Maryland Foreclosure Case Search

Description

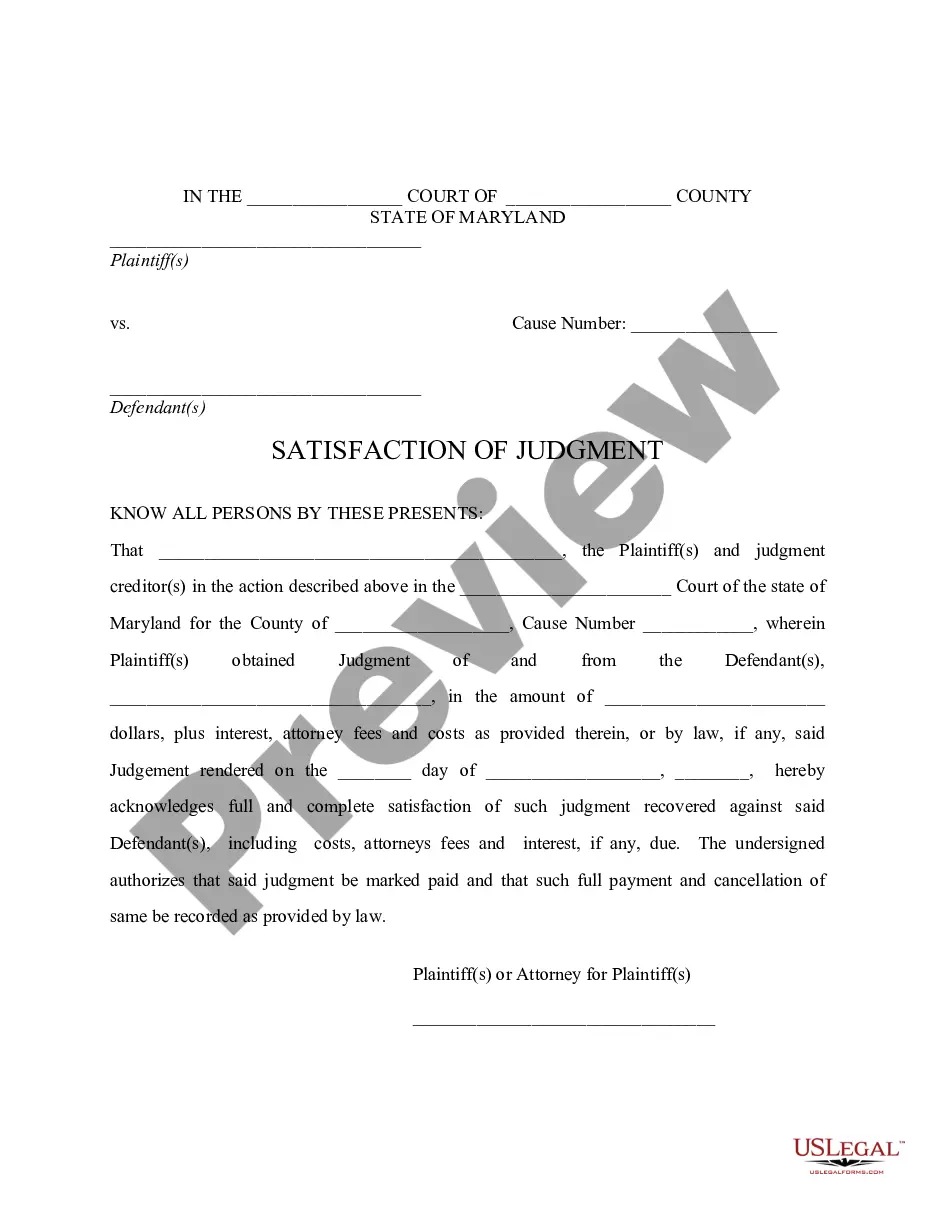

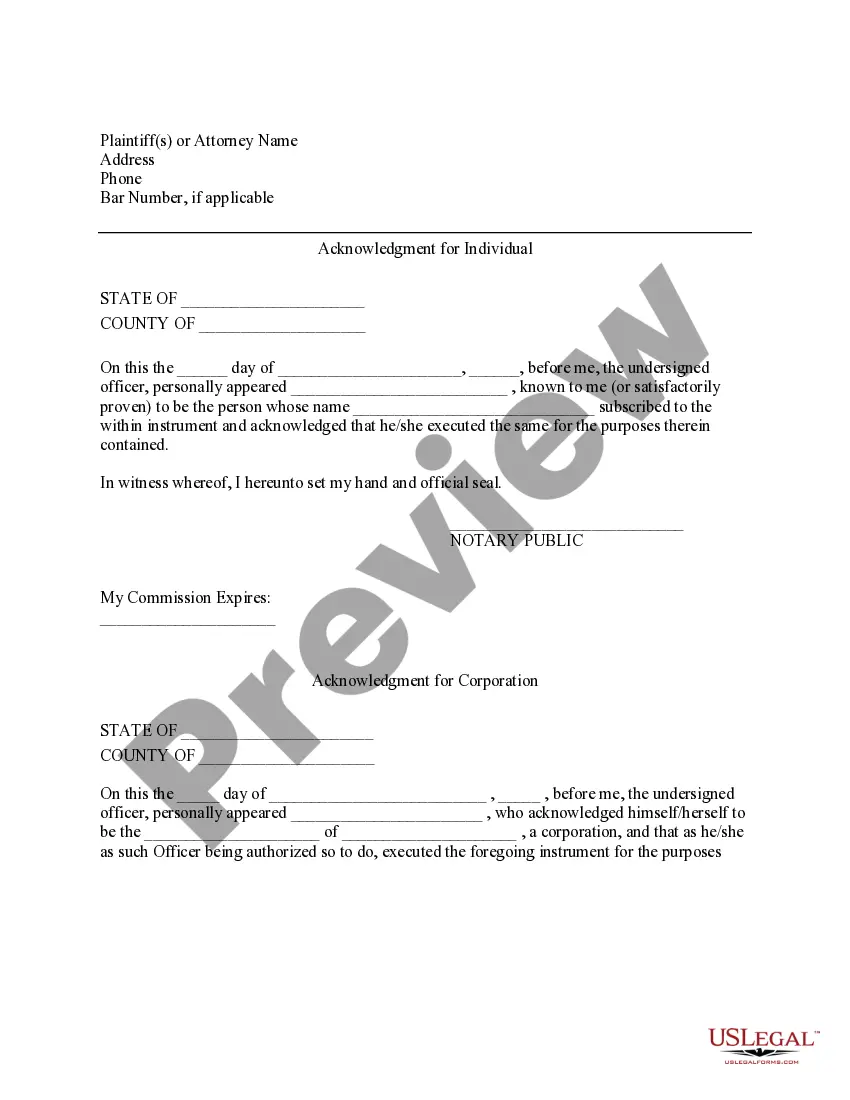

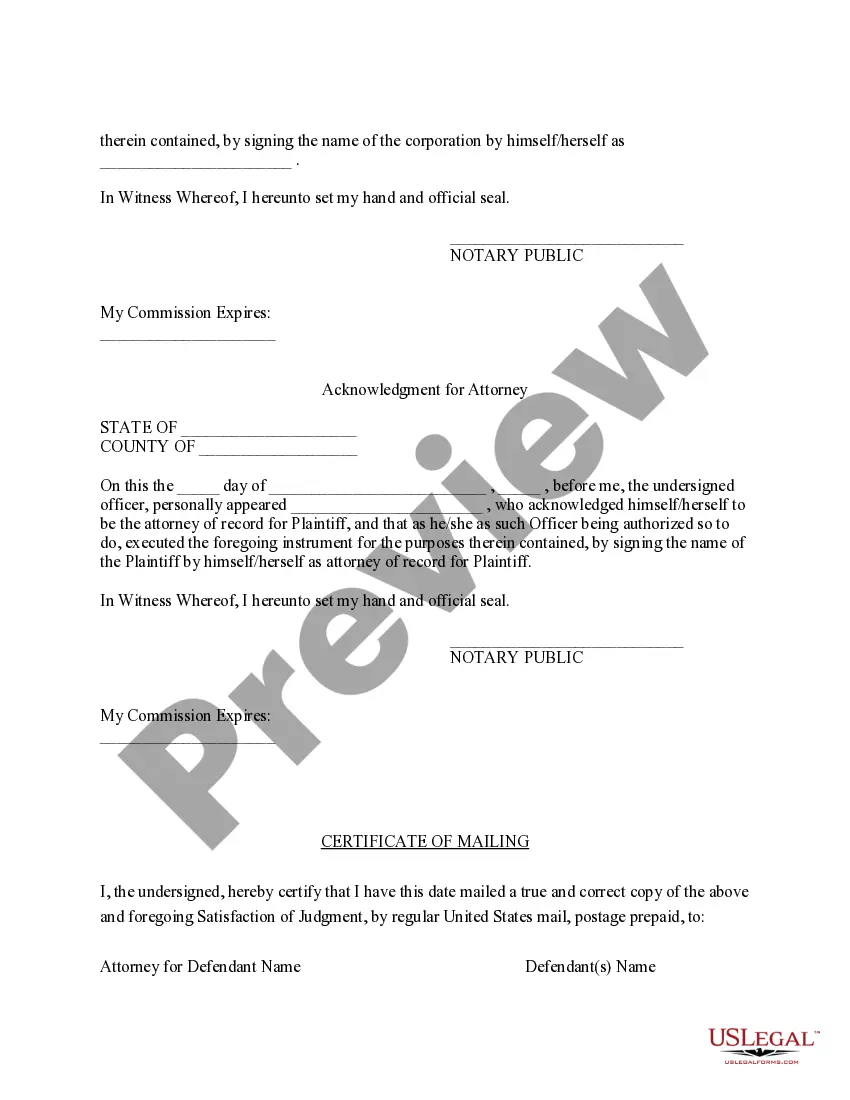

How to fill out Maryland Satisfaction Of Judgment?

Locating a reliable resource to obtain the latest and pertinent legal documents is a significant part of navigating bureaucracy.

Identifying suitable legal paperwork requires accuracy and meticulousness, which is why it's essential to acquire samples of Maryland Foreclosure Case Search exclusively from trustworthy sources, such as US Legal Forms. A faulty template can waste your time and prolong the issue you are dealing with.

Eliminate the hassle that comes with your legal paperwork. Browse the extensive US Legal Forms collection to discover legal documents, assess their relevance to your situation, and download them instantly.

- Utilize the library browsing or search function to locate your document.

- Examine the form’s description to verify if it aligns with the requirements of your state and county.

- Check the form preview, if available, to confirm that the template is indeed the one you are seeking.

- Return to the search and find the appropriate template if the Maryland Foreclosure Case Search does not fit your needs.

- When you are certain about the form’s suitability, download it.

- If you are an authorized user, click Log in to verify your identity and access your chosen forms in My documents.

- If you do not possess an account yet, click Buy now to acquire the form.

- Choose the pricing plan that meets your requirements.

- Proceed with registration to complete your transaction.

- Finalize your purchase by selecting a payment option (credit card or PayPal).

- Choose the file format for downloading Maryland Foreclosure Case Search.

- After obtaining the form on your device, you may modify it using the editor or print it and complete it manually.

Form popularity

FAQ

The lender or mortgage servicer mails a Notice of Intent to Foreclose (NOI) to the homeowner after the first missed payment or other contractual default on a mortgage. The NOI is a warning notice that a foreclosure could be filed in court. It must be sent no less than 45 days before the foreclosure is filed.

You may be able to avoid a foreclosure by talking with the lender to find out what options are available to you. There is not much time to find a remedy for your situation. If you do not contest the foreclosure, the process may take as little as 90 days to complete in Maryland.

The homeowner can be evicted from the property as soon as 15 days after the court ratifies the sale. Homeowners are encouraged to plan for alternative housing earlier in the process to avoid a forced eviction.

The best way to find information about properties going to foreclosure is to look at the legal notices posted in local papers. The notices provide contact information to the auctioneer.

Bankruptcy Is The Only Guaranteed Way to Stop Foreclosure in Maryland. Chapter 13 and Chapter 11 bankruptcy is the only guaranteed way to stop a foreclosure and pay back what you owe, short of paying off the amount that you are behind in full as reinstatement.