Order Of Administration For Estate Forms

Description

How to fill out Order Of Administration For Estate Forms?

No longer is there a necessity to squander time looking for legal documents to comply with your local jurisdiction's regulations.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our platform provides over 85,000 templates for any business and personal legal situations categorized by state and area of use.

Utilize the Search bar above to find another template if the previous one does not meet your needs.

- All forms are expertly created and confirmed for legitimacy, so you can feel confident in securing a current Order Of Administration For Estate Forms.

- If you are knowledgeable about our platform and already possess an account, ensure your subscription is active prior to retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all downloaded documents whenever necessary by accessing the My documents tab in your profile.

- For those who have not previously utilized our platform, the process will require a few more steps to finalize.

- Here’s how new users can acquire the Order Of Administration For Estate Forms from our catalog.

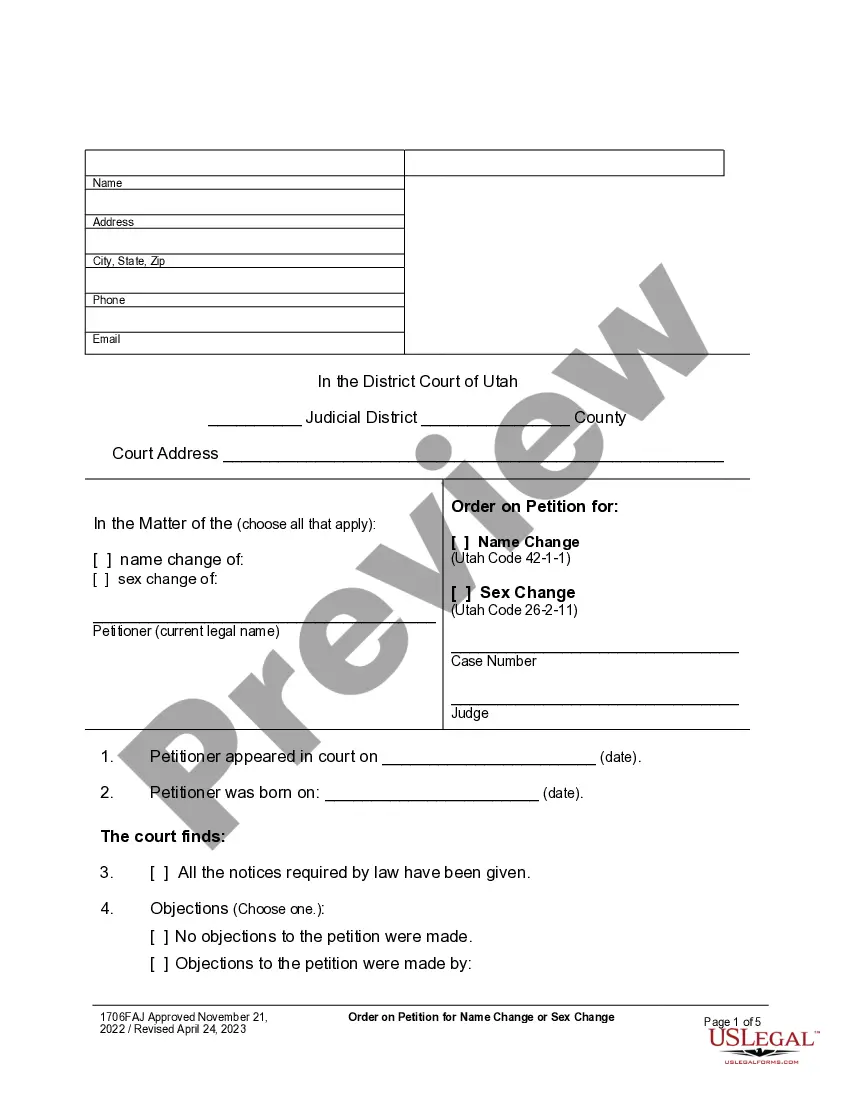

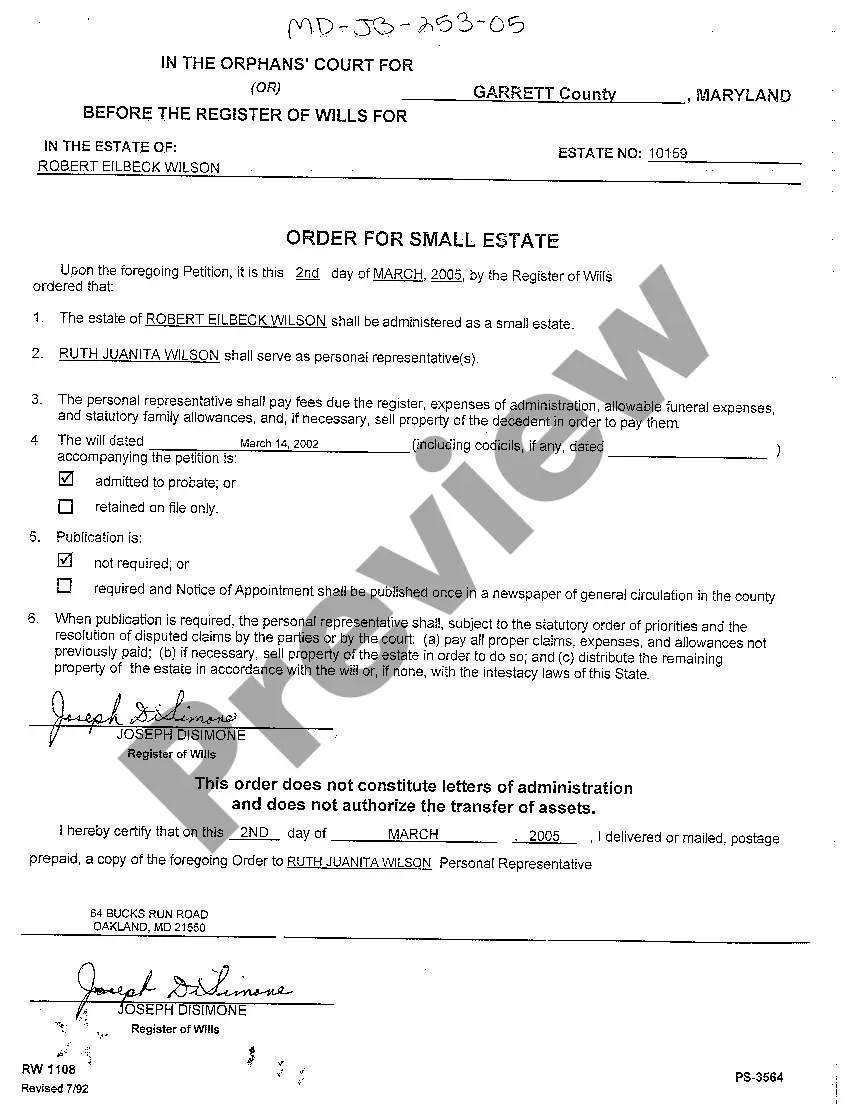

- Examine the content of the page attentively to confirm it includes the sample you need.

- To do this, leverage the form description and preview options if available.

Form popularity

FAQ

To acquire a Letter of Administration, begin by submitting a petition to the relevant probate court. You will need to provide details about the deceased, their estate, and potential heirs. The court may require a hearing before issuing the Letter of Administration. By utilizing US Legal Forms, you can easily access the necessary forms and instructions to simplify this process related to the order of administration for estate forms.

To obtain executor of estate paperwork, first, locate the will, which should name the executor. Next, file the will along with a petition for probate at your local probate court. The court will review the documents and issue letters testamentary, which grant you the legal authority to act as the executor. This process is part of the overall order of administration for estate forms, and our US Legal Forms platform can guide you through it.

An executor is a person named in a will to execute its terms and manage the estate, while a Letter of Administration is a document issued by the court when there is no will. The executor acts directly on the directives of the deceased’s wishes, whereas the administrator, who receives the Letter of Administration, follows state laws to manage the estate. Understanding these roles is essential when navigating the order of administration for estate forms.

To fill out estate paperwork correctly, begin by collecting all relevant documents, including wills, death certificates, and financial records. Take your time to understand each form required in the order of administration for estate forms, as this will simplify the process. If you need further assistance, consider using platforms like US Legal Forms to access detailed instructions and templates tailored to your needs.

Filling out form 350ES requires careful attention to detail, as it plays a vital role in the estate administration process. Start by gathering all necessary information, such as the estate's financial details and beneficiary information. Utilizing the order of administration for estate forms can guide you through the steps needed for accurate completion and submission, ensuring compliance with legal standards.

No, an executor and an administrator are not the same. An executor is appointed through a will to fulfill the deceased's wishes, while an administrator is appointed by the court when there is no will present. Understanding these distinctions is essential when dealing with the order of administration for estate forms, ensuring compliance and proper handling of the estate.

A letter of administration is a document issued by the court that appoints an administrator to oversee an estate when there is no will. In contrast, an executor is named in a will to carry out the deceased's wishes. Both roles are fundamentally linked to the order of administration for estate forms, as they govern how assets are handled and distributed.

The administrative letter serves as an official document that grants authority to an administrator to manage the estate's assets and affairs. This letter is crucial in initiating the process of settling the estate, as it allows the administrator to act on behalf of the deceased. Understanding the order of administration for estate forms ensures the proper execution of duties and compliance with legal requirements.

Estate administration and probate are related but not identical processes. Probate is the legal process through which a deceased person's will is validated, while estate administration refers to the management and settlement of the estate, whether or not there was a will. Understanding the distinction can help you navigate the order of administration for estate forms with more clarity. For more detailed guidance, consider using services like USLegalForms to simplify your experience.

To obtain a Letter of Administration for an estate, you generally need to file a petition with the probate court in your jurisdiction. You will also need to complete various Order of administration for estate forms and provide information about the deceased's assets and creditors. It's wise to gather all necessary documents beforehand. Platforms like USLegalForms can assist you in compiling the required forms efficiently.