Selling An Unsecured Promissory Note With Balloon Final Payment)

Description

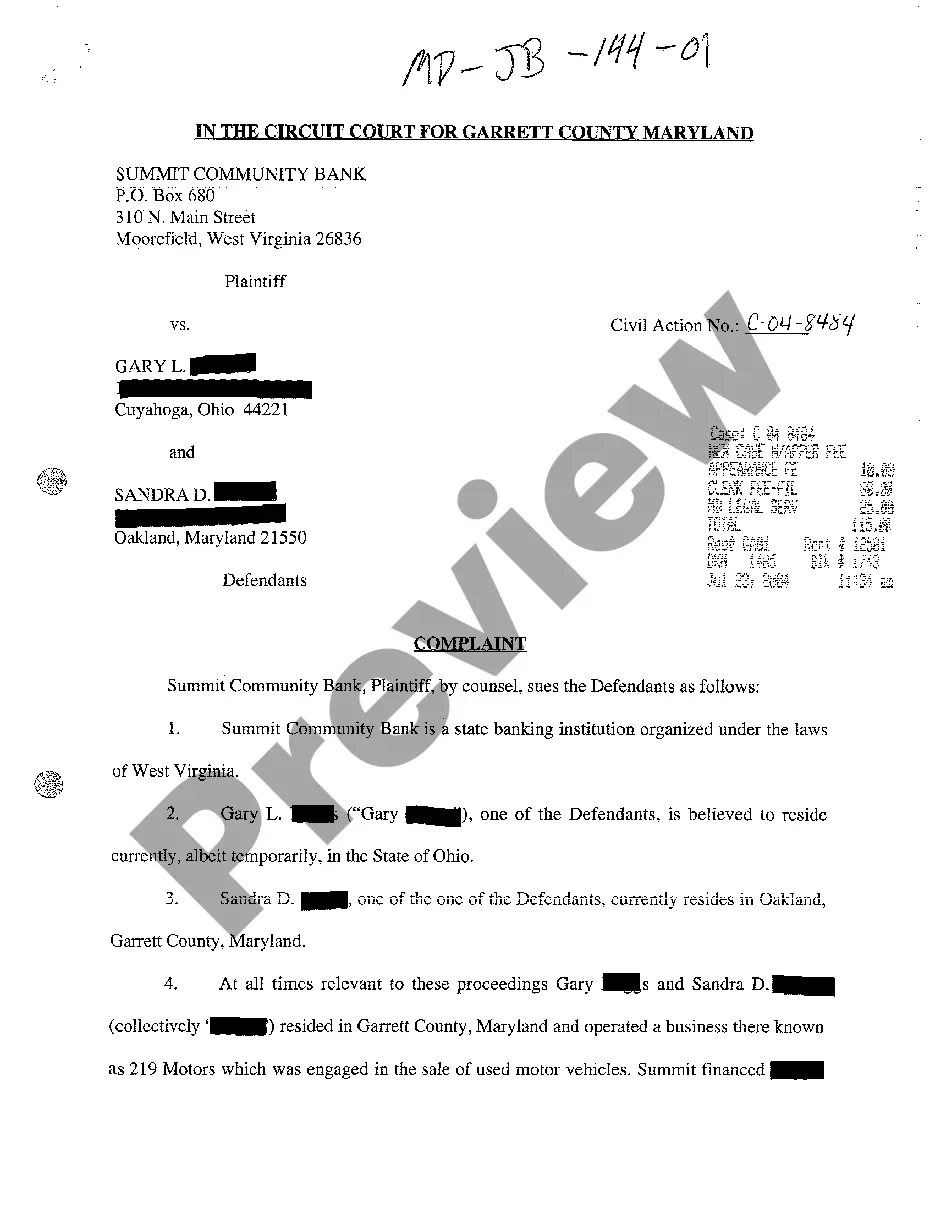

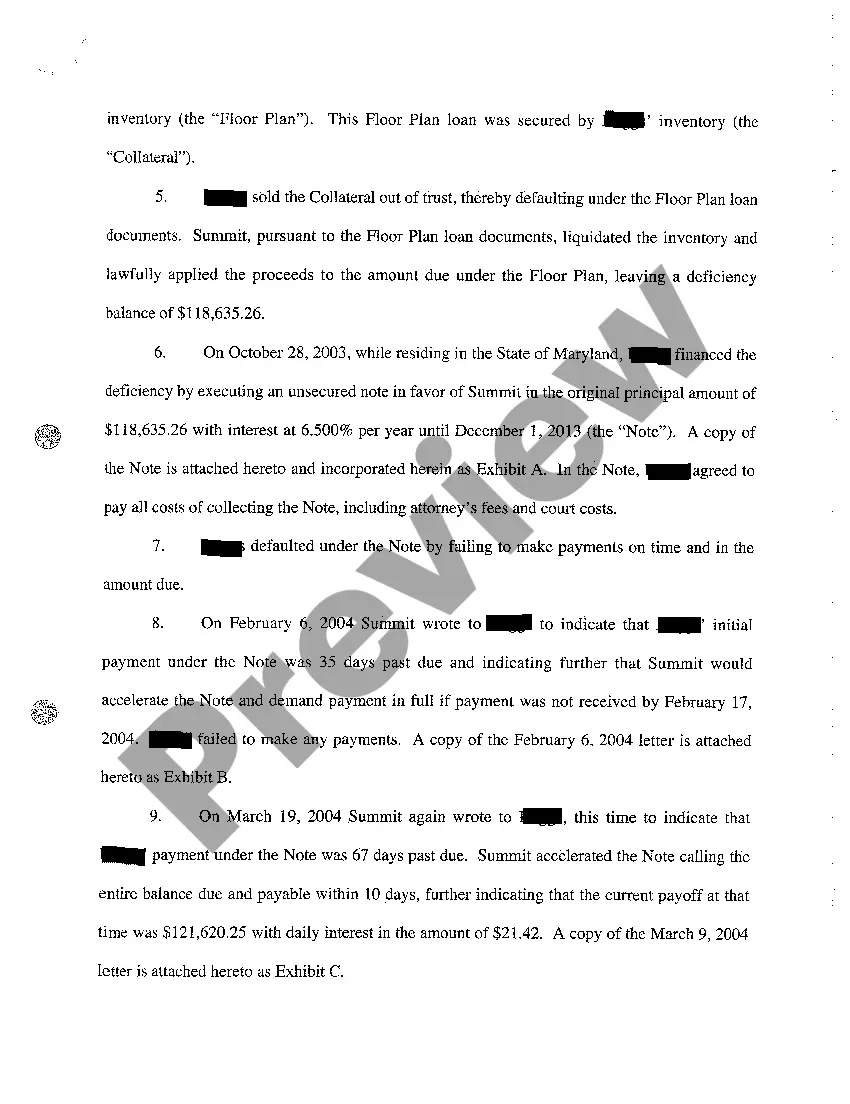

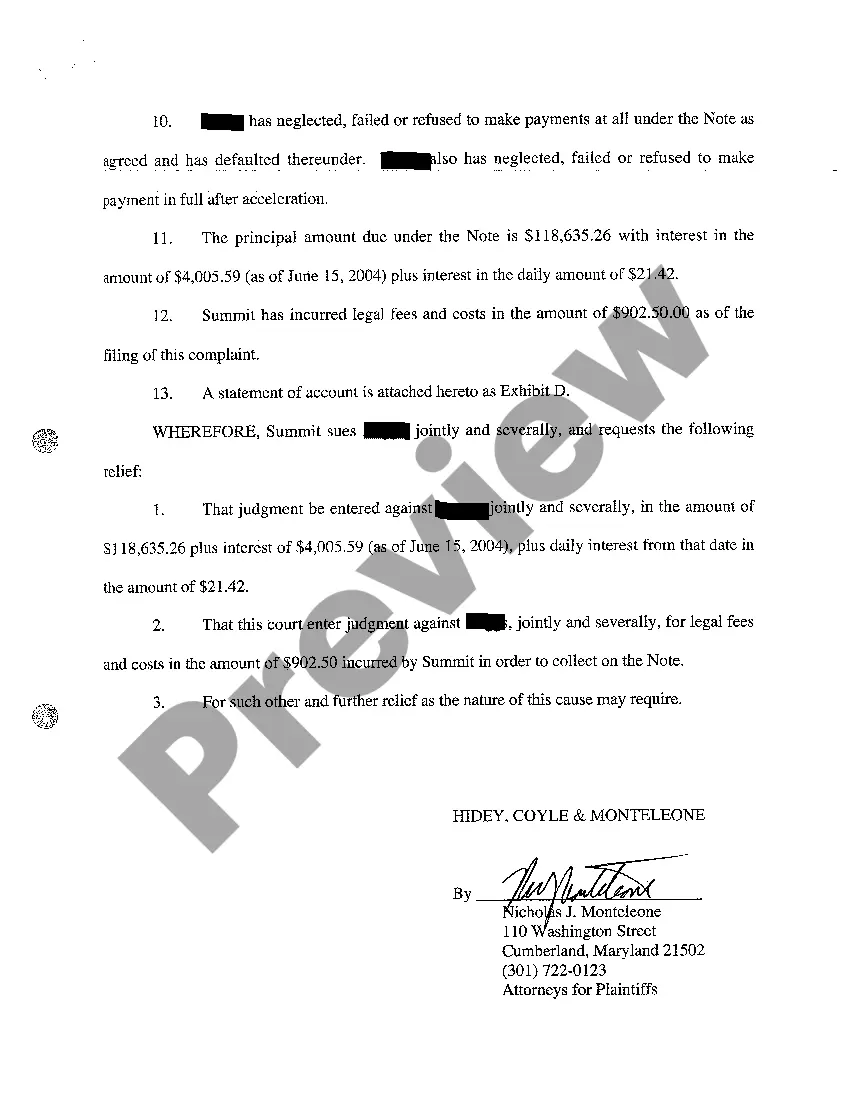

How to fill out Maryland Complaint For Breach Of Promissory Note By Selling Collateral Security?

Administration requires exactness and correctness.

If you do not manage completing documentation like Selling An Unsecured Promissory Note With Balloon Final Payment) on a regular basis, it can result in some confusion.

Selecting the appropriate example from the outset will guarantee that your document submission goes smoothly and avert any troubles of resending a file or repeating the same task from the beginning.

If you are not a registered user, finding the required template will involve a few extra steps: Use the search bar to locate the form. Ensure the Selling An Unsecured Promissory Note With Balloon Final Payment) you've found is relevant for your state or area. Open the preview or read the description with details on the form's use. If the result matches your needs, click the Buy Now button. Choose the right option from the proposed subscription plans. Log In to your account or create a new one. Finalize the purchase using a credit card or PayPal. Save the document in your preferred file format. Obtaining the correct and updated examples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic uncertainties and simplify your paperwork tasks.

- Acquire the suitable example for your paperwork in US Legal Forms.

- US Legal Forms is the largest web-based forms repository, housing over 85 thousand templates across various fields.

- You can access the latest and most pertinent version of Selling An Unsecured Promissory Note With Balloon Final Payment) simply by searching it on the site.

- Locate, retain, and download templates within your account or review the description to confirm you possess the correct one.

- Having an account at US Legal Forms allows you to obtain, store in one location, and navigate through the templates you save for quick access.

- When on the webpage, click the Log In button to authenticate.

- Then, proceed to the My documents page, where your documents are kept.

- Examine the description of the forms and download the ones you need at any time.

Form popularity

FAQ

Such an early release of a promissory note without full payment may be considered by the Internal Revenue Service ( IRS) to be a taxable event. The value of the amount of debt forgiven may be deemed either taxable income, or a gift subject to the federal estate and gift tax.

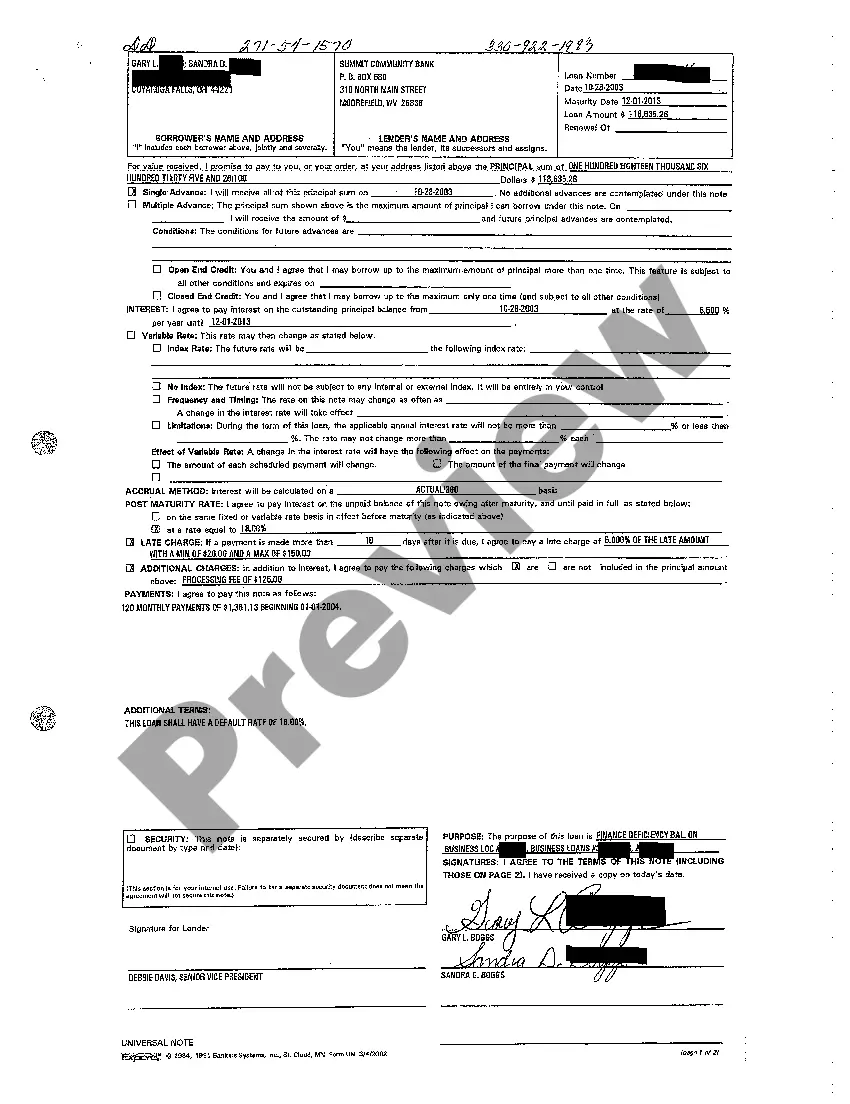

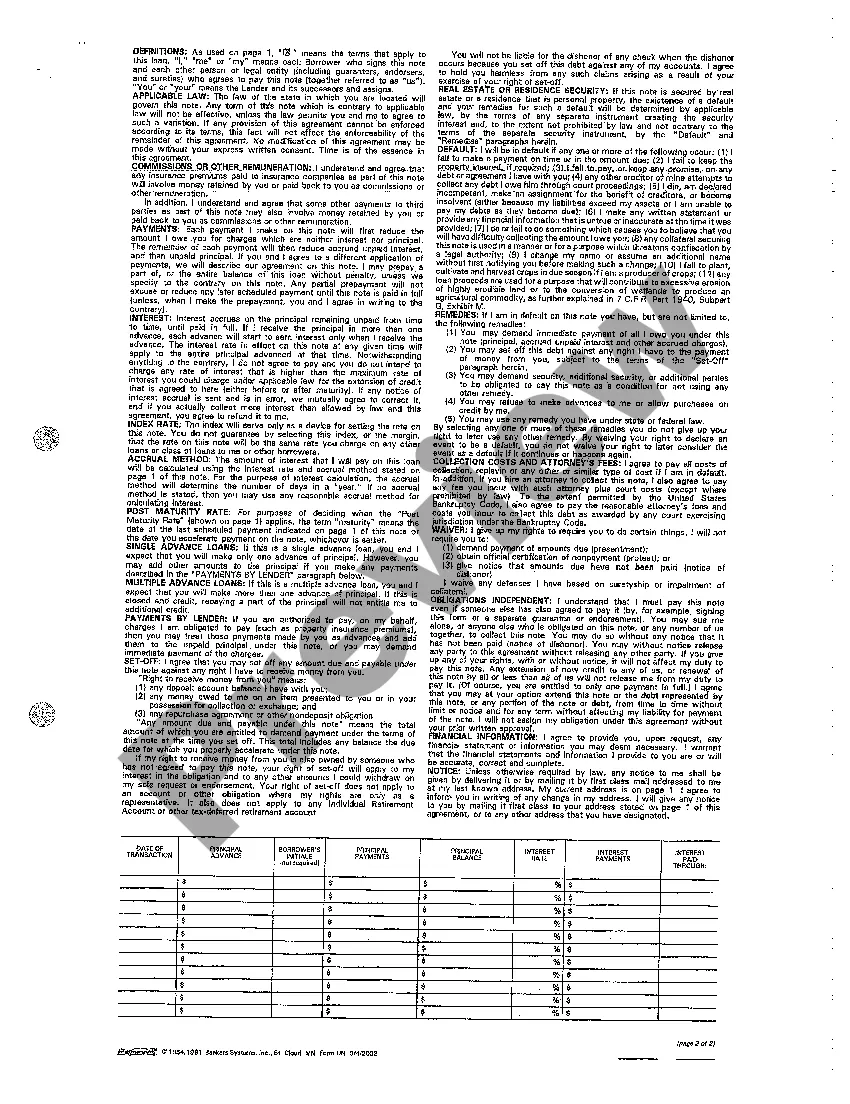

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

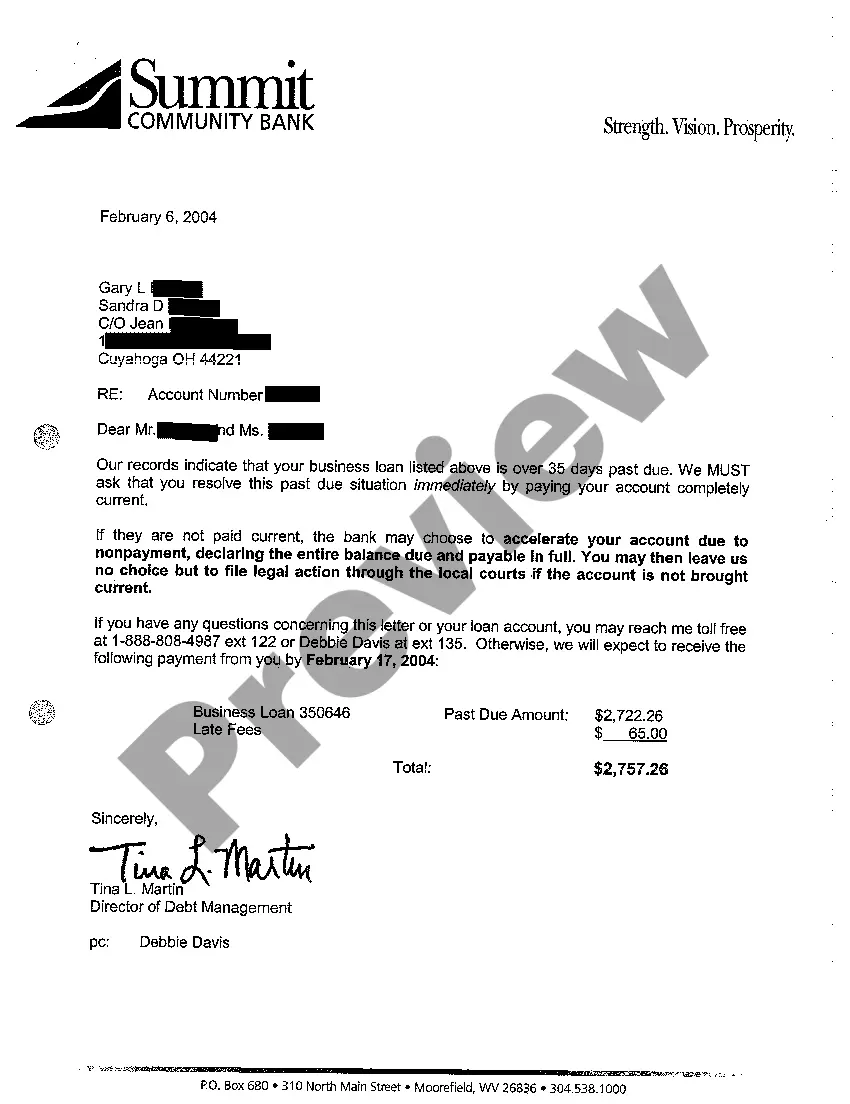

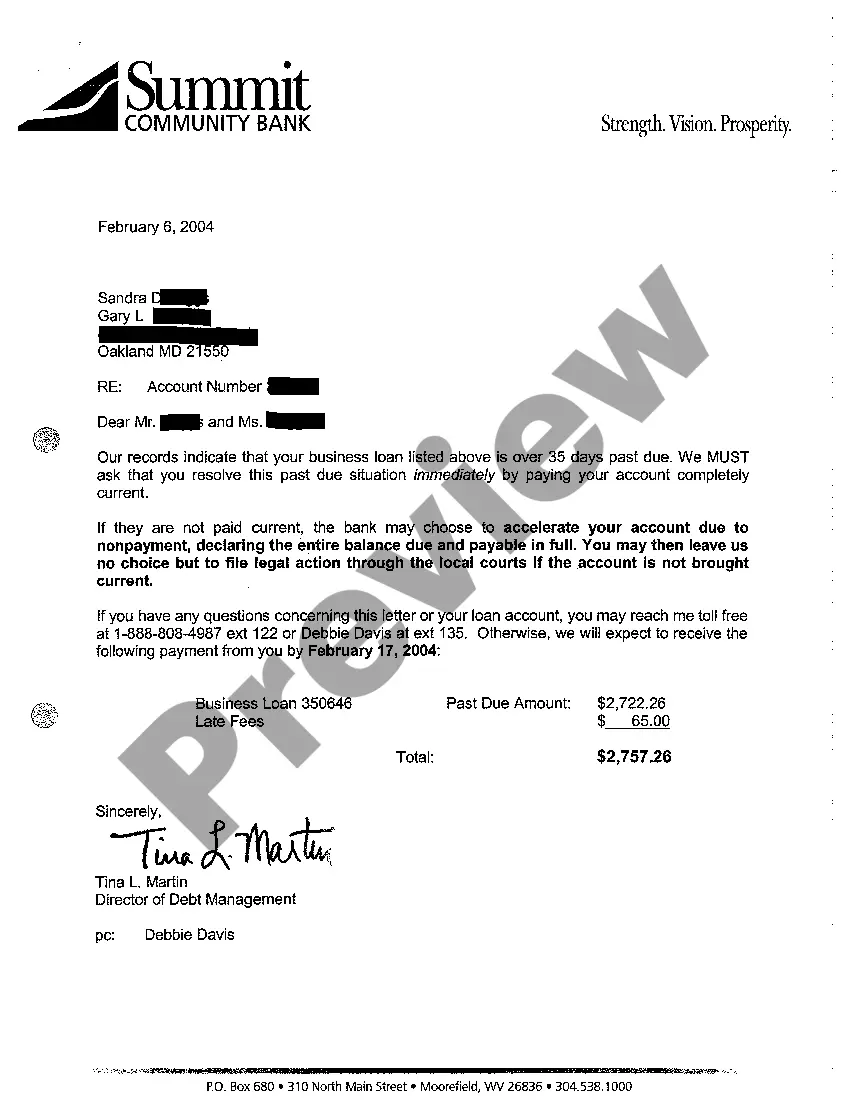

An unsecured promissory note is an obligation for payment without any property securing the payment. If the payor fails to pay, the payee must file a lawsuit and hope that the payor has sufficient assets that can be seized to satisfy the loan.

In a promissory note, the person who makes the promise to pay is called as Promisor.