Owner Corporation Form For The Information

Description

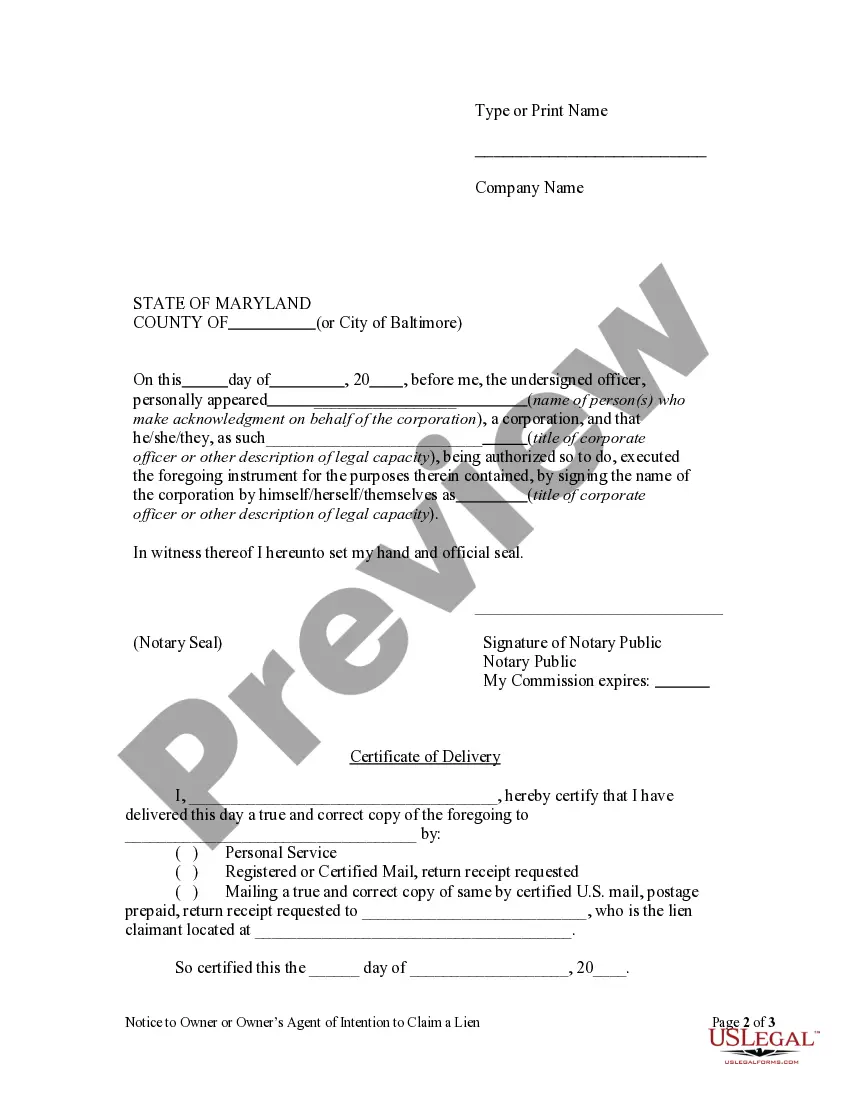

How to fill out Maryland Notice To Owner Or Owner's Agent Of Intention To Claim A Lien By Corporation Or LLC?

- Begin by logging into your US Legal Forms account. If you're an existing user, simply click here and download the required form after confirming your subscription is active.

- If this is your first visit, check the preview mode and description of the form to guarantee it meets your needs and complies with your local jurisdiction.

- If you need a different document, utilize the search bar to find the appropriate form that fits your criteria.

- Select the document by clicking the 'Buy Now' button and choose your desired subscription plan, ensuring you have an account for access.

- Proceed with the purchase by entering your payment details, either via credit card or PayPal.

- Finally, download your form to your device. You can access it anytime from the My Forms section of your profile.

By following these straightforward steps, you'll have access to your owner corporation form for the information in no time. US Legal Forms empowers users with more forms and resources than competitors, ensuring you find exactly what you need.

Get started today and streamline your legal documentation process!

Form popularity

FAQ

Whether you are required to file a Texas franchise tax return depends on your business's revenue and classification. If your organization exceeds the revenue threshold, filing is mandatory. To clarify your filing obligations, you can access tools on the US Legal Forms platform, including the owner corporation form for the information pertinent to your situation.

To file the beneficial ownership information report, you must gather details about your business's ownership structure and submit them to the appropriate state authorities. This report ensures transparency and compliance with federal regulations. The US Legal Forms site can provide the necessary owner corporation form for the information you need to facilitate a smooth filing process.

Failing to file Texas franchise tax can lead to penalties, interest on unpaid amounts, and possible revocation of your business status. The state takes compliance seriously, and prompt action upon receiving notices is vital. Using the US Legal Forms platform can help you learn about the owner corporation form for the information required to avoid setbacks in your business.

In Texas, any entity that earns above the stipulated revenue threshold and is classified as a corporation or a limited liability company must file a franchise tax return. This requirement ensures compliance with state tax obligations. To streamline your understanding, you can explore the US Legal Forms platform for the owner corporation form for the information beneficial to your filing.

Texas Form 05-102 must be filed by entities that exceed the revenue threshold set by the state for franchise tax purposes. This form is essential for corporations, partnerships, and certain other entities operating in Texas. The US Legal Forms platform offers assistance in preparing the owner corporation form for the information relevant to your specific situation.

Entities exempt from Texas franchise tax include certain non-profit organizations and small businesses below specific revenue thresholds. These exemptions depend on various factors regarding the organization’s nature and income. To determine if you qualify, consider the resources available on the US Legal Forms platform, which can assist you with the owner corporation form for the information needed.

Texas Form 05 169 is a report used to claim a franchise tax exemption for certain entities in the state. This form pertains to specific organizations that meet criteria for exemption due to their nature or income. Utilizing the US Legal Forms resources can guide you in properly completing the owner corporation form for the information that helps in filing this document correctly.

In Texas, franchise tax is typically triggered by the revenue generated by your business. If your entity qualifies as a corporation or limited liability company and meets established revenue thresholds, you must file. Engaging with the US Legal Forms platform can simplify understanding your obligations related to the owner corporation form for the information necessary to navigate franchise taxes.

Building your own corporation requires careful planning and execution. You need to establish a clear business plan, secure necessary funding, and comply with state regulations during formation. Additionally, ongoing management and growth strategies are vital for success. Utilizing platforms like uslegalforms can assist you in efficiently addressing the details of your owner corporation form for the information.

Creating your own corporation involves several steps. First, choose a unique name that complies with state requirements. Then, file the necessary paperwork with your state and create bylaws that outline how the corporation will operate. For assistance in navigating these steps, consider using uslegalforms to access templates and ensure you establish the correct owner corporation form for the information.