Maryland Judgment And Lien Search

Description

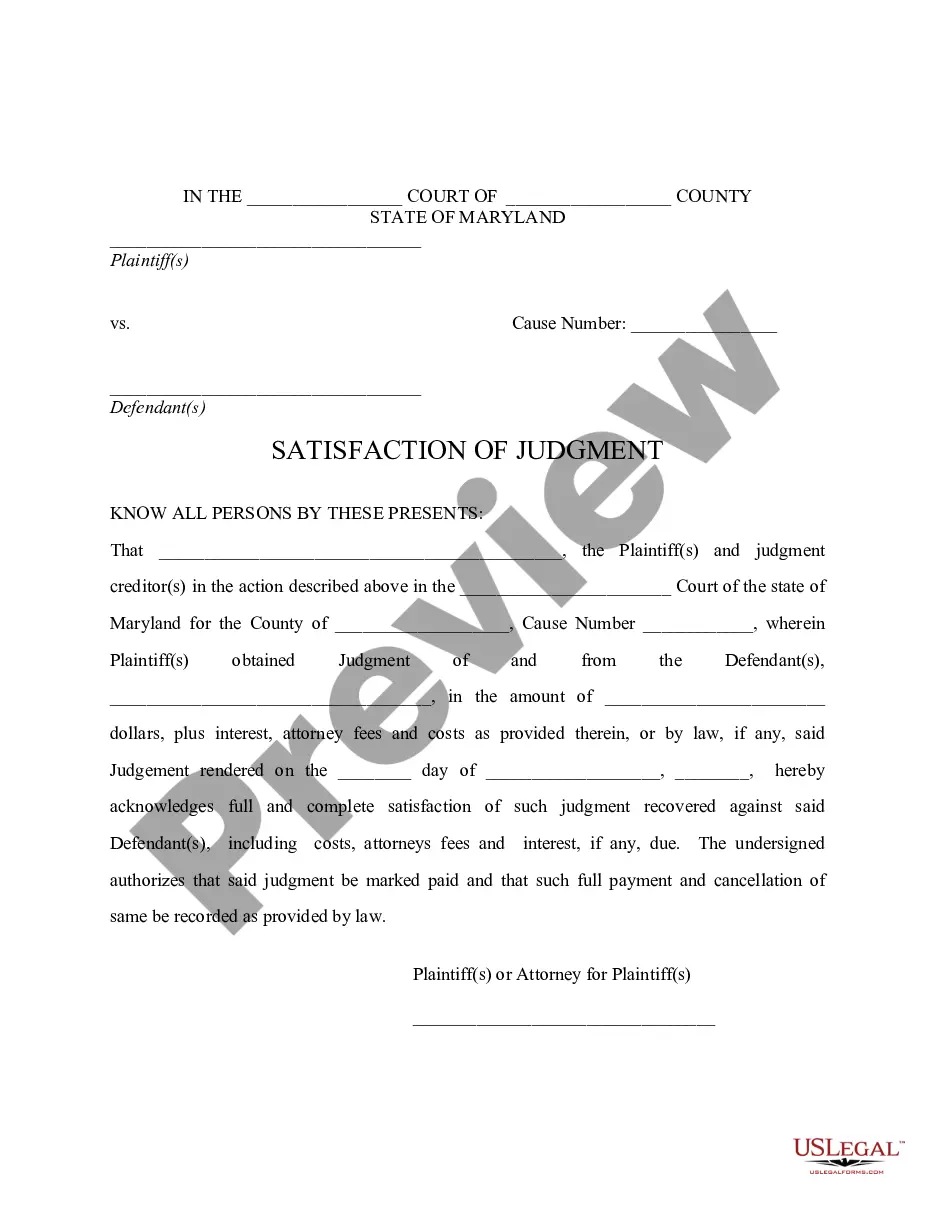

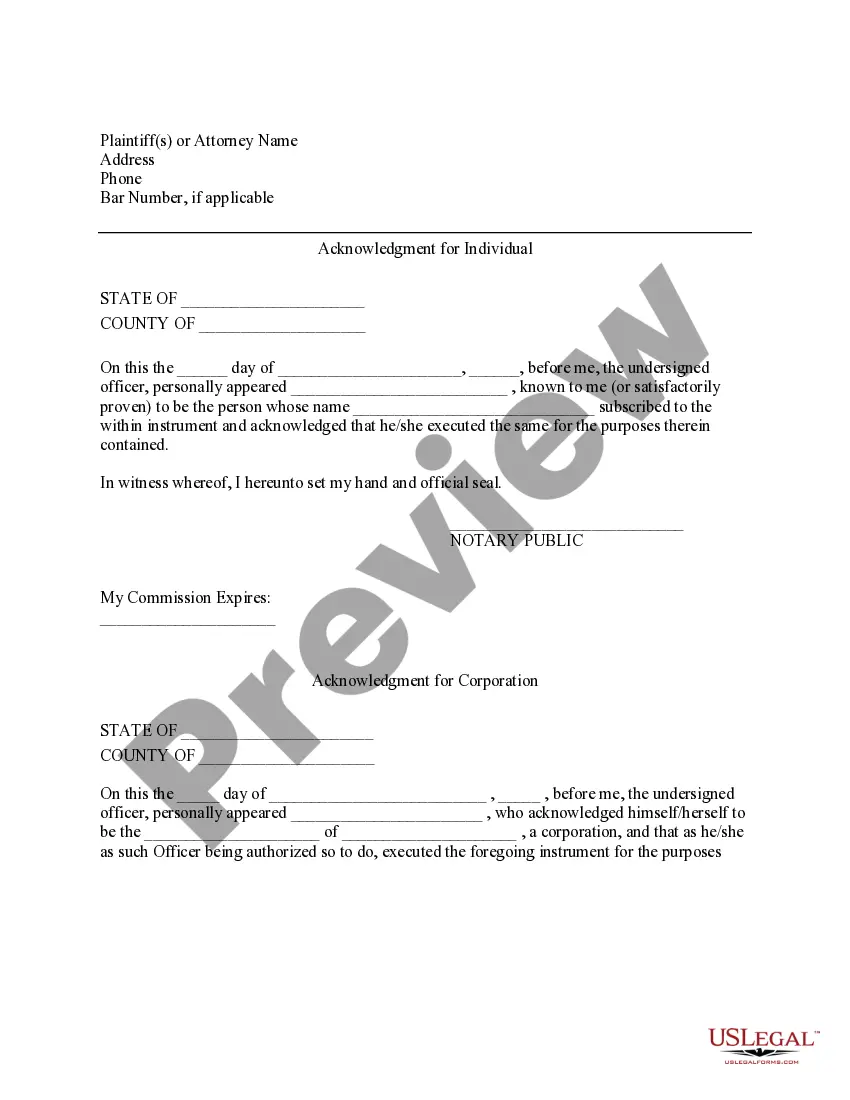

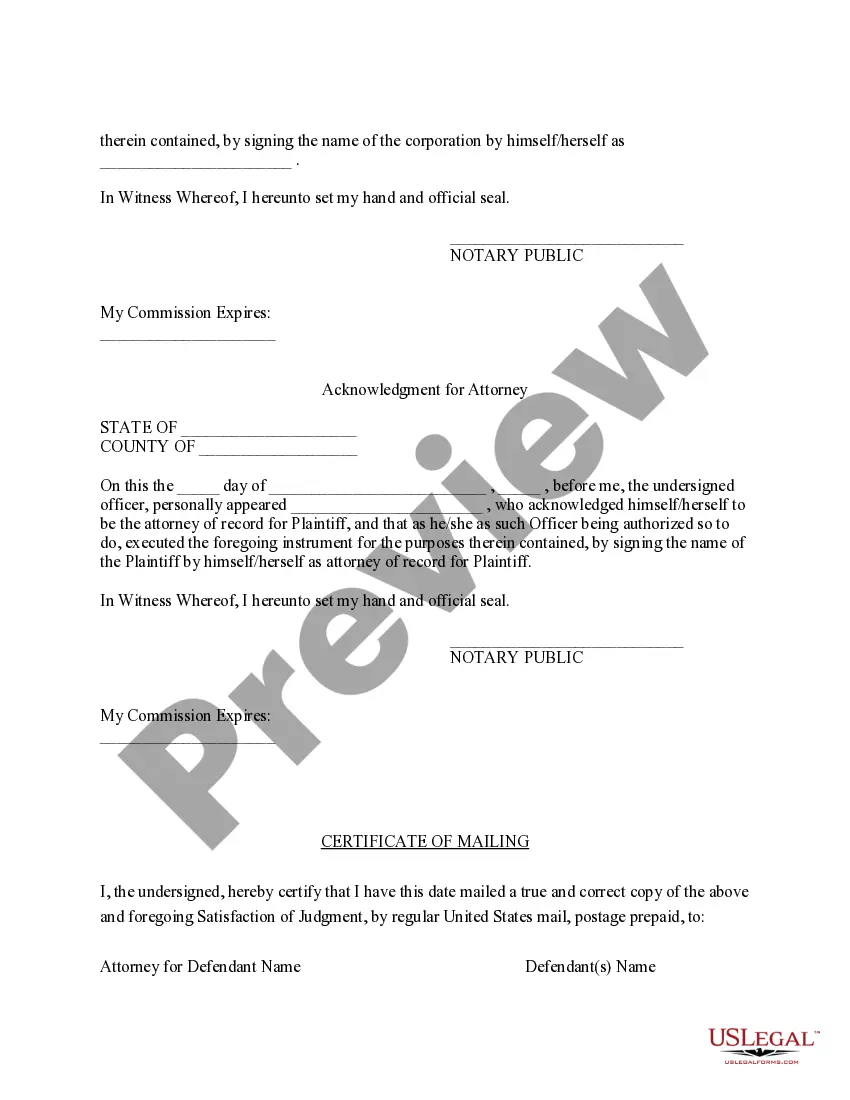

How to fill out Maryland Satisfaction Of Judgment?

Acquiring legal document samples that comply with federal and state regulations is crucial, and the internet provides a multitude of choices to select from.

However, what is the advantage of spending time searching for the accurately crafted Maryland Judgment And Lien Search document online if the US Legal Forms digital library already compiles such templates in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable templates created by attorneys for any professional and personal circumstances.

Review the template using the Preview function or through the text outline to confirm it fits your requirements.

- They are straightforward to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legal changes, so you can always ensure your documents are current and compliant when obtaining a Maryland Judgment And Lien Search from our platform.

- Obtaining a Maryland Judgment And Lien Search is simple and swift for both existing and new users.

- If you already have an account with an active subscription, Log In and download the document sample you require in the chosen format.

- If you're new to our site, follow the instructions below.

Form popularity

FAQ

Yes, judgments do expire in Maryland, typically after 12 years from the date of the judgment. After this period, creditors cannot enforce judgment rulings through the court. Everyone should be aware of this timeline and can utilize a Maryland judgment and lien search to check the status of any judgments and understand their legal standing.

In some instances, individuals may face jail time for not paying a judgment, but it usually occurs under specific circumstances. Courts can impose sanctions for refusal to comply with payment orders or for failing to provide accurate financial information. However, pursuing a Maryland judgment and lien search can help individuals understand their obligations and plan their finances accordingly.

Filing a judgment lien in Maryland involves several key steps. First, secure a certified copy of the judgment from the court and fill out the appropriate lien certificate form. After gathering these documents, submit them to the local land records office in the jurisdiction where the property is located. For those unfamiliar with the process, a Maryland judgment and lien search service, such as US Legal Forms, can provide guidance and simplify your filing experience.

To look up a judgment in Maryland, visit the Maryland Judiciary Case Search website. By entering the required details, you'll be able to find information related to court judgments against individuals or entities. For a more comprehensive experience, consider using the USLegalForms platform, which assists in conducting an efficient Maryland judgment and lien search and obtaining essential legal documents.

The 12-year limit starts at the date of the judgment, which is often the date the creditor went to court. If a court ordered you to pay a creditor money more than 12 years ago, the creditor will not be able to enforce that debt against you. This means they will not be able to garnish your wages or attach your property.

A lien is a lawful claim against property that guarantees payment of a debt. If the debt isn't paid, the creditor may be able to seize the property. The creditor may also be able to sell the property to satisfy all or part of the debt.

Go to Maryland Case Search to search for court judgments against the property's owner. Unpaid taxes on the property may result in a lien. Visit your local county or city's finance office to find property tax or other municipal liens.

Main_Content. A lien is a record maintained by the MVA of the debt owed by a vehicle owner to a secured party (lender). A secured party lends the money to the owner and has the power to repossess the vehicle if the owner does not repay the loan.

Key Takeaways. A judgment lien is a court ruling that gives a creditor the right to take possession of a debtor's property if the debtor fails to fulfill their contractual obligations. Judgment liens are nonconsensual because they are attached to property without the owner's consent or agreement.