Wh Ar 2022 Withholding

Description

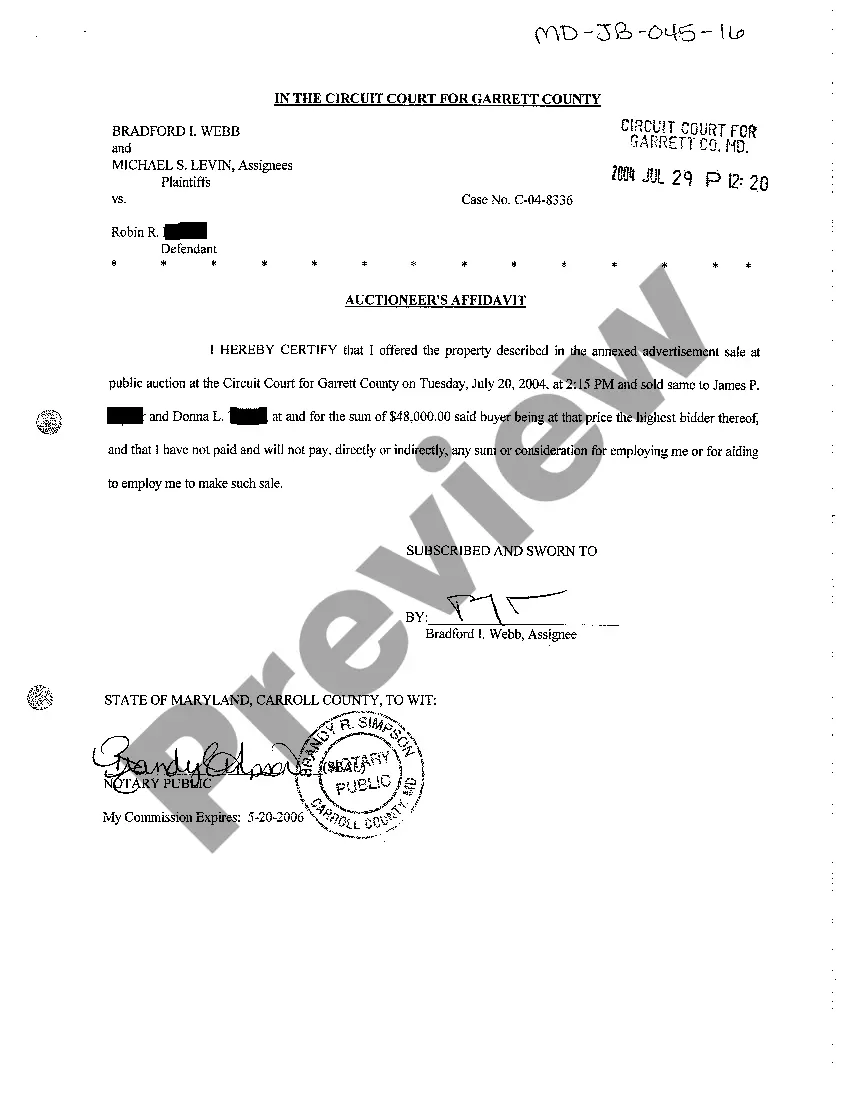

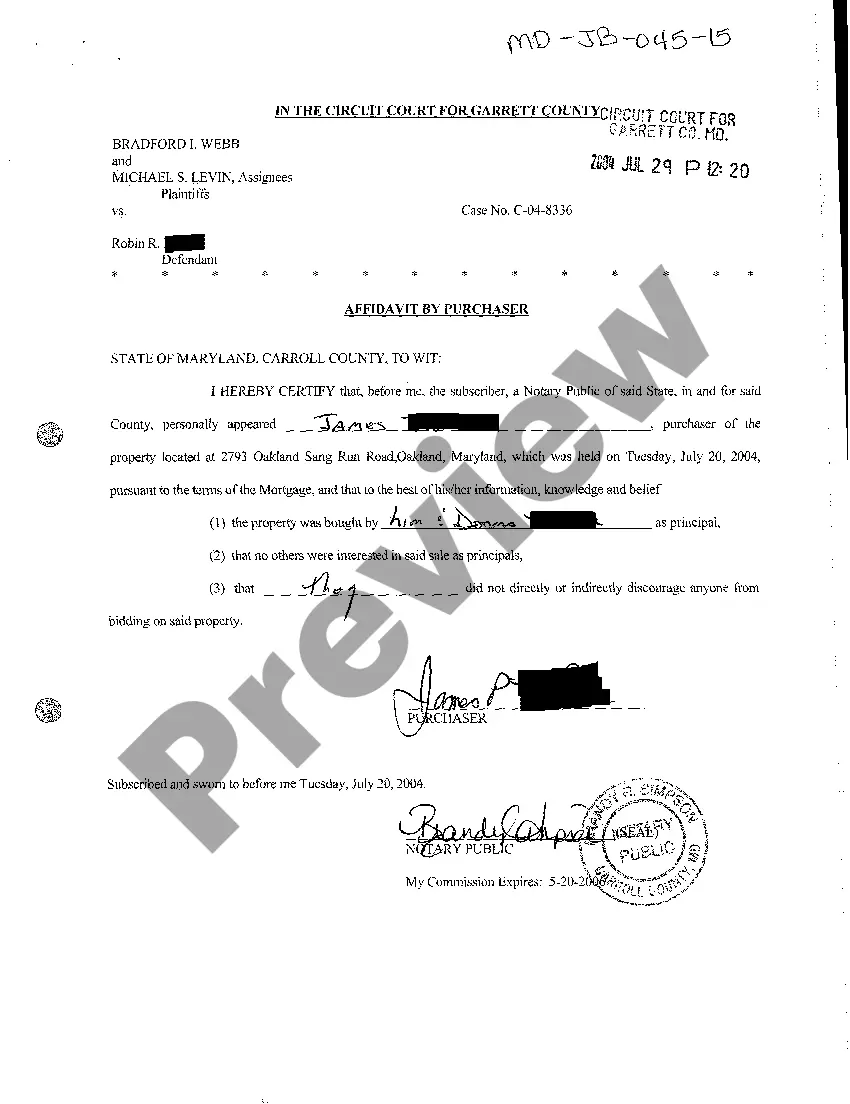

How to fill out Maryland Affidavit By Purchaser?

The Wh Ar 2022 Withholding displayed on this page is a reusable legal template crafted by experienced attorneys in adherence to federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with over 85,000 validated, state-specific forms for any business and personal event. It’s the fastest, simplest, and most dependable method to acquire the documents you require, as the service assures bank-level data safety and anti-malware safeguards.

Subscribe to US Legal Forms to have validated legal templates for all of life’s circumstances readily available.

- Search for the document you require and examine it. Browse through the file you searched and view it or check the form details to confirm it meets your requirements. If it doesn’t, utilize the search bar to find the correct one. Click Buy Now once you have identified the template you need.

- Sign up and Log In. Select the pricing plan that best fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the fillable template. Choose the format you prefer for your Wh Ar 2022 Withholding (PDF, Word, RTF) and download the sample to your device.

- Complete and sign the document. Print out the template for manual completion. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill and sign your form with an eSignature.

- Download your documents again. Access the same document whenever needed. Open the My documents section in your profile to redownload any previously purchased forms.

Form popularity

FAQ

The 7.75 percent tax must be paid to the Comptroller of Maryland with Form MW506 (Employer's Return of Income Tax Withheld). If the payor of the distribution is not currently registered with the Comptroller and has not established a withholding account, the payor can register online.

You can call us at 800-492-5909 or 410-625-5555. online. This is the fastest and most secure method to update your Maryland state tax withholding.

Use Form MW506AE to apply for a Certificate of Full or Partial Exemption from the withholding requirements on the proceeds of the sale of real property and associated personal property in Maryland by nonresident individuals and nonresident entities.

For a nonresident individual, the tax withholding amount is 7.5% of the total property's sale price. If multiple individuals own the property, then each owner is responsible for paying a percentage of the withholding that equals the percentage that he or she owns.

Maryland has a progressive income tax system with rates that range from 2.00% to 5.75%. That top rate is slightly below the U.S. average.