Maryland Rental Application Withholding

Description

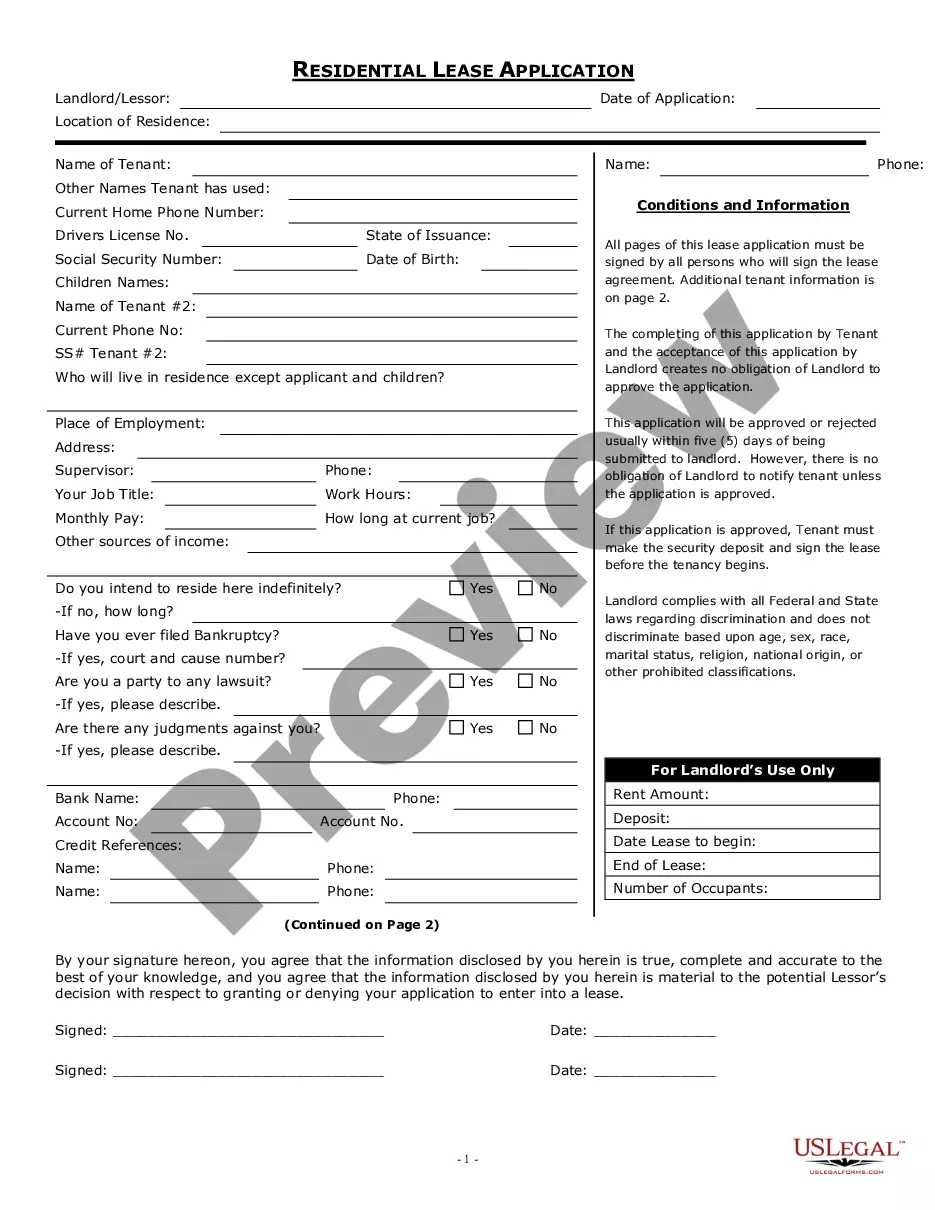

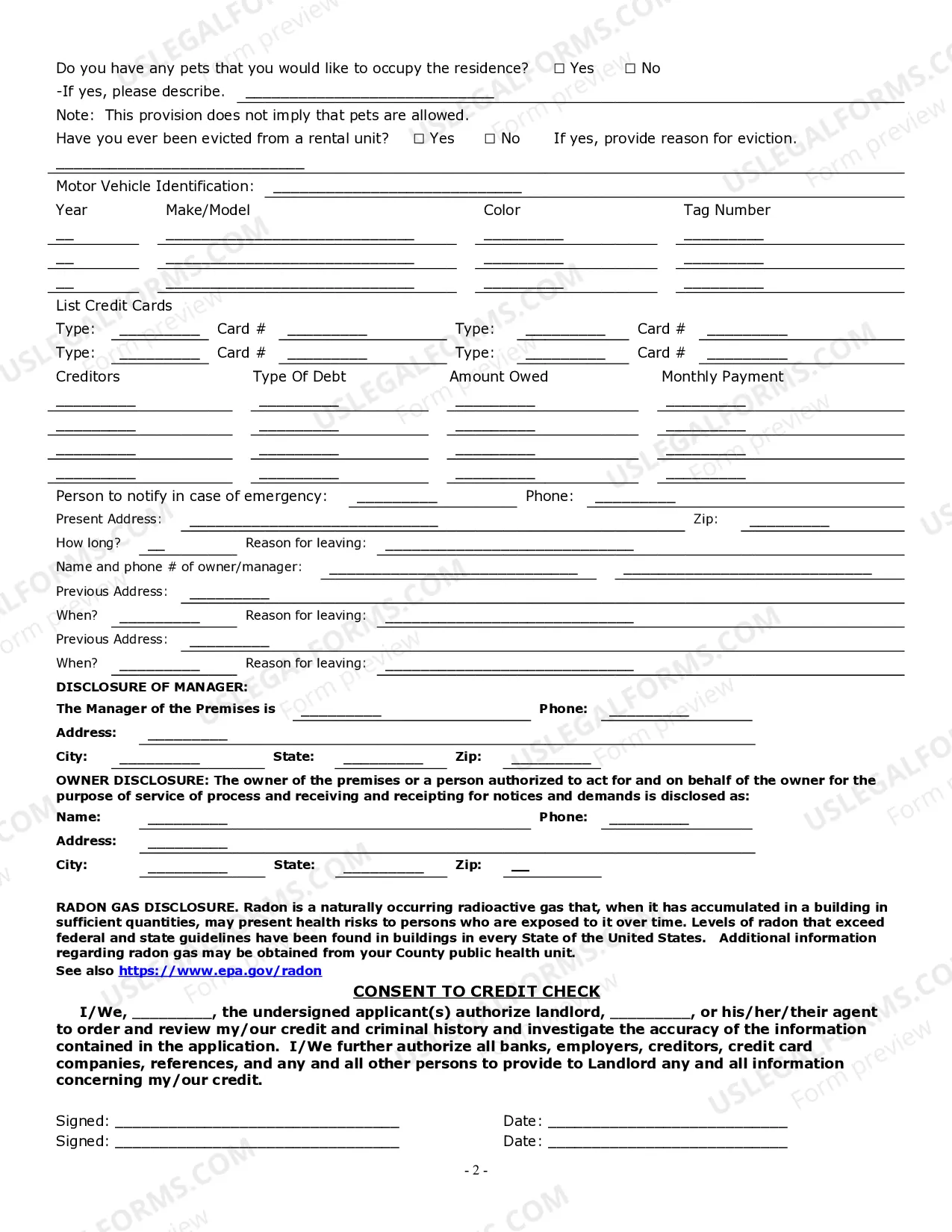

How to fill out Maryland Residential Rental Lease Application?

Well-prepared official records serve as a crucial safeguard against complications and lawsuits, but acquiring them without assistance from an attorney may require considerable time.

If you’re in need of a current Maryland Rental Application Withholding or any other forms for employment, family, or business purposes, US Legal Forms is always ready to assist.

The procedure is even more straightforward for users already subscribed to the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and hit the Download button next to the desired document. Moreover, you can retrieve the Maryland Rental Application Withholding at any time since all documents acquired on the platform remain accessible under the My documents tab in your profile. Conserve time and finances on the preparation of official records. Explore US Legal Forms today!

- Verify that the form fits your circumstances and location by reviewing the description and preview.

- Search for additional samples (if required) using the Search bar located in the page header.

- Select Buy Now once you find the appropriate template.

- Choose a pricing plan, Log In to your account, or create a new one.

- Decide on your preferred payment method to purchase the subscription plan (using a credit card or PayPal).

- Select PDF or DOCX file format for your Maryland Rental Application Withholding.

- Click Download, then print the template to fill it out or upload it to an online editing tool.

Form popularity

FAQ

You can confirm your exemption from Maryland withholding by evaluating your income and filing status. If you had no tax liability in the prior year and anticipate none this year, you may be eligible. For detailed information, utilizing resources like uslegalforms can provide clarity on your withholding situation.

In Maryland, certain individuals may be exempt from state tax based on specific criteria, such as low-income earners or those who qualify under particular provisions. It is important to review state guidelines to assess your eligibility. Understanding your exemption status can ease your Maryland rental application withholding requirements.

Yes, Maryland requires employees to complete a state withholding form to establish their tax withholding status. This form helps employers deduct the correct amount from your paycheck. By correctly managing your Maryland rental application withholding, you can ensure compliance with state tax regulations.

The Application for Tentative Refund of Withholding allows taxpayers to claim a refund of their state tax withholding before the tax year ends. You'll need to file it if you believe you have overpaid your taxes through withholding. To navigate the process smoothly, consider using uslegalforms to access the correct forms and guidance.

Changing your Maryland state tax withholding can be done by submitting a new Employee’s Maryland Withholding Allowance Certificate to your employer. This form allows you to adjust the amount withheld from your paycheck based on your personal circumstances. Being proactive with Maryland rental application withholding can alleviate stress during tax time.

To determine if you are exempt from Maryland rental application withholding, you should review your income and tax situation. You may qualify for exemption if you had no tax liability in the previous year and expect none in the current year. Additionally, you might need to submit a specific form to officially declare your exemption status.

To fill out your tax withholding form correctly, begin by gathering relevant information such as your filing status and the number of dependents. Follow the instructions laid out on the form, and be honest about your income situation. By doing this, you can avoid complications and ensure your deductions align with your tax obligations. For further clarity on Maryland rental application withholding, uslegalforms offers ample resources.

Filling out a withholding exemption form requires careful attention to details. Start by providing your basic information and then indicate the number of exemptions you're eligible to claim. Make sure to review the guidelines provided by the state to ensure accuracy. If you need assistance with Maryland rental application withholding, uslegalforms can walk you through each step.

The Maryland withholding form, known as MW507, is essential for managing your state tax withholding. This form allows employees to report their number of exemptions and adjust their tax withholding accordingly. Completing this form accurately is crucial for preventing over-withholding or under-withholding of your taxes. For detailed guidance on filling out the MW507, check out uslegalforms.

Determining how many exemptions to withhold can be challenging. It often depends on your overall income and personal circumstances. Generally, if you anticipate owing taxes, you may want to withhold more by claiming fewer exemptions. For help in calculating the right amount for your Maryland rental application withholding, uslegalforms can provide valuable resources.