Difference Between Gift Deed And Settlement Deed

Description

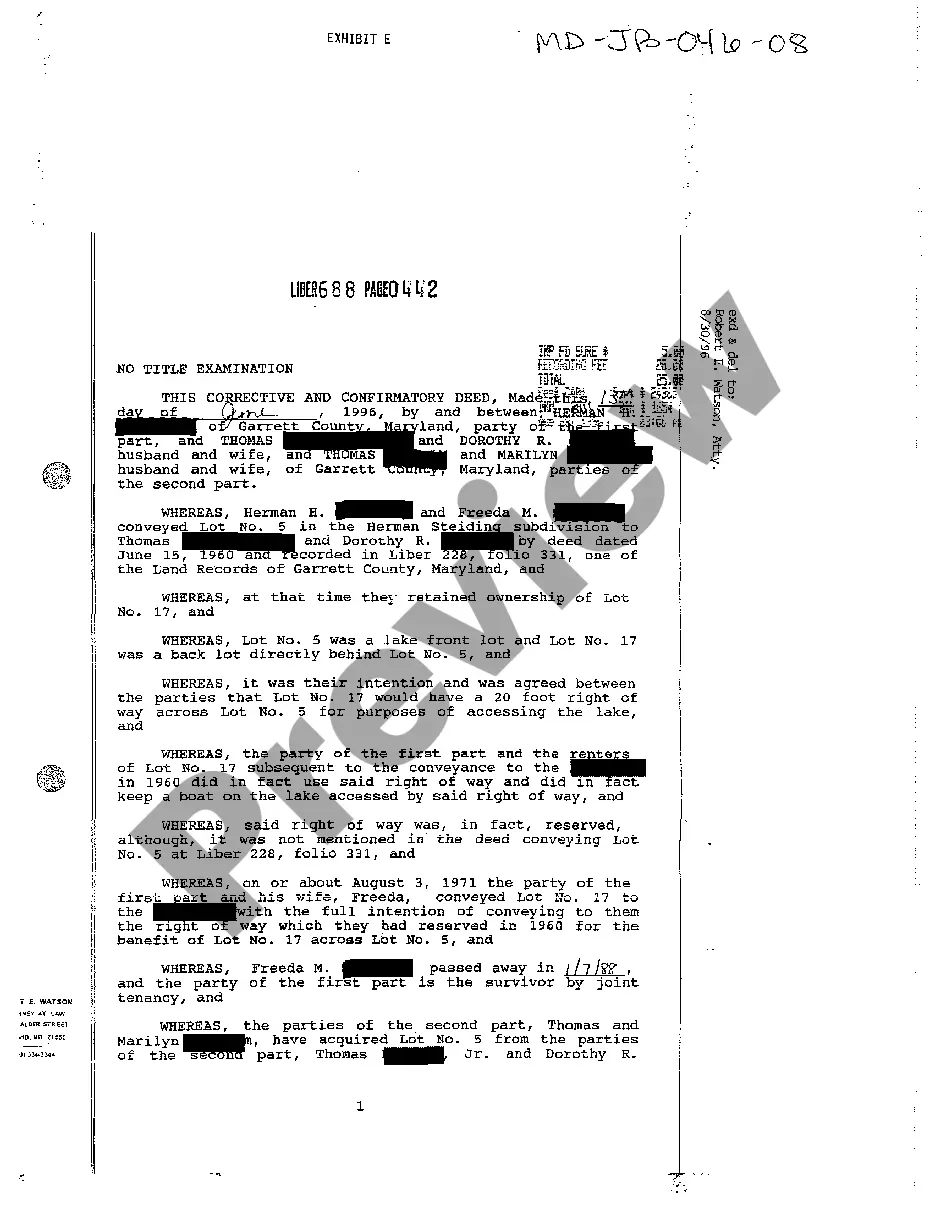

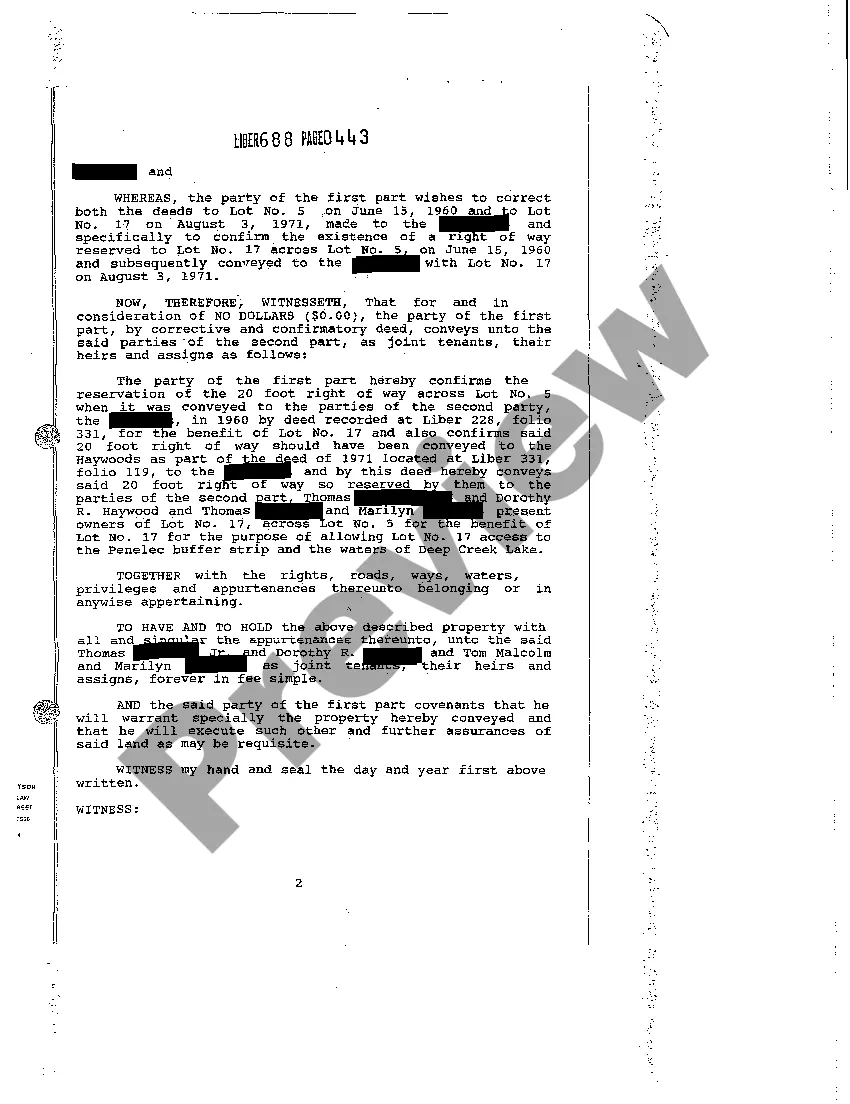

How to fill out Maryland Exhibit E Corrective And Confirmatory Deed - Husband And Wife To Married Couple?

It’s widely known that you cannot become a legal authority in a day, nor can you swiftly learn how to prepare the Difference Between Gift Deed And Settlement Deed without possessing a particular skill set.

Compiling legal documents is an extensive task that demands a defined education and expertise.

So why not entrust the preparation of the Difference Between Gift Deed And Settlement Deed to the professionals.

You can revisit your forms from the My documents tab whenever needed. If you’re a current client, you can quickly Log In, and find and download the template from the same tab.

Regardless of the intention behind your documents—whether financial, legal, or personal—our website has you covered. Explore US Legal Forms today!

- Locate the document you require by utilizing the search bar at the top of the page.

- View it (if this option is available) and review the accompanying description to determine if the Difference Between Gift Deed And Settlement Deed is what you need.

- If you require a different form, initiate your search again.

- Sign up for a complimentary account and select a subscription plan to acquire the form.

- Select Buy now. Once the payment is finalized, you can access the Difference Between Gift Deed And Settlement Deed, complete it, print it, and deliver it or send it via mail to the required individuals or organizations.

Form popularity

FAQ

Choosing between a gift deed and a sale deed hinges on whether you intend to compensate for the property. A gift deed involves no payment and reflects generosity, while a sale deed necessitates a financial transaction. When analyzing the difference between gift deed and settlement deed, consider that the latter addresses specific contingencies or disputes between parties. Each serves a unique purpose in property transfers.

The choice between a partition deed and a gift deed depends on your goals. A partition deed is suitable when you want to divide property among co-owners, whereas a gift deed transfers ownership voluntarily without compensation. Understanding the difference between gift deed and settlement deed can also influence your decision, as each serves distinct purposes. Evaluating your situation ensures you make the right choice.

The difference between gift deed and settlement deed is substantial. A gift deed transfers ownership without any exchange or payment, reflecting a one-sided intention to give. In contrast, a settlement deed is often used to resolve disputes or to divide property among family members, typically outlining specific terms. This differentiation highlights the intent and conditions surrounding the property transfer.

The choice between a settlement deed and a gift deed largely depends on your specific situation. Generally, both serve different purposes, but the key difference between gift deed and settlement deed lies in the nature of ownership transfer. A gift deed involves a voluntary transfer without consideration, while a settlement deed typically transfers rights to property for a specific purpose. Therefore, understanding your unique needs can help you choose the right deed.

The division of ancestral or inherited property between family members can be done by using a family settlement deed or gift settlement deed so that they can distribute the immovable asset among themselves. The gift settlement deed can be made with or without considerations among the family members or their dependents.

Those requirements include: An offer. This is what one party proposes to do, pay, etc. ... Acceptance. ... Valid consideration. ... Mutual assent. ... A legal purpose. ... A settlement agreement must also not be "unconscionable." This means that it cannot be illegal, fraudulent, or criminal.

Gift Deed is executed out of natural love and affection in favour of family members or loved ones whereas a deed of settlement is executed between larger family members or co-sharers to generally settle a dispute and demarcate or partition the assests. It can be prepared for both movable and immovable assets.

The document typically includes the following: The name of the parties involved. The settlement deed identifies the parties involved in the transaction, namely the seller and the buyer. ... Property details. ... Amount to be transacted. ... Terms and conditions. ... Signatures and witnesses. ... Heading. ... Parties Involved. ... Property Details.

Contents of a Family Settlement Agreement Parties to the FSA ? includes all the family members who are likely to be part of the dispute that has arisen or that may arise in the future. Particulars of Properties ? if the FSA aims to resolve property disputes, all the details of such properties should be mentioned.