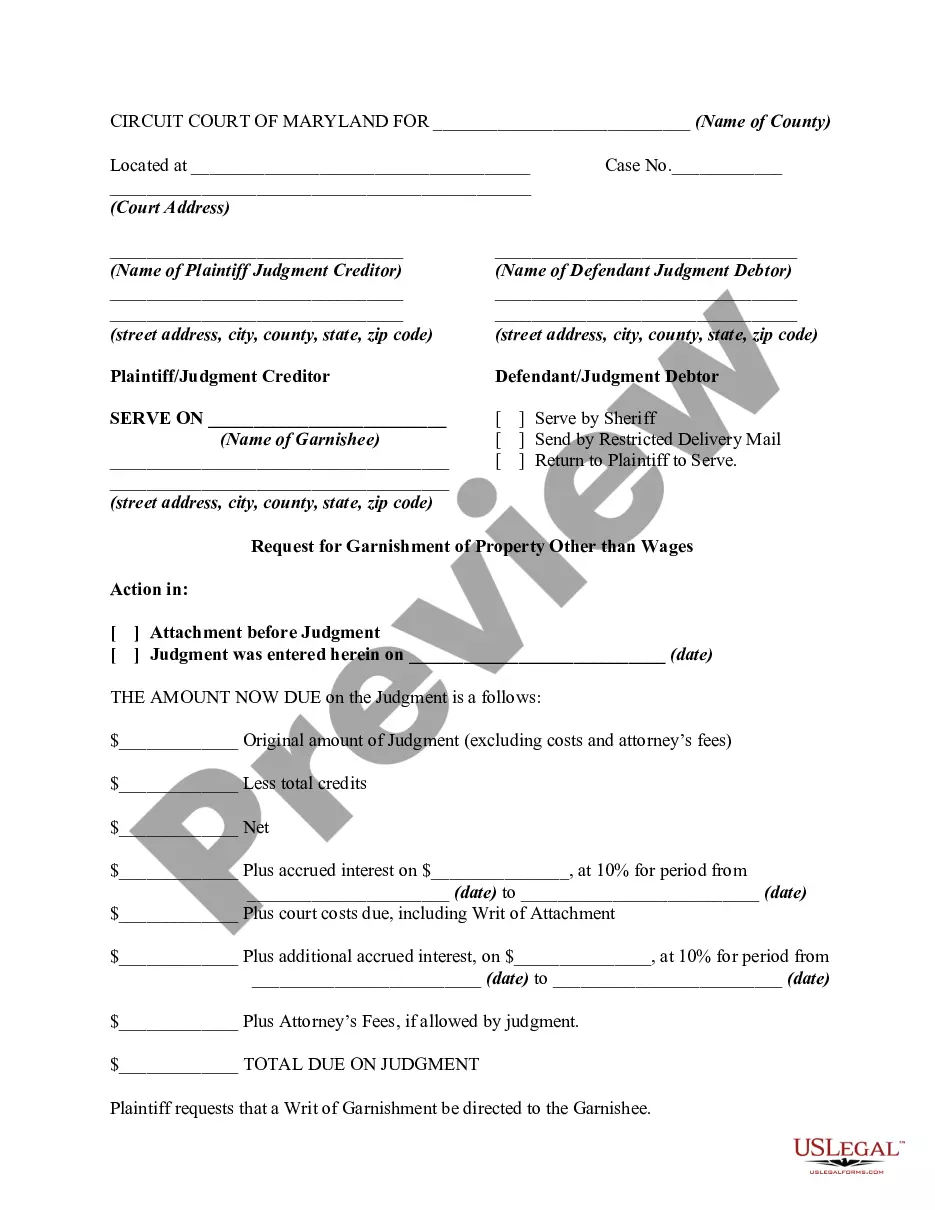

Request And Writ For Garnishment

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

- Log into your existing account on the US Legal Forms platform. Ensure your subscription is current to access the necessary document templates.

- Preview the form description and verify that it matches your garnishment needs. It's critical to ensure compliance with local jurisdiction standards.

- Utilize the search feature if the initial form you view doesn't align with your specifications. This allows you to find the most suitable template.

- Select the appropriate document by clicking the Buy Now button. Choose from various subscription plans, creating an account to unlock access to the extensive library.

- Complete the purchase process by entering your payment details, whether via credit card or PayPal.

- Download the required form directly to your device. You can later access it anytime through your profile in the My Forms menu.

In conclusion, US Legal Forms stands out with its vast array of over 85,000 fillable and editable legal documents, providing unmatched benefits for those seeking to file a writ for garnishment.

Take the first step towards simplifying your legal document needs today by visiting US Legal Forms!

Form popularity

FAQ

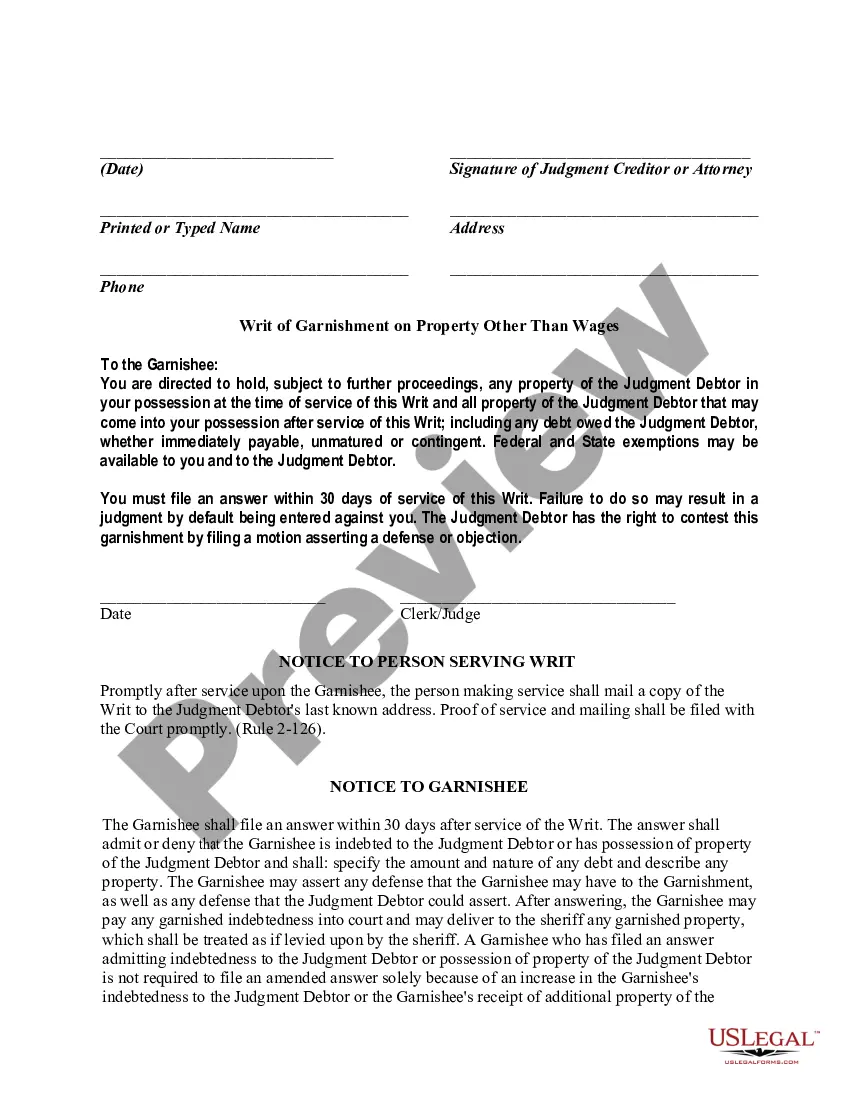

To request a writ for garnishment, you must file a motion with the court that issued your original judgment. This involves providing necessary details about the judgment and the amount owed. It’s advisable to prepare your documentation meticulously to support your case. For an easier process, you can rely on the user-friendly resources from US Legal Forms to assist you when you need to request and complete a writ for garnishment.

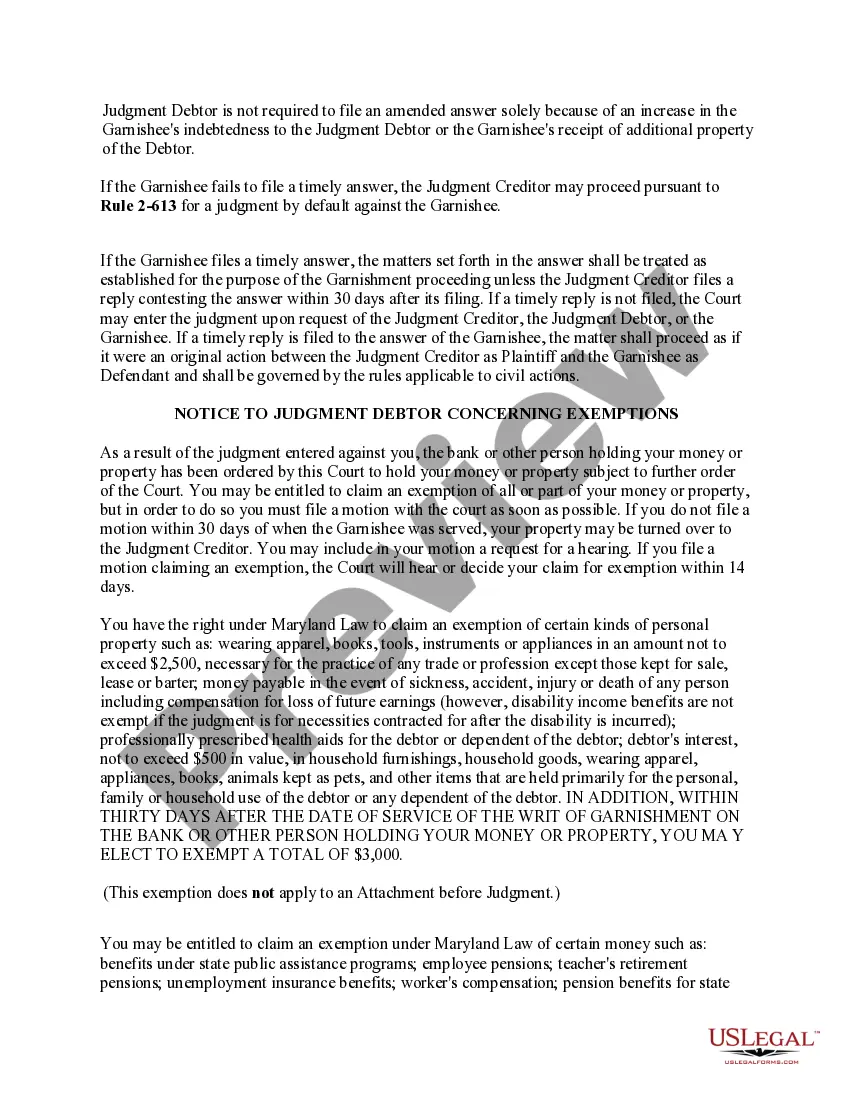

The amount a creditor can garnish from your paycheck largely depends on federal and state regulations. Typically, federal law allows creditors to garnish up to 25% of your disposable income or the amount by which your earnings exceed 30 times the federal minimum wage, whichever is less. This highlights the significance of knowing your rights when facing wage garnishments. For more tailored information on how to request and obtain a writ for garnishment, explore the resources available on US Legal Forms.

In the United States, a creditor generally has a limited time to collect a debt after obtaining a judgment. This period usually ranges from five to twenty years, depending on state laws. It's important to note that creditors can request a writ for garnishment during this time. If you are seeking guidance on how to effectively request and implement a writ for garnishment, consider utilizing the US Legal Forms platform.

Filling out a challenge to garnishment form requires precise information about the garnishment and your financial status. You should first identify the court that issued the writ for garnishment and provide the necessary details regarding your case. Ensure you answer all questions thoroughly, and it may be helpful to utilize resources from US Legal Forms that offer guidance and templates for correctly completing this form.

To write a letter aimed at stopping garnishment, you need to clearly express your request while including relevant details about your situation. Begin by stating your intent to request and writ for garnishment, and then outline the reasons for your request. Include your contact information and any case numbers associated with the garnishment. You may also consider using a template from US Legal Forms to ensure your letter follows the correct format.

The speed at which a garnishment can be stopped depends on the actions you take and the court's schedule. If you file a motion promptly and provide valid reasons, you may see results quickly. Engaging a legal platform like US Legal Forms can expedite your request and help you navigate the necessary legal processes.

The best way to stop a garnishment is to file a motion with the court to challenge the garnishment or to negotiate directly with the creditor. You can also explore options for debt relief or settlements that may halt the garnishment process. Enlisting help from services like US Legal Forms can guide you through the necessary steps effectively.

Yes, it is possible to negotiate even after wage garnishment has begun. You may contact the creditor to discuss payment terms or a settlement. This negotiation can sometimes lead to a more manageable repayment plan, allowing you to alleviate the burden of garnishment.

Yes, it is possible for wages to be garnished without your prior knowledge, particularly if the creditor obtains a court order. Often, individuals only become aware of the garnishment once they see a reduction in their paycheck. It's crucial to monitor your financial situation and respond promptly to any legal notices you receive.

To obtain a writ of assistance, you typically need to petition the court that issued the original judgment. This involves submitting the necessary forms and possibly attending a hearing to explain your situation. Utilizing a reliable platform like US Legal Forms can simplify this process, providing you with the required documents and guidance.