Wage Garnishment With Child Support

Description

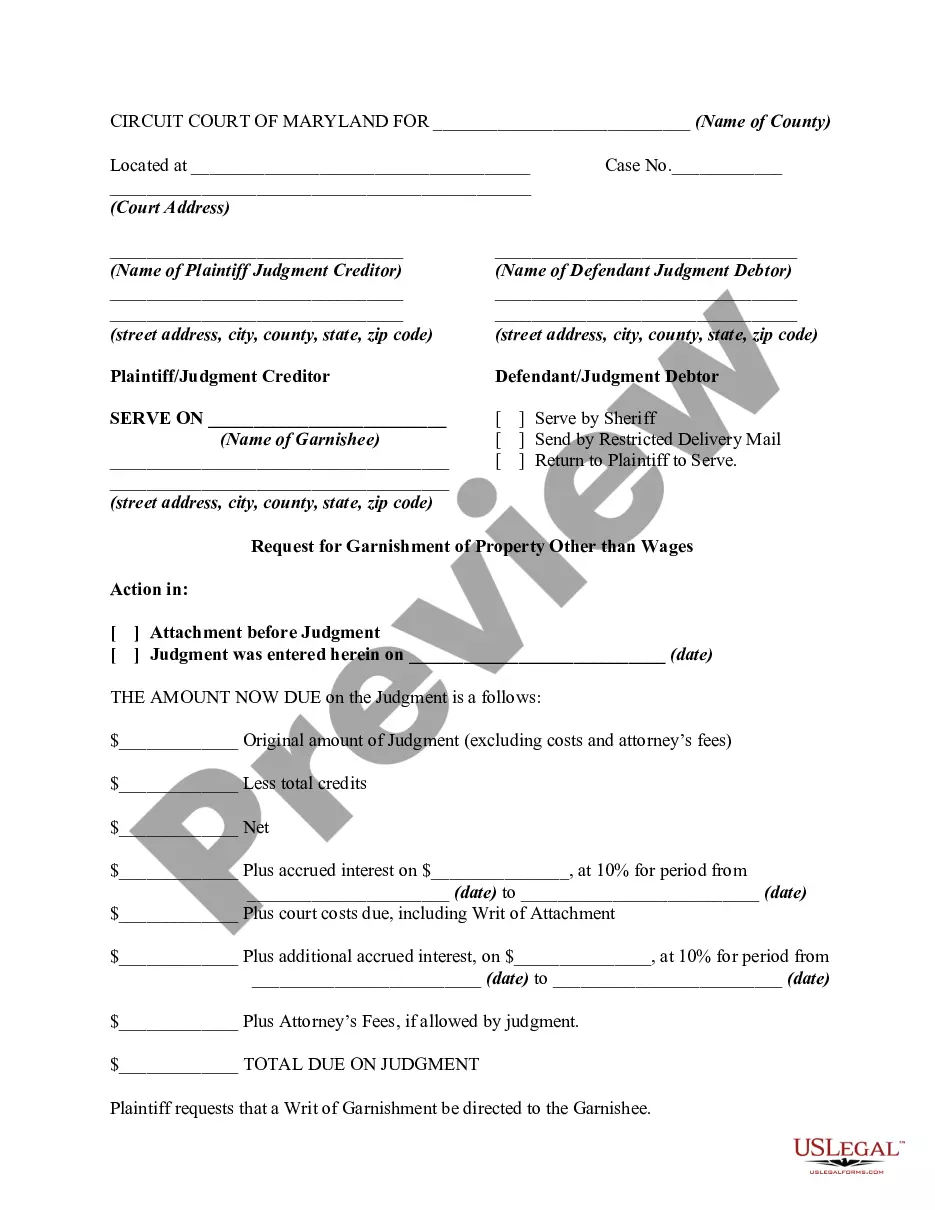

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

There's no further justification to spend time searching for legal documents to satisfy your local state mandates.

US Legal Forms has compiled all of them in a single location and simplified their availability.

Our platform provides over 85k templates for any business and individual legal situations categorized by state and area of application.

Utilize the search bar above to find another sample if the previous one did not meet your needs. Click Buy Now next to the template title when you find the suitable one. Choose the desired pricing plan and create an account or Log In. Process your payment for your subscription with a credit card or through PayPal to continue. Choose the file format for your Wage Garnishment With Child Support and download it to your device. Print your form to complete it manually or upload the sample if you prefer to manage it with an online editor. Preparing formal documents under federal and state laws and regulations is fast and straightforward with our platform. Try US Legal Forms today to keep your paperwork organized!

- All forms are expertly crafted and validated for accuracy, so you can be assured of obtaining an up-to-date Wage Garnishment With Child Support.

- If you are acquainted with our service and already possess an account, you must verify your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all saved documents at any time by opening the My documents tab in your profile.

- If you've never used our service before, the procedure will require a few additional steps to finalize.

- Here's how new users can locate the Wage Garnishment With Child Support in our catalog.

- Examine the page content closely to ensure it contains the sample you require.

- To assist with this, use the form description and preview options if available.

Form popularity

FAQ

Wage garnishment with child support allows a court to direct your employer to withhold a portion of your paycheck to fulfill child support obligations. Generally, up to 50% of your disposable earnings can be garnished if you support another child or spouse. If you do not support anyone else, this amount may increase to 60%. Understanding these limits can help you plan your finances better and ensure you meet your child support responsibilities.

No, wage garnishment with child support will not stop automatically once a payment plan is in place. You must formally request to modify or terminate the garnishment through the court or relevant agency. This often involves submitting documentation that outlines any changes in your financial situation. Check out US Legal Forms for useful tools that can assist you in navigating this process.

When writing a letter to the judge regarding wage garnishment with child support, start by clearly stating your case. Include relevant details such as your case number, the amount of child support owed, and any reasons for your request. Make sure to be respectful and concise, focusing on how your situation may impact your ability to provide for your child. If you need guidance, consider using US Legal Forms for templates that can help simplify the process.

The maximum garnishment allowed for wage garnishment with child support typically adheres to federal and state guidelines. Federal law limits garnishments for child support to no more than 60% of your disposable earnings, with possible reductions if you support other dependents. It’s crucial to familiarize yourself with both federal and state regulations to ensure compliance.

If your employer fails to implement wage garnishment with child support, they may be held liable for the unpaid support. Courts generally expect employers to comply promptly with garnishment orders. In such cases, the noncompliance could lead to legal action against your employer, as well as cumulative arrears in your child support payments.

For wage garnishment with child support, the percentage taken from your paycheck is regulated to ensure you can retain enough income for living expenses. Typically, child support can take between 50% to 60% of your disposable income depending on your circumstances. To find out exactly how much will be deducted, you should speak with your employer's payroll department or consult legal resources.

The maximum amount they can garnish for wage garnishment with child support varies by state law but typically follows federal guidelines. Under federal law, the maximum is usually 60% of your disposable income if you have no dependents, and up to 50% if you support another child or spouse. It's essential to know your rights and obligations under local laws to understand the limits applicable to your situation.

Wage garnishment with child support can take a significant portion of your paycheck depending on your financial situation. Generally, the amount garnished cannot exceed 50% of your disposable income if you are supporting another spouse or child, and 60% if you are not. This ensures that you can maintain a standard of living while fulfilling your child support obligations.