Maryland Llc Cost Formation

Description

How to fill out Maryland Limited Liability Company LLC Formation Package?

It’s widely acknowledged that you cannot become an authority in law instantly, nor can you swiftly grasp how to easily prepare Maryland Llc Cost Formation without possessing a unique skill set.

Drafting legal documents is a lengthy procedure necessitating a particular level of education and expertise.

So why not entrust the preparation of the Maryland Llc Cost Formation to the professionals.

You can revisit your documents at any time from the My documents tab.

If you're a returning customer, simply Log In, and locate and download the template from the same section.

- Utilize the search bar located at the top of the page to find the form you need.

- Review it (if the preview option is available) and read the accompanying description to determine if Maryland Llc Cost Formation is the form you're seeking.

- If you require a different form, restart your search.

- Create a complimentary account and select a subscription plan to acquire the form.

- Select Buy now. Once the payment is completed, you can obtain the Maryland Llc Cost Formation, fill it out, print it, and send or deliver it to the required parties or organizations.

Form popularity

FAQ

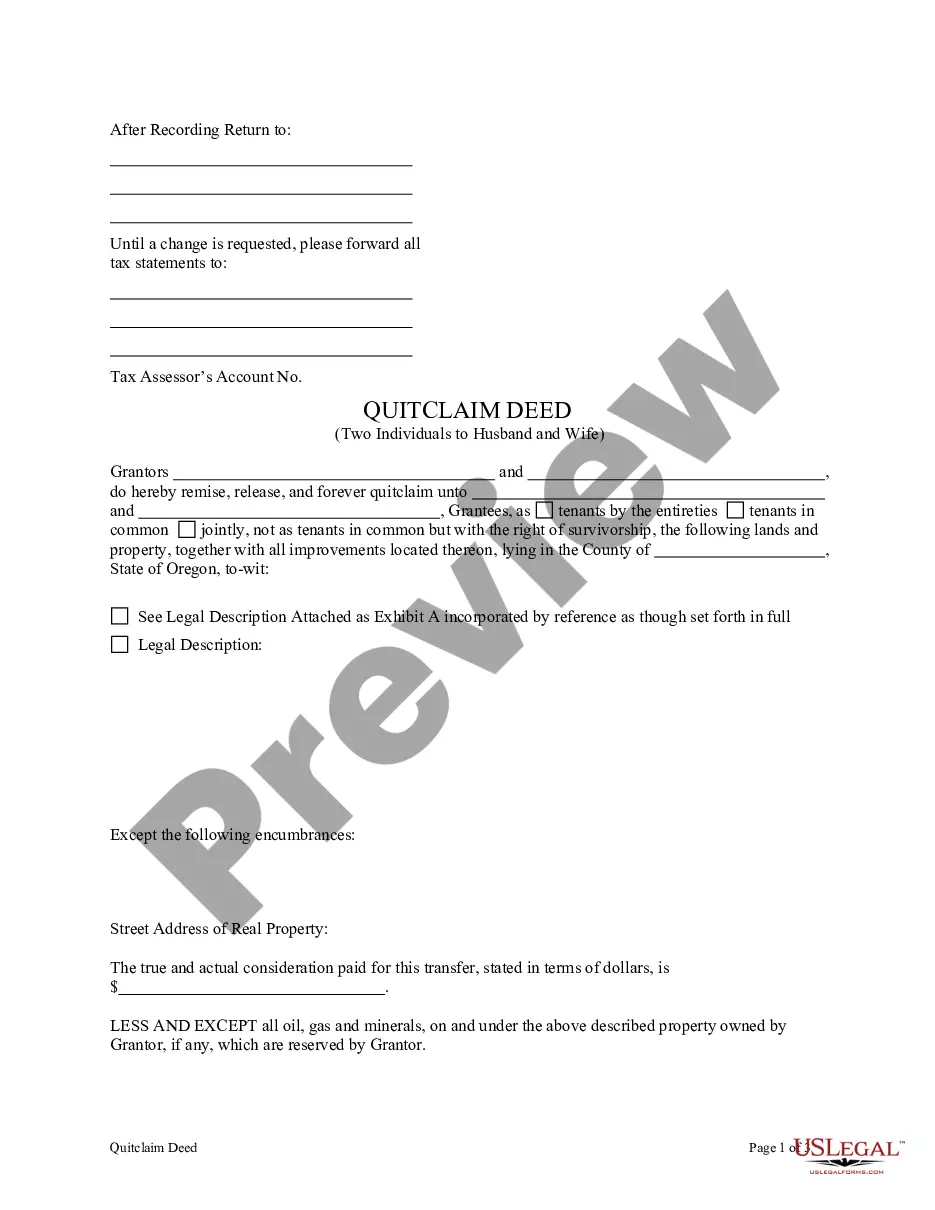

To start an LLC in Maryland, you need to file Articles of Organization with the state’s Department of Assessments and Taxation. The Maryland LLC cost formation includes state filing fees, which vary depending on your business structure. Additionally, you may want to create an operating agreement that outlines the management and ownership of the LLC. Using US Legal Forms can simplify the process by providing you with ready-to-use templates and guidance for successful formation.

The time it takes to form an LLC in Maryland typically ranges from a few days to several weeks, depending on the submission method. If you file online, the Maryland LLC cost formation process is often completed much faster, often within 24 hours. Using a platform like USLegalForms can further streamline the process, helping you receive your official documents efficiently.

In Maryland, the approval time for an LLC formation typically takes about 4 to 6 weeks if filed by mail. However, if you need faster processing, consider using online services, which can expedite the Maryland LLC cost formation. Many applicants find that using efficient online platforms can significantly reduce wait times. Always plan ahead to ensure your LLC is operational when you need it.

If you fail to file an annual report in Maryland, your LLC may face penalties and fees. Over time, these penalties can add up, leading to increased Maryland LLC cost formation. Additionally, your LLC could be administratively dissolved, which means it would lose its legal status. To avoid these issues, it’s crucial to stay compliant with annual reporting requirements.

After submitting your LLC application in Maryland, you will often receive confirmation within a week if filed online. If you choose to file by mail, expect a response within 10 to 15 business days, depending on the volume of applications. To expedite the Maryland LLC cost formation, ensure all documents are filled out correctly. Using our US Legal Forms services can help you avoid delays and understand the requirements better.

Setting up an LLC in Maryland typically takes 5 to 10 business days if you file online. However, if you choose to submit paper forms, it may take longer. With proper preparation of all necessary documents, including the Articles of Organization, you can streamline the Maryland LLC cost formation process. Consider using our US Legal Forms platform to ensure you complete everything efficiently.

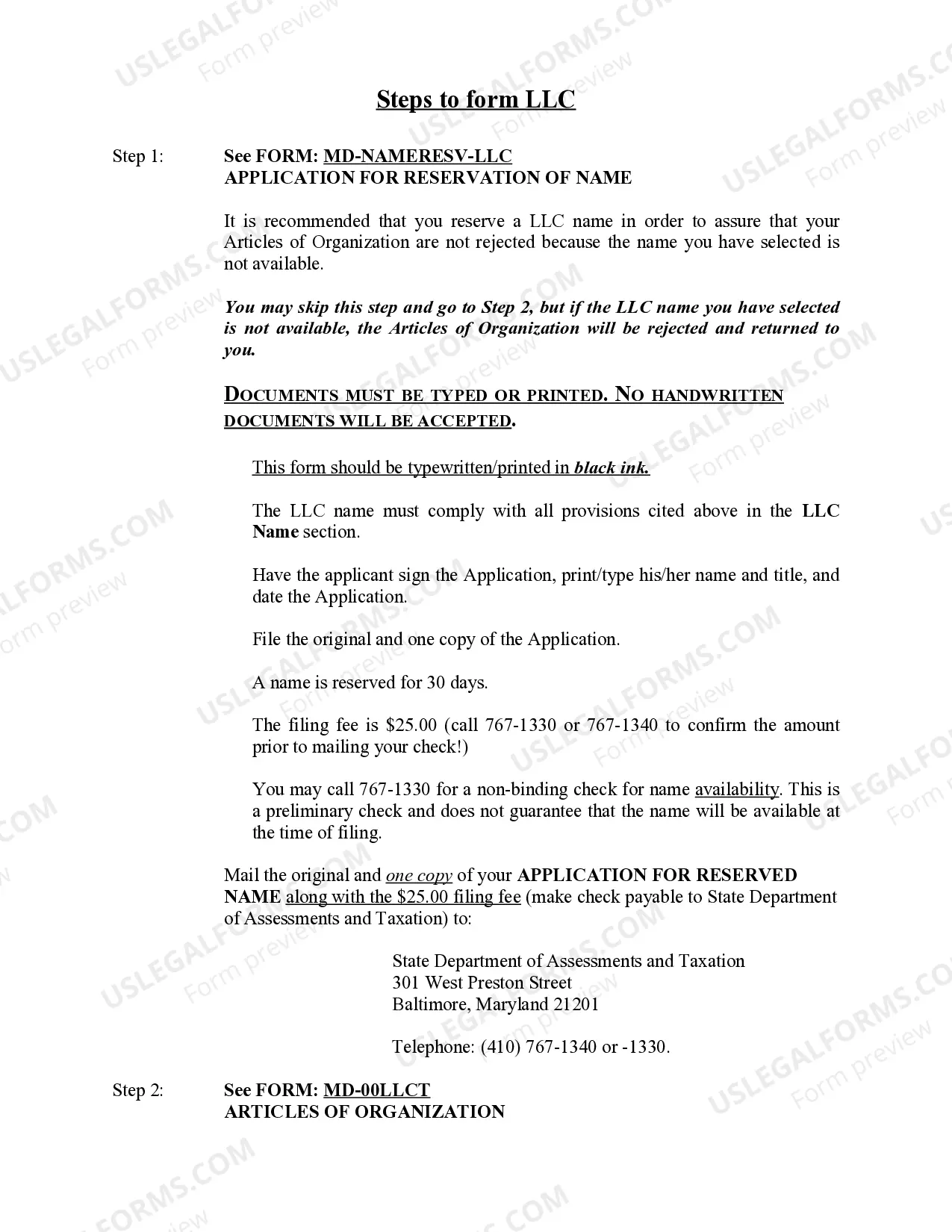

Starting an LLC in Maryland will include the following steps: #1: Name a Resident Agent. #2: Register Your Company Name. #3: File Articles of Organization. #4: Apply for a Business Identification Number. #5: Create an Operating Agreement.

In Maryland, the fee to form an LLC is $100. Online submissions are processed within seven business days, while paper filings take four to six weeks. Paper filings can be expedited and processed within seven days for an additional $50. A certified copy of your document costs $20 plus $1 per page.

An LLC name change in Maryland costs $100. This is the filing fee for the Articles of Amendment, the official form used to change your Maryland LLC name. If you file your name change online (for next-day approval time), it costs $150 for the expedited filing.

How to Start an LLC in Maryland Choose a Name for Your LLC. ... Appoint a Registered Agent. ... File Articles of Organization. ... Prepare an Operating Agreement. ... Comply With Other Tax and Regulatory Requirements. ... File Annual Reports.