Lien Release Maryland Withholding

Description

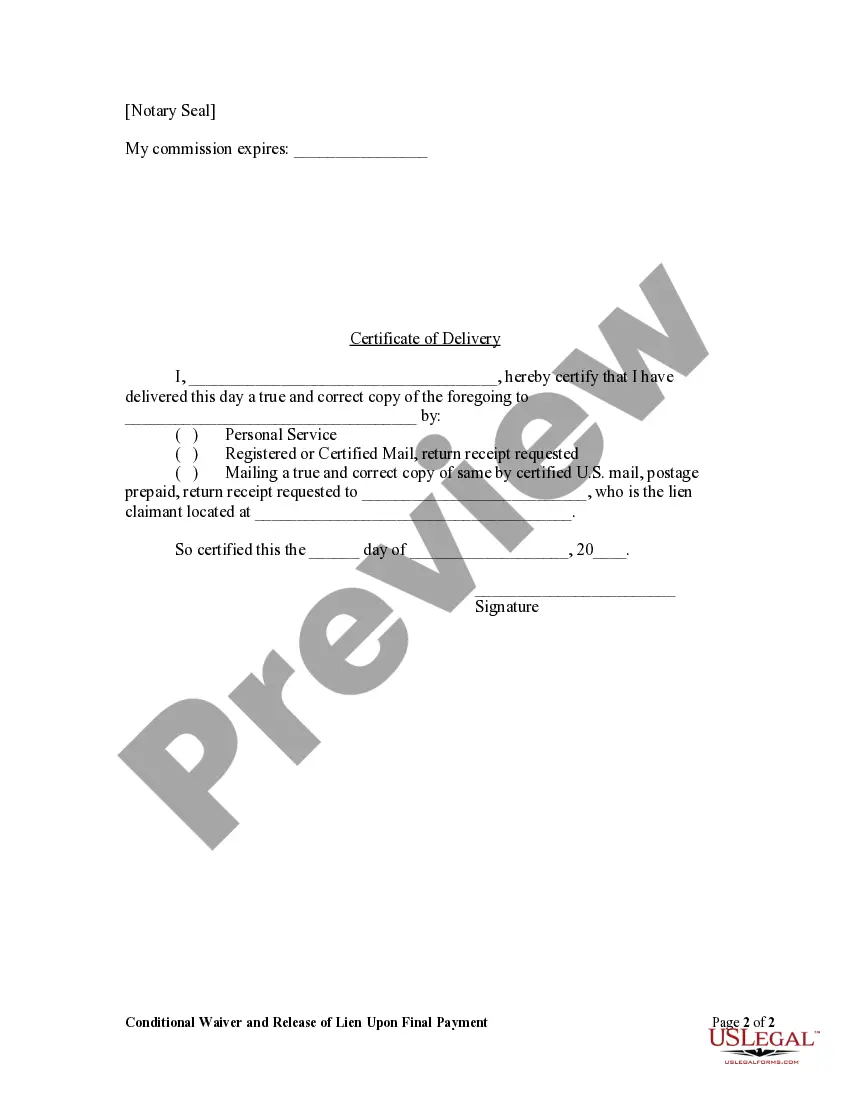

How to fill out Maryland Conditional Waiver And Release Upon Final Payment - Individual?

The Lien Release Maryland Withholding presented on this page is a reusable official template created by skilled attorneys in accordance with federal and local statutes and regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners more than 85,000 validated, state-specific documents for any professional and personal scenario.

Choose the format you desire for your Lien Release Maryland Withholding (PDF, Word, RTF) and download the template to your device.

- Search for the document you require and review it.

- Browse through the sample you sought and preview it or verify the form description to ensure it meets your requirements. If it doesn’t, utilize the search bar to locate the appropriate one. Click 'Buy Now' once you have found the template you need.

- Select and Log Into your account.

- Pick the pricing option that fits your needs and create an account. Use PayPal or a credit card for a swift payment. If you already have an account, Log In and verify your subscription to continue.

- Acquire the fillable template.

Form popularity

FAQ

On the W-4 Form complete the following and write legibly. Section 1 ? Payroll System ? RG ? Regular. Agency Code: 220100. ... Section 2 ? Federal Taxes ? Complete line 3; and then either line 5 or line 7. Section 3 ? State Taxes -- Marital status and then line 1, or 3, or 4, or 5. ... Section 4 ? Sign and date the form.

You will need to submit: A completed and signed Maryland Notice of Security Interest Filing (Form VR-217). ... A lien release letter on the lienholder's letterhead. ... Financial account number of the lien. Date the lien was released. Printed name, signature and title of the lienholder's representative.

The only surefire way to get rid of your Maryland tax lien is to pay your tax debt in full. However, if you can't pay your taxes, you may be able to negotiate to get your lien withdrawn or released. Also, you may be able to get your lien released by disputing the amount of tax owed.

The 7.75 percent tax must be paid to the Comptroller of Maryland with Form MW506 (Employer's Return of Income Tax Withheld). If the payor of the distribution is not currently registered with the Comptroller and has not established a withholding account, the payor can register online.

We've got the steps here; plus, important considerations for each step. Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.