90 Day Terminate For Non Payment

Description

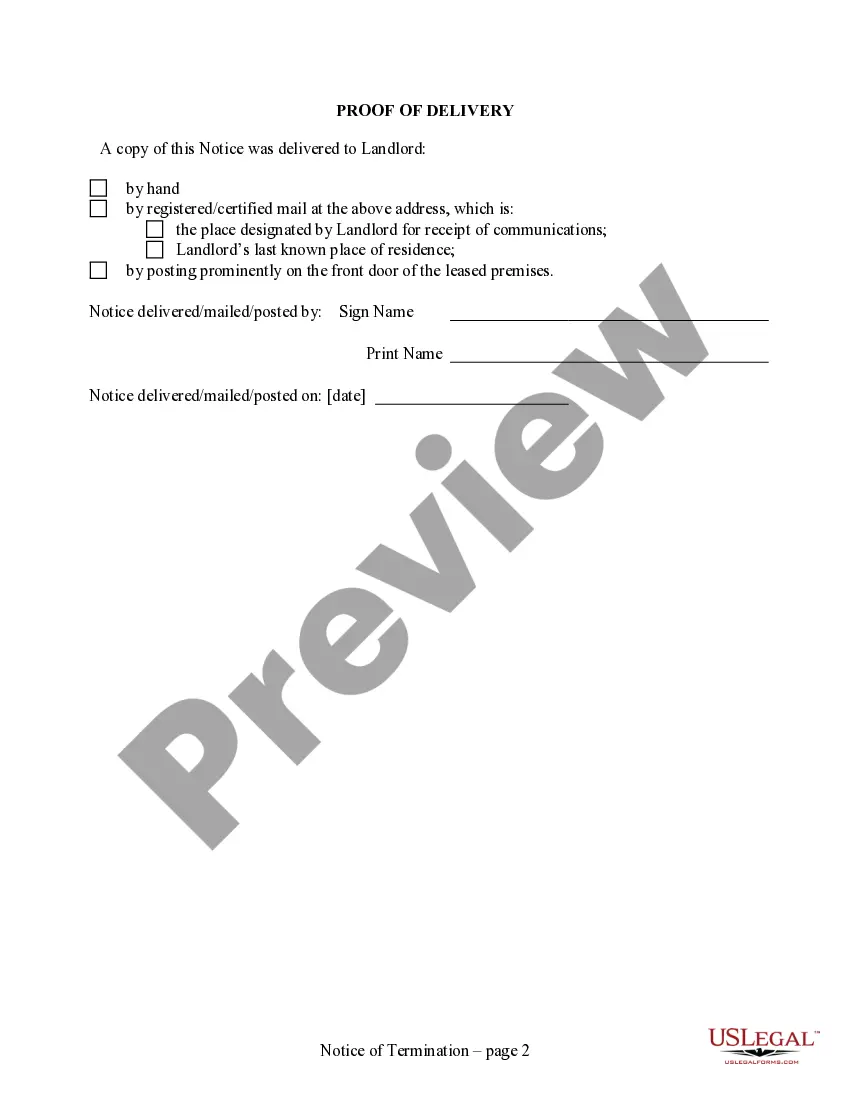

How to fill out Maryland 90 Day Notice To Terminate Year To Year Lease - Residential From Tenant To Landlord?

Legal administration can be daunting, even for the most proficient professionals.

When you are looking for a 90 Day Terminate For Non Payment and lack the time to search for the correct and current version, the process can be anxiety-inducing.

US Legal Forms caters to any needs you may have, from personal to business documents, all consolidated in one location.

Utilize advanced tools to complete and manage your 90 Day Terminate For Non Payment.

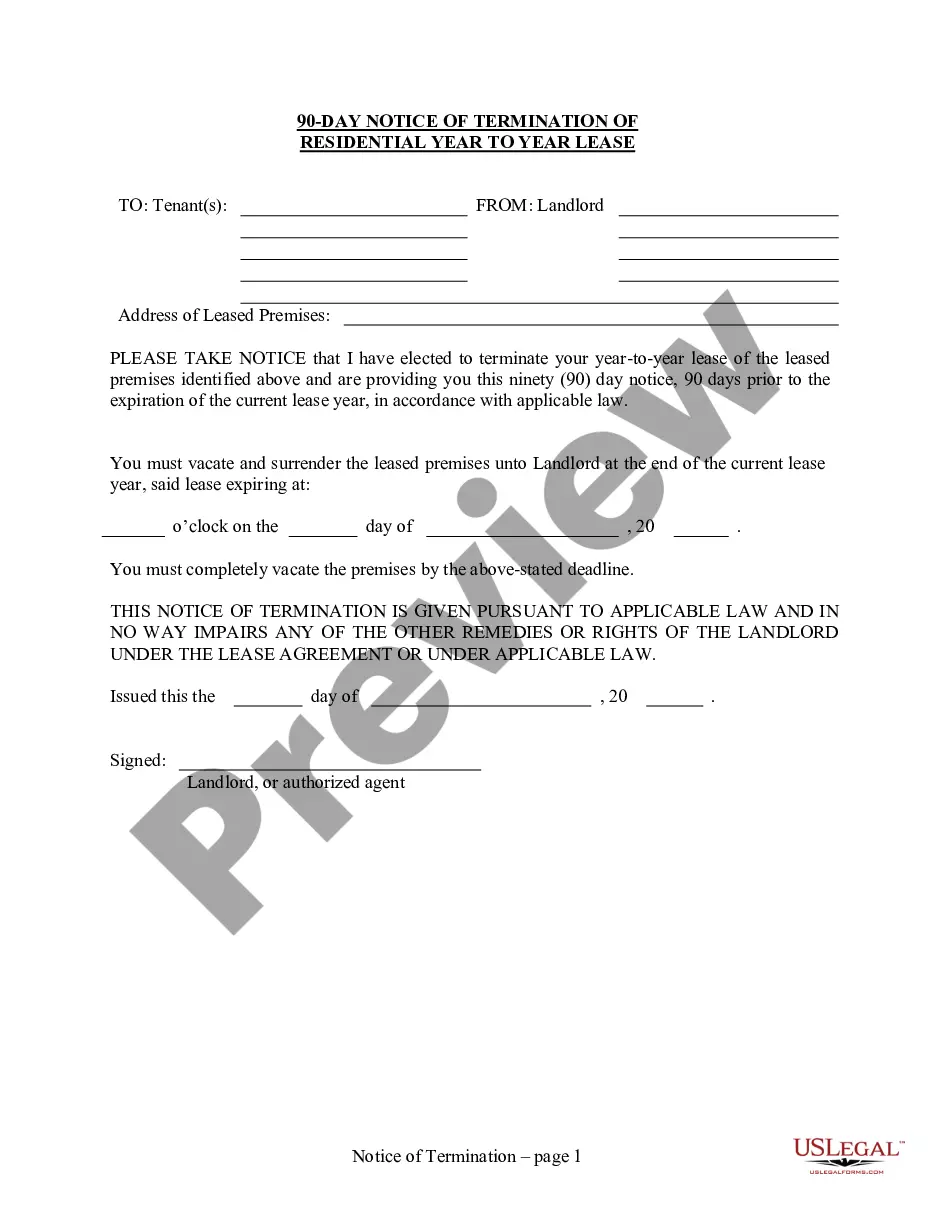

Here are the steps to follow after obtaining the form you need: Verify that this is the correct form by previewing it and reviewing its description. Confirm that the template is accepted in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the format you desire, then Download, complete, eSign, print, and send your document. Take advantage of the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your everyday document management into a seamless and user-friendly process today.

- Access a repository of articles, guides, and materials pertinent to your circumstances and needs.

- Save time and energy searching for the forms you require, and use US Legal Forms' sophisticated search and Preview feature to locate 90 Day Terminate For Non Payment and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents section to view the documents you have saved and to manage your files as necessary.

- If this is your first experience with US Legal Forms, create a free account and gain unlimited access to all the advantages of the library.

- A robust online form library could be a game-changer for those who wish to navigate these matters efficiently.

- US Legal Forms is a leading provider of online legal documents, featuring over 85,000 state-specific legal forms accessible at all times.

- With US Legal Forms, you can access state or county-specific legal and business documents.

Form popularity

FAQ

The notice letter should always feature the official address written on the lease, as well as the date of the letter, ensuring you are providing ample notice for leaving. Be sure to also state the reason you're putting this letter together and the date on which you will be moving out.

It means that, for whatever reason should the employment relationship not work out within the first 90 days, the employer can terminate the employment relationship.

90-day Notice to Quit (Section 8 housing only) Landlords can only use this type of Notice if their rental property is Section 8 subsidized housing. The Notice is a demand that the tenant moves out within 90 days. The landlord must have a legal reason ("just cause") to ask the tenant to move.

Just give the employer notice that you will be canceling your contract in 90 days. Ask them if you could leave earlier but be ready to give them your full 90 days if they refuse.

Dear (Name of landlord or manager), This letter constitutes my written (number of days' notice that you need to give based on your lease agreement) -day notice that I will be moving out of my apartment on (date), the end of my current lease. I am leaving because (new job, rent increase, etc.