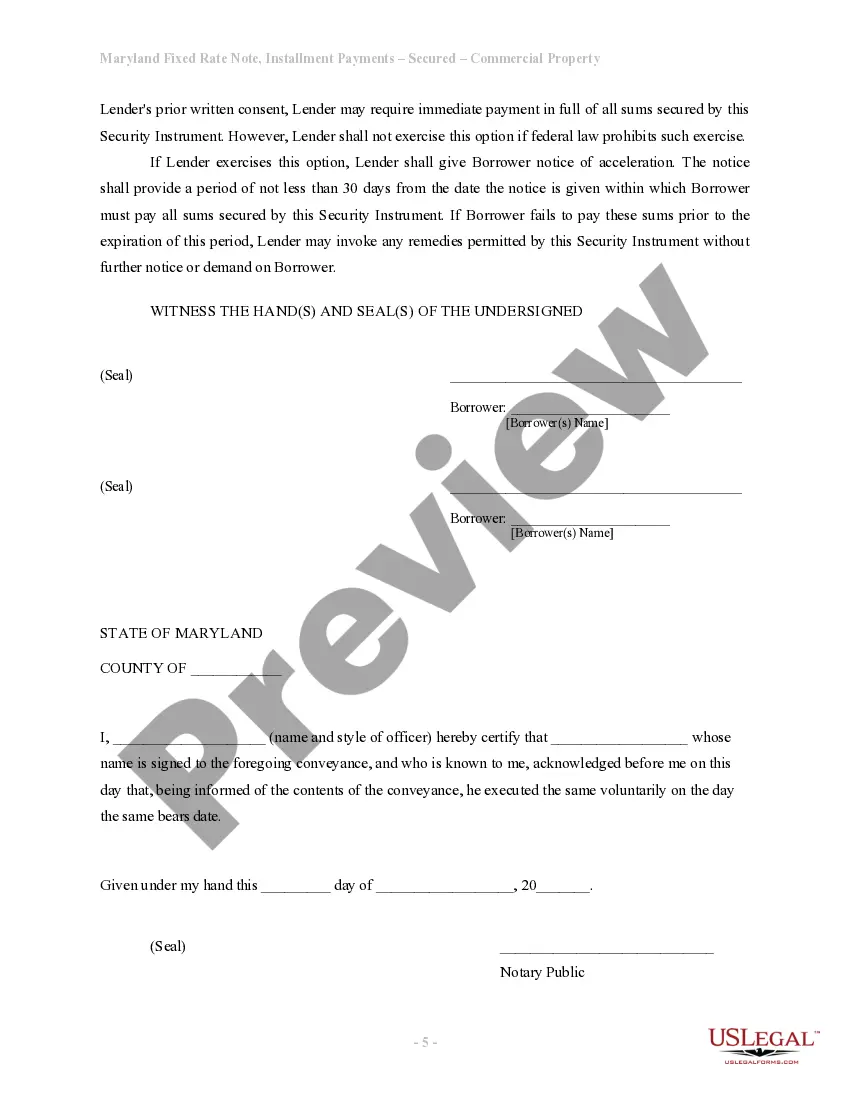

Promissory Note Template Maryland With Payment Plan

Description

How to fill out Maryland Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

It’s clear that you cannot become a legal authority instantly, nor can you learn how to swiftly create a Promissory Note Template Maryland With Payment Plan without possessing a specialized skill set.

Drafting legal documents is a lengthy process that requires specific training and expertise. So why not entrust the creation of the Promissory Note Template Maryland With Payment Plan to the experts.

With US Legal Forms, one of the largest legal template collections, you can discover everything from court documents to templates for internal communication.

You can regain access to your documents from the My documents tab at any time. If you’re an existing client, you can simply Log In, and find and download the template from the same tab.

Regardless of the purpose of your forms—whether they are financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Locate the form you need using the search bar at the top of the page.

- View it (if available) and read the accompanying description to determine if Promissory Note Template Maryland With Payment Plan is what you require.

- Initiate your search again if you seek a different template.

- Create a free account and choose a subscription plan to purchase the form.

- Select Buy now. Once the payment is processed, you can download the Promissory Note Template Maryland With Payment Plan, complete it, print it, and send or mail it to the necessary parties.

Form popularity

FAQ

Promissory notes may also be referred to as an IOU, a loan agreement, or just a note. It's a legal lending document that says the borrower promises to repay to the lender a certain amount of money in a certain time frame. This kind of document is legally enforceable and creates a legal obligation to repay the loan.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

No. Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

Promise to Pay Agreement The names of both parties (the lender and the borrower) The total amount of money borrowed. The date by which the total amount must be paid back. The amount of any interest that will be charged. The repayment schedule (whether the loan will be paid back in a lump sum or in installments over time)

A promissory note is a financial instrument that contains a written promise by one party (the note's issuer or maker) to pay another party (the note's payee) a definite sum of money, either on demand or at a specified future date.