Inheritance Tax Waiver Form Maryland For Domicile

Description

Form popularity

FAQ

To avoid inheritance taxes in Maryland, consider utilizing gifting strategies and establishing trusts during your lifetime. Another strategy is to ensure proper planning around your estate, including using the inheritance tax waiver form Maryland for domicile. Engaging with financial experts can help you navigate Maryland's tax laws effectively, protecting your heirs from unnecessary tax burdens. This proactive approach can preserve your wealth for future generations.

Yes, Maryland does allow portability of the estate tax exemption. This means that if one spouse passes away without fully using their estate tax exemption, the surviving spouse can claim the unused portion in their own estate. To benefit from this, you need to file the proper forms, including the inheritance tax waiver form Maryland for domicile. This step is crucial for ensuring financial protection for your loved ones.

To elect estate tax portability in Maryland, you must file an estate tax return and properly complete the estate tax portability section. This process allows the surviving spouse to use any unused estate tax exemption from the deceased spouse. It is essential to submit the necessary documents within nine months of the date of death, including the inheritance tax waiver form Maryland for domicile. By doing this, you can maximize tax savings for your family.

In Maryland, several types of assets are exempt from probate, simplifying the transfer process for heirs. Common exemptions include properties held in joint tenancy, assets with designated beneficiaries, and trusts. Using the inheritance tax waiver form Maryland for domicile can clarify which of your assets qualify for these exemptions, making it easier for your family to manage their inheritance efficiently and avoid probate delays.

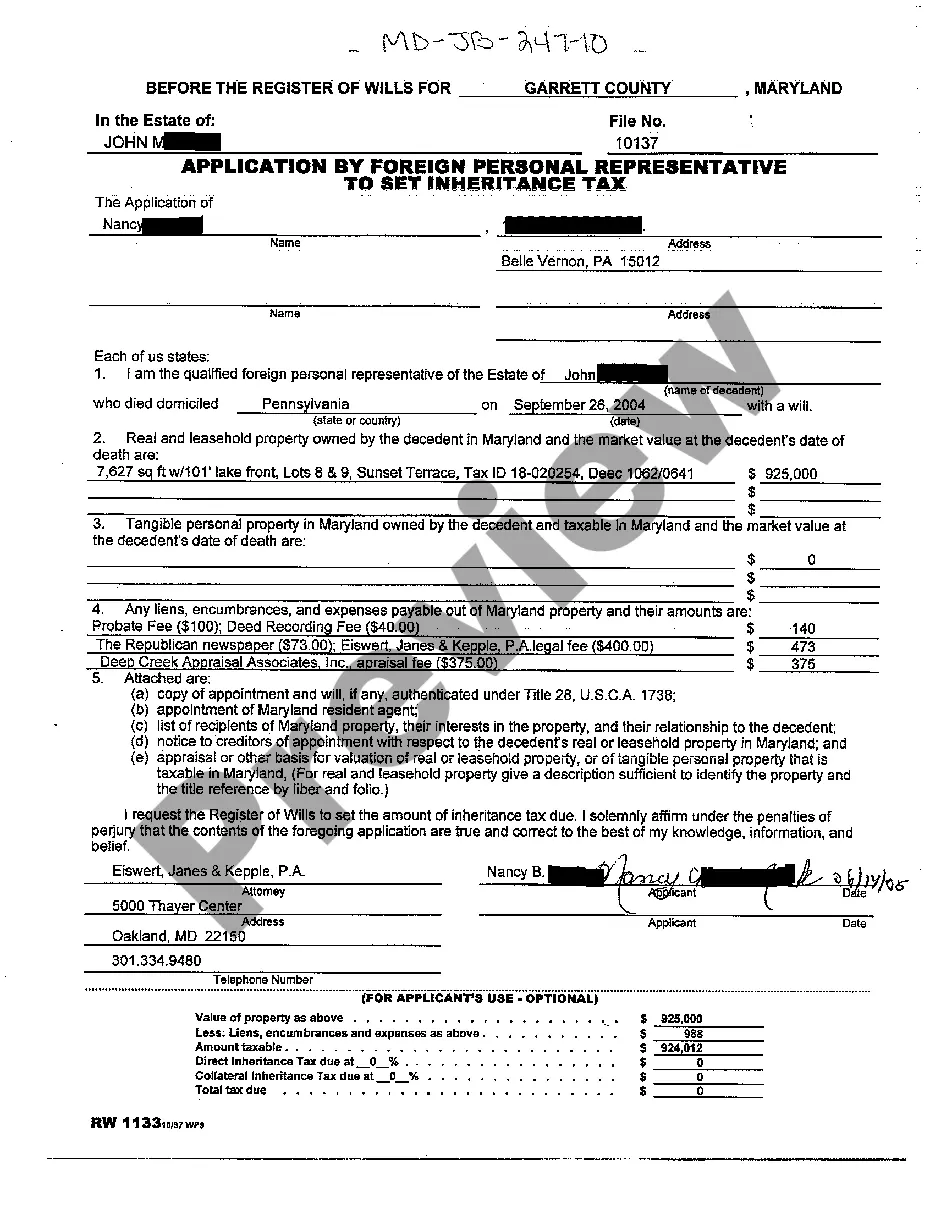

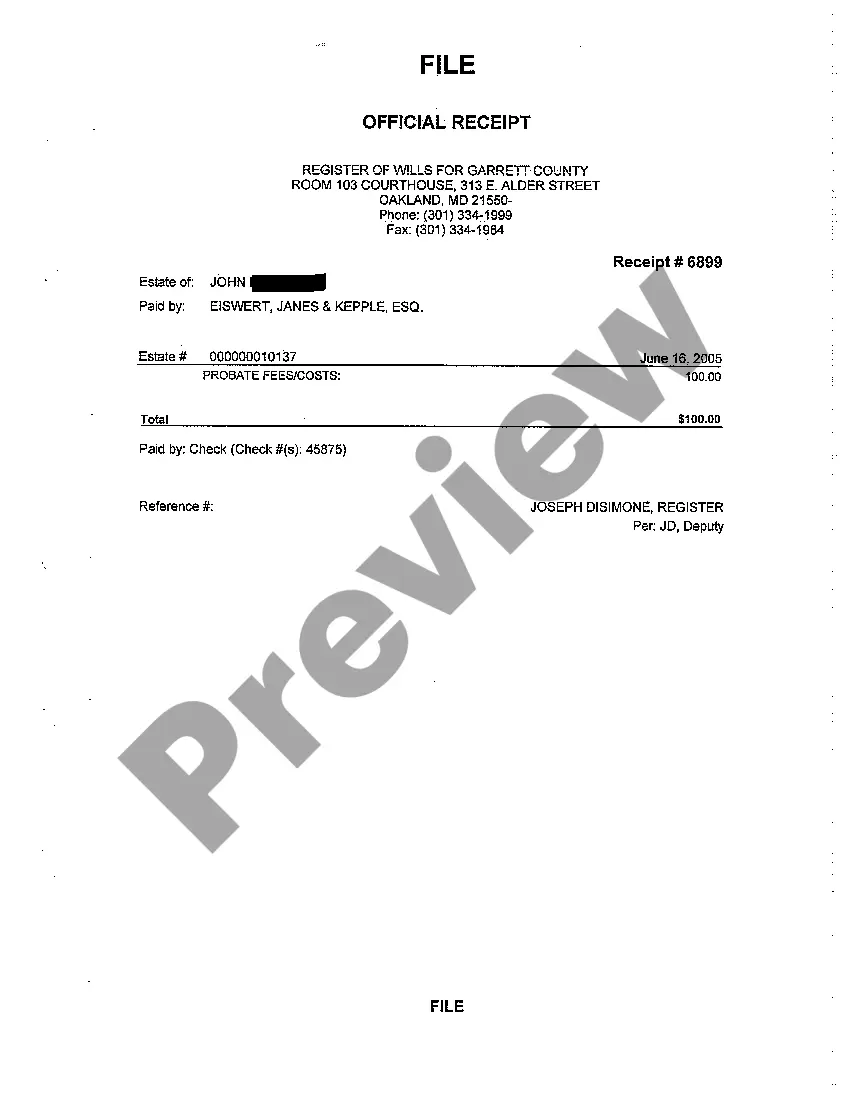

The inheritance tax waiver is a document that allows you to exempt certain assets from being subjected to Maryland's inheritance tax. This form is crucial for residents who want to ensure that their loved ones are not burdened by this tax after their passing. Completing the inheritance tax waiver form Maryland for domicile helps streamline the probate process, providing clarity on which assets can be retained by the heirs without additional tax liabilities.

Maryland enacted portability for estate tax exemptions in 2014. This change allows surviving spouses to utilize any unused exemption from their deceased spouse. It's a crucial update in estate planning, especially for those navigating the inheritance tax waiver form Maryland for domicile. Be sure to discuss this option with your tax advisor to maximize your benefits.

In Maryland, certain individuals are exempt from inheritance tax. Immediate family members, including spouses, children, and parents, enjoy this exemption. Additionally, charities and some types of property transfers may be exempt as well. Always remember to consult the inheritance tax waiver form Maryland for domicile for specific details related to exemptions.

To avoid Maryland inheritance tax on property, consider gifting the property to heirs while still alive. Another effective strategy is the use of trusts, which can transfer ownership and avoid inheritance tax. Additionally, completing the inheritance tax waiver form Maryland for domicile will clarify the exemptions applicable to your situation. Working with a legal expert can help ensure you make informed decisions.

Yes, the Maryland estate tax exemption is indeed portable between spouses. This means a surviving spouse can use any unused portion of the deceased spouse's exemption, which can significantly reduce the tax burden on the couple's estate. However, to take full advantage of this benefit, timely filing of the inheritance tax waiver form Maryland for domicile is crucial. Understanding the specifics of portability can empower you in estate planning.

One disadvantage of portability in estate planning is the potential complexity it introduces to the process. When surviving spouses choose to utilize the deceased spouse's unused exemption, it can lead to increased scrutiny from tax authorities. Moreover, if you fail to timely file the inheritance tax waiver form Maryland for domicile, you may miss out on this valuable tax benefit. It's essential to thoroughly evaluate your options before deciding on portability.