Maryland Gift Deed With Condition

Description

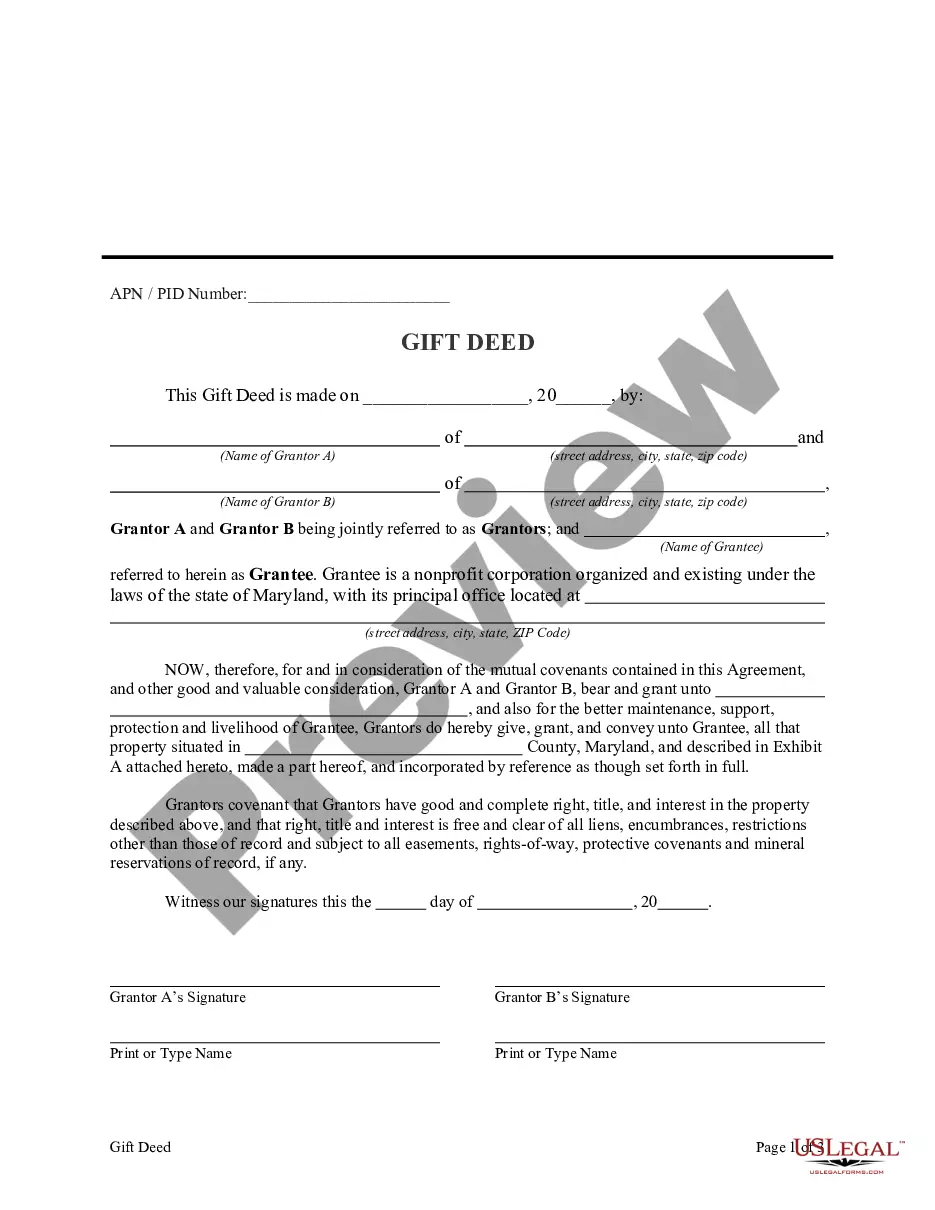

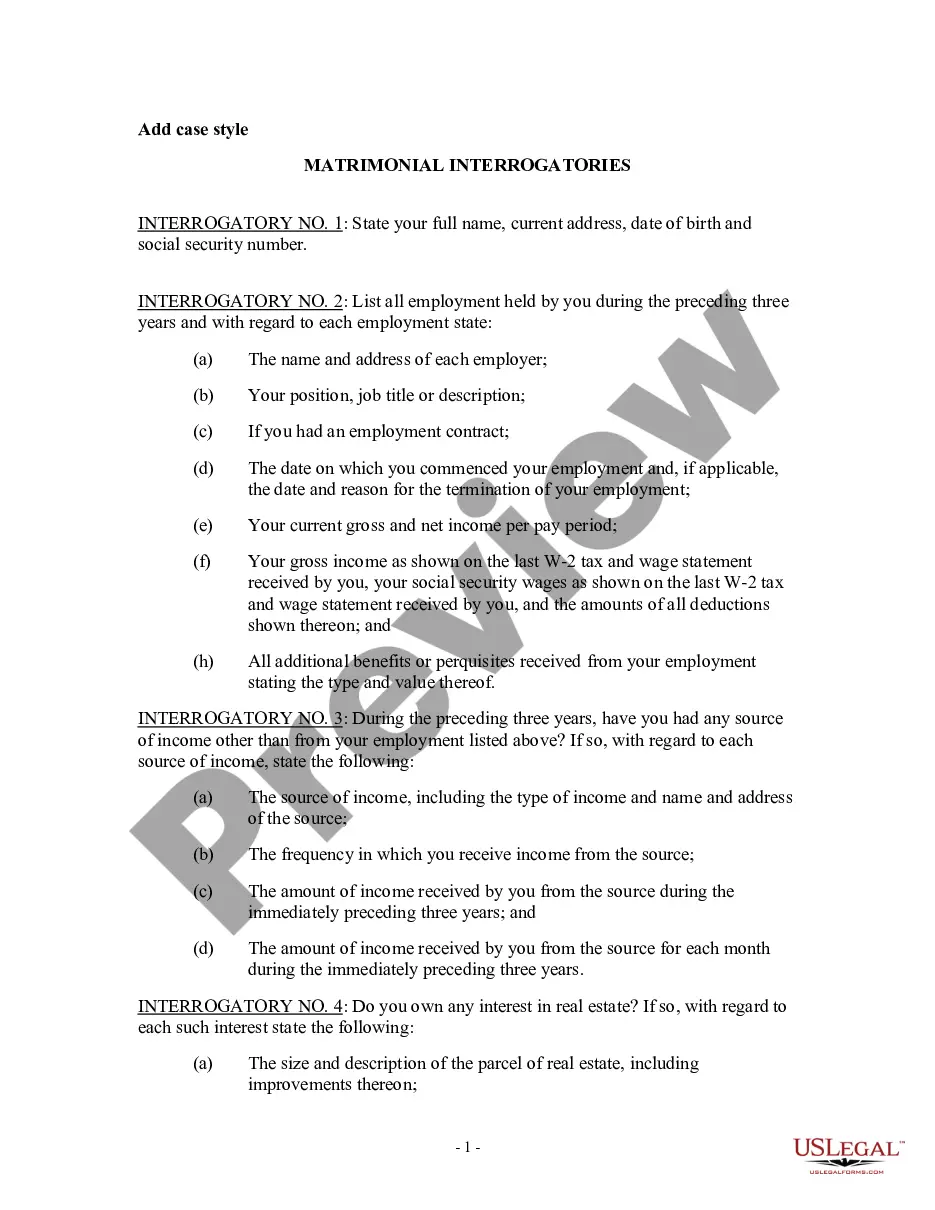

How to fill out Maryland Gift Deed From Two Grantors To A Non-Profit Corporation As Grantee.?

Individuals typically link legal documentation with something intricate that only an expert can manage.

In a certain respect, this is correct, as crafting a Maryland Gift Deed With Condition requires considerable knowledge of subject specifics, comprising state and local laws.

Nonetheless, with US Legal Forms, matters have turned more manageable: pre-formatted legal templates for any life and business circumstance tailored to state regulations are compiled in a singular online repository and are now accessible to everyone.

All templates in our collection are reusable: once obtained, they remain stored in your profile. You can access them whenever needed via the My documents tab. Discover all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- Review the content of the page carefully to ensure it meets your requirements.

- Examine the form description or view it using the Preview option.

- Search for another sample with the Search bar above if the previous one isn't suitable for you.

- Click Buy Now once you locate the appropriate Maryland Gift Deed With Condition.

- Choose a subscription plan that aligns with your needs and financial capacity.

- Create an account or sign in to move forward to the payment page.

- Complete your payment for your subscription via PayPal or with your credit card.

- Choose the format for your document and click Download.

Form popularity

FAQ

To transfer property after the death of a parent with a will in Maryland, you must initiate the probate process by filing the will with the local probate court. The court will oversee the distribution of assets according to the will's instructions. If your parent used a Maryland gift deed with condition for any property, that transfer would bypass probate, allowing for direct ownership transfer. Seeking assistance through platforms like US Legal Forms can provide you with the necessary documents and guidance for this process.

Yes, in Maryland, property can be transferable upon death through specific estate planning tools, including a trust or a Maryland gift deed with condition. These methods allow you to specify who receives your property and the terms of that transfer. This can help you avoid the lengthy probate process and ensure that your wishes are honored after you pass. Consulting a legal expert can guide you in choosing the right method for your situation.

Yes, in Maryland, if you have a valid will and property exceeding a certain value, you generally must go through the probate process. This process ensures that the deceased's wishes are carried out as outlined in the will. However, using a Maryland gift deed with condition can help transfer property without probate, simplifying asset distribution for your loved ones. It is wise to consider all options to make the transition smooth for your heirs.

In Maryland, when one owner of a jointly owned property passes away, the surviving owner typically receives full ownership through the right of survivorship. This transfer occurs automatically, meaning you do not need to go through probate. However, if the property is not held jointly, the deceased's share may be subject to the terms of their will or state succession laws. Understanding how this process works can help you navigate estate planning effectively.

To avoid probate in Maryland, consider using joint ownership, living trusts, or beneficiary designations for your assets. Additionally, employing a Maryland gift deed with condition for real estate can help ensure your property transfers smoothly without entering the probate process. Utilizing these strategies can simplify inheritance for your loved ones.

Yes, Maryland does allow Transfer on Death (TOD) accounts, which are a great way to bypass probate for financial accounts. These accounts let you designate a beneficiary who will receive the assets directly upon your passing. If you are also considering property transfers, pair this strategy with a Maryland gift deed with condition for comprehensive estate planning.

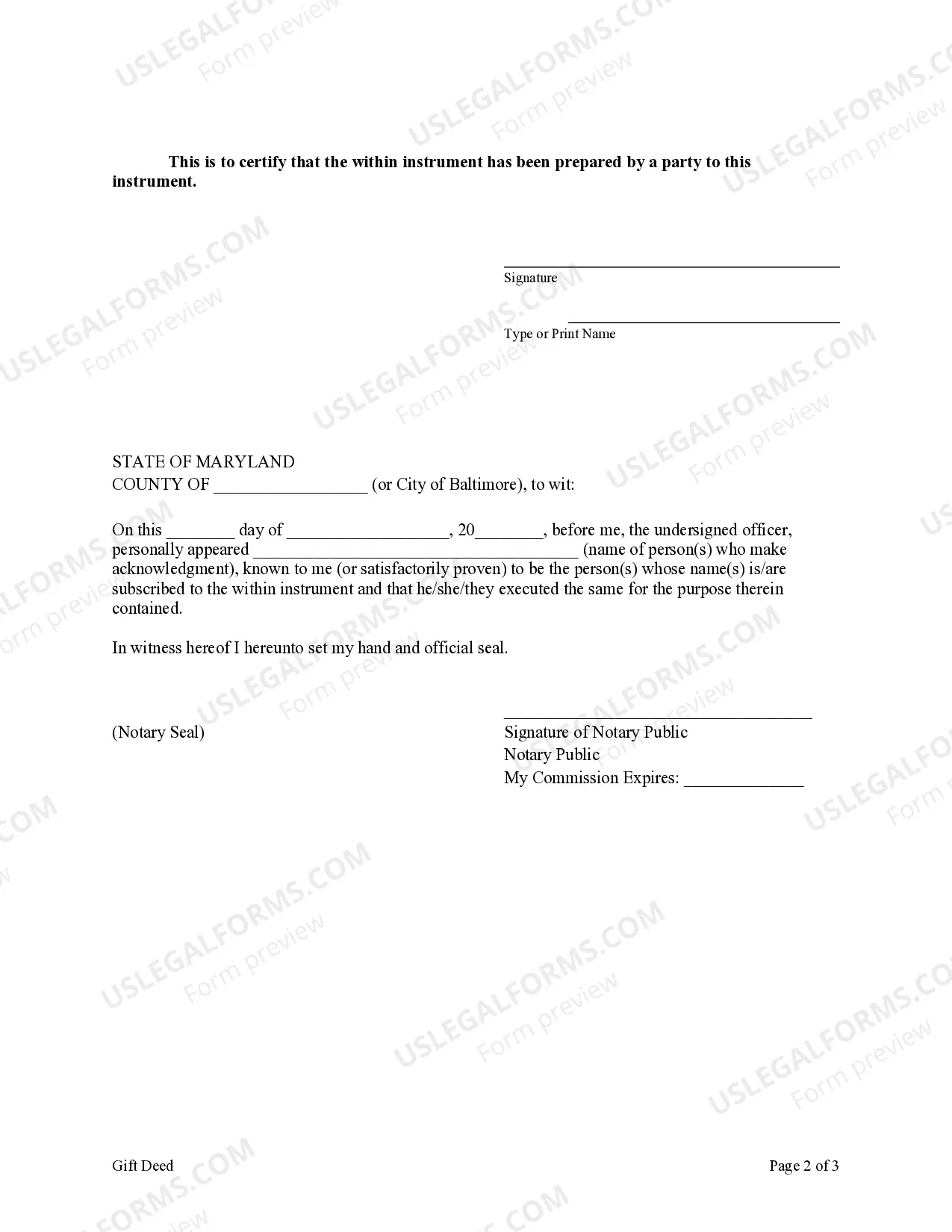

To transfer a house deed in Maryland, you need to complete a new deed that clearly states the transfer of ownership. This document should be signed, witnessed, and recorded in the local land records office. If you're looking to make a transfer with specific conditions, a Maryland gift deed with condition can outline these requirements effectively.

Yes, Maryland does allow transfer on death deeds. This feature enables you to transfer property to a designated beneficiary upon your death, avoiding the probate process. However, if you prefer a Maryland gift deed with condition, ensure that the deed reflects any stipulations for the transfer.

To obtain a copy of your house deed in Maryland, first identify the county where your property is located. Most counties have an online land records database where you can search for property records. If you prefer, you can also visit the local land records office in person. Having details like the property address and owner’s name handy will help expedite your search; this is particularly useful if you're considering a Maryland gift deed with condition in the future.

In Maryland, if your name is not on a deed but you are married, you may have certain rights related to the property. Maryland recognizes marital property; therefore, you could still have a claim to the property as a spouse. However, rights can vary based on whether the property was acquired before or during the marriage. It’s advisable to consult a legal expert to navigate your specific situation, especially if a Maryland gift deed with condition may be involved.