Physician Certification Form Maryland Withholding

Description

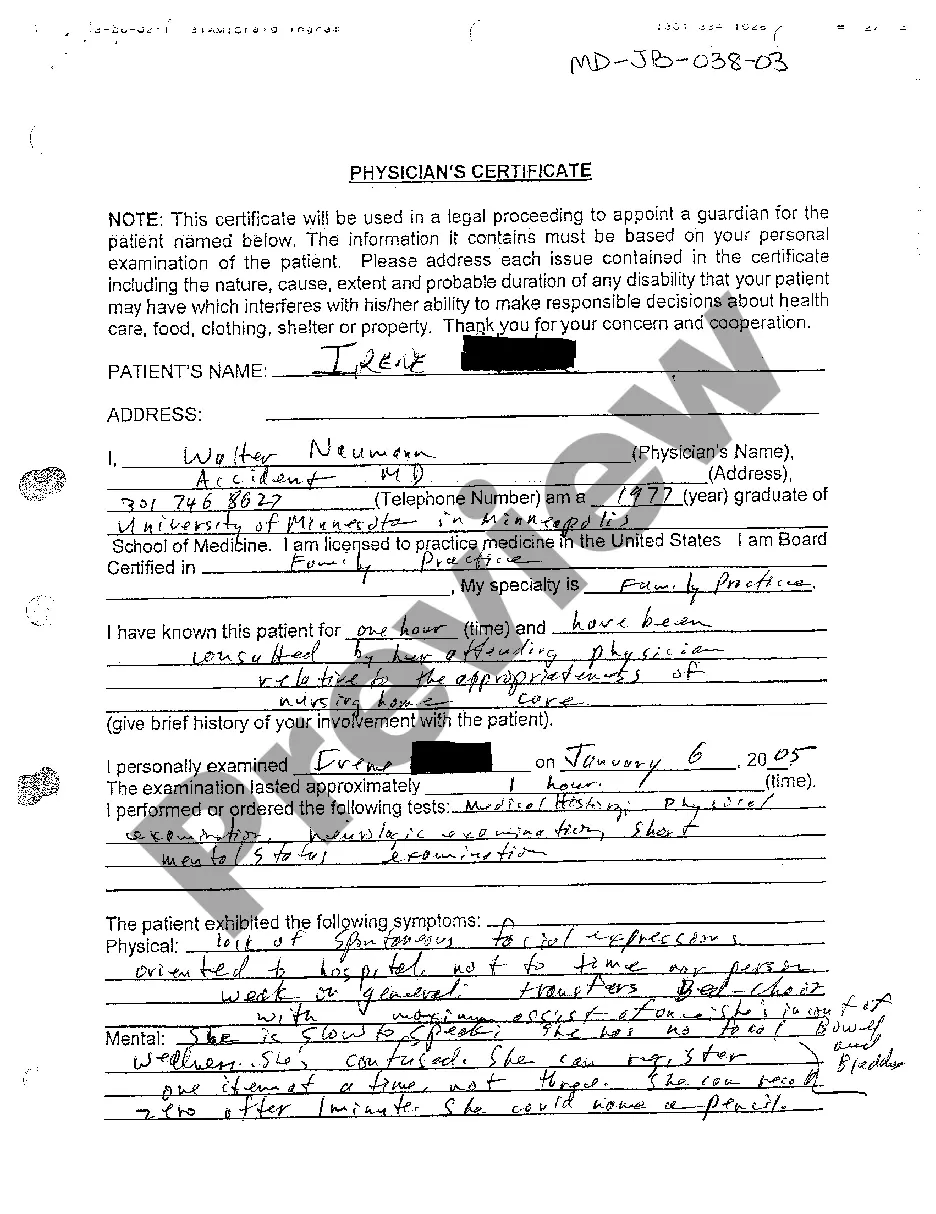

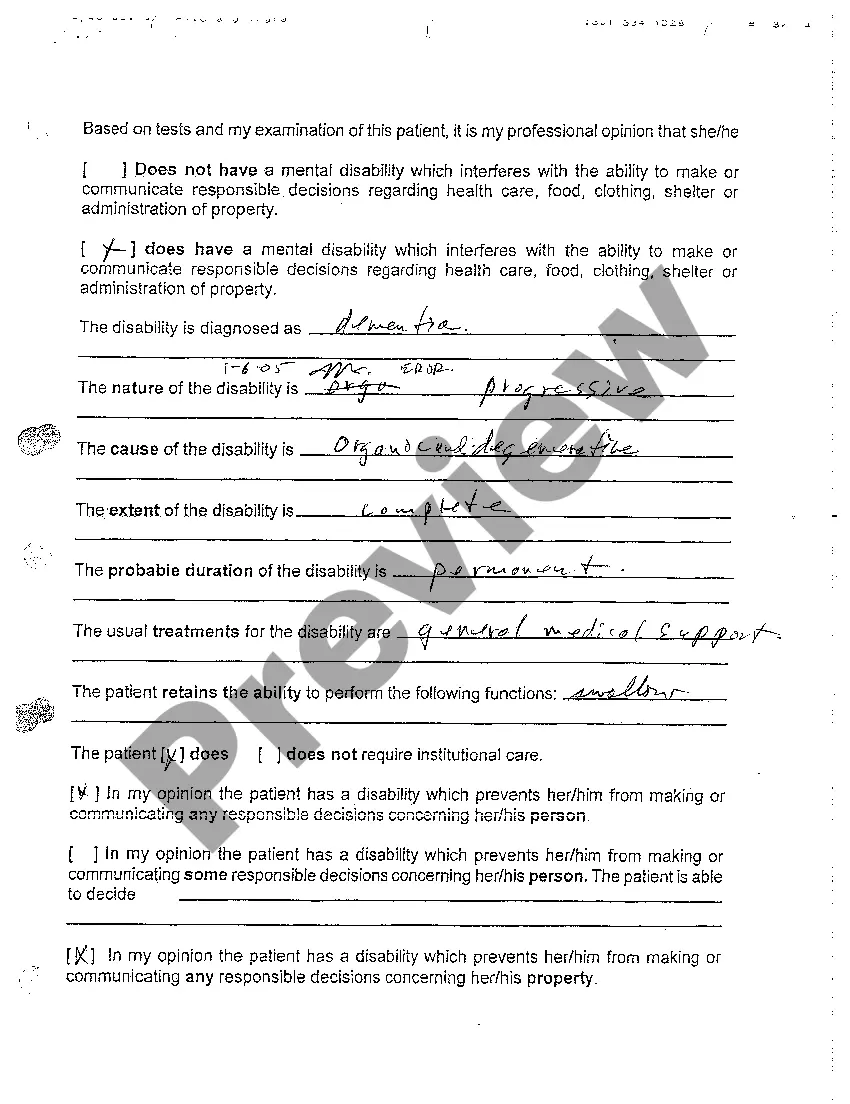

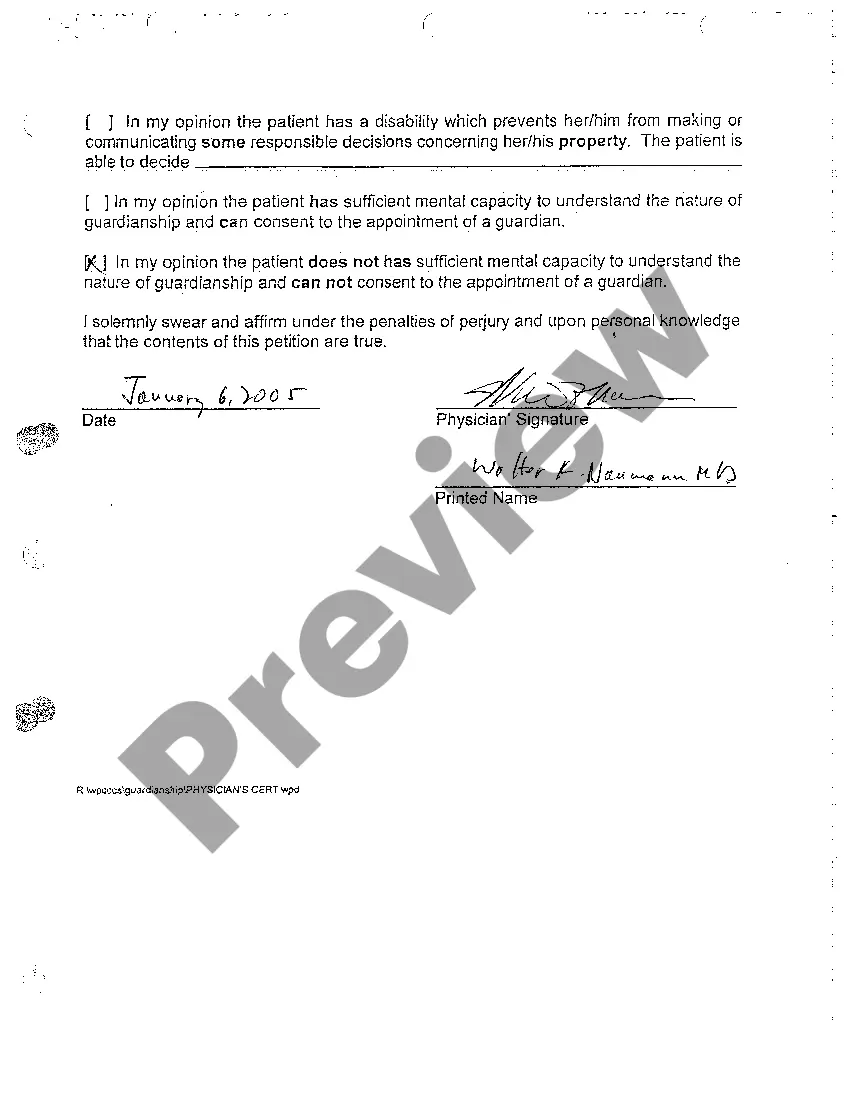

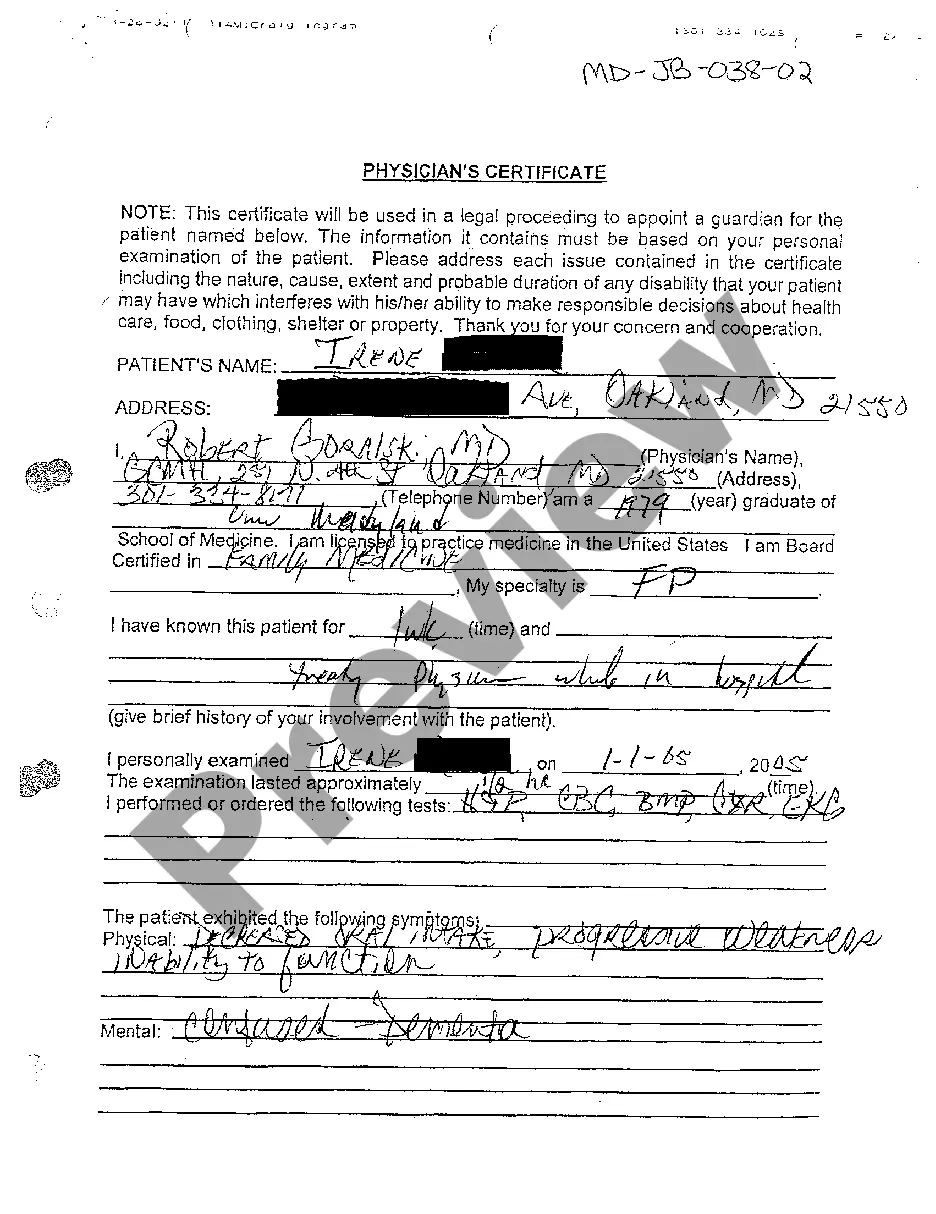

How to fill out Maryland Physician's Certificate?

It’s no secret that you can’t become a legal expert immediately, nor can you learn how to quickly draft Physician Certification Form Maryland Withholding without having a specialized set of skills. Creating legal forms is a long process requiring a particular training and skills. So why not leave the creation of the Physician Certification Form Maryland Withholding to the pros?

With US Legal Forms, one of the most extensive legal template libraries, you can access anything from court papers to templates for in-office communication. We know how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our platform and get the form you need in mere minutes:

- Discover the form you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to figure out whether Physician Certification Form Maryland Withholding is what you’re looking for.

- Start your search again if you need any other form.

- Set up a free account and select a subscription option to buy the form.

- Choose Buy now. As soon as the transaction is complete, you can get the Physician Certification Form Maryland Withholding, fill it out, print it, and send or mail it to the designated individuals or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

On the W-4 Form complete the following and write legibly. Section 1 ? Payroll System ? RG ? Regular. Agency Code: 220100. ... Section 2 ? Federal Taxes ? Complete line 3; and then either line 5 or line 7. Section 3 ? State Taxes -- Marital status and then line 1, or 3, or 4, or 5. ... Section 4 ? Sign and date the form.

Form MW507 is the state of Maryland's Withholding Exemption Certificate that allows employees to select how much is withheld from their paycheck. Form MW507 is the same as the W-4 document Americans complete for federal withholding of their working wages.

Whose annual income will be below the minimum filing requirements (annual income less than $9,350 for 2011) should claim exemption from withholding. This provides more income throughout the year and avoids the necessity of filing a Maryland income tax return.

Hear this out loud Pausenot withhold Maryland income tax from your wages. Students and Seasonal Employees whose annual income will be below the mini- mum filing requirements should claim exemption from withholding. This provides. more income throughout the year and avoids the necessity of filing a Maryland.

The law requires that you complete an Employee's Withholding Allowance Certificate so that your employer, the state of Maryland, can withhold federal and state income tax from your pay. The State of Maryland has a form that includes both the federal and state withholdings on the same form.