Maryland Information With One Another

Description

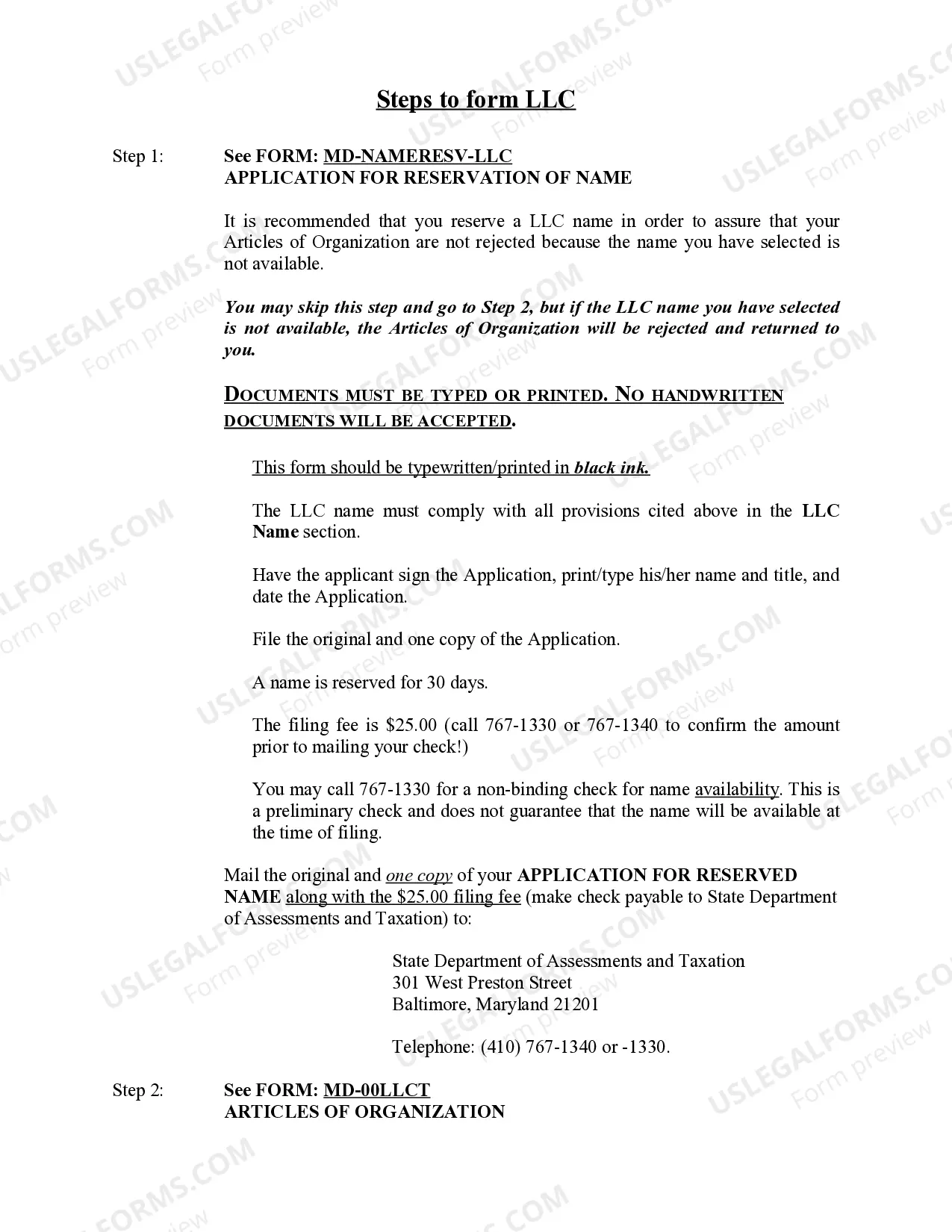

How to fill out Maryland Limited Liability Company LLC Formation Package?

Drafting legal paperwork from scratch can sometimes be daunting. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for an easier and more cost-effective way of creating Maryland Information With One Another or any other documents without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual collection of over 85,000 up-to-date legal documents covers almost every aspect of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-compliant forms diligently put together for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can quickly locate and download the Maryland Information With One Another. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Not registered yet? No worries. It takes little to no time to register it and explore the library. But before jumping directly to downloading Maryland Information With One Another, follow these recommendations:

- Check the form preview and descriptions to ensure that you have found the document you are looking for.

- Check if form you choose complies with the requirements of your state and county.

- Choose the right subscription option to get the Maryland Information With One Another.

- Download the file. Then fill out, certify, and print it out.

US Legal Forms boasts a good reputation and over 25 years of experience. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

Claiming 1 on your tax return reduces withholdings with each paycheck, which means you make more money on a week-to-week basis. When you claim 0 allowances, the IRS withholds more money each paycheck but you get a larger tax return.

Families who can claim exemptions for themselves, their spouses, and their dependents are most likely to have 3-5 exemptions.

YouthWorks 2021: MW507 - YouTube YouTube Start of suggested clip End of suggested clip 507. Form if you claim that you are exempt this means that you will have no income tax withheld fromMore507. Form if you claim that you are exempt this means that you will have no income tax withheld from your paycheck. If you do choose to file exempt do not fill out line one of this. Section.

The personal exemption is $3,200. This exemption is reduced once the taxpayer's federal adjusted gross income exceeds $100,000 ($150,000 if filing Joint, Head of Household, or Qualifying Widow(er) with Dependent Child).

On the W-4 Form complete the following and write legibly. Section 1 ? Payroll System ? RG ? Regular. Agency Code: 220100. ... Section 2 ? Federal Taxes ? Complete line 3; and then either line 5 or line 7. Section 3 ? State Taxes -- Marital status and then line 1, or 3, or 4, or 5. ... Section 4 ? Sign and date the form.