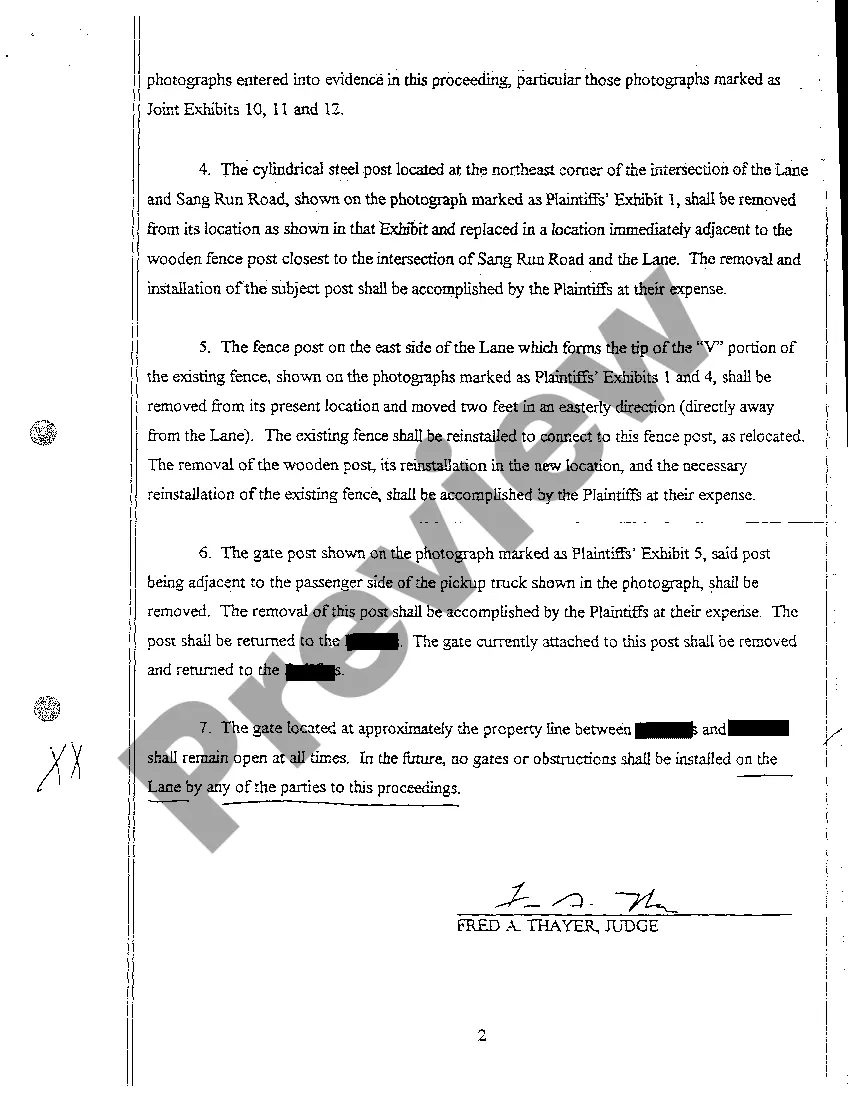

Easement By Prescription Example

Description

How to fill out Maryland Judgment Of Prescriptive Easement Dimensions And Injunctive Relief?

Legal documents administration can be daunting, even for seasoned experts.

When seeking an Easement By Prescription Example and lacking the time to search for the correct and current version, the processes may become anxiety-inducing.

US Legal Forms meets all your needs, catering to both personal and corporate documents, all consolidated in one convenient location.

Employ advanced tools to complete and manage your Easement By Prescription Example efficiently.

Here are the steps to follow after acquiring the form you need: Confirm it is the correct document by previewing and reviewing its description.

- Tap into a repository of articles, guides, and resources pertinent to your situation and requirements.

- Conserve time and effort in locating the documents you require, leveraging US Legal Forms' sophisticated search and Review feature to uncover Easement By Prescription Example and obtain it.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Check your My documents tab to review the documents you have previously downloaded and to organize your folders as desired.

- If this is your initial experience with US Legal Forms, create a free account to gain unlimited access to all platform benefits.

- Utilize a sturdy online form repository that can be a transformative resource for anyone wishing to manage these matters effectively.

- US Legal Forms is a leading provider in online legal forms, boasting over 85,000 state-specific legal forms available to you at any time.

- With US Legal Forms, you can access various legal and organizational documents tailored to your state or county.

Form popularity

FAQ

Self-Employment tax obligations in Nashville, Tennessee If you primarily work as an independent contractor, or are the owner of a sole proprietorship, you have to pay what's commonly referred to as the "self-employment tax," if your annual income from self-employment is over .

A worker who can realize a profit or suffer a loss as a result of the worker's services, in addition to the profit or loss ordinarily realized by employees, is generally an independent contractor but the worker who cannot is an employee.

You are allowed to work an independent contractor on a TN visa, as long as the employer can establish control over you. You are allowed to work for multiple employers in the U.S. only if you obtain TN status for each and every employer.

US company hiring a US citizen living abroad The company should continue to issue a Form 1099-NEC (given they paid the contractor more than $600 within a year), just like it would to its domestically-based US resident contractors.

Canadian contractors can work for American companies while remaining at home. Working from Canada requires some extra considerations from employers, however. They now must ensure that contractors working in Canada are paid legally and properly under Canadian tax and employment law.

Payment methods for TN Visa professionals are flexible, provided they aren't engaged in self-employment. The wage arrangements are between the TN Visa holder and the US contracting party and can be set up on a W-2 or 1099 basis.

With a TN Visa, can one work as a self-employed professional? This visa status, primarily for Mexican and Canadian nationals providing services to a US employer or client, necessitates an employment component for eligibility. Self-employment, however, is not permitted under TN Visa rules.

If you are maintaining control as an employer, then IRS could get you in trouble. IRS could say you should be putting this person on W2, deducting their social security taxes, other benefits, you have to put them on W2, you can't have them on 1099.