Owner Corporation Form With Irs

Description

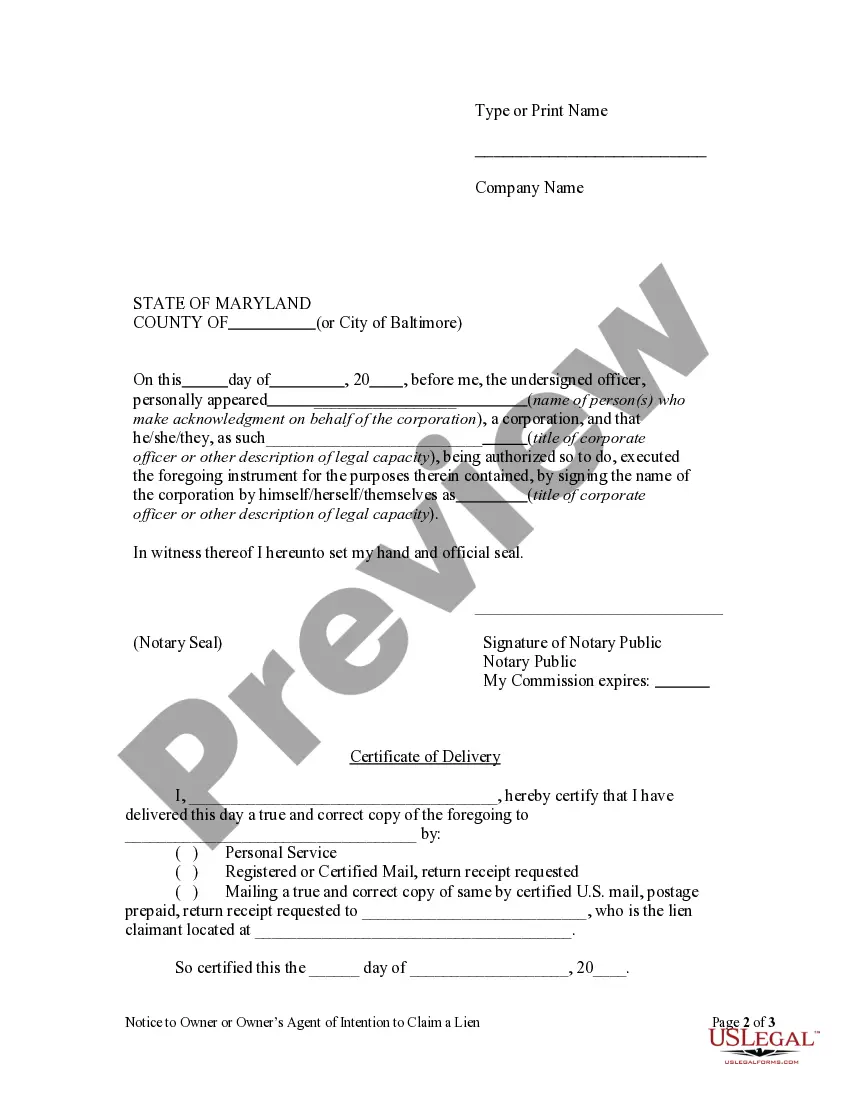

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- If you're already a user, simply log in to your account and navigate to the form you need. Ensure your subscription is active, and if it's expired, renew it according to your payment plan.

- Check the Preview mode and description of the owner corporation form to confirm it's suited to your requirements and complies with your local laws.

- If the template doesn't fit your needs, utilize the Search tab to find a suitable alternative form. Once you find the right one, proceed to purchase it.

- Click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the full resources of the library.

- Finalize your purchase by entering your payment information, either via credit card or PayPal. Complete the transaction to gain access to the document.

- Download your owner corporation form and save it to your device for easy access. You can revisit it anytime from the My Forms section of your profile.

With US Legal Forms, you have access to a robust collection of over 85,000 legal documents, more than competitors offer for a similar cost. Plus, the platform provides assistance from premium experts, ensuring that every document you complete is precise and compliant.

In conclusion, obtaining your owner corporation form with the IRS is a breeze thanks to US Legal Forms. By following these steps, you can ensure a seamless filing experience. Start your journey towards compliance today and explore the extensive resources at US Legal Forms!

Form popularity

FAQ

You can determine the type of LLC you have by reviewing your formation documents and the filing with your state. Check any elections made with the IRS, such as choosing S Corporation status, which will impact your classification. Understanding your LLC type is crucial for correct tax filings and compliance. Resources from uslegalforms can help clarify your LLC structure.

To have your LLC classified as an S Corp, you need to file IRS Form 2553, which lets the IRS know about your desire for S Corporation tax treatment. Ensure you meet the eligibility requirements, including the number of shareholders and types of permitted stock. This step can change how your LLC is taxed while allowing you potential tax benefits. Consult uslegalforms for assistance with filing.

To find out if your LLC is classified as a C Corporation or an S Corporation, review your IRS tax filings. If you filed IRS Form 1120, you are treated as a C Corp, while Form 1120S indicates S Corp status. Additionally, the election form you submitted, such as Form 2553, provides clarity on your classification. Using tools from uslegalforms can simplify this identification process.

The taxation of a corporation's owner varies based on the corporation type. Shareholders of C Corporations face double taxation, where income is taxed at both the corporate and individual levels. However, S Corporation owners generally pass income directly to their personal tax returns, avoiding double taxation. Familiarity with the correct owner corporation form with IRS will help you understand your tax responsibilities.

To determine if you are classified as an S Corporation or an LLC, you need to consider how your business is registered and taxed. An LLC offers flexibility in taxation, allowing you to choose how you want to be taxed. If you meet specific requirements and file Form 2553, you can elect to be treated as an S Corp. Visit uslegalforms for guidance on identifying your business structure accurately.

Determining whether your LLC is classified as an S Corporation or a C Corporation primarily depends on your choice of tax treatment with the IRS. Most LLCs default to being treated as a disregarded entity or a partnership. However, if you file IRS Form 2553, you can elect S Corp status. Understanding your classification helps you use the appropriate owner corporation form with IRS.

The IRS requires business owners to fill out various forms depending on their entity type. For a corporation, the primary form is Form 1120, while S Corporations use Form 1120S. If you are a single-member LLC, you may report your income on Schedule C, which is part of your personal tax return. It's essential to identify the right owner corporation form with IRS to ensure compliance.

To obtain a copy of your Form 2553, you can contact the IRS directly or check your records if you filed it previously. This form is necessary for electing S Corporation status, which significantly influences your tax obligations. For detailed instructions, refer to the guidance provided on the IRS website or consider support from a tax professional.

Form 1120 does not explicitly show ownership of the corporation; rather, it details the income, deductions, and tax; however, it needs to be filed correctly to comply with IRS regulations. The ownership structure affects your tax reporting and should be documented separately. Utilizing the owner corporation form with the IRS is essential for clarity in ownership and operational structures.

Form 720 is specifically for businesses that have certain types of liabilities, such as excise taxes. If your single member LLC is engaged in activities that necessitate this form, then you must file it. To ensure compliance, it's advisable to review your business activities and consult a tax advisor.