Red tape necessitates exactness and correctness.

If you do not manage filling out documents like the Financial Checkup Checklist For Widows daily, it may lead to some confusion.

Selecting the appropriate sample from the beginning will guarantee that your document submission goes smoothly and avert any complications of resending a file or duplicating the same effort from the beginning.

If you are not a subscribed user, finding the necessary sample would take a few additional steps.

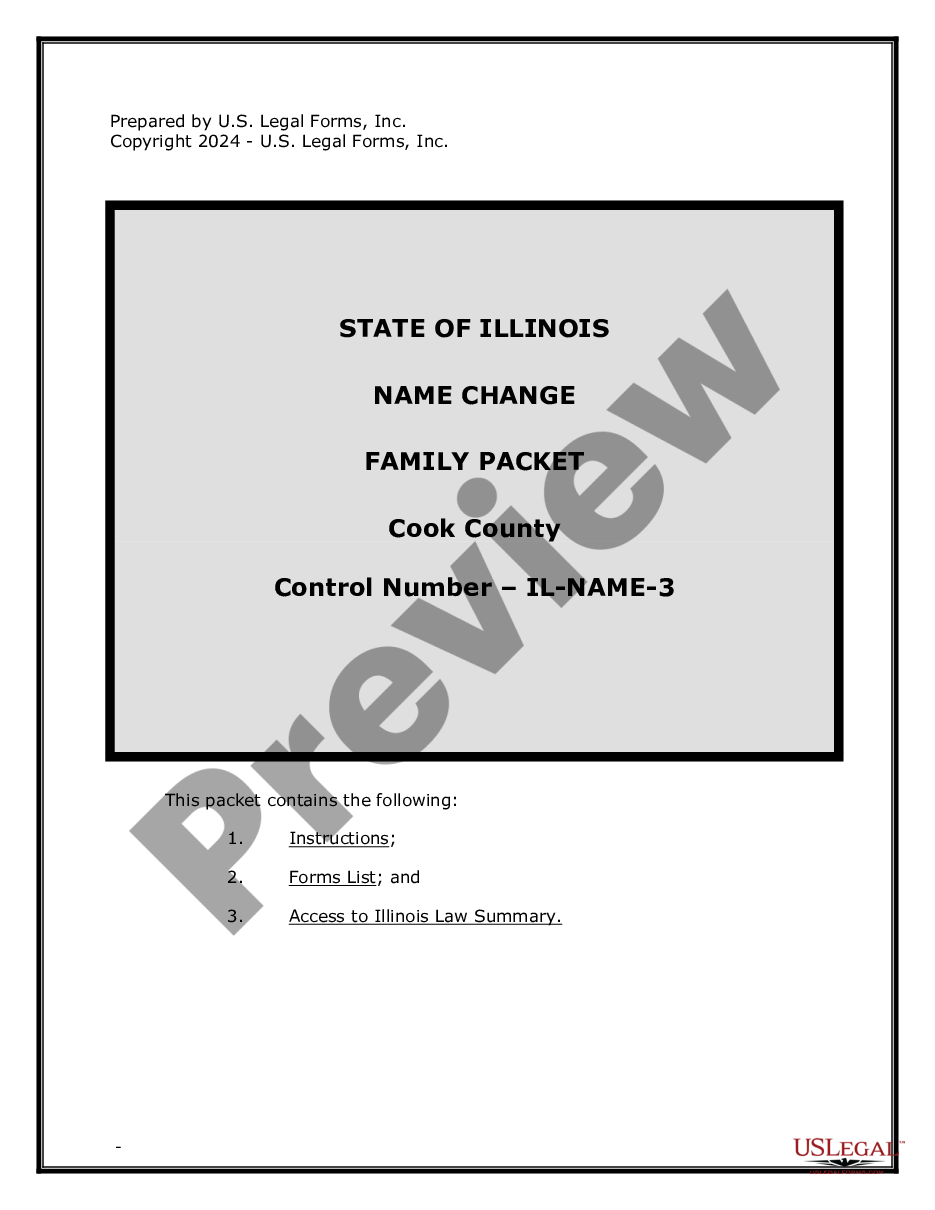

- Obtain the necessary sample for your documentation at US Legal Forms.

- US Legal Forms is the most extensive online forms repository that retains over 85 thousand samples for various sectors.

- You can access the most recent and pertinent version of the Financial Checkup Checklist For Widows simply by searching for it on the platform.

- Find, store, and save templates in your profile or verify with the description to ensure you have the correct one on hand.

- With an account at US Legal Forms, you can gather, store in one location, and browse through the templates you save to retrieve them in just a few clicks.

- When on the site, click the Log In button to authenticate.

- Then, navigate to the My documents page, where your forms are cataloged.

- Review the details of the forms and save the ones you require at any time.

These may include bank and investment accounts, retirement plans, real estate, certificates of deposit, and other assets. • Contact each bank and financial.This will tell you what kind of forms you will need. The good news is that there is no "right" or "wrong" time to buy a home it all depends on when you're personally and financially ready. If you own your own home, then you know the financial security and sense of pride that homeownership can provide. After tracking down these items, sort quickly, putting like with like. Operations and Maintenance Download a printable version of this checklist. Fill out your information below the checklist of interest to receive a PDF download via email. Spring home maintenance checklist: windows, dryer vents and water stains. So are you ready for your checkup?