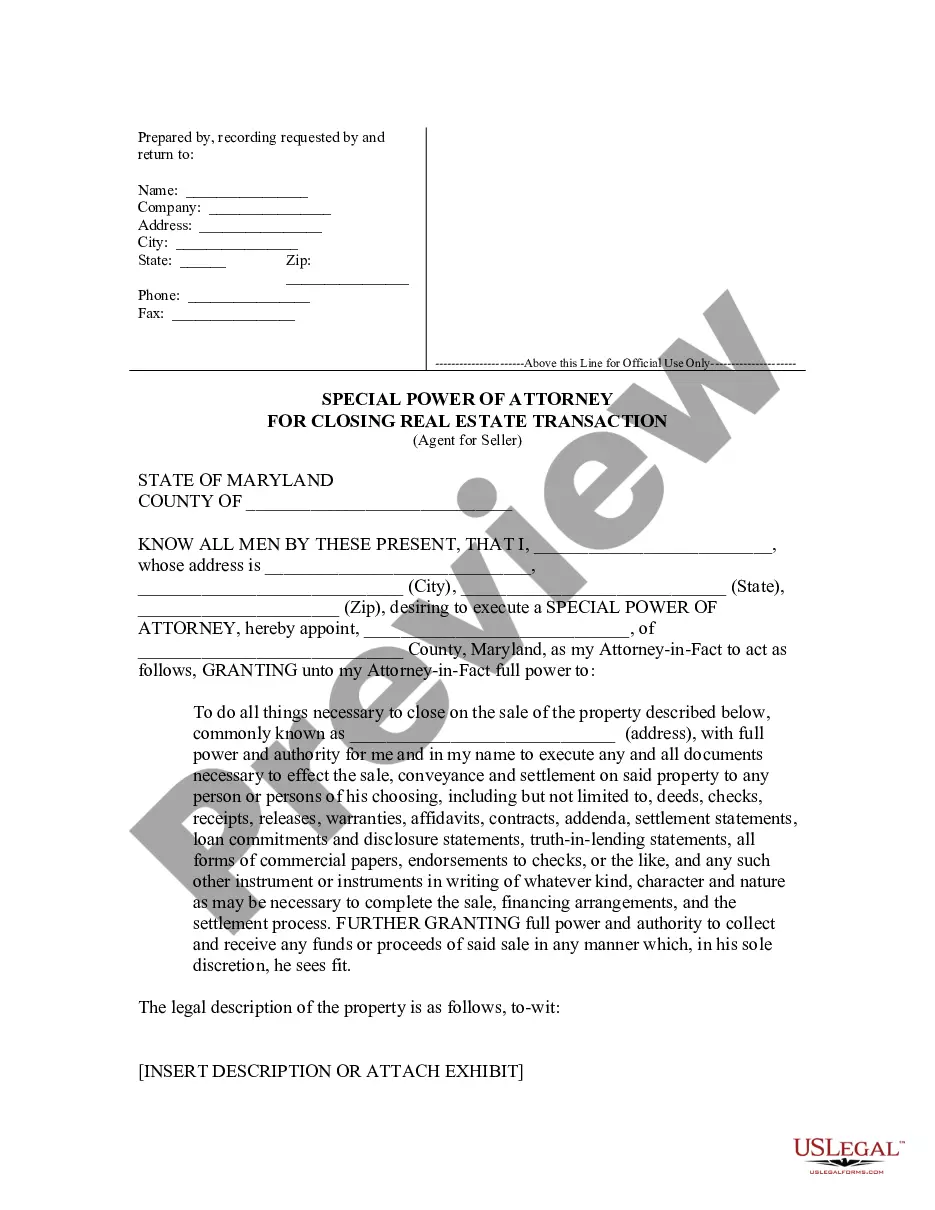

How to fill out Maryland Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

- Log into your US Legal Forms account if you're an existing user. Ensure your subscription is active; renew it if necessary.

- If you're new, start by checking the Preview mode and form description to confirm you have the correct template that complies with your local laws.

- If adjustments are needed, utilize the Search tab to find a suitable alternative template.

- Once confident, purchase the selected document by clicking the Buy Now button and choosing an appropriate subscription plan, ensuring you create an account for access.

- Complete your transaction using a credit card or PayPal, followed by securing your form by downloading it.

- Access your downloaded template anytime from the My Forms section of your profile to complete it at your convenience.

US Legal Forms stands out by empowering both individuals and legal professionals. With over 85,000 legal forms available, users can find more options than with competitors, ensuring they are well-equipped for their specific needs.

Get started with US Legal Forms today, and streamline your legal document process for peace of mind in your estate planning.

Form popularity

FAQ

A legal power of attorney cannot make decisions regarding your personal medical treatment, finalize your divorce, or change your will. Therefore, while a limited power of attorney with a will can handle financial and legal matters, it does not extend to certain personal choices. Understanding these limitations helps clarify the role of your agent and ensures your wishes are honored.

Filling out a limited power of attorney form involves clearly stating the powers you wish to grant and specifying the duration of authority. You can find user-friendly templates on platforms like uslegalforms, simplifying the process for you. Ensure that all the necessary details are accurate and that both you and your agent sign the document for it to be legally enforceable.

You should update your power of attorney whenever there are significant life changes, such as marriage, divorce, or changes in financial status. It's beneficial to review your limited power attorney with a will regularly to ensure that it reflects your current wishes and circumstances. Also, if your chosen agent can no longer serve, it’s crucial to make adjustments.

The maximum validity of a power of attorney often depends on state laws and the type of powers granted. Some states allow a limited power of attorney to remain valid for several years, while others may limit it to specific transactions. Generally, it would help if you checked the requirements of your state law when creating a limited power of attorney with a will to ensure compliance.

Yes, even if you have a will, a power of attorney is essential for managing your affairs while you are alive. A will only takes effect after your death, whereas a limited power of attorney with a will allows someone to handle your affairs and make decisions for you if you become incapacitated. It provides vital support during times when you cannot make decisions, ensuring your wishes are respected.

A limited power of attorney is generally valid for a specified duration defined in the document. The duration can range from days to years, depending on your needs and the tasks granted to the agent. Once the term expires, the authority ceases unless you renew it. Therefore, when considering a limited power of attorney with a will, ensure you understand the time frame involved.

To obtain a limited power of attorney, you can start by drafting the document that specifies the authority you want to grant. You may choose to use platforms like uslegalforms, which provide templates to simplify this process. After preparing the document, ensure it is signed in front of a notary to make it legally valid. This will allow you to have a well-drafted limited power attorney with a will that serves your intended purpose.

Yes, a power of attorney (POA) is generally more limited than a living will. A POA grants someone authority to make decisions on your behalf, while a living will specifically details your medical preferences. It's essential to understand that both documents serve different purposes but can complement each other. Consider incorporating a limited power attorney with a will to ensure your wishes are followed in all aspects of your life.

A limited power of attorney typically lasts for a specified period outlined in the document. This duration can vary based on your needs and preferences. Often, it remains effective until the specified tasks are completed or until you revoke it. It's crucial to regularly review and update your limited power attorney with a will to reflect any changes in your life circumstances.

The best person for power of attorney is someone you trust implicitly, often a spouse, adult child, or close friend. This individual should understand your wishes and be capable of making sound decisions on your behalf. Additionally, they must be willing to act in your best interests, especially regarding your limited power attorney with a will. Choosing the right person ensures your needs are honored and respected.