Maryland Llc Cost With Ein

Description

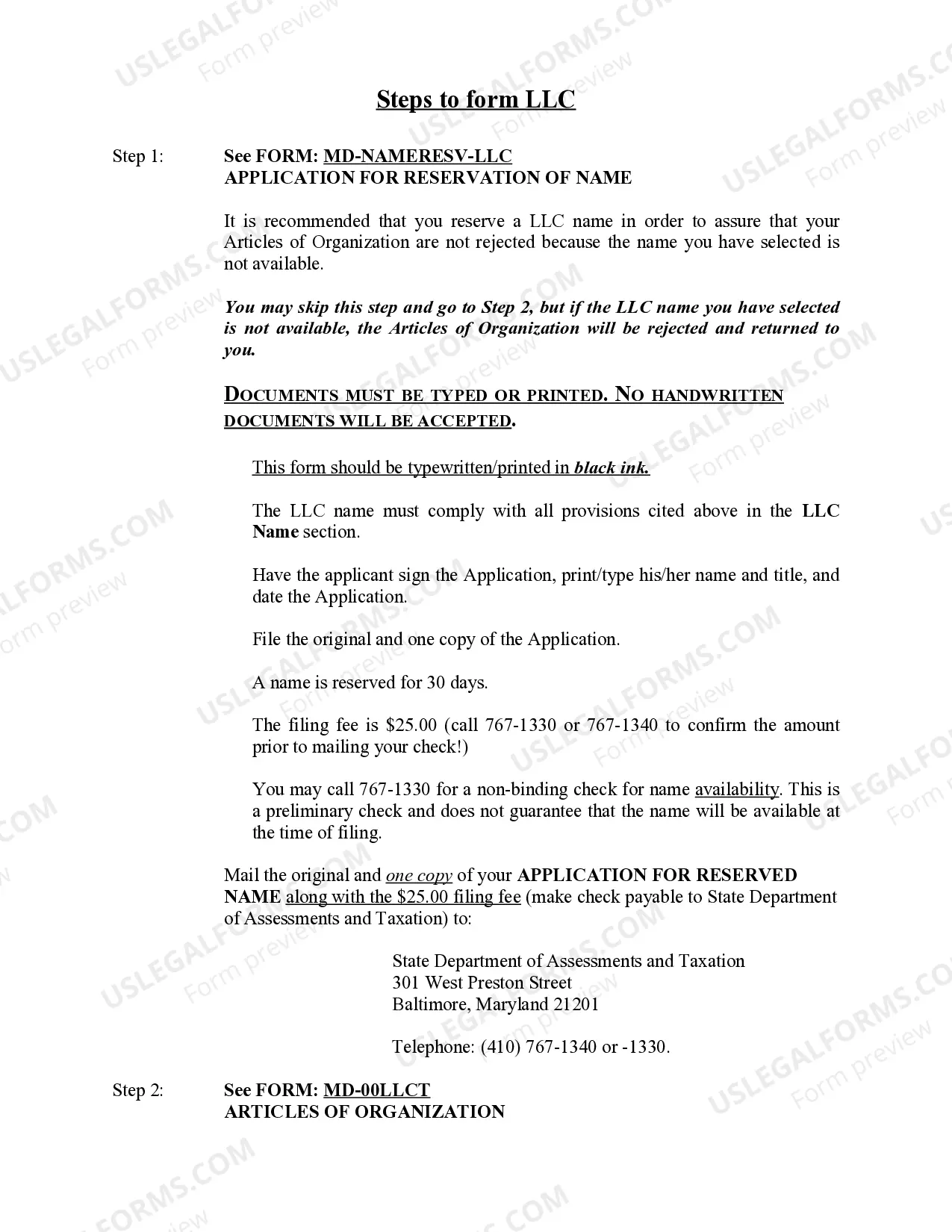

How to fill out Maryland Limited Liability Company LLC Formation Package?

Regardless of whether for commercial objectives or personal matters, everyone must confront legal issues at some point in their lifetime.

Filling out legal documents requires diligent focus, commencing with selecting the appropriate form template.

With an extensive US Legal Forms catalog available, you don't need to waste time searching for the appropriate sample online. Leverage the library's easy navigation to discover the suitable template for any circumstance.

- For example, if you choose an incorrect version of a Maryland LLC Cost With EIN, it will be rejected upon submission.

- Thus, it's imperative to source trustworthy legal documents such as US Legal Forms.

- To acquire a Maryland LLC Cost With EIN template, adhere to these straightforward steps.

- 1. Retrieve the necessary sample using the search bar or catalog browsing.

- 2. Review the description of the form to ensure it aligns with your circumstances, state, and region.

- 3. Click on the preview of the form to inspect it.

- 4. If it turns out to be the wrong document, go back to the search option to locate the Maryland LLC Cost With EIN template you need.

- 5. Obtain the file once it meets your criteria.

- 6. If you possess a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- 7. If you haven't created an account yet, you can download the form by clicking Buy now.

- 8. Select the appropriate pricing option.

- 9. Complete the profile registration form.

- 10. Choose your payment method: use a credit card or PayPal account.

- 11. Specify the document format you wish and download the Maryland LLC Cost With EIN.

- 12. Once downloaded, you can either fill out the form using editing software or print it for manual completion.

Form popularity

FAQ

Yes, in Maryland, you need to renew your LLC annually. This process includes submitting a Personal Property Return and paying the associated fees. Ignoring this requirement can lead to fines and the potential dissolution of your LLC. By staying on top of these renewals, you can ensure your business remains compliant and continues to thrive.

The cheapest place to get an LLC is usually your state's official website. This allows you to file directly with the state, minimizing additional charges from third-party agencies. Additionally, you may find cost-effective options through online legal service providers like USLegalForms. They offer competitive rates tailored to meet your needs while ensuring you understand the Maryland LLC cost with EIN.

The cheapest way to get an LLC often involves filing the paperwork yourself. You can visit your state’s official website to find the necessary forms and guidance, which can significantly reduce costs. However, be mindful of potential pitfalls due to the lack of professional support; errors can lead to additional fees. If you prefer a streamlined process, consider platforms like USLegalForms, which provide efficient services to help manage your Maryland LLC cost with EIN.

To open an LLC in Maryland, you need to file Articles of Organization with the state. Additionally, you'll require an EIN for tax purposes. Consider using US Legal Forms to help you navigate the necessary documents, which can simplify the process and contribute to a better understanding of the Maryland LLC cost with EIN.

The processing time for establishing an LLC in Maryland can range from a few days to a couple of weeks. After you submit your documents, the state typically reviews and approves your application within five to seven business days. Fast processing can help you manage your Maryland LLC cost with EIN more effectively and start your business sooner.

In Maryland, the tax rate for an LLC generally aligns with the income tax rates applicable to your earnings. The state imposes a personal income tax, ranging from 2% to 5.75%, based on your income brackets. Understanding how these taxes influence the overall Maryland llc cost with ein can simplify your financial planning. Consulting with a tax professional can also provide clarity tailored to your unique situation.

The cheapest way to file for an LLC generally involves filing online directly with the Maryland State Department. This method typically saves on costs related to mailing and includes reduced state filing fees. Additionally, platforms like uslegalforms provide affordable packages that simplify the process, ensuring you stay within your budget for Maryland LLC cost with EIN. Always verify if there are additional local fees that may apply.

To obtain an EIN for your LLC in Maryland, you can apply online through the IRS website. The process is straightforward and usually takes about 10 minutes to complete. Once you have your LLC established, obtaining the EIN becomes a crucial step in your Maryland LLC cost with EIN. Using resources from uslegalforms can guide you through securing your EIN confidently.

The cheapest state to open an LLC often varies, but Delaware and Wyoming are frequently cited for their low filing fees. However, factors such as ongoing maintenance requirements and taxes might affect your overall Maryland LLC cost with EIN. It’s important to balance initial costs with long-term business needs. Always evaluate the specific advantages each state offers before making your decision.

You can typically get an LLC in Maryland in about 5-10 business days if you file online. However, processing times can vary based on the volume of applications the state receives. To speed up the process, consider using expedited services offered through platforms like uslegalforms. Ensuring your documentation is complete can help minimize delays in your Maryland LLC cost with EIN.