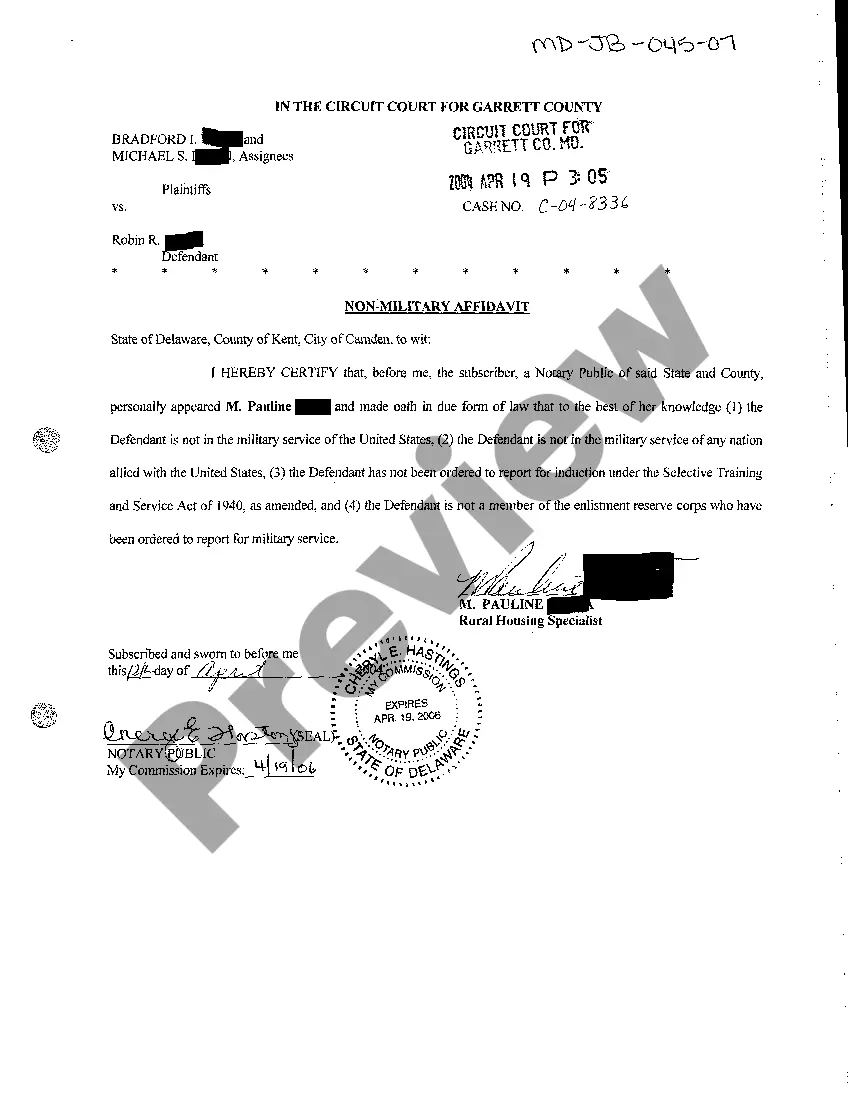

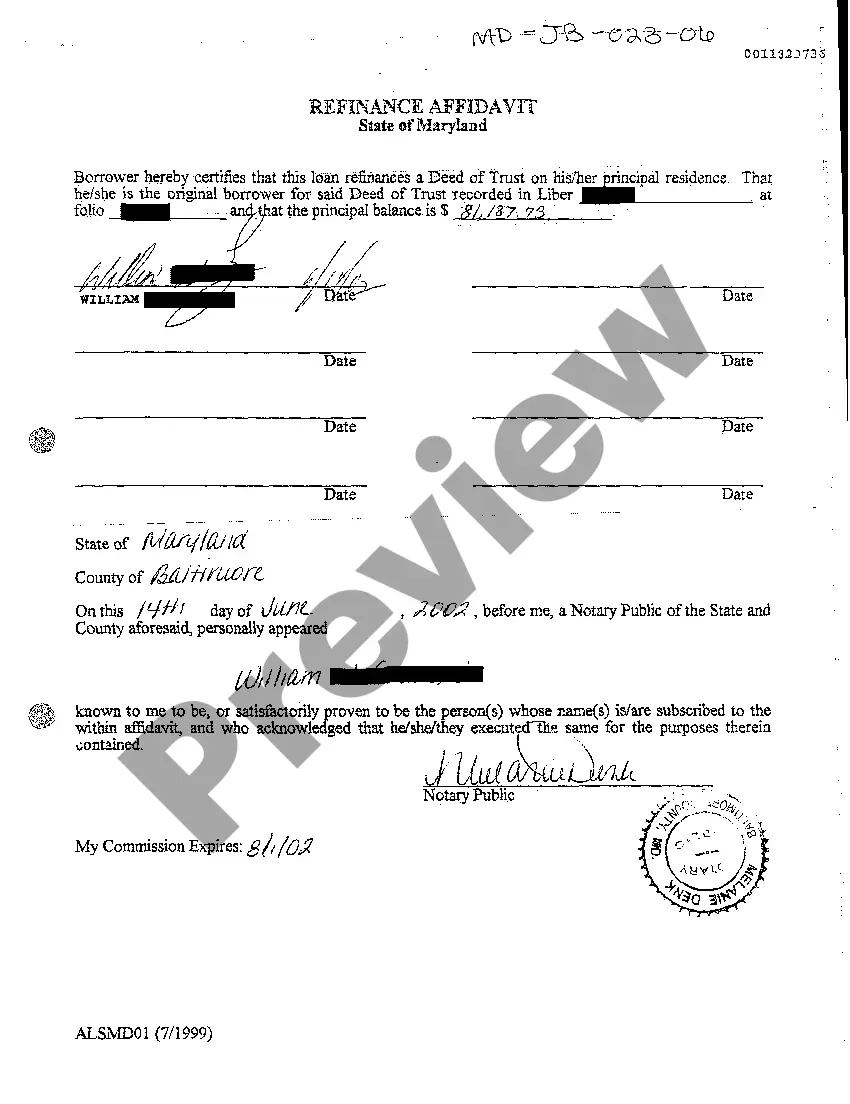

Maryland Refinance Affidavit Form Form

Description

How to fill out Maryland Refinance Affidavit?

When you need to fulfill the Maryland Refinance Affidavit Form that adheres to your local state's guidelines, there can be various options available.

There's no need to scrutinize every document to ensure it satisfies all legal standards if you are a US Legal Forms member.

It is a trustworthy resource that can assist you in obtaining a reusable and current template on any topic.

Getting expertly crafted official documents is straightforward with US Legal Forms. Furthermore, Premium users can also utilize the potent integrated tools for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online repository with a compilation of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to align with each state's laws and regulations.

- Hence, when downloading the Maryland Refinance Affidavit Form from our site, you can be assured that you possess a valid and up-to-date document.

- Acquiring the necessary template from our platform is quite simple.

- If you already have an account, just Log In to the system, ensure your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and have continual access to the Maryland Refinance Affidavit Form at any time.

- If this is your first visit to our site, please follow the instructions below.

- Browse the suggested page and verify it meets your needs.

Form popularity

FAQ

The Refinance Exemption allows that, in the event the amount secured by a refinance deed of trust is greater than the unpaid principal balance of the loan secured by the existing deed of trust, State Recordation Tax is calculated on the amount of the increase, as opposed to on the entire new principal amount.

Regarding transfer taxes, most jurisdictions in Maryland do not require you to pay new transfer taxes at the time of your refinance settlement. However, in most jurisdictions, you must pay the State Revenue Stamps (this amount varies by county) on the new money being borrowed.

Neither Maryland State law nor Montgomery County require that property taxes be paid when refinancing a mortgage. However, often mortgage lenders will require that property taxes be current before the new mortgage is issued to the taxpayer.

The Transfer Tax in Prince George's County is 1.4%. Consummation Another term for the settlement or closing.