Maryland Child Support Forms Formula

Description

How to fill out Maryland Motion To Modify Custody And Child Support?

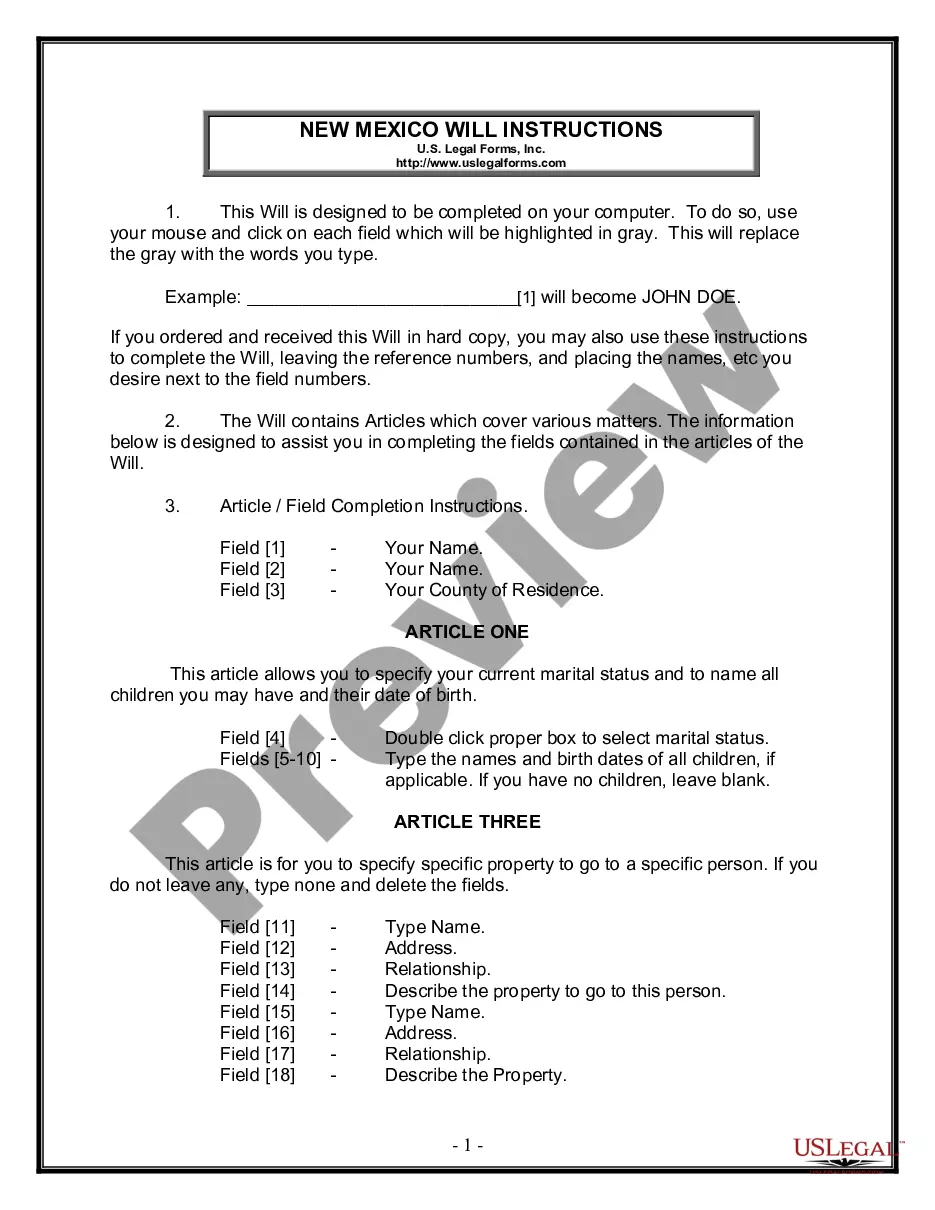

Utilizing legal templates that comply with federal and state regulations is essential, and the internet provides countless choices to select from.

However, what's the purpose of wasting time searching for the properly drafted Maryland Child Support Forms Formula example online when the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable forms prepared by attorneys for any commercial and personal situation. They are easy to navigate with all documents organized by state and intended use. Our experts stay updated with legislative changes, ensuring your documents are always current and compliant when obtaining a Maryland Child Support Forms Formula from our site.

Register for an account or Log In and complete a payment via PayPal or a credit card. Choose the best format for your Maryland Child Support Forms Formula and download it. All documents available through US Legal Forms are reusable. To redownload and fill out previously saved forms, access the My documents tab in your account. Take advantage of the most extensive and user-friendly legal documentation service!

- Acquiring a Maryland Child Support Forms Formula is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the required document sample in the appropriate format.

- If you are a newcomer to our site, follow the steps below.

- Review the template using the Preview option or through the text outline to ensure it meets your specifications.

- Search for another example using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the appropriate form and choose a subscription plan.

Form popularity

FAQ

A. The Basic Rate: The California Constitution allows parties to contract for interest on a loan primarily for personal, family or household purposes at a rate not exceeding 10% per year.

Vermont Interest Rate Laws When considering a personal loans in Vermont, the statutory interest rate for these types of unsecured, consumer loans is 12 percent. This is the maximum interest that can be charged on any personal, consumer loan in the State of Vermont.

Chapter 113 : Judgment Lien (c) Interest on a judgment lien shall accrue at the rate of 12 percent per annum. (d) If a judgment lien is not satisfied within 30 days of recording, it may be foreclosed and redeemed as provided in this title and V.R.C.P.

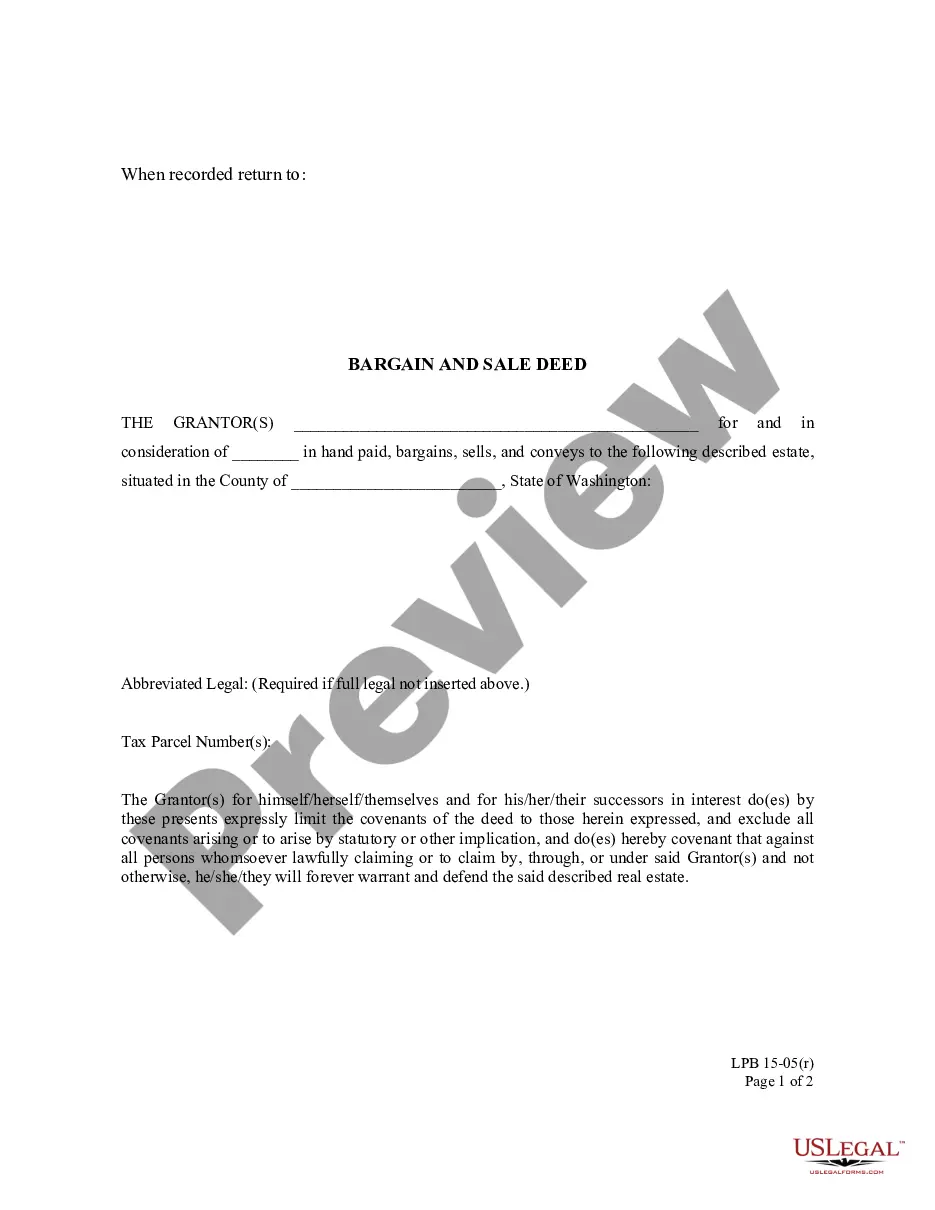

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home.

VERMONT: The legal rate of interest and judgment rate of interest is 12%. On retail installment contracts, the maximum rate is 18% on the first $500, 15% above $500. The general usury limit is 12%.

Mortgages are "secured loans" because the house is used as collateral, meaning if you're unable to repay the loan, the home may go into foreclosure by the lender. In contrast, an unsecured loan isn't protected by collateral and is therefore higher risk to the lender.

Rounding up to the nearest quarter of a percent, the annual rate for the overpayment and underpayment of tax for 2023 will be 4.0%. This rate will be effective beginning January 1, 2023 and will apply to interest that accrues in calendar year 2023.

A secured collateral loan requires that the borrower use their assets (such as a car, house or savings account) as collateral to ?secure? the loan. The collateral is a promise to the lender that if the borrower cannot repay the loan, the lender can take possession of that asset.