Maryland Wage Garnishment Form With 2 Points

Description

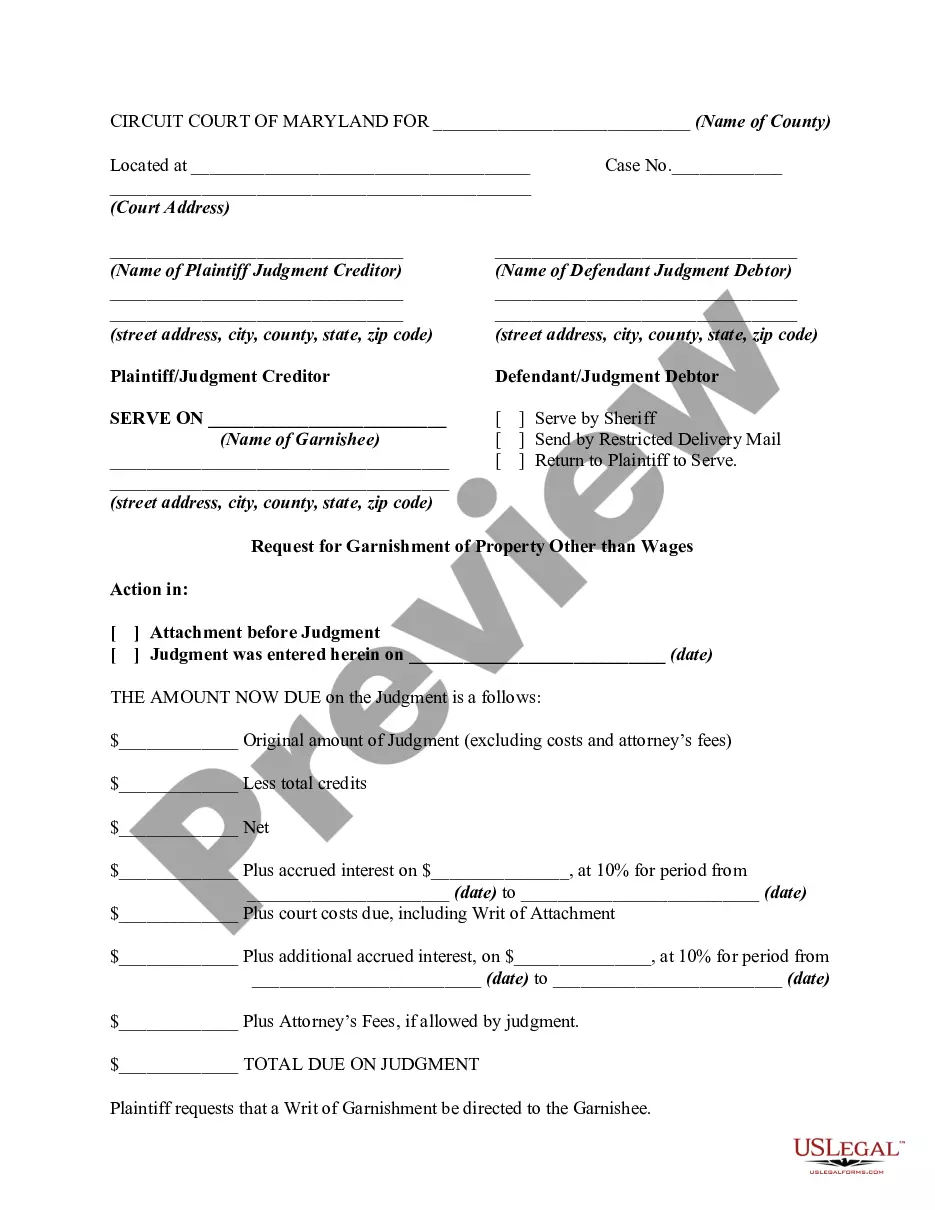

How to fill out Maryland Request For Garnishment Of Property Other Than Wages?

The Maryland Wage Garnishment Form With 2 Points you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Maryland Wage Garnishment Form With 2 Points will take you just a few simple steps:

- Look for the document you need and check it. Look through the file you searched and preview it or review the form description to ensure it suits your needs. If it does not, use the search bar to find the right one. Click Buy Now when you have located the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Obtain the fillable template. Pick the format you want for your Maryland Wage Garnishment Form With 2 Points (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

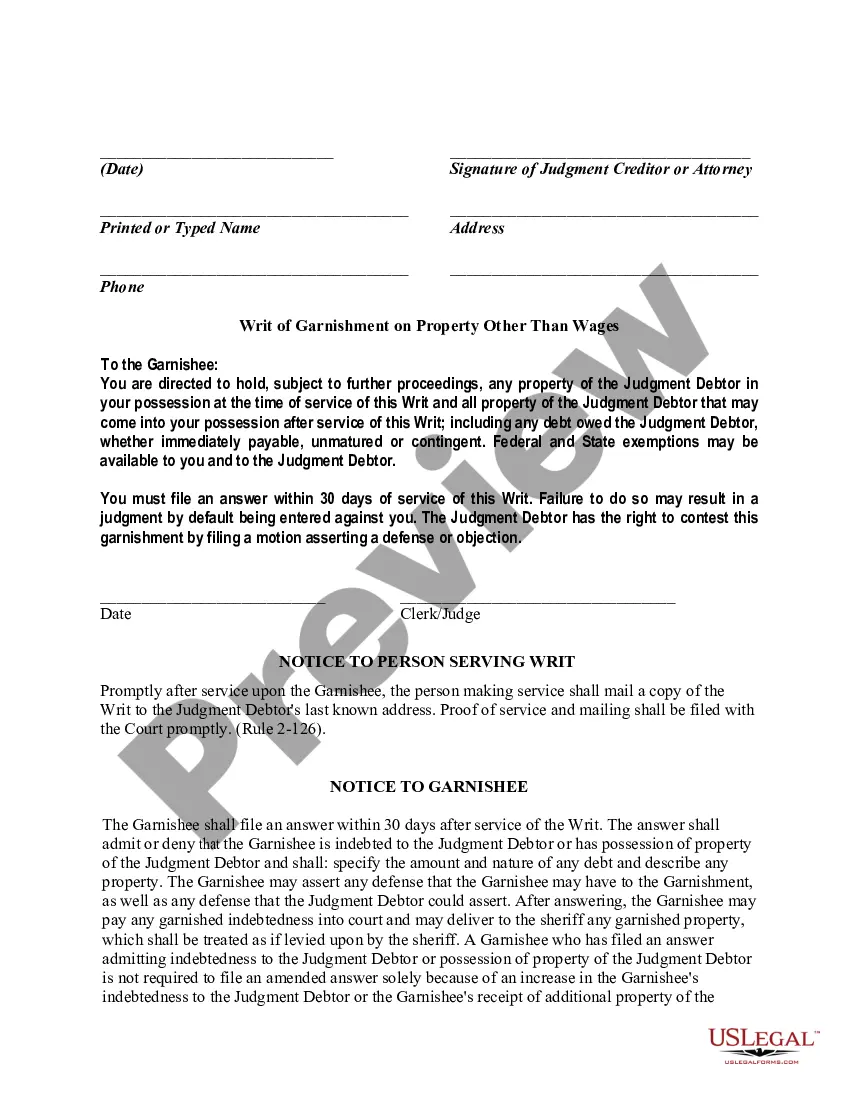

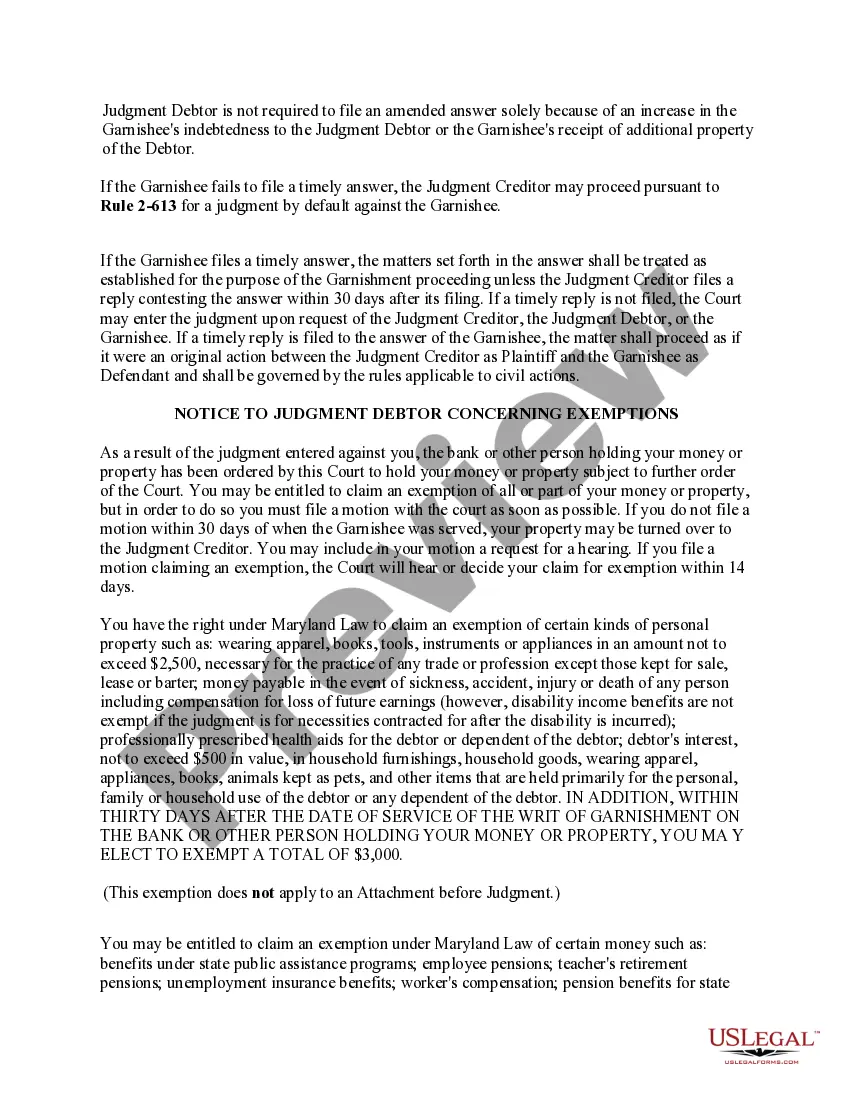

You may request an exemption to the garnishment. You must make your request within 30 days of when the garnishment was served on the bank. Use the form Motion for Release of Property from Levy/Garnishment (DC-CV-036).

In any event, no more than 25% of your disposable wages for a week can be garnished. Understanding the amount that can be garnished may be confusing. The District Court publishes (DC-CV-065BR) a helpful brochure that contains an example of how the exemptions work: Debtor earns $7.25 per hour, (federal minimum wage).

Maryland's laws vary depending on the county in which you live. In Montgomery County, pursuant to Commercial Law Article § 15-601.1, creditors can garnish the lesser of: 25% of your disposable earnings for that week, or. the amount by which your disposable earnings for the week exceed $145.

After you obtain a judgment, you file a Request for Writ of Garnishment of Wages (DC-CV-065). To complete the form, you need to know the name and address of the debtor's employer, the amount of the judgment and any additional money owed (such as court costs and interest.)

A creditor may not garnish more than 25% of your wages per pay period. For individuals earning minimum wage or near minimum wage, you must be left with an amount equal to 30 times the Maryland minimum hourly wage.