Maryland Affidavit Of Self Employment

Description

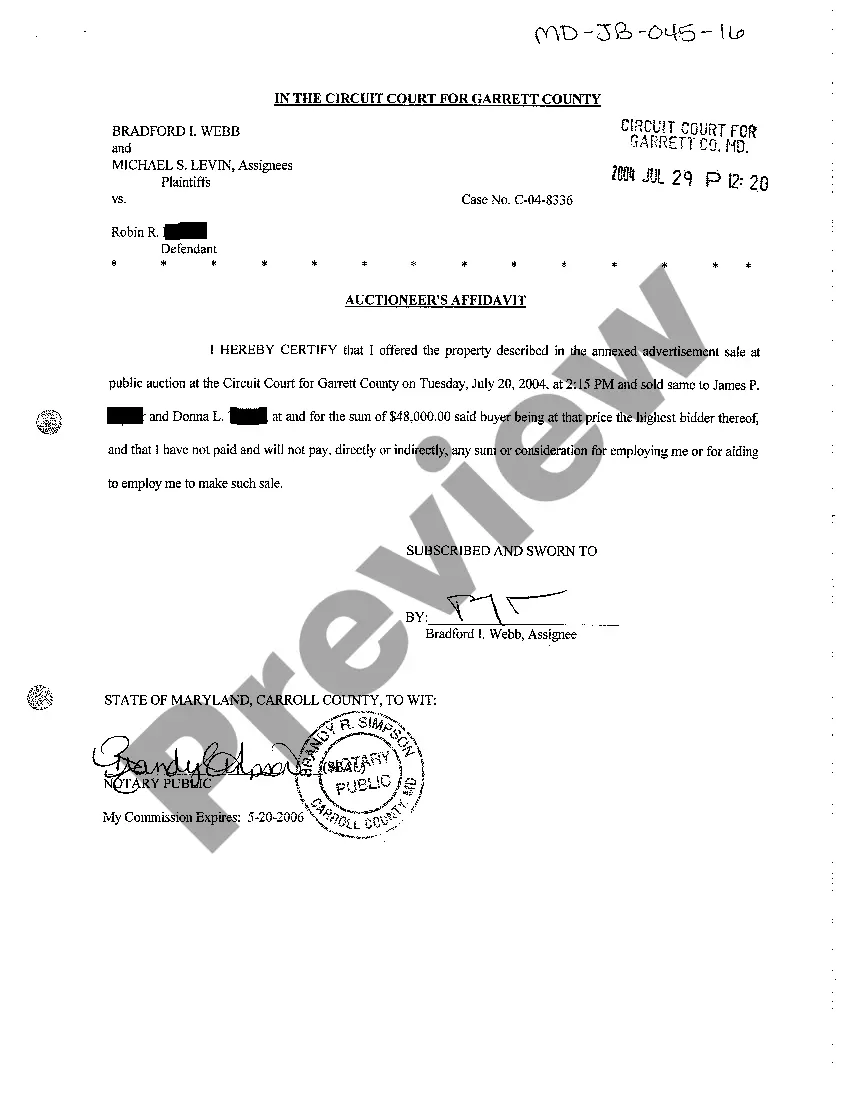

How to fill out Maryland Auctioneer's Affidavit?

Individuals frequently connect legal documentation with something complex that solely an expert can manage.

In a certain sense, this holds true, as composing a Maryland Affidavit of Self Employment requires substantial knowledge of subject standards, including state and county laws.

However, with US Legal Forms, everything has become simpler: pre-made legal forms for any life and business occasion tailored to state regulations are gathered in one online repository and are now accessible to all.

Create an account or Log In to proceed to the payment page. Process your payment through PayPal or using your credit card. Select the format for your file and click Download. You can print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once purchased, they remain saved in your profile. You can access them anytime you need through the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k contemporary documents categorized by state and area of application, making it easy to search for a Maryland Affidavit of Self Employment or any specific template in just a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to retrieve the form.

- New users will need to create an account and subscribe before they can download any documentation.

- Here is a detailed guide on how to obtain the Maryland Affidavit of Self Employment.

- Carefully review the page content to ensure it meets your requirements.

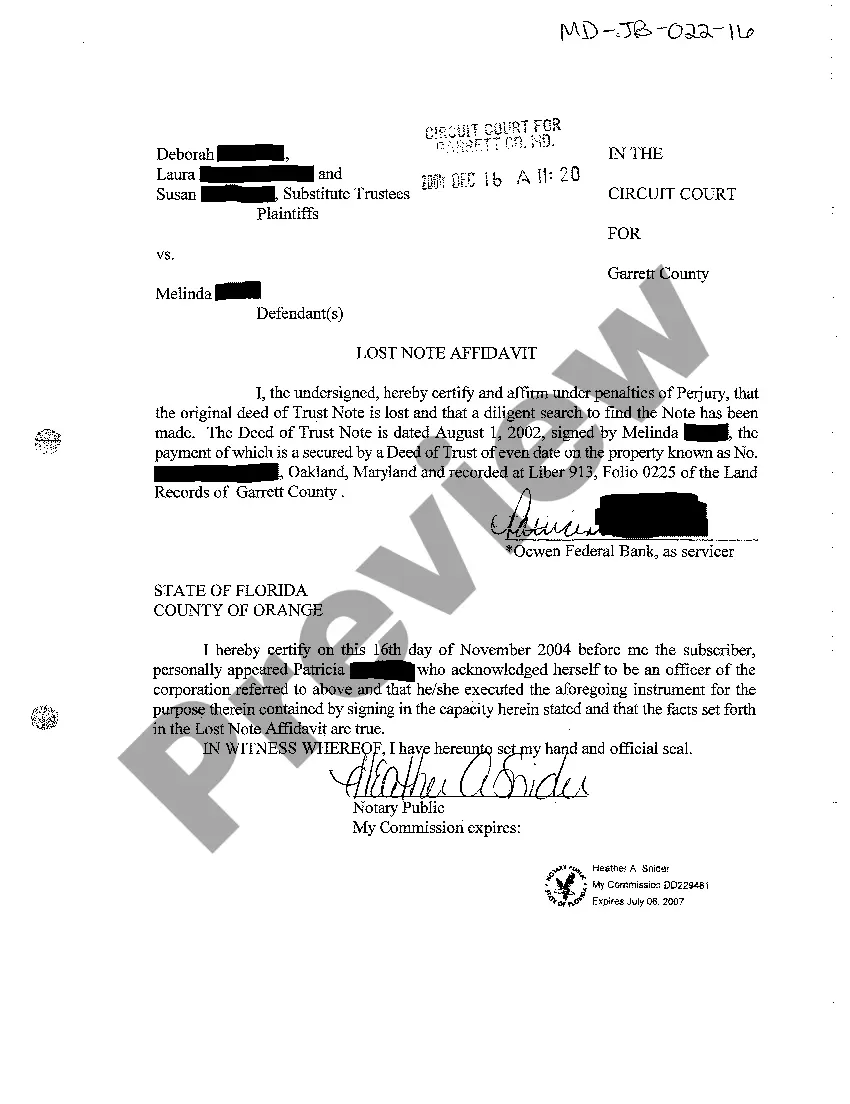

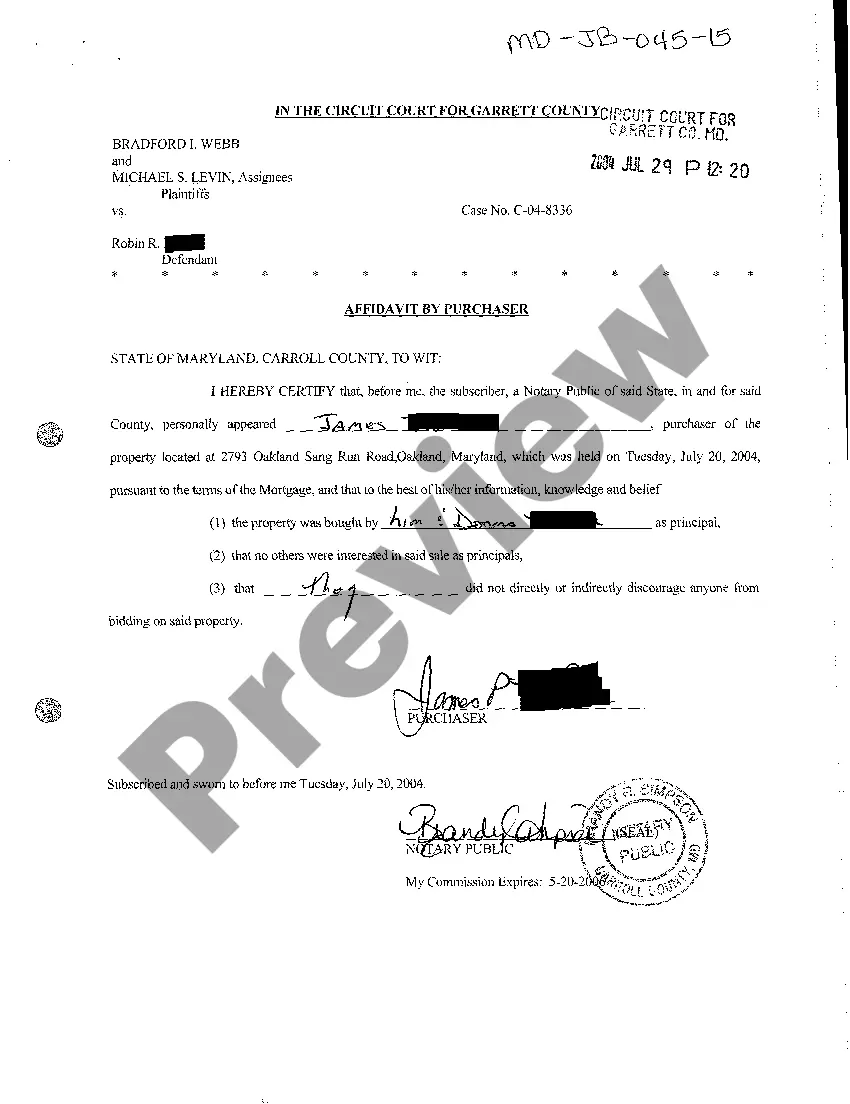

- Read the form description or check it using the Preview option.

- If the previous sample does not meet your needs, search for another one using the Search bar in the header.

- Once you find the appropriate Maryland Affidavit of Self Employment, click Buy Now.

- Select a pricing plan that aligns with your needs and budget.

Form popularity

FAQ

3 Types of documents that can be used as proof of incomeAnnual tax returns. Your federal tax return is solid proof of what you've made over the course of a year.Bank statements. Your bank statements should show all your incoming payments from clients or sales.Profit and loss statements.

1. Annual tax returns. Your federal tax return is solid proof of what you've made over the course of a year. It's a legal document that is officially recognized by the Internal Revenue Service that shows your total income and expenses for that year.

SELF EMPLOYMENT AFFIDAVIT. SELF-EMPLOYMENT AFFIDAVIT. You have applied to live in an apartment that is governed by the federal government's Housing Credit Program. This Program requires us to certify all of your income, assets and eligibility information as part of determining your household's eligibility.

To create your Affidavit of No Income you'll need the following minimum information:The name and details (e.g. nationality and address) of the affiant;The name and details (e.g. address, government registration details) of the business;The period during which the business does not have any income; and.More items...

Wage and Tax Statement for Self Employed (1099). These forms prove your wages and taxes as a self employed individual. It's one of the most reliable proofs of income you can produce since it is a legal document. Profit and Loss Statement or Ledger Documentation.