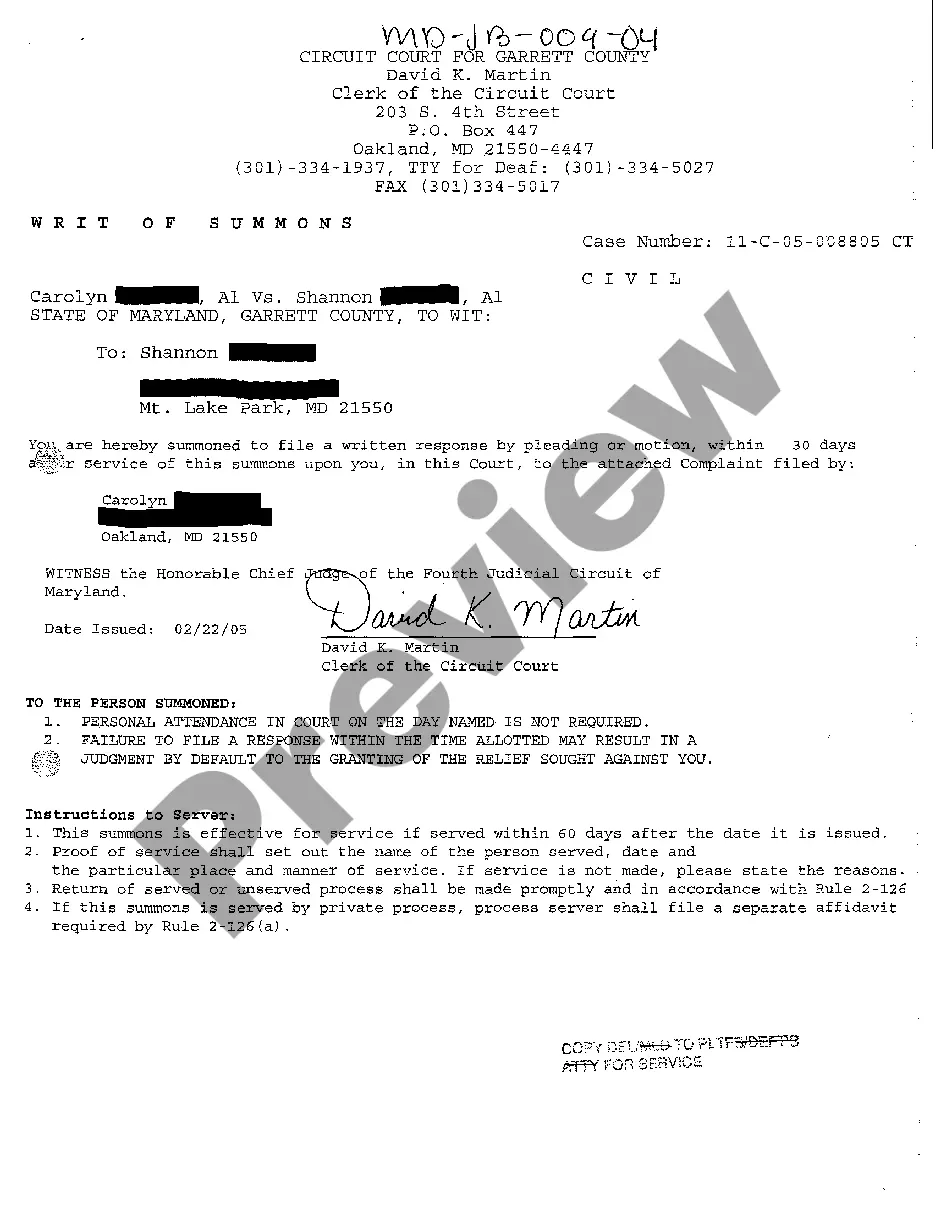

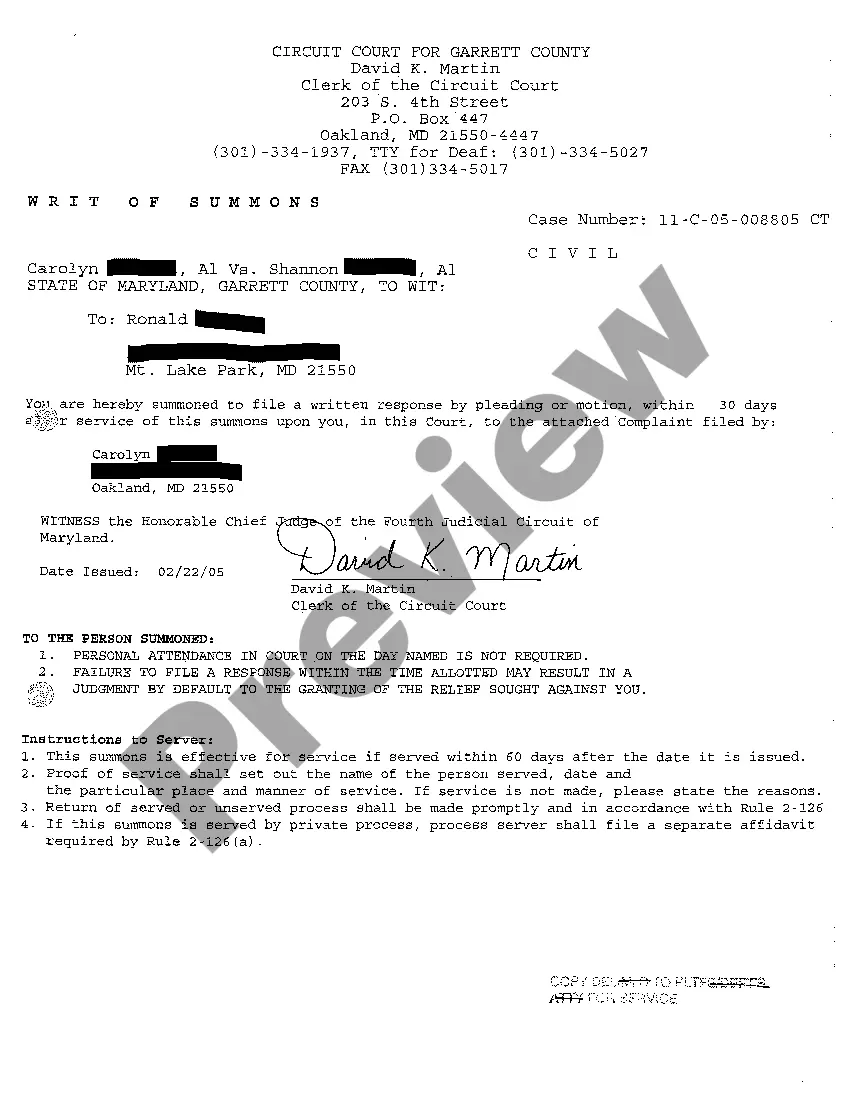

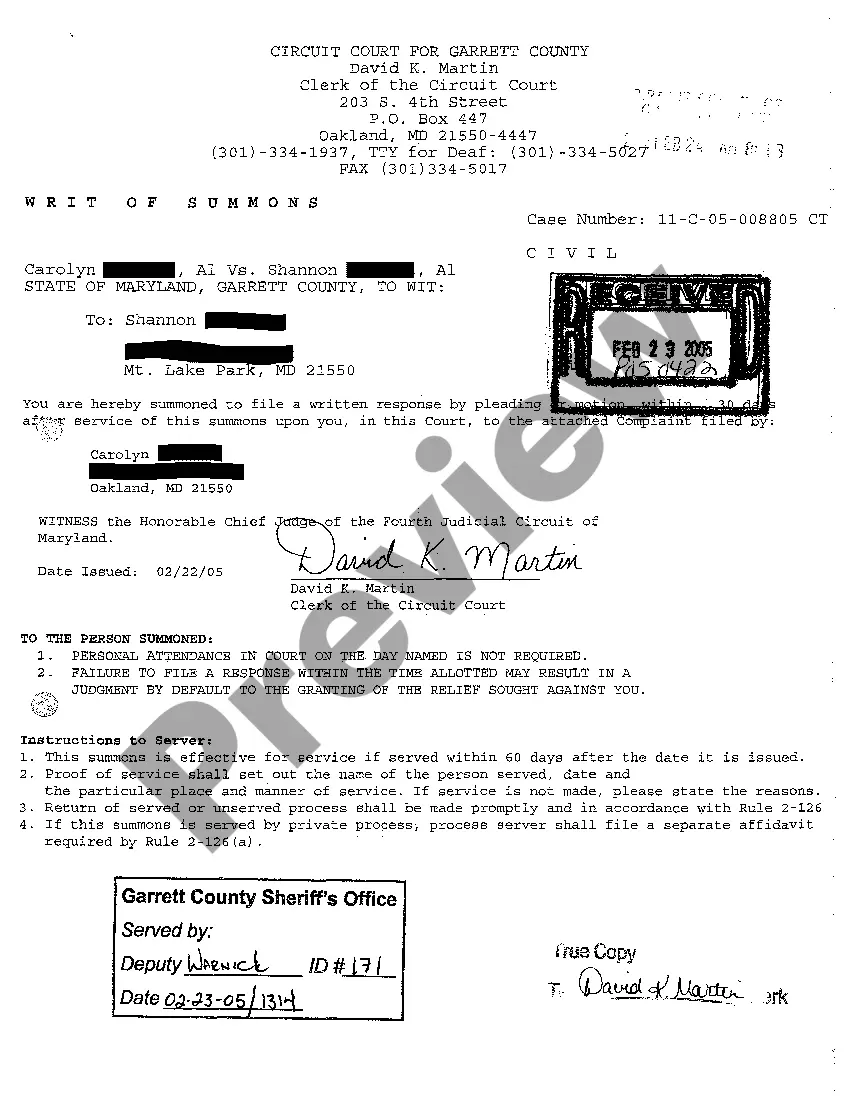

Writ Summons Pleading In Maryland Criminal Without Court Order

Description

How to fill out Maryland Writ Of Summons?

Obtaining legal templates that comply with both federal and local laws is essential, and the web provides numerous options to consider.

However, what is the purpose of expending time searching for the appropriate Writ Summons Pleading In Maryland Criminal Without Court Order sample online when the US Legal Forms virtual library already consolidates such templates in one location.

US Legal Forms is the premier online legal repository with more than 85,000 fillable templates crafted by lawyers for various professional and personal situations.

Review the template using the Preview option or through the text outline to ensure it suits your requirements.

- They are straightforward to navigate with documents categorized by state and intended use.

- Our experts stay informed on legal updates, ensuring your form remains current and compliant when acquiring a Writ Summons Pleading In Maryland Criminal Without Court Order from our site.

- Obtaining a Writ Summons Pleading In Maryland Criminal Without Court Order is quick and easy for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document sample you need in the appropriate format.

- For new users of our site, follow the steps outlined below.

Form popularity

FAQ

In Maryland, judgments do not expire; however, they can be renewed. If a judgment is not renewed, it may become unenforceable after a certain period, typically 12 years. It's important to understand that if you receive a writ summons pleading in Maryland criminal without court order, it may influence how long these judgments remain active. Always consult with a legal professional for the most accurate guidance.

Forms OR-40, OR-40-P, and OR-40-N can be found at .oregon.gov/dor/forms or you can contact us to order it.

An S corporation carrying on or doing business in Oregon must also pay $150 minimum excise tax. The minimum tax does not flow through to the shareholders. The income or loss of an S corporation is reported to each shareholder on federal form Schedule K-1. See shareholder filing requirements for more information.

Request online You need to be logged in to your Revenue Online account to use this option. Once you are, click on the Request photocopies link under "I want to." If you don't have an account, signing up for one is quick and easy.

Use Form 40 to change (amend) your full-year resident return. Check the amended return box in the upper left corner of the form. You must also complete and include the Oregon Amended Schedule with your amended return. For prior year tax booklets or the Oregon Amended Schedule, please visit our website or contact us.

To form an Oregon S corp, you'll need to ensure your company has an Oregon formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.

Purpose of Schedule OR-21 An upper-tier PTE that is a member of an electing PTE will also use Form OR-21 to pass its share of the lower-tier entity's distributive proceeds, addition, and tax credit through to the upper-tier PTE's individual owners. Form OR-21 is filed on a calendar-year basis only.

Download forms from the Oregon Department of Revenue website or request paper forms be mailed to you. Order forms by calling 1-800-356-4222. The IRS provides 1040 forms and instructions and schedules 1-3 for the library to distribute.

If you change taxable income by filing an amended federal or Oregon income tax return, you must file an amended Form MC-40 within 60 days of when the amended federal or Oregon income tax return was filed. Include a copy of your amended federal or Oregon income tax return and explain the adjustments made.