Maryland State Information

Description

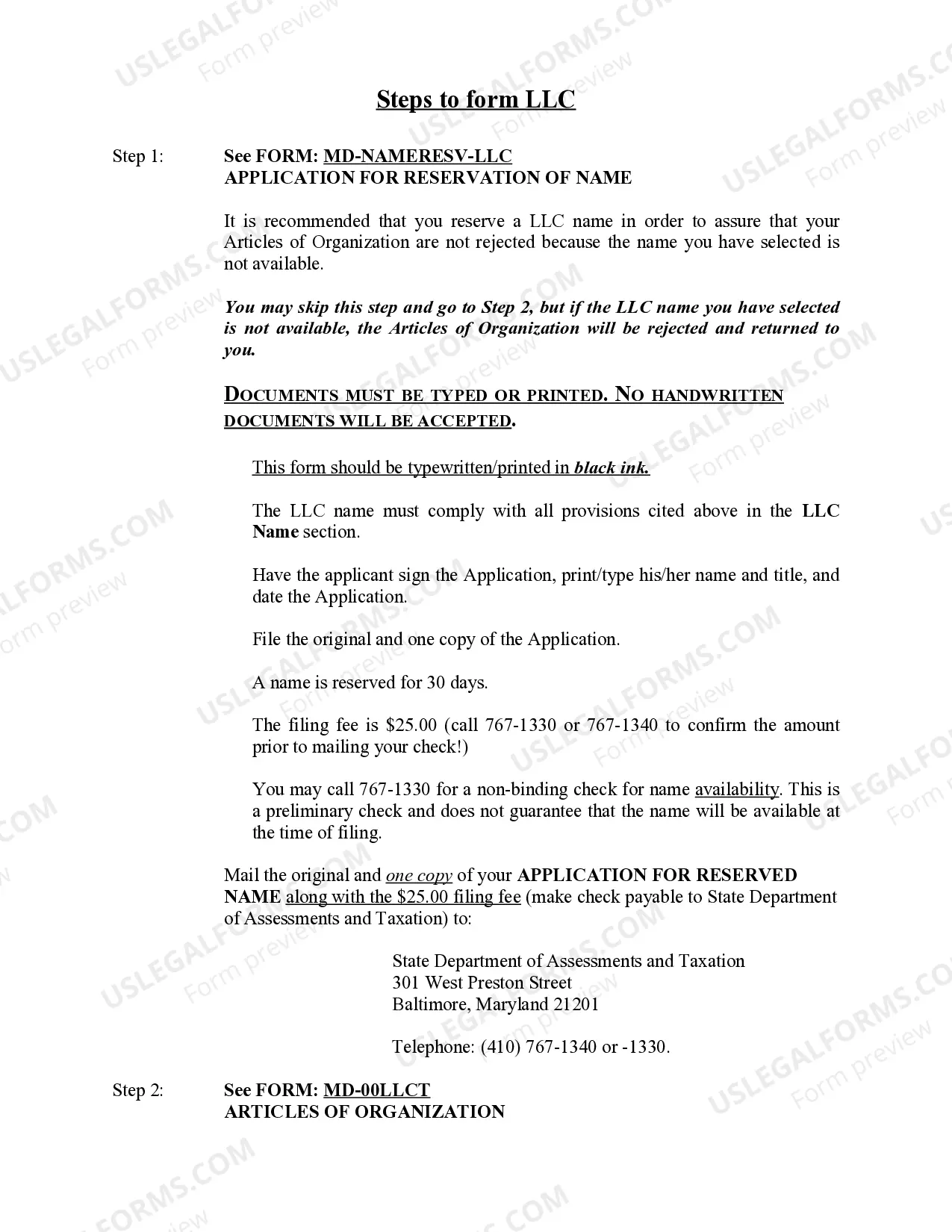

How to fill out Maryland Limited Liability Company LLC Formation Package?

The Maryland State Information you see on this page is a multi-usable legal template drafted by professional lawyers in compliance with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Maryland State Information will take you just a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or check the form description to verify it satisfies your requirements. If it does not, use the search option to get the correct one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Pick the format you want for your Maryland State Information (PDF, DOCX, RTF) and save the sample on your device.

- Fill out and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a valid.

- Download your papers again. Utilize the same document once again whenever needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Defined coverage areas: Contact InformationMailing Address110 Carroll Street Comptroller Of The Treasury Annapolis MD 21401 All countriesTax Questions410-260-7980Main Email Addresstaxhelp@marylandtaxes.govMain Contact Name20 more rows

Comptroller of Maryland Register online. Allow approximately 5-7 business days to receive your Central Registration Number. If you need to receive your Central Registration Number more urgently or wish to speak with the Comptroller's office, call 800-MD-TAXES.

Most Maryland businesses will need an EIN, since most will either be formed by multiple people, need to hire employees, or will apply for loans and bank accounts.

Maryland Resident Income Tax Return with Form 502B.

Choose the Right Income Tax Form If you lived in Maryland only part of the year, you must file Form 502. If you are a nonresident, you must file Form 505 and Form 505NR. If you are a nonresident and need to amend your return, you must file Form 505X.