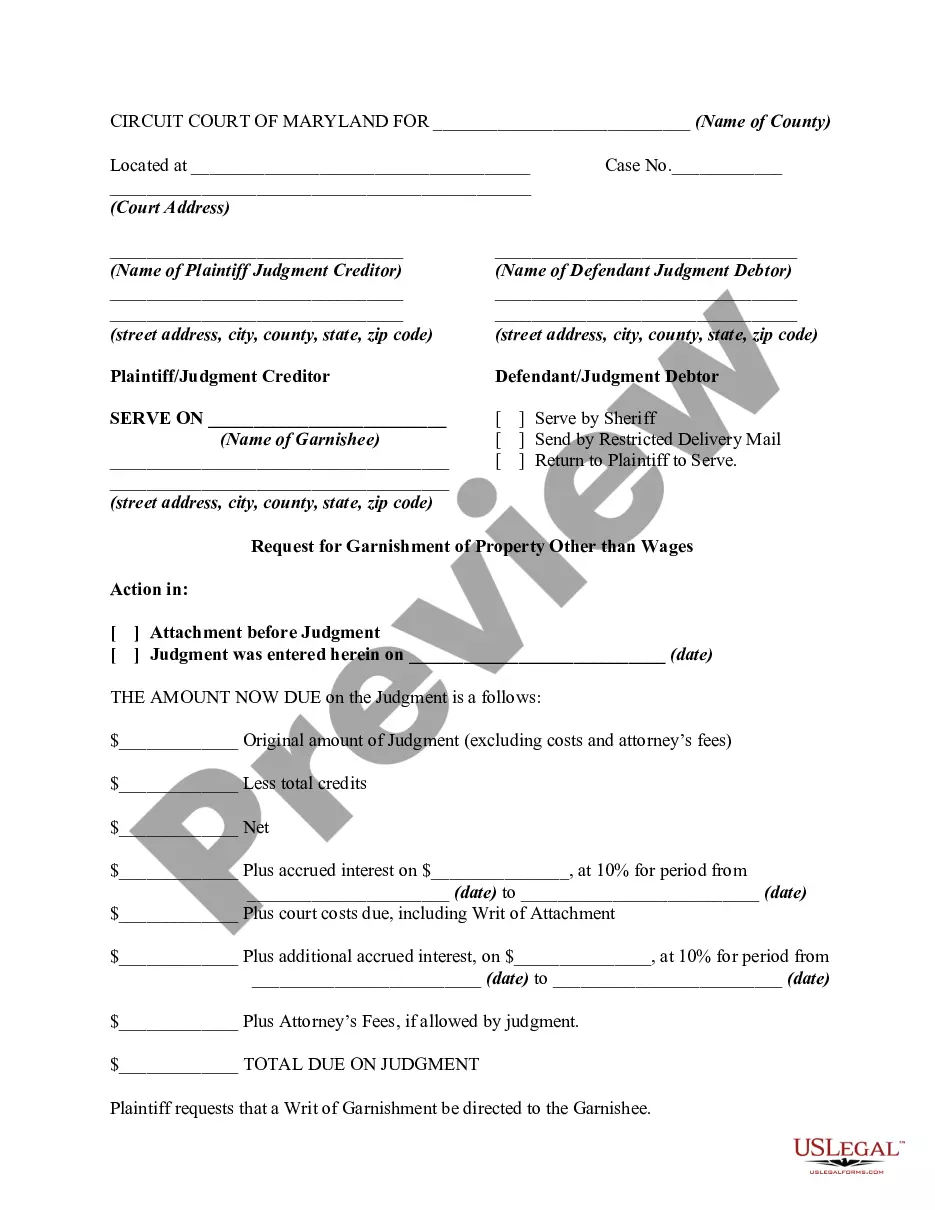

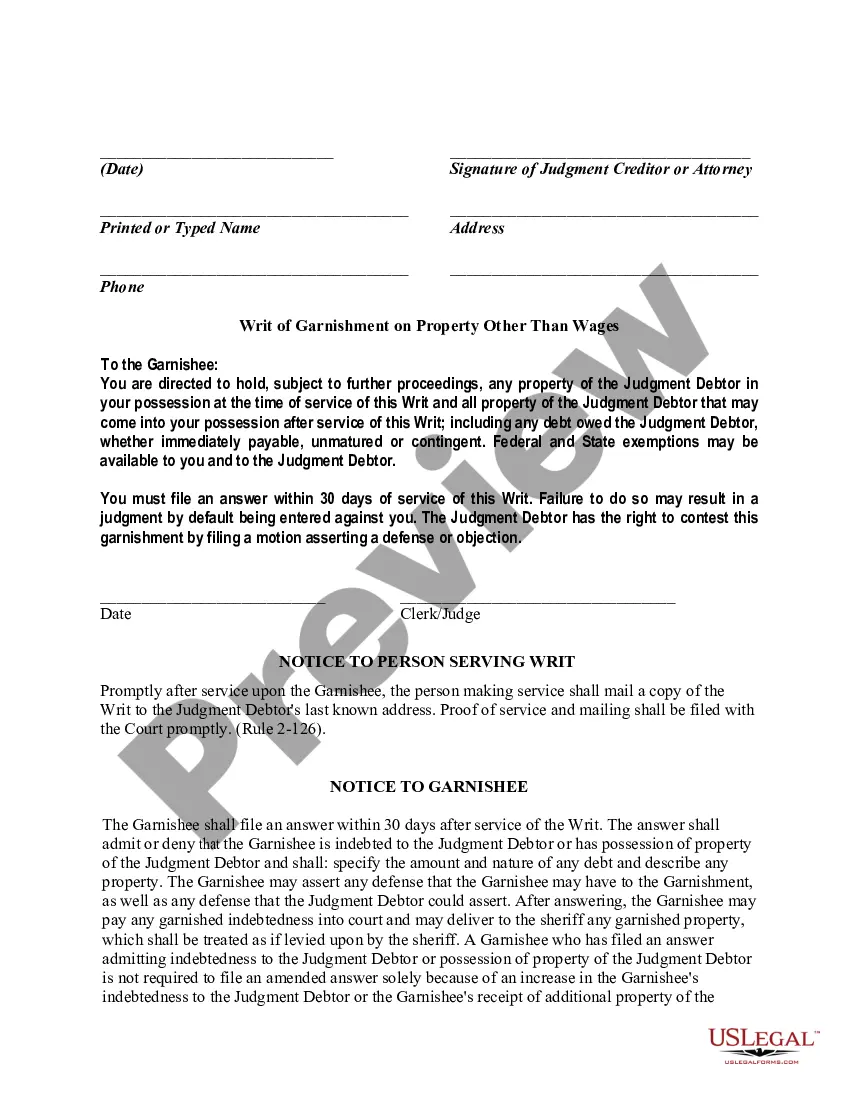

The judgment creditor may obtain issuance of a writ of garnishment by filing in the same action in which the judgment was entered a request that contains (1) the caption of the action, (2) the amount owed under the judgment, (3) the name and last known address of each judgment debtor with respect to whom a writ is requested, and (4) the name and address of the garnishee. Upon the filing of the request, the clerk shall issue a writ of garnishment directed to the garnishee.

Maryland Wage Garnishment Form With Payment

Description

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

Legal management might be mind-boggling, even for skilled experts. When you are interested in a Maryland Wage Garnishment Form With Payment and do not have the a chance to spend looking for the appropriate and updated version, the procedures might be nerve-racking. A robust online form library might be a gamechanger for anyone who wants to take care of these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available to you anytime.

With US Legal Forms, you may:

- Access state- or county-specific legal and business forms. US Legal Forms covers any needs you may have, from individual to enterprise papers, in one place.

- Utilize advanced resources to complete and manage your Maryland Wage Garnishment Form With Payment

- Access a useful resource base of articles, tutorials and handbooks and resources related to your situation and requirements

Save time and effort looking for the papers you will need, and use US Legal Forms’ advanced search and Preview feature to discover Maryland Wage Garnishment Form With Payment and get it. For those who have a subscription, log in to the US Legal Forms account, look for the form, and get it. Review your My Forms tab to find out the papers you previously saved as well as to manage your folders as you see fit.

Should it be the first time with US Legal Forms, make a free account and obtain limitless use of all advantages of the platform. Here are the steps to consider after downloading the form you want:

- Validate it is the right form by previewing it and reading through its description.

- Ensure that the sample is acknowledged in your state or county.

- Select Buy Now once you are all set.

- Choose a monthly subscription plan.

- Find the formatting you want, and Download, complete, eSign, print out and send your document.

Benefit from the US Legal Forms online library, supported with 25 years of experience and reliability. Change your daily document management in a easy and easy-to-use process today.

Form popularity

FAQ

You may be able to stop wage garnishment by negotiating with the creditor. If this is not possible and you feel the judgement was incorrect you may be able to object to or challenge the garnishment.

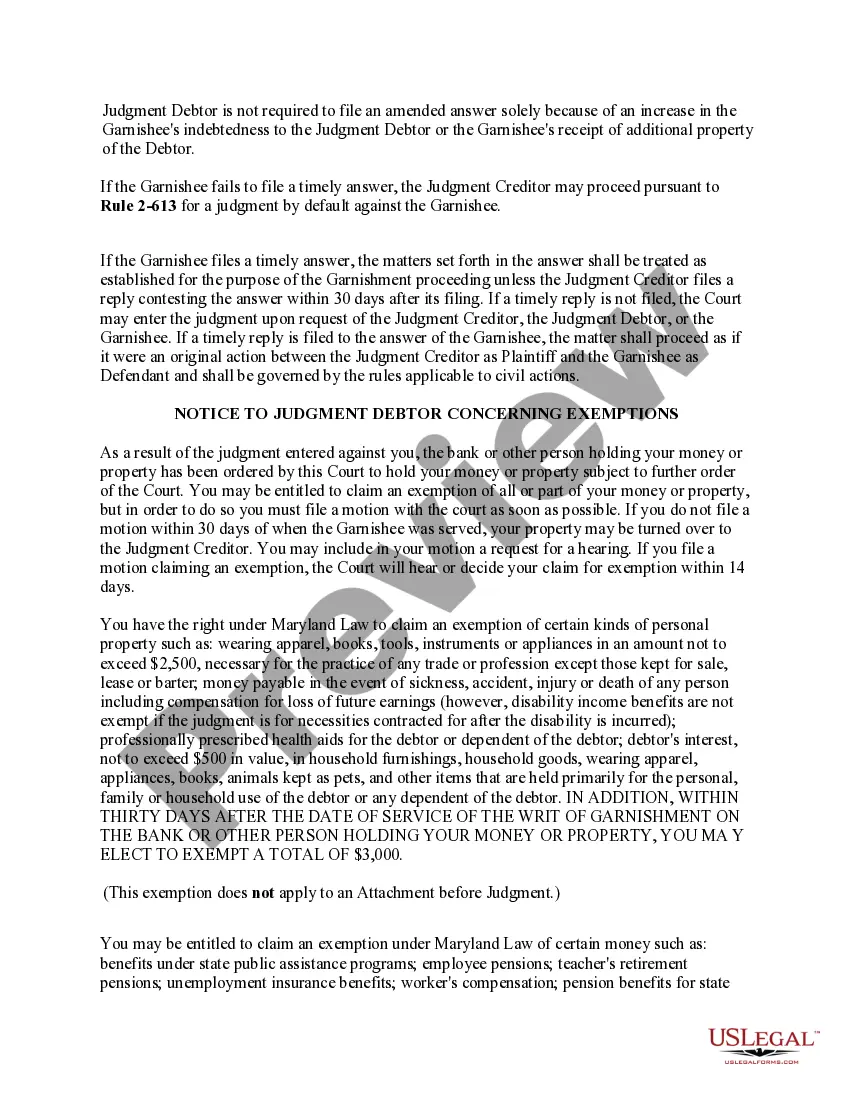

Wages cannot be garnished if the judgment debtor's disposable wages are less than 30 times the State minimum hourly wage multiplied by the number of weeks during which the wages due were earned. In any event, no more than 25% of your disposable wages for a week can be garnished.

Maryland's laws vary depending on the county in which you live. In Montgomery County, pursuant to Commercial Law Article § 15-601.1, creditors can garnish the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for the week exceed $145.

Garnishment, or wage garnishment, is when money is legally withheld from your paycheck and sent to another party. It refers to a legal process that instructs a third party to deduct payments directly from a debtor's wage or bank account. Typically, the third party is the debtor's employer and is known as the garnishee.

Ordinary garnishments Under Title III, the amount that an employer may garnish from an employee in any workweek or pay period is the lesser of: 25% of disposable earnings -or- The amount by which disposable earnings are 30 times greater than the federal minimum wage.