Promissory Note Template Maryland Without Interest

Description

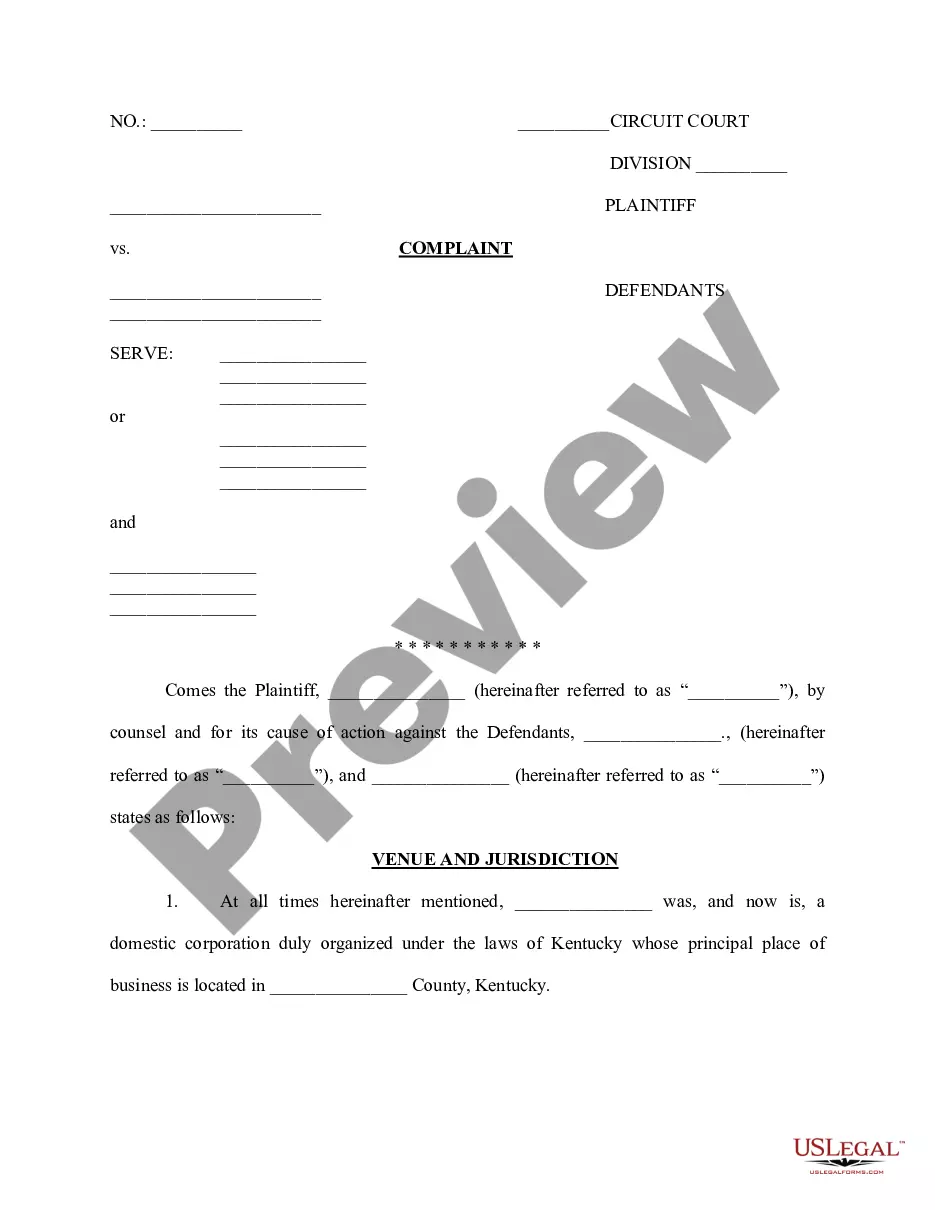

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Managing legal documents and processes can be a labor-intensive addition to the day.

Promissory Note Template Maryland Without Interest and similar forms typically necessitate you to look for them and comprehend how to fill them out accurately.

Consequently, whether you are addressing financial, legal, or personal affairs, possessing a comprehensive and straightforward online directory of forms when you require it will be extremely beneficial.

US Legal Forms is the leading online source of legal templates, featuring over 85,000 state-specific forms and various resources to help you finalize your paperwork swiftly.

Is this your first time using US Legal Forms? Create an account in just a few minutes and you’ll gain access to the form catalog and Promissory Note Template Maryland Without Interest. Then, follow the steps below to complete your form: Ensure you have the correct form by using the Review option and reading the form description. Choose Buy Now when ready, and select the monthly subscription plan that fits you. Click Download and then fill out, sign, and print the form. US Legal Forms has 25 years of expertise assisting users with their legal paperwork. Locate the form you need right away and improve any process effortlessly.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms supplies you with state- and county-specific forms available at any time for download.

- Safeguard your document management processes with a premium service that enables you to prepare any form within minutes without any extra or concealed fees.

- Simply Log In to your account, locate Promissory Note Template Maryland Without Interest, and download it promptly from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

As to element (1), promissory notes (and contracts) both require consideration. Consideration is typically anything of value promised to another when making a contract/promissory note. One defense to a breach of contract or breach of promissory note suit, then, is that the contract/note did not have consideration.

Most formal promissory notes will include interest, but it is not a requirement for a legally valid promissory note. If you do not want to charge your friend or family member interest, then make the loan interest-free or use 0% as your interest rate.

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.